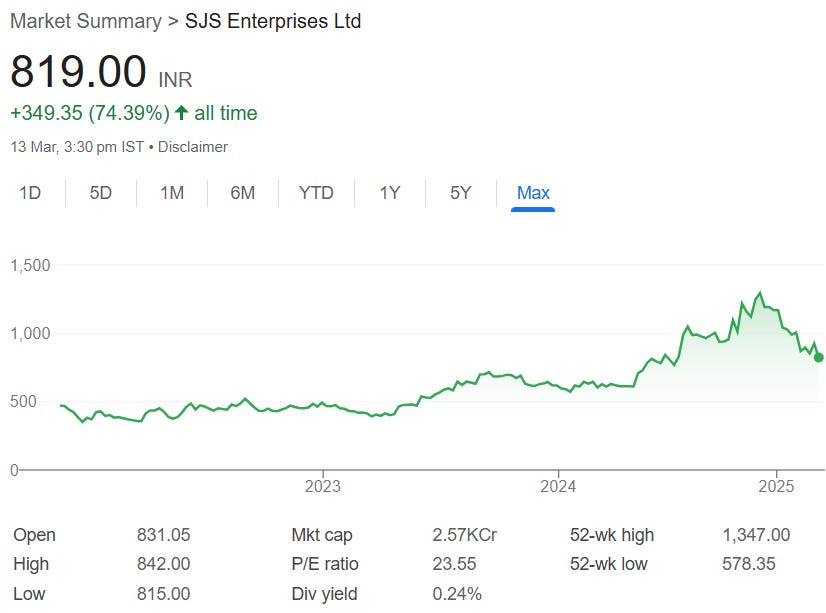

SJS Enterprises: PAT growth of 46% & revenue growth of 27% for 9M-25 at a PE of 24

Outlook for 20%+ growth in FY25. Outlook of 15% revenue CAGR till FY28 excluding acquisitions. Cashflow in place to support capex. No debt to support acquisitions. Attractive free cash flow yield

1. Premium aesthetics products manufacturer

sjsindia.com | NSE: SJS

Wide product range: Decals, appliques/dials, overlays, logos/3D lux, aluminium badges, in-mold decoratives (IMD), optical plastics and lens mask covers for diverse applications

2. FY20-24: PAT CAGR of 47% & Revenue CAGR of 14%

3. Strong FY23: PAT down 29% & Revenue up 18%

4. Strong FY24: PAT up 27% & Revenue up 45% YoY

5. Q3-25: PAT up 33% & Revenue up 11% YoY

6. 9M-25: PAT up 46% & Revenue up 27% YoY

7. Business metrics: Strong return ratios

8. Strong outlook: ~20% growth in FY25; 15% CAGR till FY28 excluding acquisitions

Growth Outlook & Guidance

Outperformance Goal: Target to continue outperforming the underlying industry growth by 1.5x, driven by:

Premiumization of automotive and consumer durable products.

Building mega accounts with key OEMs.

Expansion in exports and leveraging the Walter Pack India (WPI) acquisition for new-gen technologies.

Revenue Growth: FY25 guidance maintains a strong double-digit growth trajectory, supported by new customer wins and product categories.

Exports Vision:

Target to increase exports share to 14%-15% of consolidated revenue by FY28 (currently ~7.5% in 9MFY25).

Large export orders already secured from Whirlpool (US) and Stellantis (global) to drive growth.

Focus on deepening presence in ASEAN, Turkey, Brazil, Argentina, Colombia, South Korea, with active business development.

Capacity Expansion & Capex

Chrome Plating & Painting Facility: Capex of Rs 100 cr in Pune to expand chrome plating and painting capacity (targeted completion: Q1-26).

Optical Cover Glass Facility (Hosur):

Rs 40 cr investment in the first-of-its-kind cover glass manufacturing unit in India (target operational by end of FY26).

Product used in automotive displays, touchscreens, and aesthetic panels; future potential to expand into consumer electronics (smartphones, appliances).

Exotech & Walter Pack Expansion:

Adding 4.1 MW captive solar power to support green manufacturing and reduce costs.

Greenfield expansion for Exotech chrome plating underway.

Product & Technology Pipeline

Focus on High-Value New-Age Aesthetic Products:

In-Mold Labeling/Decoration (IML/IMD)

Optical Plastics & Cover Glass

Illuminated Logos

In-Moulded Electronics (IME) – Development stage, with prototypes shared with OEMs.

Kit Value Expansion Strategy:

From Rs 1,200-1,500 per vehicle to a potential of Rs 4,000-6,000 per vehicle in the future.

Premiumization and higher content per vehicle via advanced products.

Financial Performance and Outlook

Strong Margins: EBITDA margins expected to sustain at ~26%-27%, aided by operational efficiencies and higher-value products.

Free Cash Flow Generation: Rs 100.3 cr in 9MFY25, ensuring sufficient internal funding for expansion.

Customer and Market Diversification

Mega Accounts Development: Expanding wallet share with key customers like Mahindra, Tata Motors, Stellantis, Whirlpool, Visteon, Atomberg, Samsung, Royal Enfield.

Diversification Strategy:

Passenger Vehicles (PV) and Consumer Durables as key growth drivers.

Consumer Durables contribution to remain around 20% of sales, driven by new US wins like Whirlpool.

Continue deep penetration in 2-wheeler (2W) and PV industries with value-added aesthetic products.

Strategic Focus on Inorganic Growth

Acquisition Roadmap:

Actively exploring value-accretive acquisitions in adjacent aesthetic product categories.

Focused on IME, IML/IMD, and optical technologies to complement organic growth.

i. FY25: 20% Revenue growth expectations

Full-year FY25 estimate assumes ~Rs 180-200 cr revenue in Q4FY25, considering seasonal uptick and new orders starting delivery.

ii. FY24-28: Revenue CAGR of 15% without acquisitions

Industry Growth Assumption (Base Growth Rate):

Passenger Vehicle (PV) & 2-Wheeler (2W) Industry:

Expected 5-7% annual production growth over the next 3 years.

SJS consistently outperformed industry growth by 1.5x-2x in 21 quarters.

Consumer Durables Industry:

India expected to grow at 10-12% annually, with focus on premium products, which aligns well with SJS offerings (aesthetic components for appliances, electronics).

Base industry growth will drive organic demand, and SJS will outperform due to premiumization.

Premiumization & Increased Kit Value:

Increasing aesthetic content per vehicle (logos, illuminated parts, chrome, cover glass):

Kit value to increase from Rs 1,200-1,500 to Rs 3,500-5,000 per PV over time (management target).

Similar increases for 2W (1.5-2x) and consumer durables (3-4x growth per product).

Higher value per unit sale through new-gen products (IML, IMD, IME, Optical Plastics).

Capacity Expansions Becoming Operational (Volume Growth Driver):

Chrome Plating and Painting Plant (Rs 100 Cr capex, Pune):

Operational from Q1 FY26, catering to rising demand in automotive.

Optical Cover Glass Plant (Rs 40 Cr capex, Hosur):

Operational by end of FY26, targeting fast-growing display segment (autos + appliances).

Exotech & Walter Pack capacity expansions and operational efficiencies to add volume and value.

New capacities to start contributing significantly from FY26 onwards, supporting double-digit growth.

Export Growth (Doubling Export Contribution):

Current exports at ~7.5% of revenue (₹421.6 Mn for 9M FY25).

Target to grow exports to 14-15% by FY28, including large wins:

Whirlpool US, Stellantis global contract, Samsung, Visteon.

Export expansion to new markets: ASEAN, LATAM, Europe, North America.

Export revenues will double over 3 years, becoming a key growth lever.

Inorganic Growth/Acquisitions (Optional Upside, Not Considered):

SJS is exploring acquisitions in adjacent aesthetic tech (IME, IML, Optical).

Management has indicated M&A as a key growth pillar, but timing and scale not fixed yet.

Export Pricing and Margin Stability (Assumed in Revenue CAGR):

Import substitution (cover glass) to command high margins.

Export products such as IML/IMD parts for global clients to sustain premium pricing.

Management focus on maintaining EBITDA margins ~26%, implying price discipline is part of growth.

No major pricing erosion; focus on high-value niche products.

Revenue Contribution from New Segments:

Cover glass, illuminated logos, optical plastics to contribute incrementally from FY26-FY28.

Increased cross-selling within mega accounts (Mahindra, Whirlpool, Stellantis, Tata, etc.).

New product pipeline will add ~3-5% incremental growth per annum by FY28.

Total CAGR potential: ~14-16% (conservative estimate without acquisitions)

9. PAT growth of 46% & Revenue growth of 27% in 9M-25 at a PE of 24

10. Hold?

If I hold the stock then one may continue holding on to SJS

SJS has delivered a 9M-25 and is on track to delivering as strong FY25 with ~20% growth

SJS is indicating towards a strong outlook for beyond FY25.

With a robust financial foundation and consistent cash flow generation, we are well equipped to pursue strategic growth initiatives. Our key focus areas include, planned capex in cover glass segment, as well as going on expansion of Walter Pack and Exotech. Additionally, our strong balance sheet enables us to scale operations efficiently to meet diverse application demands while actively exploring inorganic growth opportunities to further strengthen our market presence

SJS has corrected significantly from its recent peaks but its business execution remains unaffected. One can hold on as long as the business execution is in place and one has the ability to stomach the volatility as seen recently

11. Buy?

If I am looking to enter SJS then

SJS has delivered PAT growth of 46% and revenue growth of 27% in 9M-25 at a PE of 24 which makes the valuations fairly priced in the short term.

Outlook for an organic revenue CAGR of 15% with the possibility inorganic growth at a PE of 24 which makes the valuations attractive from a longer term.

SJS generated free cash flow of Rs 100.3 cr in 9M-25, resulting in a free cash flow yield of 3.9%(not annualized) based on its current market cap of Rs 2,565.57 cr which makes the valuations quite attractive from a free cash flow perspective.

Expectations of strong free cash flow generation implies in FY25 that valuation of SJS are reasonable.

Debt-free status would improve margin and cash-flow generation on account of reduction in interest cost.

We are already generating a large amount of free cash, so we will shore up revenue and by the end of this financial year, we should again have corpus available with strong cash generation abilities.

SJS has successfully repaid a term loan of INR300.0 million, achieving a debt-free status.

We have a vacant plant in SJS Bangalore. And the Board has decided to monetize this asset. Maybe within, let's say, a period of 12 months, we expect the cash inflow

The opportunity in SJS exists over the longer term as new acquisition and entry into exports and non automotive segments via appliance manufacturers and consumer electricals will play out.

Previous coverage of SJS

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer