Shriram Finance: PAT growth of 23% & net interest income growth of 18% in FY24 at a PE of 13

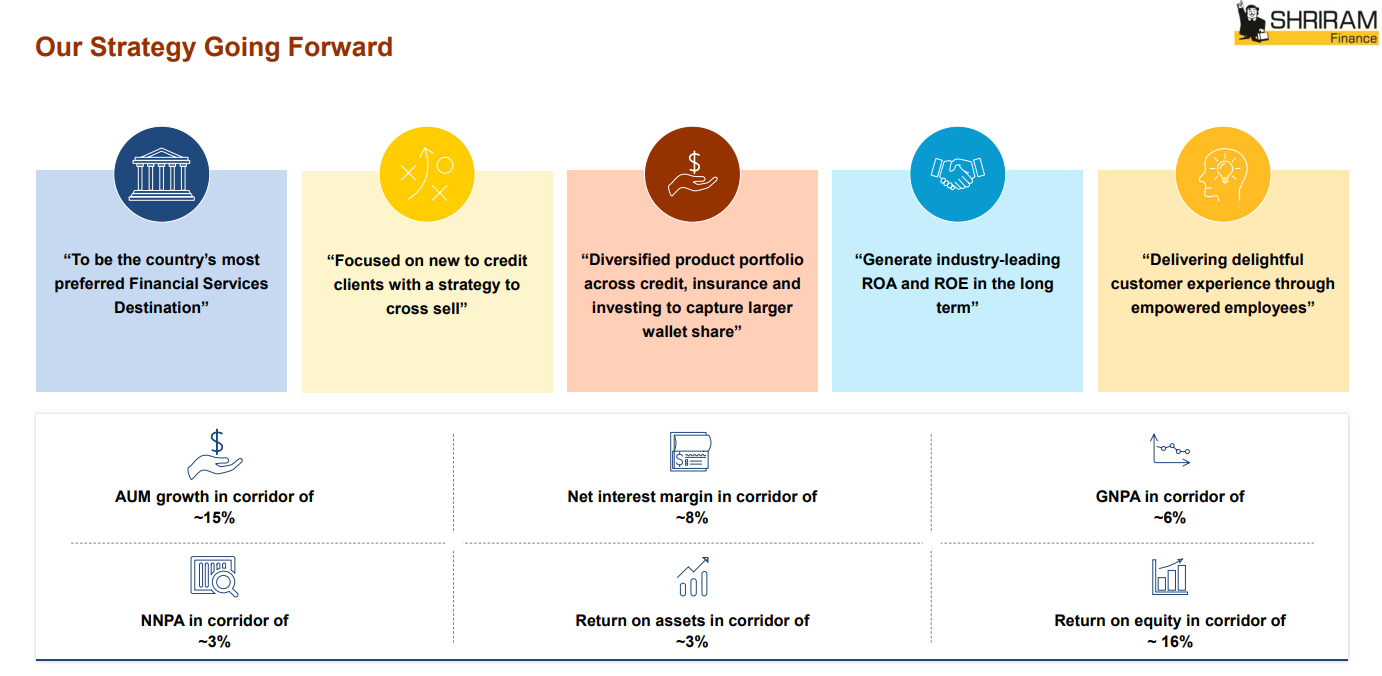

Guidance of AUM growth of 15% for FY24-26. SHRIRAMFIN has beaten guidance for FY24. Management confident of meeting FY25 guidance. At reasonable valuations on price to book of 1.95

1. Leading player in organized high yield pre-owned CV financing segment and Two-wheeler segment.

shriramfinance.in | NSE: SHRIRAMFIN

Shriram Finance Limited has significant presence in Consumer Finance, Life Insurance, General Insurance, Housing Finance, Stock Broking and Distribution businesses.

One of India’s largest retail asset financing Non-Banking Finance Company (NBFC) with Assets under Management (AUM) above Rs 2.14 trillion.

Leader in organised financing of pre-owned commercial vehicles and two wheelers.

Products which include passenger commercial vehicles, loans to micro and small and medium enterprises (MSMEs), tractors, gold, personal loans and working capital loans etc.

2. FY22-24: Strong growth

The figures for the FY 2022-23 includes the effect of merger of transferor Companies SCUF and SCL and are therefore not comparable with figures of previous years

3. FY23: PAT up 122% & Net interest income up 85% YoY

4. 9M-24: PAT up 14% & Net interest income up 16% YoY

5. Q4-24: PAT up 57% & Net interest income up 22% YoY

PAT increased QoQ consecutively in all the quarters of FY24

6. FY24: PAT up 23% & Net interest income up 18% YoY

7. Business metrics: Strong & improving return ratios

Return on Equity:

See, we have given guidance of 16% to 18% as the range.

FY24: And we are already at 16-plus.

FY25: I think this financial year, we should be able to cross 17%.

FY26: And definitely, by ‘26 we will be 18%.

8. Outlook: AUM Growth of 15%

i. 15% AUM growth CAGR for FY24-26

guidance for three years 15% AUM growth will continue

ii. EPS to grow at 15%+ CAGR for FY24-26 if AUM growth is 15%

The focus will be to improve on the net profits bottom line rather than the top line growth.

9. PAT growth of 23% & net interest income growth of 18% in FY24 at a PE of 13

10. So Wait and Watch

If I hold the stock then one may continue holding on to SHRIRAMFIN

Coverage of SHRIRAMFIN was initiated after Q1-24 results. The investment thesis has not changed after delivering a strong FY-24.

SHRIRAMFIN is in the middle of a strong earnings streak and has delivered sequential QoQ growth in PAT and net interest income in all the 4 quarters of FY24

The outlook for SHRIRAMFIN looks strong given the guidance for AUM growth of 15% and PAT growing faster than the top-line

So, our aim is to grow the bottom line larger than the top line. That is the idea. So, our focus will be more on a granular small ticket and high-yielding products. So, the entire energy will be on growing the bottom line faster than the top line

SHRIRAMFIN management is confident of sticking to its longer term guidance

credit cost, we have been giving a long-term guidance of around 2%. And this year, we have ended up with 2.06% against the previous year, we ended up with 1.97% for the full year. And we should be able to maintain that around that level for the full year.

11. Or, join the ride

If I am looking to enter SHRIRAMFIN then

SHRIRAMFIN has delivered PAT growth of 23% & net interest income growth of 18% in FY24 at a PE of 13 which makes valuations quite reasonable in the short term.

AUM guidance of 15% growth with bottom line growing faster than the top line at a PE of 13 makes valuations quite reasonable from the medium to longer term.

SHRIRAMFIN with a net-worth of Rs 48,947.17 cr on market cap of Rs 95,497 cr implies the stock is available at price to book (P/B) of 1.95 which is reasonable for India’s largest retail NBFC

Previous coverage of SHRIRAMFIN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer