Shriram Finance: PAT growth of 20% & Net Interest Income growth of 16% in H1-24 at a PE of 12 and price to book of 1.66

SHRIRAMFIN is working on a guidance of AUM growth of 15% for FY24-26. Its execution in H1-24 is ahead of the guidance and is available at reasonable valuations on a price to book of 1.66 & PE of 12

1. Pre-owned CV financing & 2-wheeler financing

shriramfinance.in | NSE : SHRIRAMFIN

Portfolio – PCV’s, Construction Equipment, Tractor Financing, Personal Loans, Gold Loans, MSME Finance

Shriram Finance Limited; erstwhile Shriram Transport Finance Company Limited, is a non-banking financial company (NBFC). In Nov-22, Shriram City Union Finance Company Limited and Shriram Capital Limited were merged with Shriram Transport Finance. Shriram Transport Finance was then renamed Shriram Finance Limited.

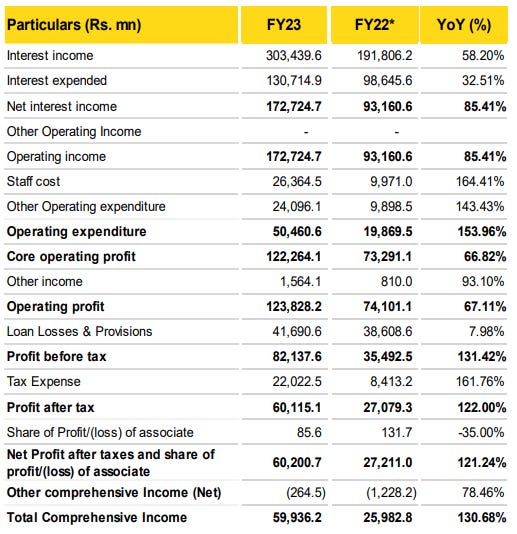

2. FY20-23: Growth kicked in from FY23

3. FY23: PAT up 122% & Net Interest Income up 85% YoY

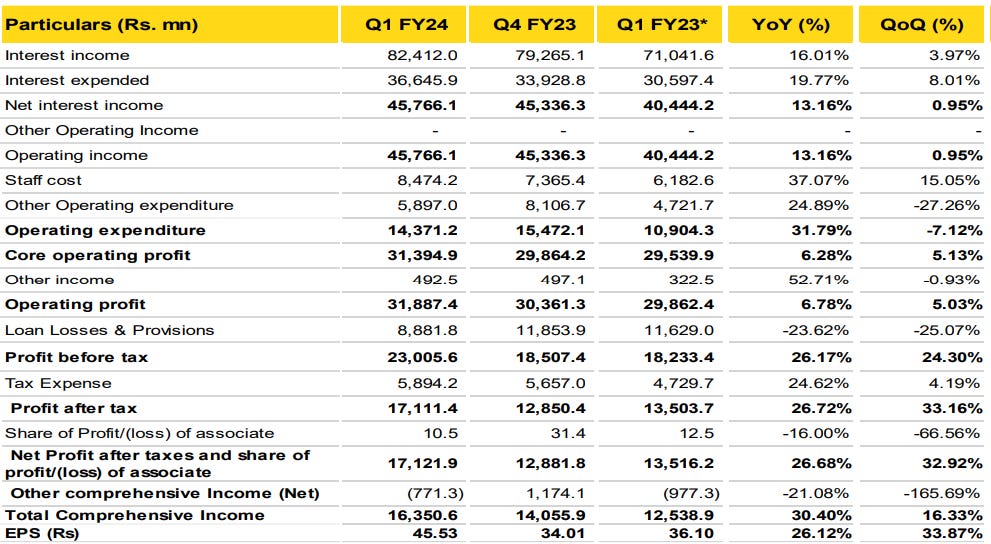

4. Q1-24: PAT up 27% & Net Interest Income up 13% YoY

PAT up 33% & Net interest income up 1% QoQ

5. Q2-24: PAT up 14% & Net Interest Income up 19% YoY

PAT up 5% & Net interest income up 9% QoQ

6. H1-24: PAT up 20% & Net Interest Income up 16% YoY

7. Outlook for 15%+ EPS growth for FY24-26

i. 15% AUM growth CAGR for FY24-26

guidance for three years 15% AUM growth will continue

ii. Possibility of AUM growth for FY24 increasing to 18-19%

See, as of now, we will stick to 15% guidance, but coming to the end of the second quarter, we'll be able to clearly say what is likely growth for the full year, because we would like to see the monsoon coverage fully and see how the rural economy shapes up and that will help us to give a concrete number. But as you indicated, this 18%-19% is something in the first quarter is a good sign and we can expect these numbers to be maintained for the full year.

iii. EPS to grow at 15%+ CAGR for FY24-26 if AUM growth is 15%

The focus will be to improve on the net profits bottom line rather than the top line growth.

8. PAT growth of 20% & Net Interest Income growth of 16% in H1-24 at a PE of 12

9. So Wait and Watch

If I hold the stock then one may continue holding on to SHRIRAMFIN

Coverage of SHRIRAMFIN was initiated after Q1-24 results. The investment thesis has not changed after a strong H1-24. The only changes are the delivery of a strong H1-24 and the increased confidence in the management to deliver a stronger FY24

SHRIRAMFIN has delivered 20% AUM growth as of Q2-24 ahead of its guidance of 15%. This has opened up the possibility of the AUM guidance to be increased for FY24.

10. Or, join the ride

If I am looking to enter SHRIRAMFIN then

For the growth SHRIRAMFIN has delivered in H1-24, the PE of 12 looks attractive against the management guidance of 15% AUM growth.

15%+ EPS growth for a PE of 12 also makes valuations quite attractive.

Possibility of SHRIRAMFIN delivering ahead of the 15% AUM growth guidance in FY24. Possibility of 20%+ earnings growth if AUM growth is 18-19% for FY24

SHRIRAMFIN with a net-worth of Rs 46,613 cr on market cap of Rs 77,000+ cr implies the stock is available at price to book (P/B) of 1.66 which is reasonable for India’s largest retail NBFC

Previous coverage of SHRIRAMFIN

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades