Shriram Finance Q4 FY25 Results: AUM Up 17%, PAT Up 15%, FY26 Outlook Positive for Investors

Shriram Finance enters FY26 focused on 15–18% AUM growth, asset quality, margin stability, and retail-digital expansion - building a long-term compounding story

shriramfinance.in | NSE: SHRIRAMFIN

1. FY23-25: Track Record of Steady Growth

Net Interest Income (NII) CAGR of 16% & PAT CAGR of 18% (ex. one-time exceptional gain)

The figures for the FY 2022-23 includes the effect of merger of companies SCUF and SCL and are therefore not comparable with figures of previous years

*PAT for FY25 excludes the one-time exceptional gain for a cleaner comparison2. Q4-25: Strong Finish to the Year

PAT up 14% & NII up 16% YoY

2.1 Key Drivers Behind the Q4-25 Performance:

Strong Disbursement Growth:

Disbursements remained robust across commercial vehicles, MSME loans, two-wheelers, and personal loan segments, supporting 17% AUM growth YoY.Net Interest Margin (NIM) Stability:

Margins were broadly stable, aided by a well-diversified borrowing profile and strong collections. Funding costs rose marginally but were offset by better yields.Improved Asset Quality:

Gross Stage 3 assets declined meaningfully by 90 basis points YoY to 4.55%, driven by sustained recovery efforts, improved collections, and technical write-offs (~₹540 crore in Q4, fully provisioned earlier).Cost Rationalization:

Operating expenses were well managed, leading to a stable cost-to-income ratio despite branch expansion and digital investments.Profitability:

Core profit after tax (excluding the exceptional gain from the sale of Shriram Housing Finance) grew by 14% YoY, reflecting operational efficiency and credit discipline.Balance Sheet Strengthening:

Provision coverage remained high (~43% on Stage 3 loans), ensuring that potential credit risks are adequately provided for.

3. FY25: Broad-Based Growth and Strengthening Fundamentals of Shriram Finance

PAT up 15% & NII up 16% YoY

3.1 Key Highlights of FY25:

Broad-Based AUM Growth:

AUM expanded by 17% YoY, led by strong disbursement momentum across core segments — pre-owned commercial vehicles, MSME loans, two-wheeler finance, and personal loans.Net Interest Income Expansion:

NII grew 16% YoY, driven by healthy asset growth, improved yield management, and operational efficiencies.Steady Profitability:

Core PAT (excluding one-time gain from the sale of Shriram Housing Finance) grew 15% YoY to ₹8,272 crore, indicating disciplined credit underwriting and strong operating leverage.Exceptional Gain Boost:

The reported PAT of ₹9,761 crore includes a one-time post-tax gain of ₹1,489 crore from divesting Shriram Housing Finance.Improved Asset Quality: Reflecting better collections and focused recovery efforts.

Stable Margins and Credit Costs:

Net Interest Margins (NIMs) remained resilient despite a rising interest rate environment, while credit costs were maintained within the guided range.Healthy Capitalization:

Net worth rose 13% YoY to ₹56,898.73 crore, ensuring a strong capital adequacy position to support future growth.Dividend Payouts:

Total dividend declared at ₹9.90 per share (post stock split), maintaining a payout policy that balances shareholder returns and reinvestment for growth.

4. Business Metrics: Strong Return Ratios, Healthy Profitability

Return on Equity (RoE): RoE moderated slightly to 14.4% in FY25, compared to 15.6% in FY24.

The dip reflects balance sheet expansion post-merger and a more diversified asset mix.

Despite this, RoE remains healthy and above long-term averages for retail NBFCs.

Return on Assets (RoA):

RoA declined modestly from 3.1% to 2.7%, primarily due to scaling up newer, higher-volume retail segments which typically carry lower ticket sizes but higher risk-adjusted yields.

Structural Profitability Remains Strong:

Even with moderation, both RoE and RoA are comfortably above pre-merger historical averages.

This supports Shriram Finance’s fair current valuation multiples (~12.6x P/E, ~2.14x P/B).

5. Commentary and Strategic Outlook by Shriram Finance Management

5.1 Business Growth Strategy

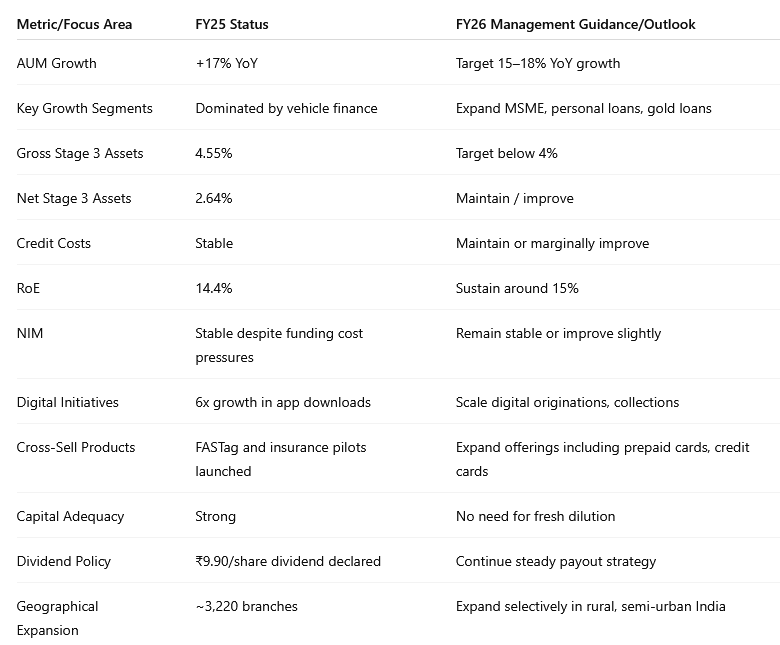

AUM Growth: Management has guided for 15–18% YoY AUM growth in FY26, following a 17% YoY growth in FY25.

Key Growth Drivers: Future growth is expected to be increasingly led by MSME loans, personal unsecured loans, and gold loans, complementing the existing strength in pre-owned commercial vehicle finance.

Geographical Focus: Shriram plans selective branch expansion across rural and semi-urban markets, leveraging its deep regional franchise to tap underserved customer segments.

5.2 Net Interest Margin (NIM) Outlook

FY25 NIM Performance: Despite moderate upward pressure on borrowing costs, NIMs remained stable thanks to better loan pricing and a shift towards higher-yielding segments like MSME and personal loans.

FY26 NIM Expectations: Management expects NIMs to remain stable or slightly expand, aided by richer loan mix, disciplined pricing, and controlled funding costs through diversified borrowing channels.

5.3 Asset Quality and Credit Risk Management

FY26 Asset Quality Goals:

Further reduce Gross Stage 3 Assets below 4%.

Keep credit costs stable or improve slightly with careful underwriting, especially in MSME and unsecured retail segments.

Risk Buffer Strategy: Management remains committed to maintaining strong provision buffers and protecting balance sheet quality even during growth acceleration.

5.4 Capital Position and Dividend Strategy

Shriram Finance remains well-capitalized, with a strong net worth of ₹56,898.73 crore and no immediate requirement for fresh capital infusion.

Dividend Policy:

The company declared a ₹9.90 per share total dividend for FY25 and plans to maintain a balanced payout strategy, ensuring steady dividends while retaining sufficient profits for growth investments.

6. Valuation Analysis: Fairly Valued with Room for Compounding

PAT growth of 15% & NII growth of 16% in FY-25 at a PE of 13 & P/B of 2.14

6.1 How The Valuations of Shriram Finance Stack Up

P/E Ratio at 12.6x:

Shriram Finance is trading at a modest earnings multiple, considering its 14.4% RoE and consistent profitability.

Within the NBFC sector, high-quality lenders typically command P/Es between 12x–18x based on growth visibility and asset quality.

P/B Ratio at ~2.14x:

Relative to its reported Book Value per Share of ₹299.30 and strong RoE (~14.4%), a P/B around 2.1–2.2x appears fairly valued.

Well-run retail NBFCs with RoE above 14–15% typically trade between 2x–3x P/B when asset quality is stable.

Re-Rating Justification:

Stock's performance has been supported by AUM expansion, margin resilience, asset quality improvement, and a successful merger strategy.

Current valuations are reasonable, not excessive.

6.2 Valuation Drivers Going Forward

6.3 Valuation Risks to Watch

Aggressive expansion into riskier unsecured lending could lead to higher NPAs if underwriting standards slip.

Persistent high cost of funds environment could compress NIMs over time.

Competitive intensity in MSME and personal loans may lead to pressure on yields.

Rural consumption or cash-flow slowdown could impact growth assumptions.

7. Hold: Steady Compounding Story Strengthens Post FY25

Growth story to continue

Positive Management Outlook for FY26

Consistent PAT Growth

Strong AUM Growth

Stable Margins Despite Headwinds:

Improving Asset Quality

Steady Return Ratios: RoE and RoA remain healthy relative to sector averages

Healthy Capital Position: Net worth +13% YoY, providing ample capacity to fund future growth without immediate equity dilution risk.

8. Buy View: A Structural Compounder Trading at Fair Valuations

If I am looking to enter SHRIRAMFIN then its business provides

Consistent Profitability and Operational Discipline:

Shriram Finance posted 15% YoY PAT growth (excluding exceptional gains) in FY25, demonstrating resilience despite rising funding costs and business restructuring.Healthy Return Ratios:

Strong RoE of 14.4% and RoA of 2.7% underline efficient capital deployment and profitability, positioning Shriram as one of the better-performing retail NBFCs.Improving Asset Quality with Risk Controls:

Gross Stage 3 assets improved to 4.55%, and management aims to reduce it below 4% in FY26, backed by superior collections and disciplined credit underwriting.Diversified Growth Engines for the Future:

Newer businesses like MSME lending, gold loans, and personal unsecured loans are scaling up well, creating additional revenue streams beyond the traditional CV financing core.Strong AUM Growth Guidance for FY26:

Management has guided for 15–18% YoY AUM growth in FY26, indicating confidence in expanding across rural, semi-urban, and new-to-credit segments despite macro uncertainties.Margins: Stability or slight expansion in FY26, aided by richer loan mix

Capital Strength and Self-Funded Growth:

With a net worth of ₹56,898.7 crore and conservative leverage, Shriram Finance is well-positioned to fund its expansion plans without immediate need for external equity, preserving shareholder value.Attractive Valuation with Long-Term Compounding Potential:

Trading at ~12.6x P/E and ~2.14x P/B, Shriram Finance offers a reasonable valuation relative to its growth prospects, making it an attractive choice for long-term investors seeking sustainable compounding.

Previous coverage of SHRIRAMFIN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer