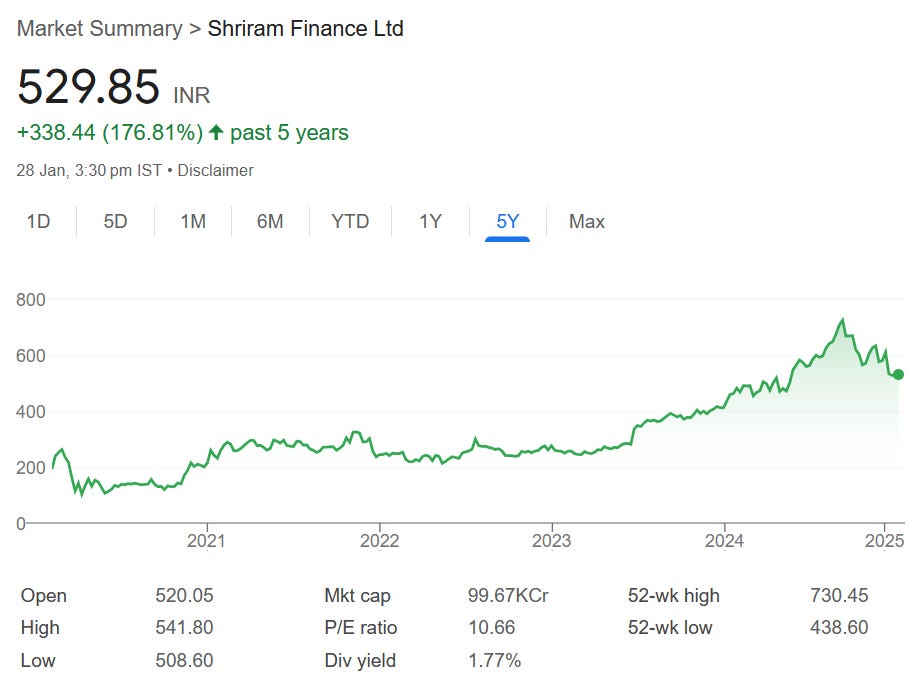

Shriram Finance: PAT growth of 17% & net interest income growth of 17% in 9M-25 at a PE of 11

Guidance of AUM growth of 15%+ for FY25. Guidance of AUM growth of 15% for FY24-26. At reasonable valuations on price to book of 1.8

shriramfinance.in | NSE: SHRIRAMFIN

1. One of the largest Retail NBFCs in India

Shriram City Union Finance Limited & Shriram Capital Limited merged with Shriram Transport Finance Company Limited and was subsequently renamed as Shriram Finance Limited

Shriram Finance Limited has significant presence in Consumer Finance, Life Insurance, General Insurance, Housing Finance, Stock Broking and Distribution businesses.

Leader in organised financing of pre-owned commercial vehicles and two wheelers.

Products include passenger commercial vehicles, loans to micro and small and medium enterprises (MSMEs), tractors, gold, personal loans and working capital loans etc.

2. FY20-24: PAT CAGR of 30% & Net Interest Income CAGR of 25%

The figures for the FY 2022-23 includes the effect of merger of transferor Companies SCUF and SCL and are therefore not comparable with figures of previous years3. FY24: PAT up 23% & Net interest income up 18% YoY

4. Q3-25: PAT up 14% & Net interest income up 14% YoY

Exceptional item is the gain on sale of its subsidiary (SHFL)5. 9M-25: PAT up 17% & Net interest income up 17% YoY

6. Business metrics: Strong & improving return ratios

Return on Equity: Guidance of 16% to 18% as the range.

FY25: I think this financial year, we should be able to cross 17%.

FY26: And definitely, by ‘26 we will be 18%.

7. Outlook: AUM Growth of 15%

i. FY25: 15% AUM growth

ii. FY24-26: 15% AUM growth CAGR

guidance for three years 15% AUM growth will continue

ii. EPS to grow at 15%+ CAGR for FY24-26 if AUM growth is 15%

The focus will be to improve on the net profits bottom line rather than the top line growth.

8. PAT growth of 17% & net interest income growth of 17% in 9M-25 at a PE of 11

9. Hold?

If I hold the stock then one may continue holding on to SHRIRAMFIN

SHRIRAMFIN has delivered a strong FY24 and followed it up with a strong 9M-25. The management is pointing towards a strong Q4-25

Anticipate the next quarter to be the busiest with improving numbers.

Asset quality is expected to remain reasonably strong.

The outlook of SHRIRAMFIN for FY26 is strong.

The company expects to continue growing at a mid-teen level for the next financial year, given expectations for Indian GDP growth.

SHRIRAMFIN is in the middle of a strong earnings streak and has delivered sequential QoQ growth in PAT (excluding exceptional items) in the last 8 consecutive quarters starting Q4-23

The outlook for SHRIRAMFIN looks strong with AUM growth of 19% as of Q3-25 end against the guidance for AUM growth of 15%

SHRIRAMFIN is expecting tailwinds to support growth in FY26

While there have been some fluctuations in NIM and asset quality, the management is confident about the future, especially with the expected improvements in the rural market, government spending, and demand in various vehicle segments. The company is strategically focusing on different segments and operational efficiencies to maintain its growth trajectory.

10. Buy?

If I am looking to enter SHRIRAMFIN then

SHRIRAMFIN has delivered PAT growth of 17% & net interest income growth of 17% in 9M-25 at a PE of 11 which makes valuations quite reasonable in the short term.

SHRIRAMFIN has grown its book-value by 17% at a PE of 11 which makes valuations reasonable.

AUM guidance of 15%+ CAGR for FY24-26 at a PE of 11 makes valuations quite reasonable from the medium to longer term.

SHRIRAMFIN is trading at a price to book (P/B) ratio of 1.8 which makes valuations reasonable. Re-rating to price to book closer to 2 will create opportunities opportunities in the stock.

Previous coverage of SHRIRAMFIN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer