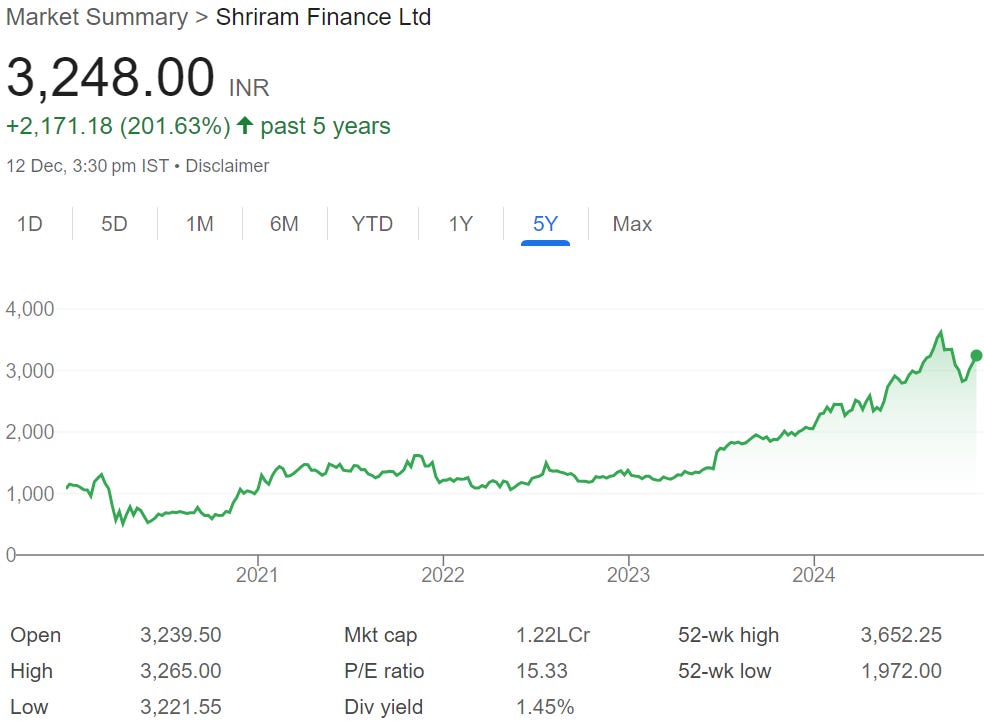

Shriram Finance: PAT growth of 18% & net interest income growth of 18% in H1-25 at a PE of 15

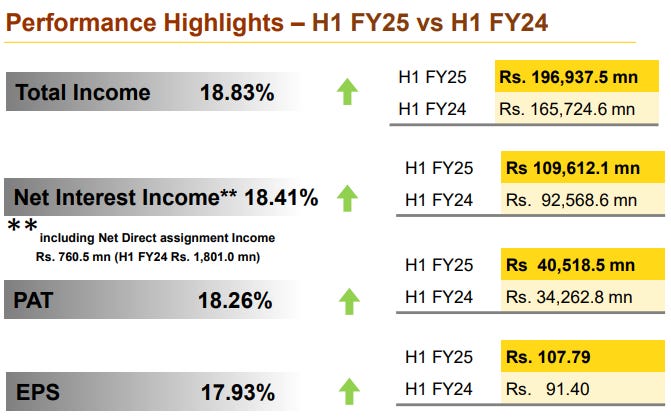

Guidance of AUM growth of 15%+ for FY25. Guidance of AUM growth of 15% for FY24-26. At reasonable valuations on price to book of 2.4

shriramfinance.in | NSE: SHRIRAMFIN

1. One of the largest Retail NBFCs in India

Shriram City Union Finance Limited & Shriram Capital Limited merged with Shriram Transport Finance Company Limited and was subsequently renamed as Shriram Finance Limited

Shriram Finance Limited has significant presence in Consumer Finance, Life Insurance, General Insurance, Housing Finance, Stock Broking and Distribution businesses.

Leader in organised financing of pre-owned commercial vehicles and two wheelers.

Products include passenger commercial vehicles, loans to micro and small and medium enterprises (MSMEs), tractors, gold, personal loans and working capital loans etc.

2. FY20-24: PAT CAGR of 30% & Net Interest Income CAGR of 25%

The figures for the FY 2022-23 includes the effect of merger of transferor Companies SCUF and SCL and are therefore not comparable with figures of previous years3. FY24: PAT up 23% & Net interest income up 18% YoY

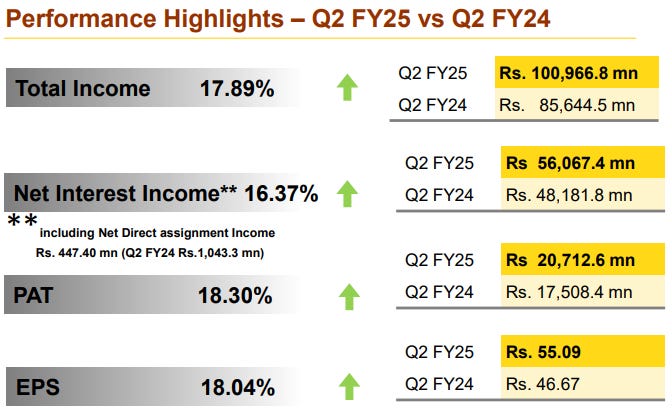

4. Q2-25: PAT up 18% & Net interest income up 16% YoY

5. H1-25: PAT up 18% & Net interest income up 18% YoY

6. Business metrics: Strong & improving return ratios

Return on Equity: Guidance of 16% to 18% as the range.

FY25: I think this financial year, we should be able to cross 17%.

FY26: And definitely, by ‘26 we will be 18%.

7. Outlook: AUM Growth of 15%

Asset Quality expected to remain stable: SHRIRAMFIN management does not foresee any further significant improvement in asset quality, but they also do not anticipate any deterioration due to the robust economic activity, strong government spending on infrastructure, and positive outlook for the rural economy following a good monsoon season. They aim to improve stage three assets to around 5%.

Growth in CV Portfolio: SHRIRAMFIN expects its commercial vehicle (CV) portfolio to grow at 17%-18% over the next two quarters. This is attributed to improved utilisation of existing vehicles and stable used vehicle prices.

Personal Loan Portfolio Growth to Resume in the Future: The personal loan (PL) portfolio growth has been deliberately slowed down to address market concerns and regulatory scrutiny. SHRIRAMFIN plans to resume growth in this segment once the industry and regulators gain comfort with its performance.

Net Interest Margin (NIM) to Remain Stable: SHRIRAMFIN anticipates that the net interest margin will remain at the current level.

Merger Benefits Continue to Materialise: SHRIRAMFIN still sees scope for further cross-selling opportunities, particularly for MSME and gold loan products in new geographies and branches.

Rating Upgrade Expectations: Management remains optimistic about the possibility.

i. FY25: 15% AUM growth

Potential for upward revision of AUM growth

FY25: Our guidance will remain at 15. But this quarter has been good. So we expect momentum is good. So it will continue to be good for the rest of the year. We don't want to change the guidance now. But we can expect to do much better than the guidance

ii. FY24-26: 15% AUM growth CAGR

guidance for three years 15% AUM growth will continue

ii. EPS to grow at 15%+ CAGR for FY24-26 if AUM growth is 15%

The focus will be to improve on the net profits bottom line rather than the top line growth.

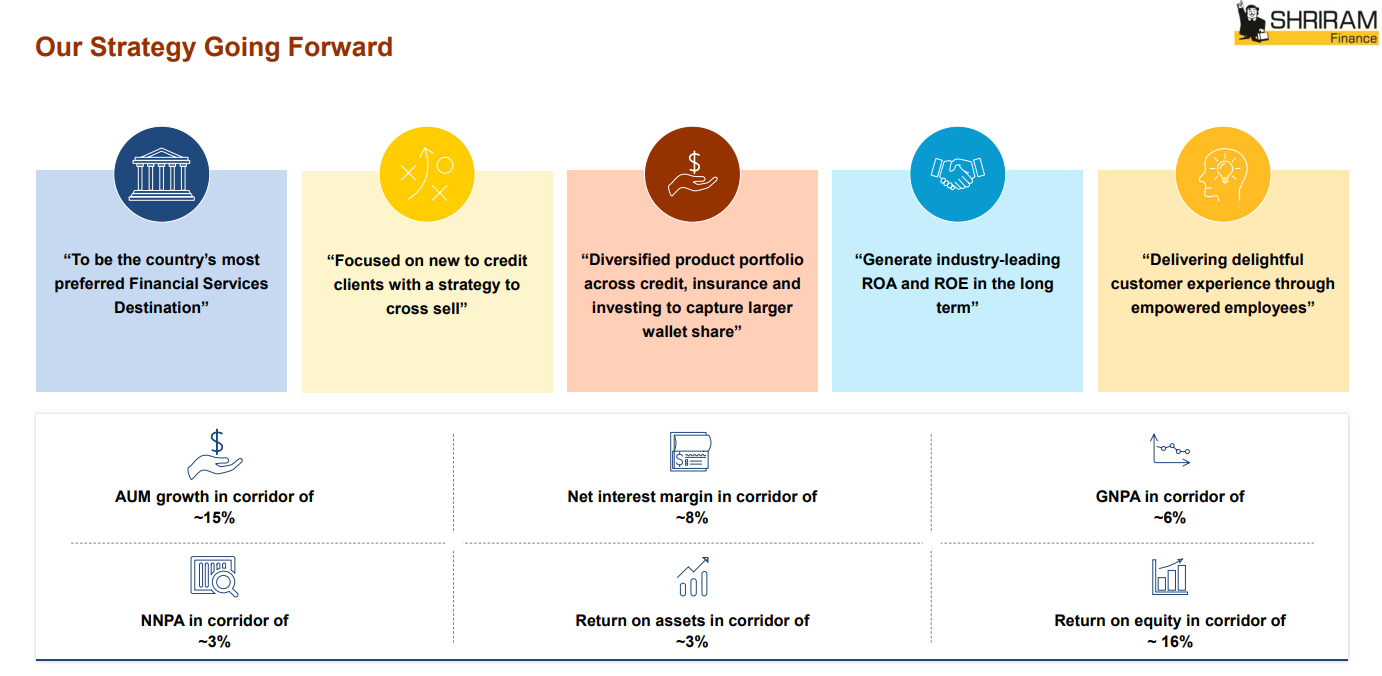

8. PAT growth of 18% & net interest income growth of 18% in FY24 at a PE of 15

9. Hold?

If I hold the stock then one may continue holding on to SHRIRAMFIN

SHRIRAMFIN has delivered a strong FY24 and followed it up with a strong H1-25. The expectations for H2-25 are strong given the expectation of 17-18% growth in the CV portfolio

I think we should grow our CV portfolio, next 2 quarters should grow at 17%-18% comfortably.

SHRIRAMFIN is in the middle of a strong earnings streak and has delivered sequential QoQ growth in PAT in the last 7 consecutive quarters starting Q4-23

The outlook for SHRIRAMFIN looks strong with AUM growth of 20% as of Q2-25 end against the guidance for AUM growth of 15%

Monetization of Shriram Housing Finance Limited (SHFL) for Rs 3,929 cr will add to the balance sheet and add to the value of the business in the short term.

10. Buy?

If I am looking to enter SHRIRAMFIN then

SHRIRAMFIN has delivered PAT growth of 18% & net interest income growth of 18% in H1-25 at a PE of 15 which makes valuations quite reasonable in the short term.

AUM guidance of 15%+ CAGR for FY24-26 with margin expansion at a PE of 15 makes valuations quite reasonable from the medium to longer term.

SHRIRAMFIN is trading at a price to book (P/B) ratio of 2.3. This valuation is considered reasonable for India's largest retail NBFC. The monetization of Shriram Housing Finance Limited (SHFL) for Rs 3,929 cr will add to the balance sheet and marginally improve the price to book ratio.

Previous coverage of SHRIRAMFIN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer