Shriram Finance: PAT growth of 19% & net interest income growth of 22% in Q1-25 at a PE of 16

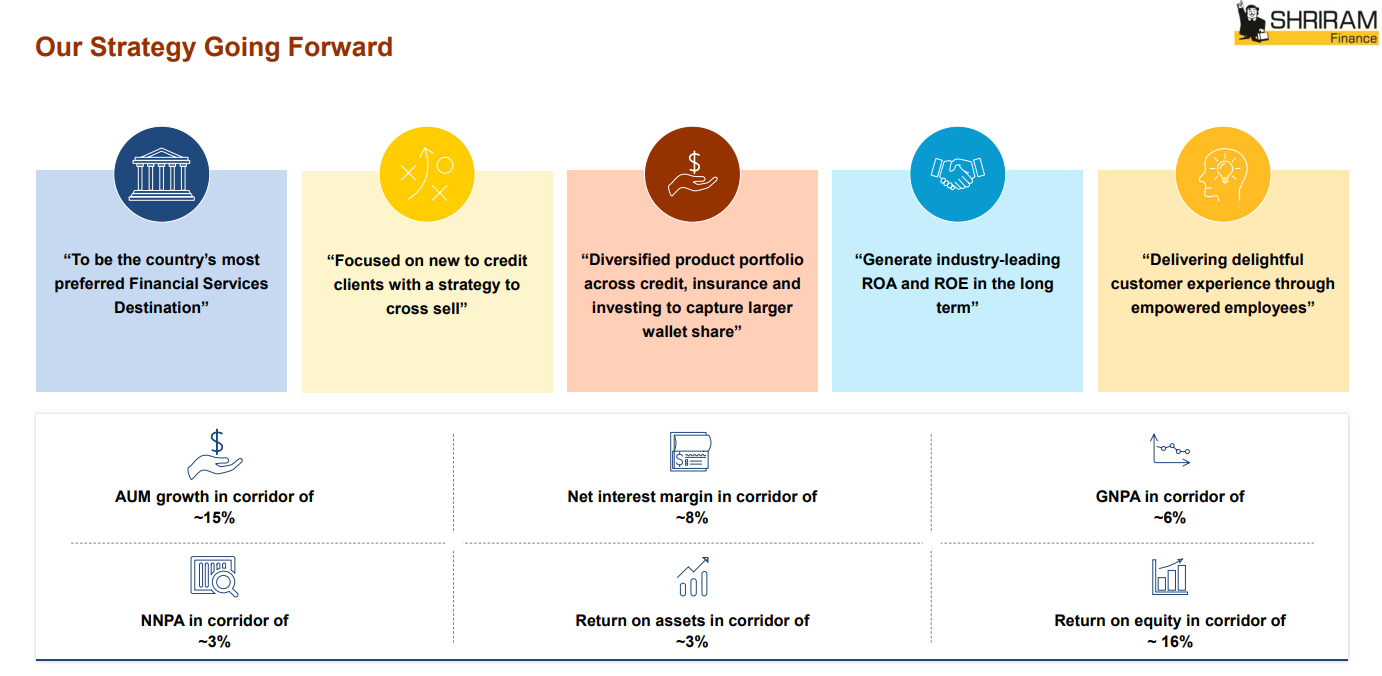

Guidance of AUM growth of 15%+ for FY25. Guidance of AUM growth of 15% for FY24-26. Upward revision of FY25 guidance possible. At reasonable valuations on price to book of 2.4

1. Why is SHRIRAMFIN interesting?

shriramfinance.in | NSE: SHRIRAMFIN

SHRIRAMFIN is guiding for strong AUM growth, with profits growing faster than its top-line and is available at reasonable valuations.2. One of the largest retail asset financing Non-Banking Finance Company (NBFC)

Shriram City Union Finance Limited & Shriram Capital Limited merged with Shriram Transport Finance Company Limited and was subsequently renamed as Shriram Finance Limited

Shriram Finance Limited has significant presence in Consumer Finance, Life Insurance, General Insurance, Housing Finance, Stock Broking and Distribution businesses.

Leader in organised financing of pre-owned commercial vehicles and two wheelers.

Products include passenger commercial vehicles, loans to micro and small and medium enterprises (MSMEs), tractors, gold, personal loans and working capital loans etc.

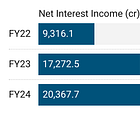

3. FY20-24: PAT CAGR of 30% & Net Interest Income CAGR of 25%

The figures for the FY 2022-23 includes the effect of merger of transferor Companies SCUF and SCL and are therefore not comparable with figures of previous years4. FY23: PAT up 122% & Net interest income up 85% YoY

5. FY24: PAT up 23% & Net interest income up 18% YoY

5. Q1-25: PAT up 19% & Net interest income up 22% YoY

PAT increased QoQ consecutively in all the quarters of FY24

6. Business metrics: Strong & improving return ratios

Return on Equity: Guidance of 16% to 18% as the range.

FY25: I think this financial year, we should be able to cross 17%.

FY26: And definitely, by ‘26 we will be 18%.

7. Outlook: AUM Growth of 15%

i. FY25: 15% AUM growth

Potential for upward revision of AUM growth

FY25: Our guidance will remain at 15. But this quarter has been good. So we expect momentum is good. So it will continue to be good for the rest of the year. We don't want to change the guidance now. But we can expect to do much better than the guidance

ii. FY24-26: 15% AUM growth CAGR

guidance for three years 15% AUM growth will continue

ii. EPS to grow at 15%+ CAGR for FY24-26 if AUM growth is 15%

The focus will be to improve on the net profits bottom line rather than the top line growth.

8. PAT growth of 19% & net interest income growth of 22% in FY24 at a PE of 16

9. Do I stay?

If I hold the stock then one may continue holding on to SHRIRAMFIN

SHRIRAMFIN has delivered a strong FY24 and followed it up with a strong Q1-25. It is now indicating towards a good Q2-25

But we expect with good monsoon this year to improve in the Q2.

SHRIRAMFIN is in the middle of a strong earnings streak and has delivered sequential QoQ growth in PAT in the last 5 consecutive quarters starting Q1-24

The outlook for SHRIRAMFIN looks strong given the guidance for AUM growth of 15% (with possibility of upward revision) and margin expansion.

10. Do I enter?

If I am looking to enter SHRIRAMFIN then

SHRIRAMFIN has delivered PAT growth of 19% & net interest income growth of 22% in FY24 at a PE of 16 which makes valuations quite reasonable in the short term.

AUM guidance of 15%+ CAGR for FY24-26 with margin expansion at a PE of 16 makes valuations quite reasonable from the medium to longer term.

Shriram Finance, with a net worth of Rs 50,411 cr as of Q1-25 end at a current market capitalization of Rs 1,22,186 crore, is trading at a price to book (P/B) ratio of 2.42. This valuation is considered reasonable for India's largest retail NBFC.

Value unlocking expected from the sale of its subsidiary, Shriram Housing Finance Limited

proposal for disinvestment of the company's entire stake in Shriram Housing Finance Limited, a listed non-material subsidiary of the company. In this regard, the company has entered into a share purchase agreement with Mango Crush Investment Limited, an affiliate of Warburg Pincus

Previous coverage of SHRIRAMFIN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer