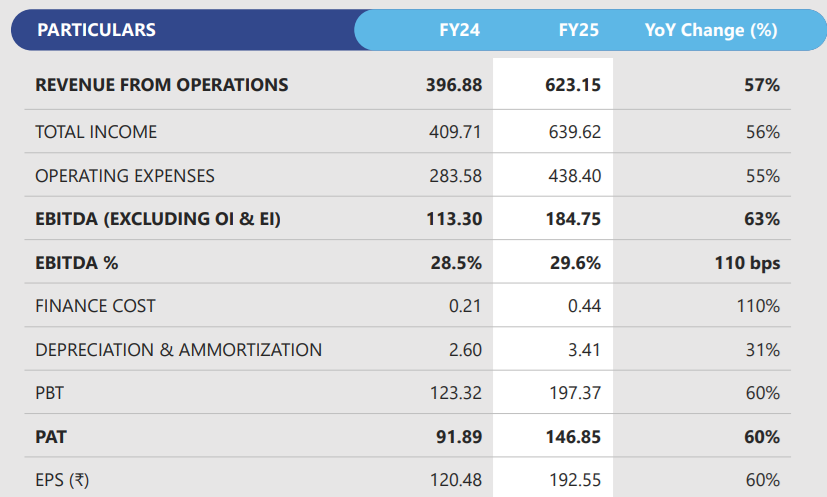

Shilchar Technologies Results: FY25 PAT Up 60%, FY26 Growth Slows

FY26 outlook moderates with 20–28% growth guidance. Capacity constraints, tariff overhang, and rich valuations weigh, but renewables remain a key tailwind.

1. Power & Distribution Transformer Manufacturer

shilchar.com | BOM: 531201

2. FY20-24: PAT CAGR of 127% and Revenue CAGR of 52%

3. Strong FY24: PAT up 113% & Revenue up 42% YoY

4. Strong Q4-25: PAT up 121% & Revenue up 120% YoY

5. Strong FY25: PAT up 60% & Revenue up 57% YoY

6. Business metrics: Strong & improving return ratios

7. Outlook: FY26 growth of 20-28%

i. FY26: Revenue growth of 20-28%

FY26 revenue of Rs 750-800 cr implies a revenue growth of 36-44% in FY26 over its expected revenue of Rs 623 cr in FY25.

ii. Revenue visibility is strong

The demand outlook continues to be positive across both domestic and export markets, supported by healthy order inquiries and business visibility

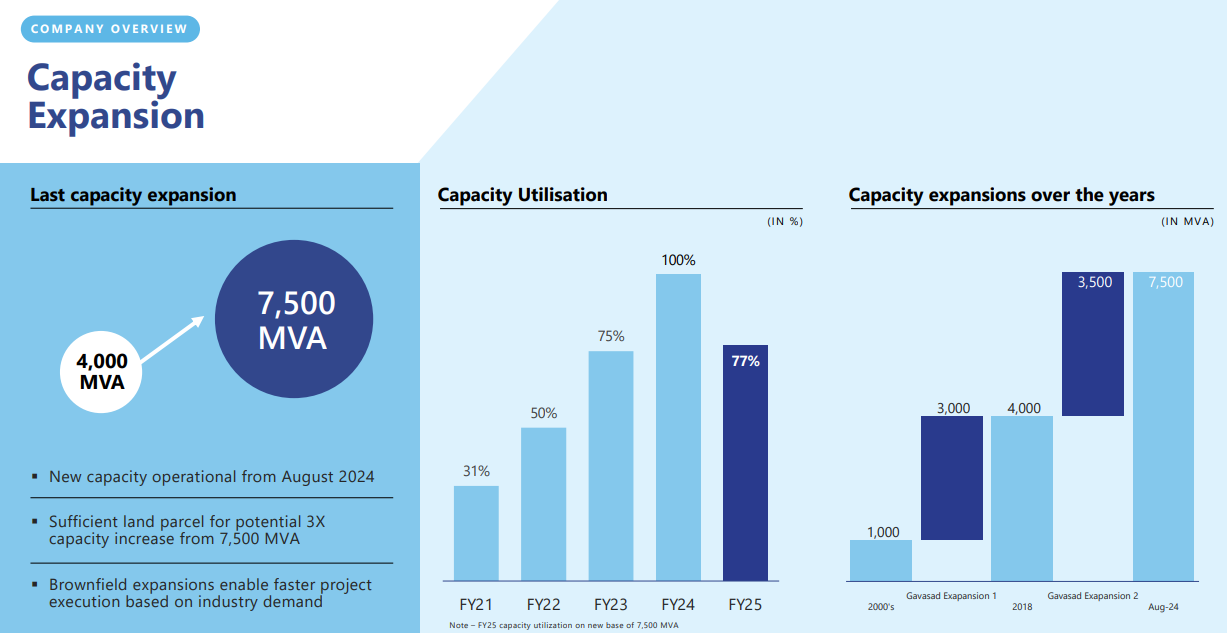

iii. FY26: Capacity in place to support growth

At a 77% Capacity utilization the headroom to grow may be limited if the growth momentum continues.

Given the robust demand environment, there is potential for further capacity expansion. For now, our immediate priority is to optimize existing operations and consolidate recent gains. Although we have not yet finalized any additional investments, I want to assure you that Shilchar is fully prepared to capitalise on the emerging opportunities in the transformer sector.

8. PAT growth of 60% & Revenue growth of 57% in FY25 at a PE of 33

9. Hold?

If I hold the stock then one can definitely hold on to Shilchar

Shilchar has delivered a strong FY25 delivering revenue significantly higher than its guidance of Rs 550 cr.

Looking ahead, we are on track to meet our annual topline target of ~₹550 crore for FY25 and are confident in fully leveraging our incremental capacity in FY26.

Shilchar is signaling a moderation in momentum,

FY26 revenue growth expected at 20–28%, a slowdown from FY25 highs.

Growth may be capped by current capacity constraints

Management appears cautious amid global tariff uncertainties.

That said, strong domestic tailwinds, especially from the renewables sector, continue to drive robust underlying demand.

Tariff overhang is a risk for Shilchar and needs to be watched closely.

US export outlook stable for now, but 90-day tariff pause could change dynamics.

If tariffs hit, margins and volumes on exports could take a hit.

The quality of growth has deteriorated. One needs to watch for further deterioration and could be a reason to exit.

Trade receivables doubled in FY25 (₹93 Cr → ₹228 Cr), raising questions on cash flow timing.

Cash from operations halved YoY despite record PAT.

10. Buy?

If I am looking to enter Shilchar then

Shilchar has delivered PAT growth of 60% & Revenue growth of 57% in FY25 at a PE of 37 which makes the valuations fully priced.

Outlook for FY26 revenue growth of 20-28% with improvement in margins at a PE of 33 implies that valuations are fully priced.

Quality transformer supplier can command better pricing

Structural growth tailwinds are in place benefiting from India’s multi-year capex in renewables, T&D, and power infrastructure.

Also exposed to global demand—transformer shortage = pricing power.

If the industry tailwinds with renewables driving demand for the next 5 years sustain then there is opportunity in Shilchar for the performance beyond FY26

Shilchar trades at 33 FY25 earnings which is premium for capital goods and implies little margin of safety if growth disappoints.

Shilchar is fairly valued given the structural tailwinds

At 33 PE, the stock isn’t cheap from a FY26 perspective

It is pricing in quality & continuation of the momentum in FY27

Previous coverage of Shilchar

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer