Shilchar Technologies: PAT up 39% & Revenue up 37% in 9M-25 at a PE of 37

Revenue growth of 39% growth in FY25. FY26 revenue growth of 45-64%. Industry tailwinds to support growth. Order book to support FY25 revenue. Capacity expansion to support growth till FY26.

1. Power & Distribution Transformer Manufacturer

shilchar.com | BOM: 531201

Specializes in custom made transformers for Renewables & Industrial applications

Transformers up to 50 MVA & 132 KV class

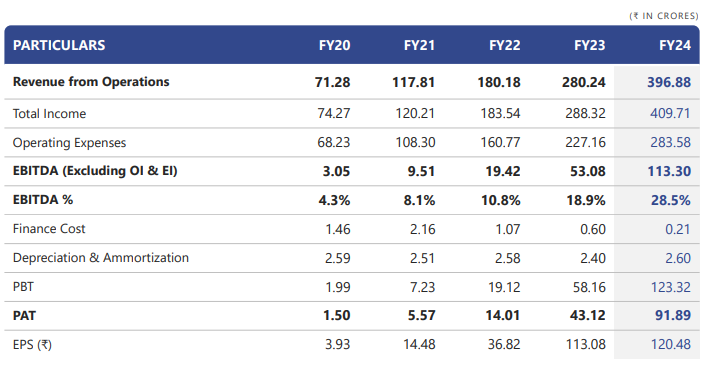

2. FY20-24: PAT CAGR of 180% and Revenue CAGR of 54%

3. Strong FY24: PAT up 113% & Revenue up 42% YoY

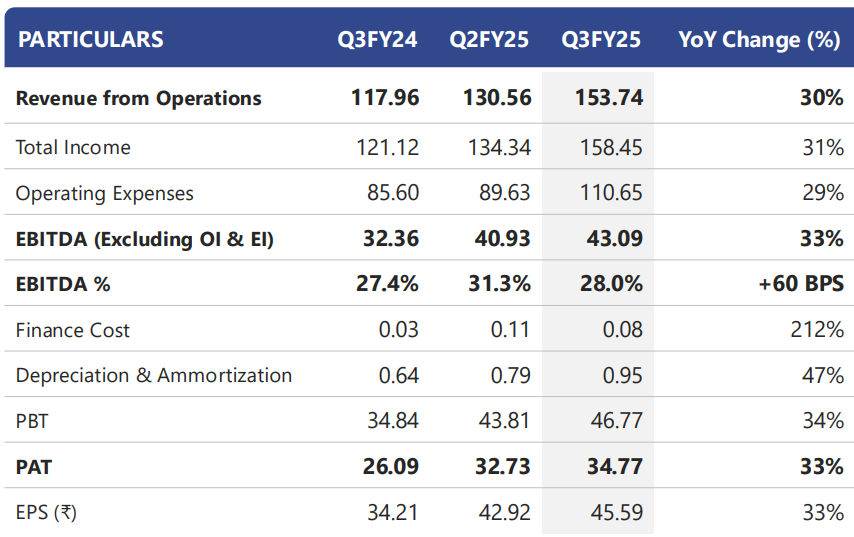

4. Strong Q3-25: PAT up 33% & Revenue up 30% YoY

5. Strong 9M-25: PAT up 37% & Revenue up 34% YoY

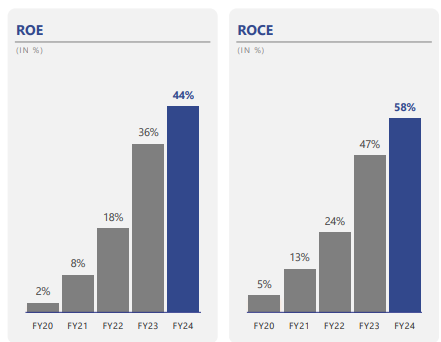

6. Business metrics: Strong & improving return ratios

7. Outlook: FY25 growth of 39%

i. FY25: Revenue growth of 39%

Shilchar management is confident of Rs 550 cr revenue in FY25. It implies required rate of Rs 160 cr revenue in Q4-25 which looks reasonable given that Rs 153 cr revenue was achieved in Q3-25. Revenue growth of 39% as revenue expected to grow to Rs 550 cr in FY24 from Rs 397 cr in FY24

Looking ahead, we are on track to meet our annual topline target of ~₹550 crore for FY25 and are confident in fully leveraging our incremental capacity in FY26.

ii. FY26: Revenue growth of 45-64%

FY26 revenue of Rs 800-900 cr implies a revenue growth of 45-64% in FY26 over its expected revenue of Rs 550 cr in FY25.

We expect the turnover of around Rs. 800 to Rs. 900 crores in two years.

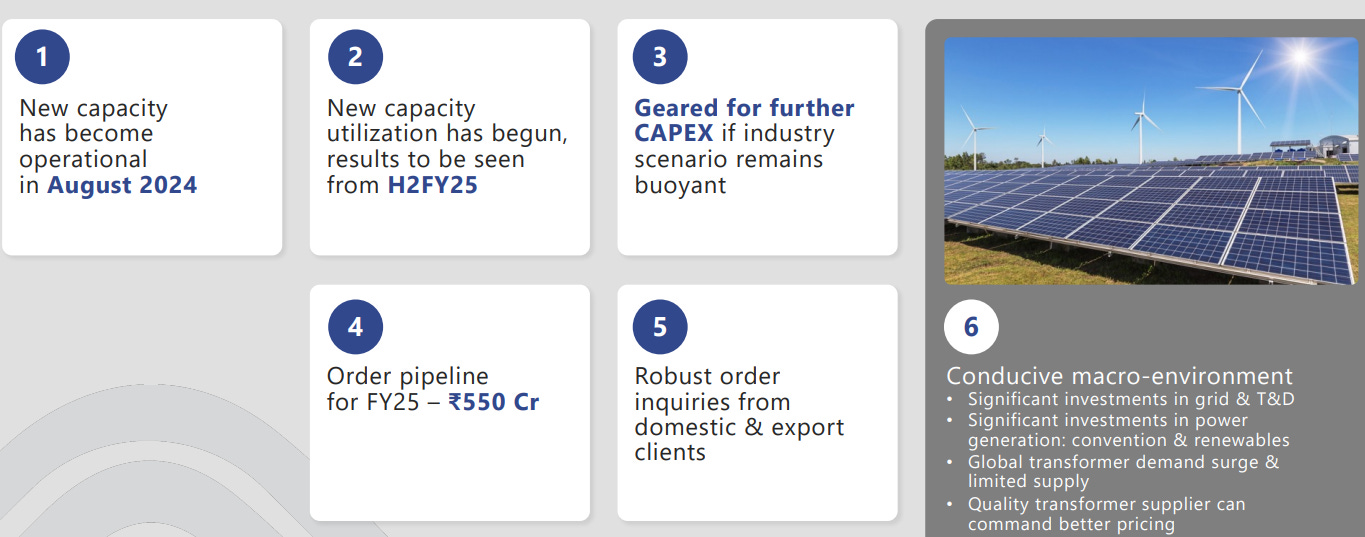

iii. Strong revenue visibility: Order book FY-25

Given the capacity constraints and ramp up of capacity during H2-25, the order pipeline of Rs 550 cr looks sufficient to support FY25 revenue

Order pipeline for FY25 – ₹550 Cr

Order book remained healthy owing to increased demand from end-user industries.

iv. FY26: Capacity expansion in place to support growth

8. PAT growth of 37% & Revenue growth of 34% in 9M-25 at a PE of 37

9. Hold?

If I hold the stock then one can definitely hold on to Shilchar

Shilchar has delivered a strong 9M-25 and pointing towards a strong FY25 and equally strong FY26.

The new plant has contributed to incremental production volumes, as evidenced by the topline growth in Q3. Demand remains strong in both domestic and international markets, providing us with good business visibility for the upcoming financial year.

One can stay the course with Shilchar as it is indicating a growth of 45-64% as it grows to Rs 800-900 cr in FY26 over the expected revenue of Rs 550cr in FY25.

Industry headwinds related to raw material supply have abated.

Initial concerns regarding the availability of the industry’s primary raw material, CRGO, have subsided following the renewal of BIS licenses for several CRGO suppliers. We anticipate no challenges in raw material procurement for the foreseeable future.

Strong industry tailwinds with renewables driving demand for the next 5 years

Our current business pipeline indicates strong visibility across various markets and product categories. We intend to maintain our export mix consistent with this year's performance.

The price stock price is 36% down from its 52 wk high which is creating a lot of doubts. However, the business momentum and execution in FY25 continues uninterrupted.

10. Buy?

If I am looking to enter Shilchar then

Shilchar has delivered PAT growth of 37% & Revenue growth of 34% in 9M-25 at a PE of 37 which makes the valuations fully priced.

Shilchar is guiding to deliver 39% Revenue growth in FY25 at a PE of 37 which makes the valuations fully priced.

Outlook for FY26 revenue growth of 45-64% at a PE of 37 provides a longer term opportunity in the stock.

The capacity expansion provides support to the growth outlook.

If the industry tailwinds with renewables driving demand for the next 5 years sustain then there is opportunity in Shilchar for the performance beyond FY26

At current valuations, the margin of safety is limited at a PE of 37. The stock would not be able to sustain even a single quarter of ordinary performance at a PE of 37

Previous coverage of Shilchar

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer