Shilchar Technologies: PAT up 39% & Revenue up 37% in H1-25 at a PE of 51

39% revenue growth guidance for FY25. 40-50% FY24-26 revenue CAGR guidance. Industry tailwinds to support growth. Order book to support FY25 revenue. Capacity expansion to support growth till FY26.

1. Power & Distribution Transformer Manufacturer

shilchar.com | BOM: 531201

Specializes in custom made transformers for Renewables & Industrial applications

Transformers up to 50 MVA & 132 KV class

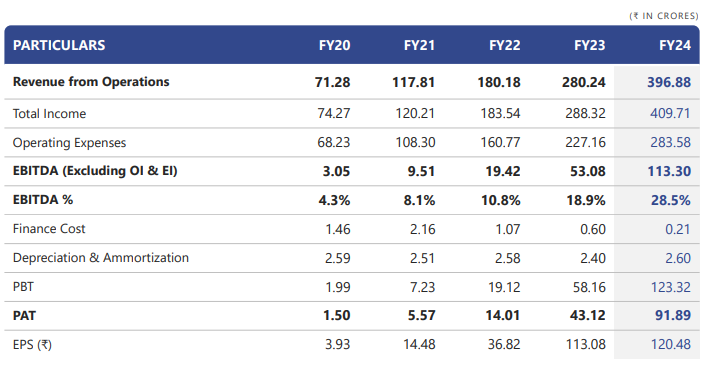

2. FY20-24: PAT CAGR of 180% and Revenue CAGR of 54%

3. Strong FY24: PAT up 113% & Revenue up 42% YoY

4. Strong Q2-25: PAT up 34% & Revenue up 23% YoY

5. Strong H1-25: PAT up 39% & Revenue up 37% YoY

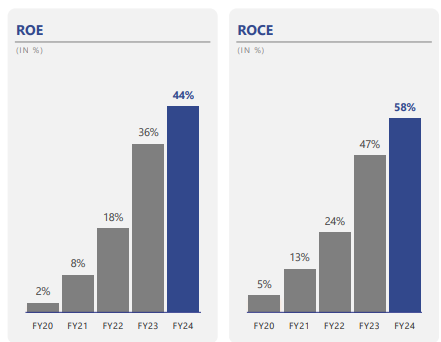

6. Business metrics: Strong & improving return ratios

7. Outlook: FY25 growth of 39%

i. FY25: Revenue growth of 39%

Revenue growth of 39% as revenue expected to grow to Rs 550 cr in FY24 from Rs 397 cr in FY24

We remain committed to achieving our target of ~₹550 Cr for FY25 and are poised to fully utilize the incremental capacity by FY26.

ii. FY24-FY26: Revenue CAGR of 40-50%

FY24 revenue doubling to Rs 800-900 cr implies a revenue CAGR of 40-50%

We expect the turnover of around Rs. 800 to Rs. 900 crores in two years.

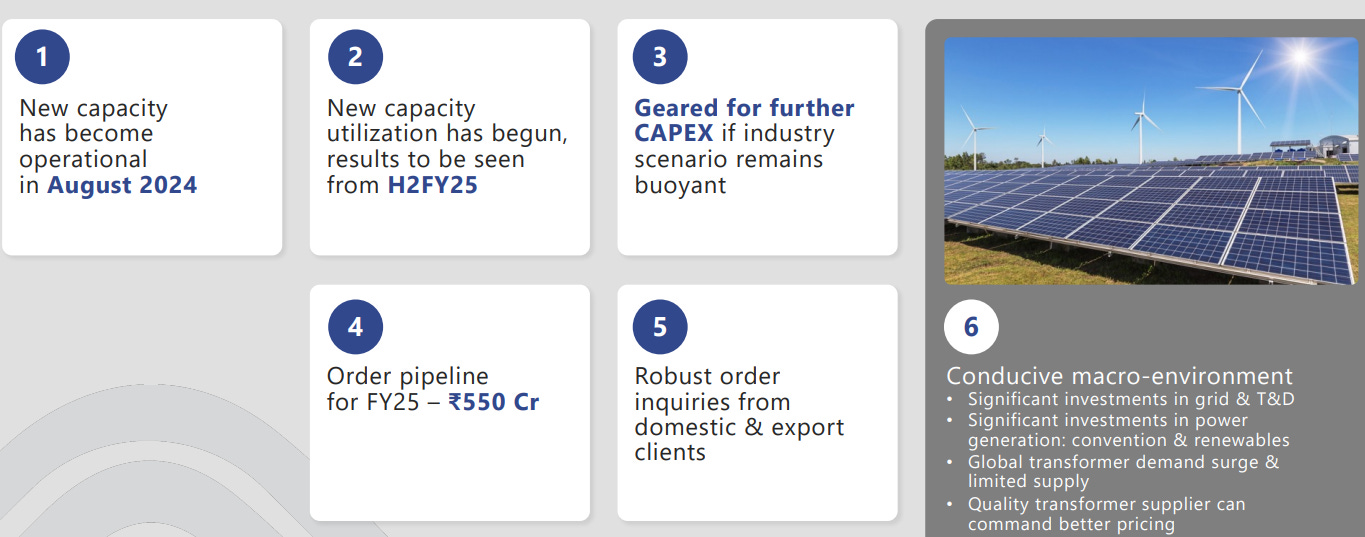

iii. Strong revenue visibility: Order book FY-25

Given the capacity constraints and ramp up of capacity during H2-25, the order pipeline of Rs 550 cr looks sufficient to support FY25 revenue

Order pipeline for FY25 – ₹550 Cr

iv. FY25: Capacity expansion by 88%

8. PAT growth of 46% & Revenue growth of 59% in Q1-25 at a PE of 47

9. Hold?

If I hold the stock then one can definitely hold on to Shilchar

Coverage of Shilchar was initiated after Q1-24 results. The investment thesis has not changed after a strong FY24 and equally strong H1-25.

FY25 would be muted as FY24 operations were constrained by capacity. New capacity will come online in H2-25. full impact of the capex will be seen in FY26. With capacity constraints 39% revenue growth is being promised by the management in FY25.

One can stay the course with Shilchar as it has roadmap to double revenue by FY26.

Strong industry tailwinds with renewables driving demand for the next 5 years

We are anticipating demand in renewable energy sector. This is mainly because of the government push government is targeting almost like you know 35 to 40 Gigawatt of the renewable you know projects to be installed each year so this will generate a huge demand of Transformers and I think for next 5 years at this demand should continue

10. Buy?

If I am looking to enter Shilchar then

Shilchar has delivered PAT growth of 39% & Revenue growth of 37% in H1-25 at a PE of 51 which makes the valuations fully priced.

Shilchar is guiding to deliver 39% Revenue growth in FY25 at a PE of 51 which makes the valuations fully priced.

The outlook for FY24-26 revenue CAGR of 40-45% at a PE of 51 implies that guidance for FY26 is also priced in.

The capacity expansion provides support to the growth outlook.

If the industry tailwinds with renewables driving demand for the next 5 years sustain then there is opportunity in Shilchar for the performance beyond FY26

At current valuations, the margin of safety is limited at a PE of 51. The stock would not be able to sustain even a single quarter of ordinary performance at a PE of 51

Previous coverage of Shilchar

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer