Shilchar Technologies Q1 FY26 Results: PAT Up 73%, On-track FY26 Guidance

FY26 20–28% growth guidance. Outlook moderates with capacity constraint. Tariffs, competitive pressure rich valuations weigh in, but demand tailwinds are strong

1. Power & Distribution Transformer Manufacturer

shilchar.com | BOM: 531201

2. FY21-25: PAT CAGR of 127% & Revenue CAGR of 52%

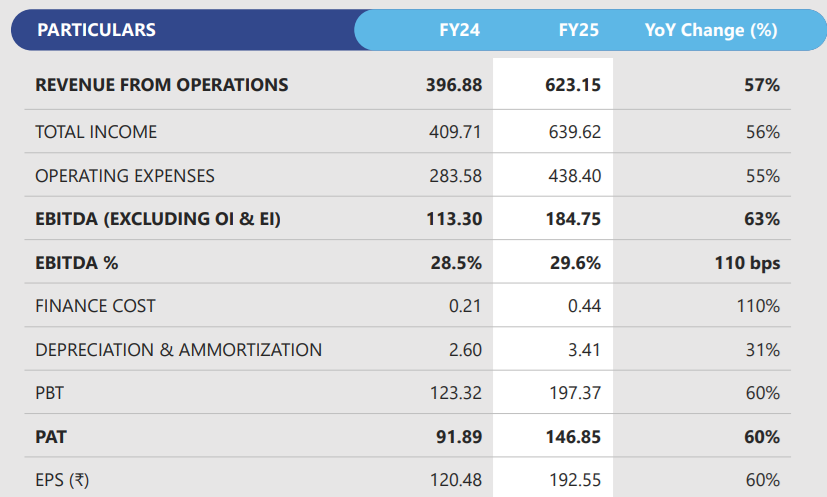

3. Strong FY25: PAT up 60% & Revenue up 57% YoY

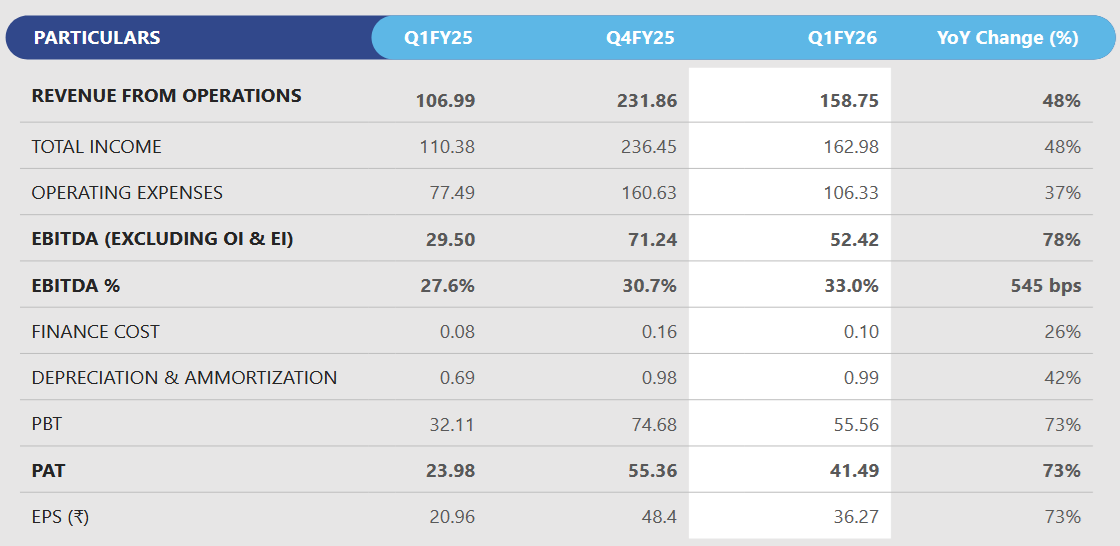

4. Strong Q1-26: PAT up 73% & Revenue up 48% YoY

Revenue Growth: Robust demand in solar transformers & healthy export traction.

EBITDA Margins: expanding to 33%, highlighting cost efficiency and premium positioning.

Sector Tailwinds: India added ~12.3 GW capacity in Q1FY26, of which 10.6 GW from solar – directly benefiting Shilchar.

Export Outlook: Global transformer shortages and grid investments in the US/EU driving export demand.

Domestic Growth: Management expects greater domestic share in FY26 as local demand accelerates.

5. Business metrics: Strong & improving return ratios

6. Outlook: FY26 growth of 20-28%

6.1 Management Guidance and Future Outlook

Q1FY26, reflecting the continued momentum carried over from the previous year. Demand from export markets also remains healthy during the quarter.

Industry demand outlook encouraging — driven by renewable energy installations, especially in the Solar sector

Tariff policy developments — awaiting further clarity in the coming months

Remain confident to achieve revenue target of ₹750–800 Cr for FY26.

Potential opportunities for further capacity expansion and are actively assessing our options.

In the interim, primary focus is on optimizing current operations and consolidating recent gains

Our business pipeline provides good visibility across both domestic and international markets,

We intend to maintain our export mix in line with this year’s achievements, leveraging our diverse market exposure and execution capabilities

6.2 Q1 FY26 vs FY26 Guidance

Q1-26 Run-rate in-line to meet FY26 guidance

Revenue: Inline with seasonality (Q1 is typically softer, Q4 strongest). Trajectory supports full-year ₹750–800 Cr.

Strong Start: Q1 revenue and PAT delivery (~21–22% of full-year) align well with guidance, despite Q1 being a seasonally lighter quarter.

Profitability Outperformance: Margins are tracking ahead at 33% providing cushion for the year.

Execution Visibility: Order book (~₹350–400 Cr on hand) and ongoing inquiry flow support management’s revenue target of ₹750–800 Cr.

Guidance Realism: Management’s FY26 guidance (~20–25% growth) is achievable, but upside beyond ₹800 Cr is limited by full capacity utilization.

What to Watch:

Q2FY26 revenue momentum (especially domestic share).

US tariff impact (due Q2FY26).

Capacity expansion announcement timing — critical for FY27–28 growth visibility.

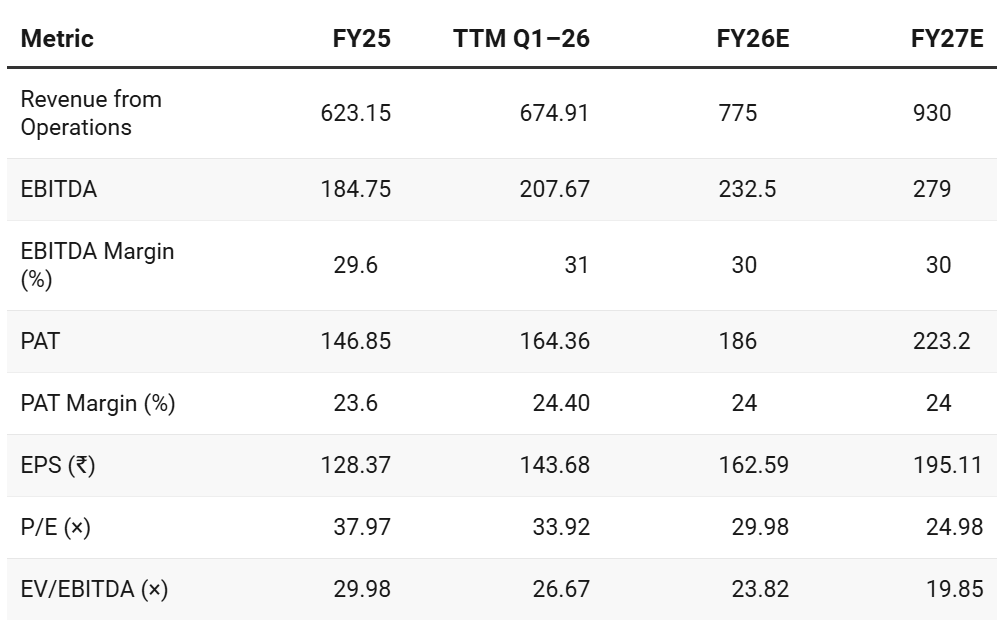

7. Valuation Analysis – Shilchar Technologies

7.1 Valuation Snapshot

CMP ₹4,874.05; Mcap ₹5,576 Cr

Capacity Utilization Constraint:

Execution Ceiling: Even with sector tailwinds, revenue beyond ~₹930 Cr cannot materialize until FY28 when new capacity comes online.

Q4FY25 delivered ₹232 Cr revenue at 100% utilization of 7,500 MVA capacity.

Annualized, this caps near-term revenue potential at ~₹930 Cr — which aligns with FY27E estimates.

Management Prudence:

We are already working on all the datas and drawings and what kind of capacity we want to increase, what will the cost be, what kind of land which we will be requiring for this new CAPEX. We are going a bit slow because we are a bit conservative, we want to make sure that any expansion we do has to be manageable and sustainable. But the plan is already going on, and at the right moment we will make a formal announcement.

New Capacity: it will take anywhere between 12 months to 18 months to complete the project and start production

Management is cautious in committing fresh capex.

This cautious stance reduces execution risk, but also mutes the growth opportunities till FY27 end or early FY28.

Valuations:

At ~25× FY27E P/E and ~20× EV/EBITDA, the market is already pricing in growth up to capacity ceiling.

With limited room for surprise, risk-reward becomes skewed toward downside if expansion is delayed.

Macro Pressures

Policy Risk: US tariffs remain a key swing factor for exports.

North America is about 20% of our total export, and the rest is around 80%, mainly Middle East and North Africa

Competitive Pressure: Peers are adding capacity faster — risking share loss, and or pricing pressure with increasing capacity.

Summary View

Base Case (Capacity-Capped): Revenue growth slows after FY26, peaking near ₹930 Cr (FY27). PAT capped at ~₹220–230 Cr. Valuations at ~25× P/E FY27E leave limited upside.

Bull Case (Expansion): If new capacity is announced & ready in ~12–18 months, growth could re-accelerate from FY28. Premium multiples can sustain.

Bear Case (Delay + Tariff Headwinds): If expansion is postponed beyond FY27 and US tariffs impact exports, revenue growth stalls at current levels; multiples compress toward 18–20× (sector average).

Variables to watch

Capacity growth

Impact of tariffs — will become clear in Q2-26

Sustainability of tailwinds — new capacity coming in the industry and pricing pressure

7.2 Opportunity at Current Valuation

Bull Case Expansion Optionality: If management accelerates capacity addition (12–18 months timeline), growth can re-accelerate post-FY27, extending earnings visibility beyond current ceiling.

Tailwind Support: Strong demand from renewable energy (solar, wind), global transformer shortages, and grid capex ensures order inflow remains robust until new capacity arrives.

Export Franchise: Diversified export base across 25+ countries offers pricing premiums and cushions against tariffs and domestic slowdown.

7.3 Risk at Current Valuation

Valuation Risk: The stock already discounts strong growth and margins till FY27. While upside is capped until new capacity comes online. Any slip in execution could trigger a sharp de-rating.

Capacity Saturation: With Q4FY25 at 100% utilization, there is no headroom for growth until expansion — creating a hard ceiling on revenue/PAT despite strong sector demand.

Management Conservatism: A cautious approach to capacity expansion may cause Shilchar to cede growth opportunities to faster-moving competitors in a strong demand cycle.

Competitive Intensity: Multiple peers have announced aggressive expansions; rising industry capacity could pressure pricing and dilute Shilchar’s current margin advantage.

Policy Uncertainty: Export-driven growth faces risks from US tariff policy and other trade restrictions, which may impact order flow or realizations.

Previous coverage of Shilchar

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Guys love the breakdown & thanks for simplifying complex topic like this so easy and fun to read