Shilchar Technologies: PAT up 113% & Revenue up 42% in FY24 at a PE of 45

40-50% revenue CAGR guidance for FY24-26. Industry tailwinds to support growth for the next 5 years. Order book is sufficient for H1-25. Capacity expansion in place to support growth till FY26.

1. Transformer Manufacturer

shilchar.com | BOM: 531201

Shilchar Technologies Ltd. a manufacturers of Electronics & Telecom and Power & Distribution transformers.

The Company has concentrated on catering needs of renewable energy sector including solar and wind energy in local market where in the Company has been enjoying commendable position being one of the top companies in India supplying transformers for renewable energy.

2. FY20-24: PAT CAGR of 180% and Revenue CAGR of 54%

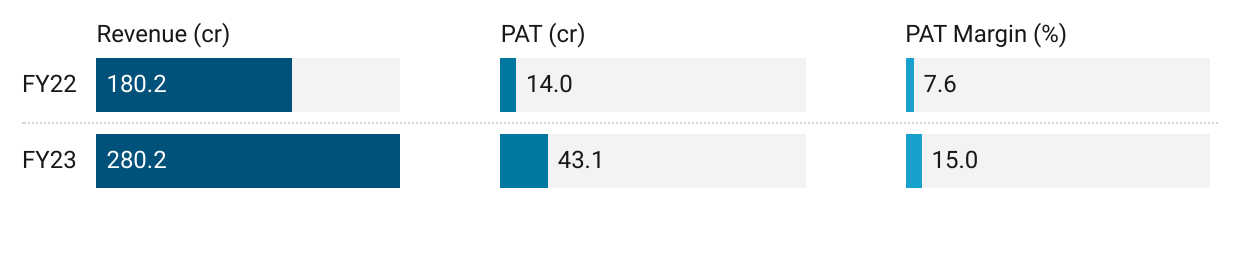

3. Strong FY23: PAT up 207% and Revenue up 56% YoY

4. Strong 9M-24: PAT up 149% & Revenue up 57% YoY

5. Strong Q4-24: PAT up 54% & Revenue up 11% YoY

Q4-24 growth constrained by capacity

We have a capacity of 4000 MVA at present out of which and this year we are running 100% capacity

6. Strong FY24: PAT up 113% & Revenue up 42% YoY

7. Business metrics: Strong & improving return ratios

8. Outlook: Order book in place to support H1-25 revenue

i. Strong revenue visibility: Order book is sufficient for H1-25

From the Rs 355cr order book of 1-Jan-24, Rs 105 cr of orders executed in Q4-24. This implies order book of at least Rs 255 cr is in place to support revenue for H1-25

Total order booking as on 1st January 2024 is INR 355 crores.

ii. FY24-FY26: Revenue CAGR of 40-50%

FY24 revenue doubling to Rs 800-900 cr implies a revenue CAGR of 40-50%

We expect the turnover of around Rs. 800 to Rs. 900 crores in two years.

iii. Capacity expansion by 88% in FY25

The full impact of the capacity expansion will be felt in FY26. FY25 will see a partial impact of the capacity expansion

Manufacturing for phase 1 expansion to start from 1st April 2024

Capacity to increase from 4000 MVA p.a. to 5500 MVA p.a.

Manufacturing for phase 2 expansion to start from 1st July 2024

Capacity to increase from 5500 MVA p.a. to 7500 MVA p.a

It normally takes about 2 years for 100% utilise the capacity so I think FY 2025-26 we should be able to get 100% capacity

9. PAT growth of 113% & Revenue growth of 42% in 9M-24 at a PE of 45

10. So Wait and Watch

If I hold the stock then one can definitely hold on to Shilchar

Coverage of Shilchar was initiated after Q1-24 results. The investment thesis has not changed after a strong FY24. The delivery of a strong FY24 has increased confidence in the management to deliver a stronger FY25

One can stay the course with Shilchar as has roadmap to double revenue by FY26.

One needs to keep a watch on the planned capacity getting executed and not getting delayed.

Strong industry tailwinds with renewables driving demand for the next 5 years

We are anticipating demand in renewable energy sector. This is mainly because of the government push government is targeting almost like you know 35 to 40 Gigawatt of the renewable you know projects to be installed each year so this will generate a huge demand of Transformers and I think for next 5 years at this demand should continue

11. Or, join the ride

If I am looking to Shilchar then

Shilchar has delivered PAT growth of 113% & Revenue growth of 42% in FY24 at a PE of 45 which makes the valuations acceptable.

The outlook for FY24-26 revenue CAGR of 40-45% at a PE of 45 which makes the valuations acceptable.

The outlook for 88% capacity expansion provides support to the growth outlook.

If the momentum continues as delivered in the past, there is significant opportunity in Shilchar however the margin of safety is reducing at a PE of 45. The stock would not be able to sustain even a single weak quarter at a PE of 45

Previous coverage of Shilchar

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer