Shankara Building Products: PAT up 29% & Revenue up 31% in H1-24 with outlook of revenue CAGR of 26% for FY23-28 at a PE of 23

SHANKARA took a clear call for FY23 to up the ante for top line growth. Aspiration to grow to Rs 10,000 cr by FY28 while expanding margins. H1-24 performance on track to deliver FY28 targets

1. Marketplace for Building Materials

shankarabuildpro.com | NSE: SHANKARA

Products: Non-steel business expansion to drive blended EBITDA margin improvement in the coming years

2. FY17-23: Delivering top-line growth in FY23

FY23 PAT still below the FY18 peak

We sort of were very focused on working capital and balance sheet management. Last year, i.e., ‘22-23, the management took a clear call that we need to up our ante as far as top line growth

3. FY23: PAT up 84% and revenue up 67% YoY

4. Strong Q1-24: PAT up 44% and revenue up 36% YoY

5. Q2-24: PAT up 17% and revenue up 26% YoY

6. Strong H1-24: PAT up 29% and revenue up 31% YoY

7. Business metrics: Improving return ratios but cashflow has been hit

7. Outlook: Revenue CAGR of 26% for FY23-28

i. Rs 10,000 cr revenue by FY28 i.e. CAGR of 26% for FY23-28

We are aspiring to grow our revenue at 20% to 30% CAGR over the next 4 to 5 years. We aspire to become a Rs. 10,000 crores top line company in the next 5 years.

ii. EBITDA margin expansion

EBITDA Margin: Aspirational is 4 percentage.

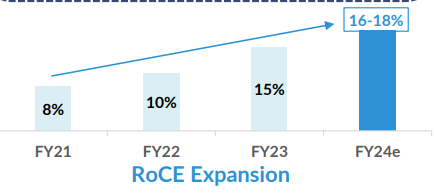

iii. Targeting ROCE of 16-18% in FY24

ROCE as of H1-24 was 16%. It is in line with the target of 16-18% ROCE for FY24.

8. PAT growth of 29% & revenue growth of 31% YoY in H1-24 at a PE of 23

9. So Wait and Watch

If I hold the stock then one may continue holding on to SHANKARA .

Coverage of SHANKARA was initiated after Q1-24 results. The investment thesis has not changed after a strong H1-24. The only changes are the delivery of a strong H1-24 and the increased confidence in the management to deliver a stronger FY24

H2-24 is expected to be stronger than H1-24 and SHANKARA is on track to deliver a FY24 in line with its target to achieve Rs 10,000 cr revenue by FY28

Deterioration of cashflow in Q2-24 is a red flag. Needs to be observed for Q3-24.

10. Or, join the ride

If I am looking to enter SHANKARA then

SHANKARA has delivered PAT growth of 29% and revenue growth of 31% in H1-24 at a PE of 23 which makes the valuations fair.

H2-24 is expected to be stronger than H1-24 which makes the valuations look reasonable at a PE of 23 in the medium term

From a longer term perspective, FY24 performance is in line to deliver Rs 10,000 cr by FY28 at revenue CAGR of 26%. A revenue CAGR of 26% for FY23-28 at a PE of 23 makes valuations quite reasonable.

Previous coverage of SHANKARA

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades