Shankara Building Products: 34% EBITDA & 26% revenue CAGR for FY23-28 at a PE of 24

SHANKARA management took a clear call for FY23 to up the ante for top line growth. Aspiration to grow to Rs 10,000 cr by FY28 while expanding margins

1. Marketplace for Building Materials

shankarabuildpro.com | NSE: SHANKARA

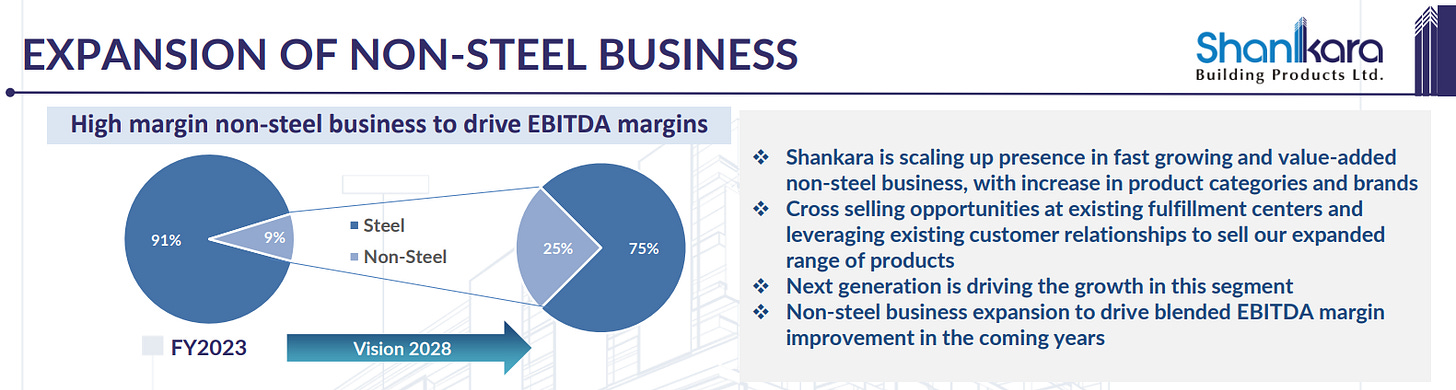

Products: Non-steel business expansion to drive blended EBITDA margin improvement in the coming years

2. FY17-23: Delivering top-line growth in FY23

FY23 PAT still below the FY18 peak

We sort of were very focused on working capital and balance sheet management. Last year, i.e., ‘22-23, the management took a clear call that we need to up our ante as far as top line growth

3. FY23: PAT up 84% and revenue up 67% YoY

For FY '23, our total revenue came by INR4,029 crores registering a growth of 67% as compared to the previous year of -- previous year FY '22.

EBITDA was at INR125 crores, which has grown to 42% and the margin came at 3.1%.

PAT was INR63 crores as against INR34.3 crores in the previous year.

4. Q1-24: PAT up 44% and revenue up 36% YoY

On the back of a positive real estate cycle and an increasing trend of home premiumization, our revenues have increased by 36% YoY during the quarter. This growth is a testament of our ability to capitalize on the favourable market conditions.

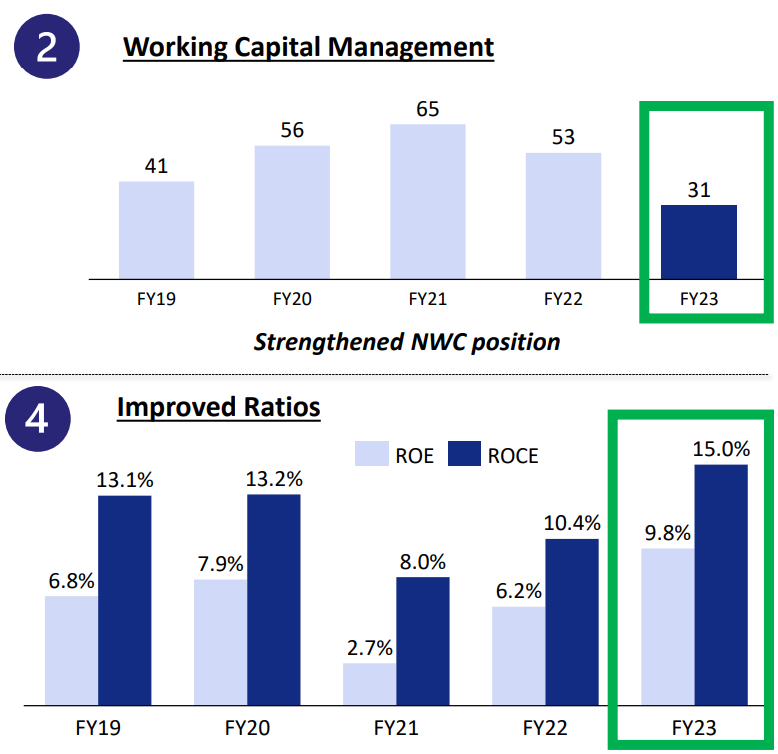

5. Business metrics: Generating free cash flow & improving return ratios

We have at least in mind, the target figure of 20%. We have moved from 10% to 15%. So we have a target figure of 20 this year. And we believe that the -- on the back of an expansion of margin is where the ROCE should start improving

6. Outlook: 34% EBITDA CAGR for FY23-28

i. Rs 10,000 cr revenue by FY28 i.e. CAGR of 26% for FY23-28

We are aspiring to grow our revenue at 20% to 30% CAGR over the next 4 to 5 years. We aspire to become a Rs. 10,000 crores top line company in the next 5 years.

ii. EBITDA to grow at CAGR of 34% for FY23-28

FY28 EBIDTA expected to be Rs 400 cr on a 4% margin on a revenue of Rs 10,000 cr. This implies that EBITDA will grow from Rs 125 cr in FY23 to Rs 400 cr in FY28 implies an EBITDA growing at a CAGR of 34% for FY23-28

EBITDA Margin: Aspirational is 4 percentage.

7. 34% EBITDA CAGR for FY23-28 at a PE of 24

8. So Wait and Watch

If I hold the stock then one may continue holding on to SHANKARA given the five year growth road map toll FY28. There is potential for upside as SHANKARA is working on a target to achieve Rs 10,000 cr of revenue by FY28 while expanding margins where bottom-line is expected to grow faster than the top-line.

SHANKARA management has confirmed that top-line growth was not on the top of their agenda before FY23. The management needs to be watched towards their commitment to growth.

We sort of were very focused on working capital and balance sheet management. Last year, i.e., ‘22-23, the management took a clear call that we need to up our ante as far as top line growth

9. Or, join the ride

If I am looking to enter the stock then

34% EBITDA & 26% revenue CAGR for FY23-28 at a PE of 24 makes SHANKARA quite reasonable.

SHANKARA generated Rs 48 cr of free cash flow and is available for a market cap of Rs 1,655 cr. Its free cash flow yield of 3% makes the valuations look reasonable.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades