Shakti Pumps: PAT growth of 473% & revenue growth of 143% in 9M-25 at a PE of 36

Outlook of 182% PAT growth & 82% revenue growth in FY25 with 16-18% PAT margin. Growth supported by order book. Capex plans in place to support doubling of revenue in 3 years.

Analysis to be updated at moneymuscle.in post Q3-25 earnings call on 27-Jan

1. Manufacturing of pumps and motors

shaktipumps.com | NSE: SHAKTIPUMP

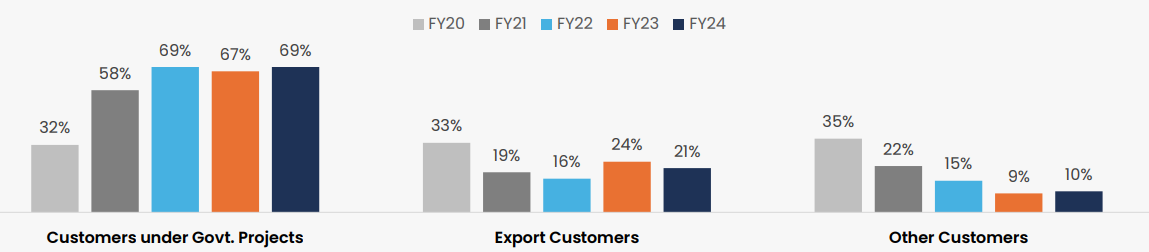

Customer Mix

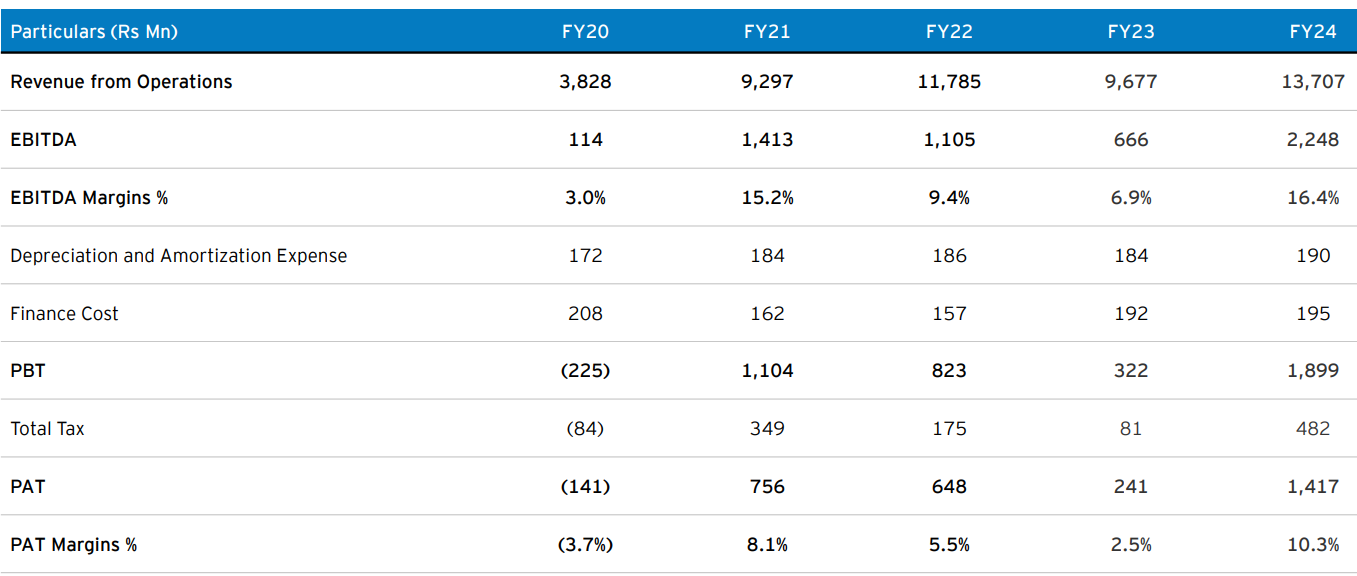

2. FY20-24: EBITDA CAGR of 111% & Revenue CAGR of 38%

3. Strong FY24: PAT up 487% & Revenue up 42% YoY

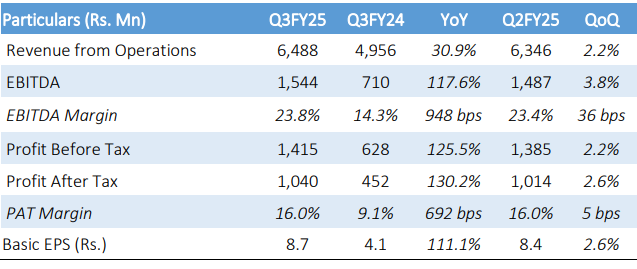

4. Q3-25: PAT up 130% & Revenue up 31% YoY

PAT up 3% & Revenue up 2% QoQ

5. 9M-25: PAT up 473% & Revenue up 143% YoY

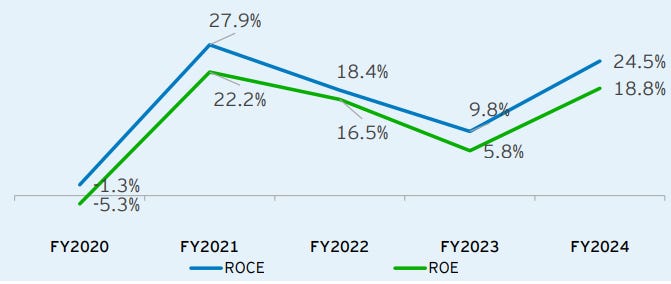

6. Business metrics: Strong & improving return ratios

7. Outlook: PAT growth of 182% & Revenue growth of 82%

i. FY25: Revenue growth of 82%

SHAKTIPUMP's 9M-25 revenue stands at Rs 1,851 cr, with Q3-25 revenue specifically at Rs 649 cr. If the company maintains Q3-25's revenue level in Q4, it would translate to a revenue of Rs 2500 cr in FY25 a 82% revenue growth. The expectation looks reasonable as Q4 is typically the largest quarter of the year.

ii. FY25: PAT growth of 182%

SHAKTIPUMP had delivered 16.1% PAT margin in 9M-25. The guidance of 16-18% PAT margin looks achievable for FY25. Assuming a 16% margin on a FY25 revenue of Rs 2500 cr leads to a a PAT of Rs 400 cr in FY25. This translates to a 182% growth in PAT over the PAT of Rs 142 cr in FY24.

Minimum margin guidance of 16% to 18%.

If anything, margins could be better than this guidance.

iii. Strong order book providing revenue visibility

Order book can support the FY25 revenue of Rs 2500 cr. One needs to see the order intake for Q4-25 and outlook for FY26 to get visibility on the revenue growth in FY26.

Order inflow continued to gain momentum, resulting in a robust outstanding order book position of around Rs. 20,700 Mn (inclusive of GST) as on 31st December 2024, which is to be executed within a year.

With the diversification of orders beyond the PM KUSUM Scheme like Magel Tyala Saur Krushi Pump Scheme, we remain confident about our growth prospects.

iv. Capex to double revenue potential in 2 years

9M-25 revenue was Rs 1,851 cr which is close to the Rs 2,500 cr revenue run-rate which would trigger the capex to double the capacity in 2 years. Doubling of capacity with 25-30% growth could mean revenue doubling in 3 years

The total capacity will be 2x. In our previous calls, we have been telling that as soon as sale of Rs. 2,500 crores come then after that we will do further planning for production capacity, and we see more orders ahead. In 2 years, we will complete our investment and then our capacity will become Rs. 5,000 crores

8. PAT growth of 473% & revenue growth of 143% in 9M-25 at a PE of 36

9. Hold?

If I hold the stock then one may continue holding SHAKTIPUMP

SHAKTIPUMP exceeded revenue guidance for both Q3-25 & Q2-25. Outlook for Q4-25 should be strong. We will await the guidance in its earning call.

Revenue guidance for Q3-25 is at least ₹500 crore

Gave a revenue guidance of ₹500 crore for Q2-25, but revenue was ₹640 crore.

Will provide guidance for Q4-25 at the end of Q3-25.

Q4 is historically strong quarter. One could expect close to Rs 2,500 cr revenue in FY25. This would be 200% growth in FY25, if 9M-25 performance continues into Q4-25

SHAKTIPUMP order book has shown fluctuation:

Mar-24: Rs 2,400 cr

Jun-24: Dropped to Rs 2,000 cr

Sep-24: Further reduced to Rs 1,800 cr

Dec-24: Improved to Rs 2,070 cr

Management remains optimistic about potential order inflow in upcoming quarters. However, the order book remains below the March-end level, which could be a potential concern for FY26 performance.

SHAKTIPUMP is in the middle of a strong run. It has sequentially improved its PAT on a QoQ basis for the last 6 quarters since Q2-23. One should ride this wave of strong performance.

10. Buy?

If I am looking to enter SHAKTIPUMP then

SHAKTIPUMP has delivered PAT growth of 2730% & Revenue growth of 352% in H1-25 at a PE of 36 which makes valuations attractive in the short term.

The FY25 outlook of 182% PAT growth and 82% revenue growth with sustainable margins at a PE of 36 makes the valuation reasonable from the FY25 perspective.

One needs to hear the outlook for Q4-25 to get a view on the outlook for FY26.

The capex to support doubling of revenue in 3 years at a PE 36 makes the valuations reasonable from the longer term provided the order book is in place to support the growth.

Declining order book needs to be kept in mind as it will determine growth in FY26.

Previous Coverage of SHAKTIPUMP

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer