Shakti Pumps: PAT growth of 2730% & revenue growth of 352% in H1-25 at a PE of 27

Conservative outlook of 100% revenue growth in FY25 with 16-18% EBITDA margin, supported by a strong order book. Capex plans in place to support doubling of revenue in 3 years

Quick summary of latest Earning Calls & Sectoral Insights visit moneymuscle.in

1. Manufacturing of pumps and motors

shaktipumps.com | NSE: SHAKTIPUMP

Manufacturing fabrication technology-based solar/electricity operating submersible pumps

Shakti Pumps is one of the few Indian manufacturers with the competency to manufacture solar and submersible pumps and motors in-house.

The company is the biggest beneficiary under the PM KUSUM scheme and holds ~25% market share in the scheme.

Corporate Structure

Business Segments

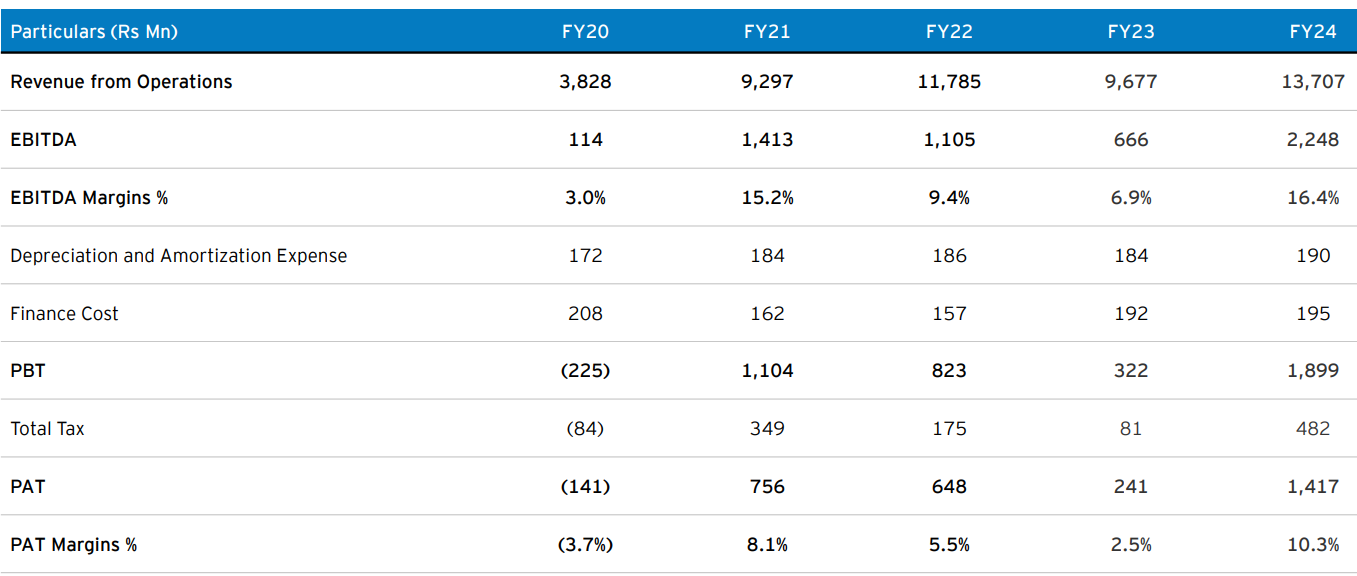

2. FY20-24: EBITDA CAGR of 111% & Revenue CAGR of 38%

3. Strong FY24: PAT up 487% & Revenue up 42% YoY

4. Q2-25: PAT up 1633% & Revenue up 315% YoY

PAT up 10% & Revenue up 12% QoQ

5. H1-25: PAT up 2730% & Revenue up 352% YoY

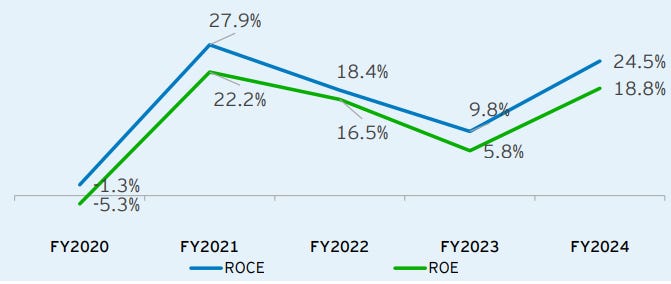

6. Business metrics: Strong & improving return ratios

7. Outlook: Revenue growth of 100%+

i. FY25: Revenue growth of 100%

H1-25 revenue of Rs 1,200 cr and Q3-25 guidance of Rs 500 cr implies 9M-25 revenue of Rs 1,700 cr indicating a 100% revenue growth in FY25

Revenue guidance for Q3-25 is at least ₹500 crore

Gave a revenue guidance of ₹500 crore for Q2-25, but revenue was ₹640 crore.

Will provide guidance for Q4-25 at the end of Q3-25.

Order book of ₹1,800 crore, will take approximately 12 months to execute

Has enough capacity for the orders it has and expects for fiscal year 2026

Expect orders to continue to come in, they stated that the main challenge will be execution

The company has already started expanding its capacity, which should help support revenue growth

This capacity expansion is expected to take approximately two years to be fully operational, but some increased capacity will be available in upcoming quarters

Expanded capacity will bring total capacity to ₹5,000 crore, which includes ₹2,500 crore from the existing capacity and ₹2,500 crore from the expansion

ii. EBITDA margins to sustain

EBITDA margin guidance of 16-18% for FY25 vs achievement of 16.4% in FY24

Minimum EBITDA margin guidance of 16% to 18%.

If anything, margins could be better than this guidance.

Solar pumping business and agricultural market would not support margins any higher than those currently achieved by Shakti Pumps.

Policy of not participating in tenders with margins below a certain percentage, but they declined to disclose that percentage in the call.

Expects gross margins in the range of 35% to 40%, assuming that the current stable prices for raw materials hold.

Experienced significant inflation in raw material costs last year and do not believe that will repeat.

Will provide further guidance on gross margins next quarter, based on any new developments.

Shakti Pumps' strong margins are due in part to the pricing of its pumps. Even when removing trading and solar business, the company maintained strong margins in the Kusum scheme.

Does not expect the prices of its pumps to decrease drastically. They believe that prices have reached a sustainable position as technology has developed.

For their new EV business, Shakti Pumps is targeting margins of 15% to 17%.

iii. Strong order book providing revenue visibility

Our order inflow continues to remain robust with the outstanding order book stood at around Rs. 1,800 Crores as on September 2024.

iv. Capex to double revenue potential in 2 years

H1-25 revenue was Rs 1202 cr which is close to the Rs 2,500 cr revenue run-rate which would trigger the capex to double the capacity in 2 years. Doubling of capacity with 25-30% growth could mean revenue doubling in 3 years

The total capacity will be 2x. In our previous calls, we have been telling that as soon as sale of Rs. 2,500 crores come then after that we will do further planning for production capacity, and we see more orders ahead. In 2 years, we will complete our investment and then our capacity will become Rs. 5,000 crores

8. PAT growth of 2730% & revenue growth of 352% in H1-25 at a PE of 25

9. Hold?

If I hold the stock then one may continue holding on to SHAKTIPUMP

SHAKTIPUMP has delivered the strongest revenue & PAT in FY24 and followed it by a strong H1-25 delivering top-line growth with a PAT margin expansion on QoQ. The outlook for Q3-25 is strong with management guiding for Rs 500 cr which looks conservative.

One could expect 100%+ growth in FY25 if H1-25 performance continues into H2-25

Better than anticipated results in FY25 indicated by SHAKTIPUMP

given our robust order book, in conjunction with our consistent success in winning more orders, we are confident that we will deliver better than anticipated results this year.

The order book of Rs 2400 cr as of Mar-24 has reduced to Rs 2,000 cr as of Jun-24 end to Rs 1,800 cr as of Sep-24 end. SHAKTIPUMP management is optimistic about the prospective order inflow from various states in the upcoming quarters. However, we need to keep a watch on the order book. Sequential fall in order book is a red flag from FY26 perspective.

Rising receivable and negative cash flow generation from operations after spectacular results is a big red flag and needs to be watched.

10. Buy?

If I am looking to enter SHAKTIPUMP then

SHAKTIPUMP has delivered PAT growth of 2730% & Revenue growth of 352% in H1-25 at a PE of 25 which makes valuations attractive in the short term.

The FY25 outlook of 100%+ growth with sustainable margins at a PE of 25 makes the valuation attractive from the medium term.

The capex to support doubling of revenue in 3 years at a PE 25 makes the valuations reasonable from the longer term provided the order book is in place to support the growth.

Declining order book and high trade receivables need to be kept in mind.

Previous Coverage of SHAKTIPUMP

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer