SG Mart: EBITDA growth of 180% & Revenue growth of 142% in FY25 at a PE of 50

Guiding for 120-128% & FY24-26 revenue CAGR. Guiding for EBITDA growth of 90-94% & Revenue CAGR of 85-89% for FY24-27.. Outlook is supported by macro tailwinds for B2B marketplaces

1. Why is SG Mart interesting?

sgmart.co.in | BOM : 512329

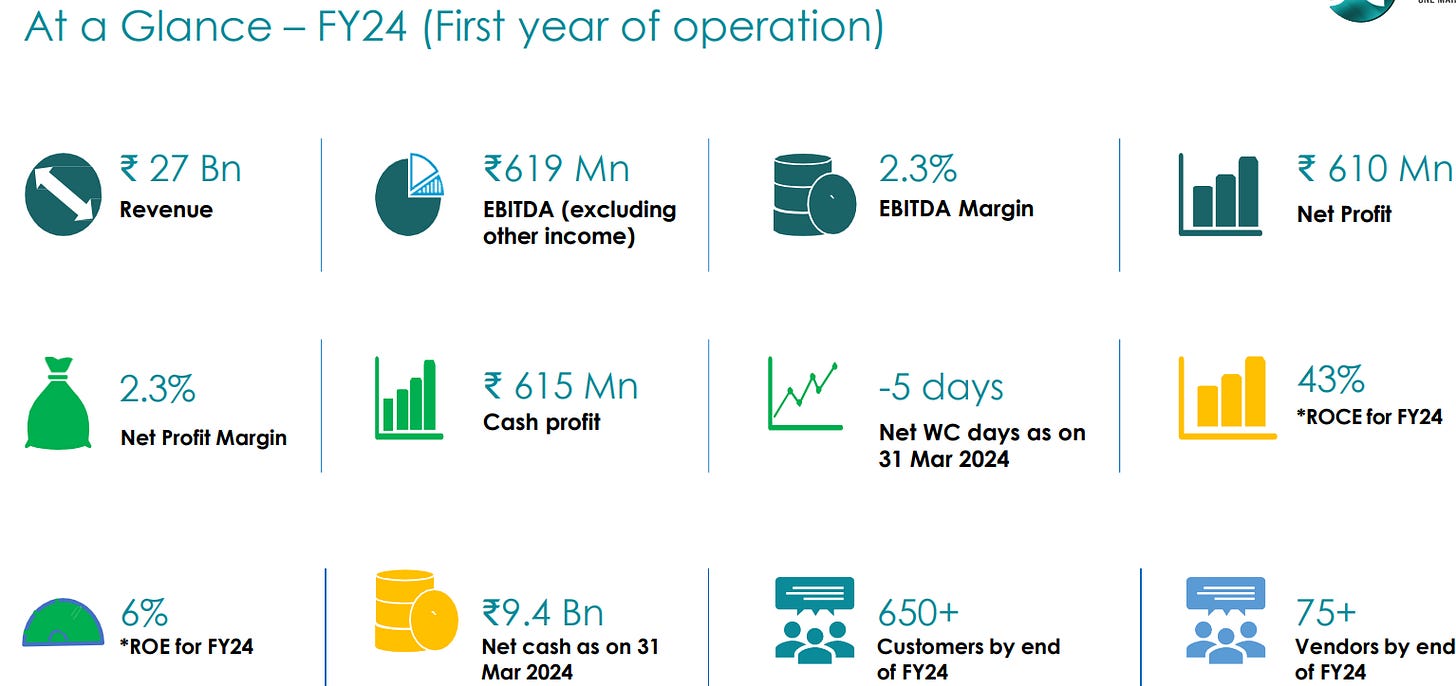

SG Mart's journey from Rs 2,700 cr in FY24 to an anticipated Rs 17,000-18,000 cr by FY27 presents an exciting outlook, buoyed by strong industry tailwinds. Equally exciting is the opportunity in the valuations that do not fully discount the long term outlook.2. A B2B market-place for construction materials

sgmart.co.in | BOM : 512329

Formerly known as Kintech Renewables Limited, SG Mart Business was started in June 2023.

SG Mart offers a wide range of products, now encompassing more than 27 product categories, and more than 1750 SKUs. These categories include steel construction products like TMT Rebars, HR Sheet, Welding rod, Binding wire, mesh net, tapping screw and barbed wire, among others. Additionally, in response to the increasing demand, the Company has introduced tiles, cement, bath fittings, laminates and paints.

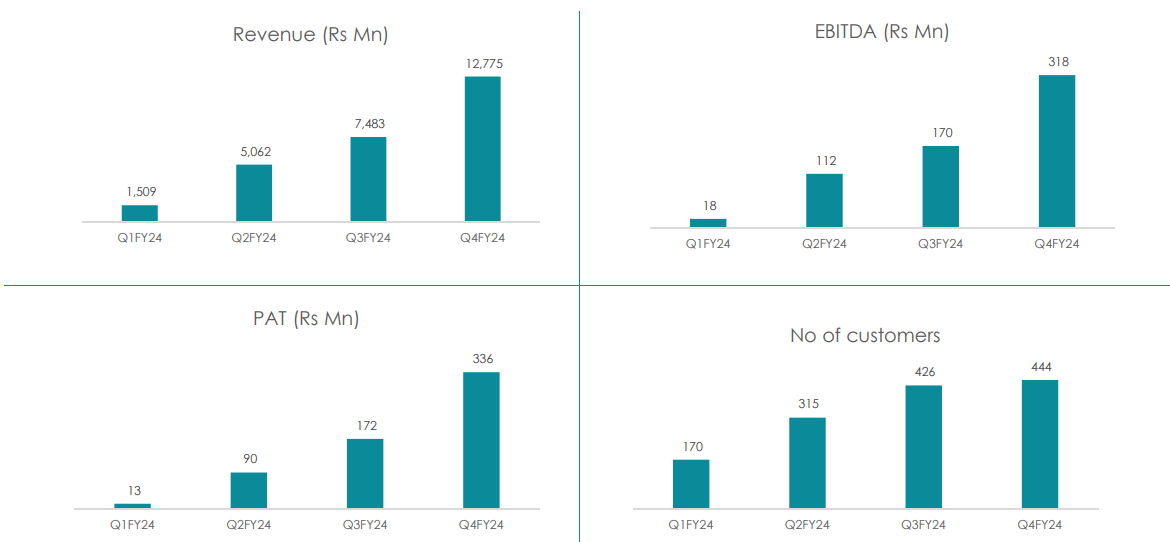

3. FY24: QoQ growth in PAT & Revenue in all quarters

FY24 (First year of operation)

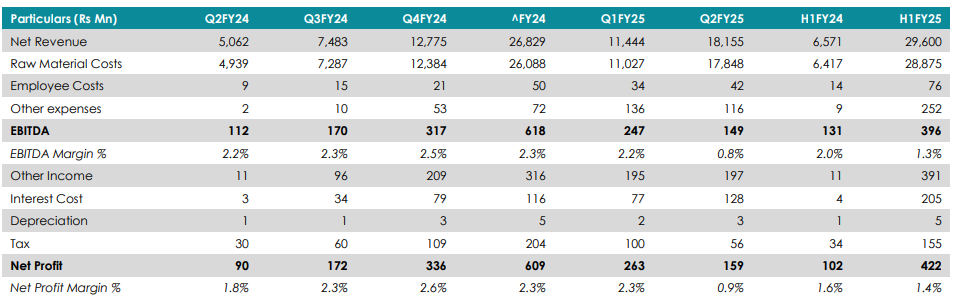

4. Strong H1-25: Not comparable YoY

Despite a 15% steel price drop impacting Q2 margins, the company maintained its FY27 revenue guidance of ₹17,000-₹18,000 crores with a 2.5% EBITDA margin.

Not comparable YoY as SG Mart started operations in Jun-23 5. Business metrics: Strong return ratios

Earning 2.5%, 3% margin makes my business pretty sustainable. What we have to look is keeping our working capital requirement low, churns 15-20 times in a year, zero creditors, zero debtors, and make 35% ROCE, maybe higher

6. Outlook: EBITDA CAGR of 90-94% & Revenue CAGR of 85-89% for FY24-27

i. FY25: EBITDA growth of 180% & Revenue growth of 142%

Rs 7,000-8,000 cr of revenue in FY25, implies a revenue growth of 161-198% in FY25. A 2-2.5% EBITDA margin of Rs 6,500 cr of revenue in FY25 implies and EBITDA growth of 110-1633%

So, I guess for full year, we are sticking to our guidance of INR6,500 crores kind of revenue.

We are building our business model, which is high volume, high churn, low margin, but high ROC. Okay, so these 2% to 2.5% EBITDA margin will generate 25%, 30% ROC, which we are chasing.

Volume: Full year we should do 1.2 million tons plus.

ii. FY24-26: Revenue CAGR of 120-128%

This will ramp up to INR13,000-INR14,000 crores next year

FY26 Volume: For next year it should be 2 million tons plus.

iii. FY24-27: EBITDA growth of 90-94% & Revenue CAGR of 85-89%

we maintain our guidance of INR17,000 crores-INR18,000 crores of revenue by FY27 with 2.5% EBITDA margin

iv. FY30: Long term vision of Rs 1,500 cr EBITDA & Rs 50,000 cr Revenue

Total capital employment that this company may require will be 5,000 crores to do 50,000 crores of top line and with 2.5% of EBITDA margin, which is broad based. So, 1,500 crores EBITDA we should be getting on 50,000 crores top line and on a total capital employment of INR5,000 crores. So, 1,200-1,300 crores networth we already have cash on the books, right?

7. FY25 guidance of EBITDA growth of 180% & Revenue growth of 142% at a PE of 49

8. Hold?

If I hold the stock then one may continue holding on to SG Mart

While the track record of SG Mart is limited, FY-24 and H1-25 execution provides confidence in the ability of SG Mart management to deliver on the FY25 guidance.

The underlying business momentum is strong even though steel prices crashed in Q2-25.

SG Mart has a strong outlook till FY27 which provides a reason to continue till the outlook plays out.

The outlook till FY27 is supported by macro tailwinds. The longer term vision of FY30 of Rs 50,000 cr is also attractive, provided it gets executed.

9. Buy?

If I am looking to enter SG Mart then

SG Mart is guiding for FY25 EBITDA growth of 180% & Revenue growth of 142% at a PE of 49 which makes valuations quite attractive from a FY25 perspective.

SG Mart is guiding for 120-128% & FY24-26 Revenue CAGR at a PE of 50 which makes valuations quite attractive from a longer term perspective.

SG Mart is guiding for EBITDA growth of 90-94% & Revenue CAGR of 85-89% for FY24-27 at a PE of 50 which makes valuations quite attractive from a longer term perspective.

SG Mart does not have a track record and hence it would be better to build positions in the stock over time as one feels more comfortable with the execution in FY25.

One needs to keep the inherent risk in the business model of SG Mart given its a high churn, low margin business.

We are building our business model, which is high volume, high churn, low margin, but high ROC.

Previous coverage of SG Mart

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer