SG Finserve Q2 FY26 Results: PAT up 101%, FY26 Guidance Revised Downward

2x+ PAT by FY27 at a CAGR of 50%+. Undemanding forward valuations. Downward revision of guidance is a red flag. Leadership transition needs to be watched closely

Confused about AUM, ROA and ROE in NBFC’s? Gain clarity now.

1. NBFC — Supply Chain Financing

sgfinserve.com | NSE: SGFIN

Business Mix & Portfolio

Supply chain financing for us constitutes about 85% of our book, with major focus is on dealer financing. So, out of that, about 90% of our book would constitute dealer financing only.

So, our main focus, forte, is conducting dealer financing portfolio only

2. FY23-25: PAT CAGR 112% & Total Income CAGR 113%

3. FY-25: PAT up 3% & Total Income up 1%

A regulatory pause lending in H1 to comply with Type II NBFC licensing norms muted growth

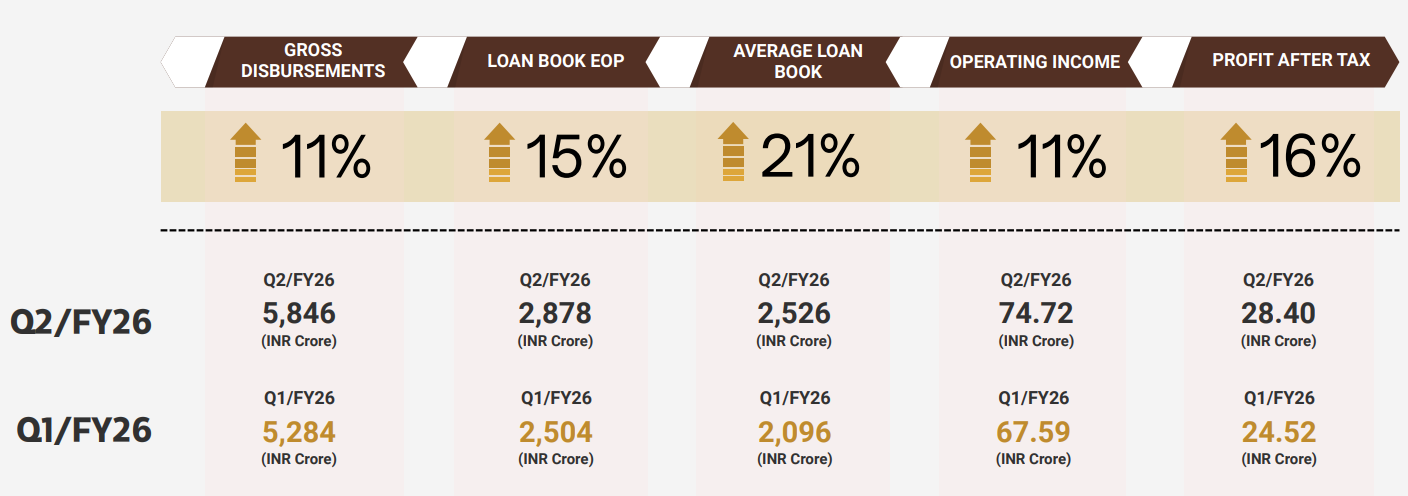

4. Q2-26: PAT up 101% & Total Income up 142% YoY

PAT up 16% & Total Income up 11% QoQ

A strong sequential performance despite softer macro conditions.

Loan Book Momentum

Loan book growth, driven by continued traction in anchor programs

Average loan book growth, indicating deeper wallet share with existing anchors.

Profitability Drivers

Interest income grew 12 %, but interest expenses rose faster (+22 %) as borrowing cost normalized, limiting NII growth to 4 %.

Portfolio Mix & Sector Split

Building Materials & Metals: ~60 % Led by APL Apollo, Tata Steel, Vedanta — healthy demand despite temporary slowdown.

Automobile (CV & PV) ~20 % New anchor tie-ups with Tata Motors, M&M, Ashok Leyland — yields slightly lower initially.

IT & Peripherals / Mobiles ~20 % Anchors include Redington, Ingram, Oppo; high-velocity short-cycle loans.

Leadership Transition

Outgoing: CEO Sorabh Dhawan & CFO Sahil Sikka (founders) moving on.

Incoming: Vine Gupta (Ex-Yes Bank, 20 yrs experience) to join as CEO in Nov 2025; Sanjay Rajput promoted to CFO.

Management assured smooth 60-day transition, no operational disruption.

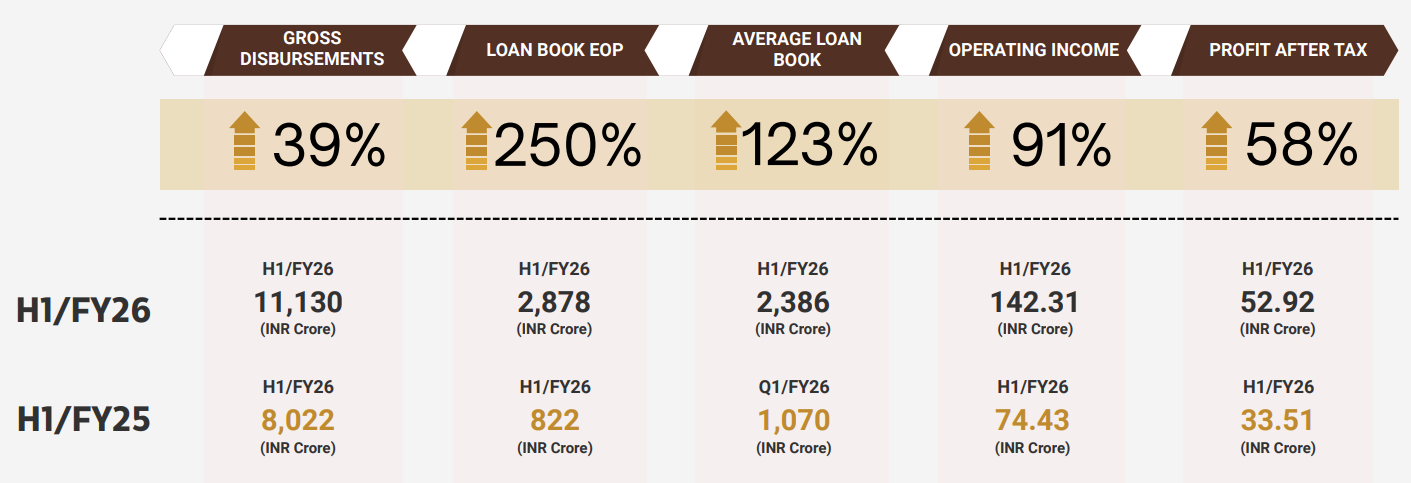

5. H1-26: PAT up 58% & Total Income up 91% YoY

Despite macro moderation, SG Finserve enters H2 FY26 with a strong overall performance.

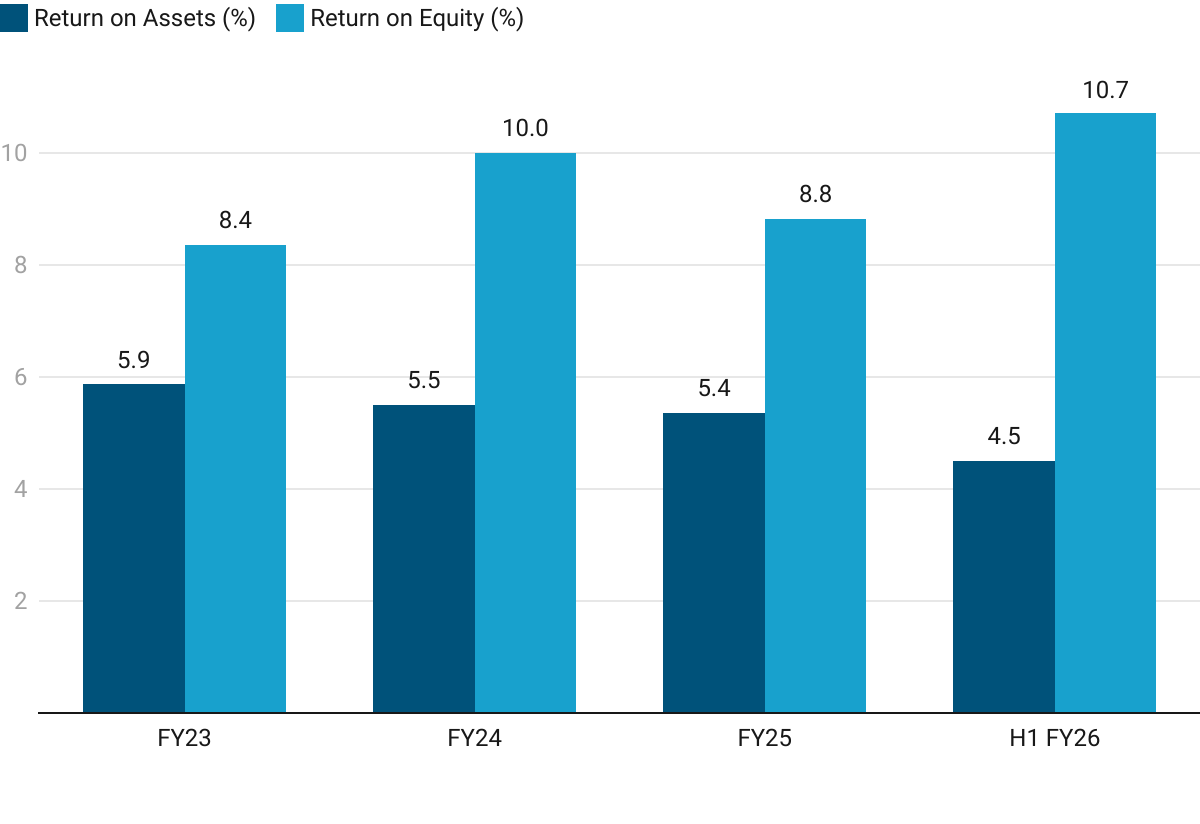

6. Business Metrics: Muted Return Ratios

Despite muted returns, the structural indicators remain healthy

7. Outlook: Disappointing — Guidance lowered

7.1 Management Guidance and Future Outlook

FY26 Guidance

Due to observed economic slowdowns, management revised its profit expectations downward but maintained confidence in achieving steady quarter-on-quarter growth:

PAT Revision: The full-year FY26 Profit After Tax (PAT) guidance was revised down to approximately ₹120-125 Cr. This is lower than the initial guidance of ₹150-160 Cr (which corresponded to 200 cr PBT)

Quarterly Growth: Investors are advised to build in 10% to 15% quarter-on-quarter growth in EPS for Q3 and Q4.

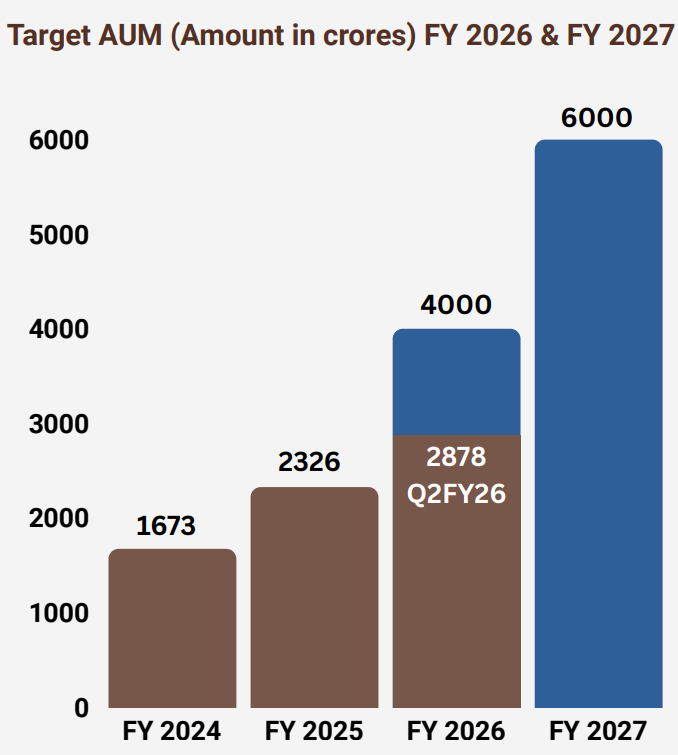

The exit loan book for FY26 is confidently projected to be around ₹3,500 Cr, with a possible positive surprise up to ₹4,000 Cr depending on economic performance in the final three month — toning down of AUM guidance

ROE: above 15% … first milestone and then take it to 18 19% eventually.

FY27 Guidance

The company aims for an AUM (loan book) of 6,000 crores by FY27, targeting a PBT of 250 cr (approximately 190 cr PAT)

7.2 H1 FY26 Performance vs FY26 Guidance – SG Finserve

AUM & PAT run-rate needs to accelerate to meet guidance

AUM: Needs strong growth to deliver on ₹4,000 Cr guidance vs Q2-26 end ₹2,878 Cr

Q2–Q4 AUM addition must average ₹560 Cr per quarter vs ₹552 Cr in H1-26

It is a challenging task and management has talked about ₹3,500-4,000 Cr range for FY26

PAT: Running behind required run-rate 52.92 120 67.08

Q2–Q4 must average ₹33.5 Cr PAT per quarter vs ₹26.5 Cr in H1-26

1.3x quarterly run-rate in H1-26 is required

Looks possible given the 10-15% QoQ growth guided by the management

8. Valuation Analysis — SG Finserve

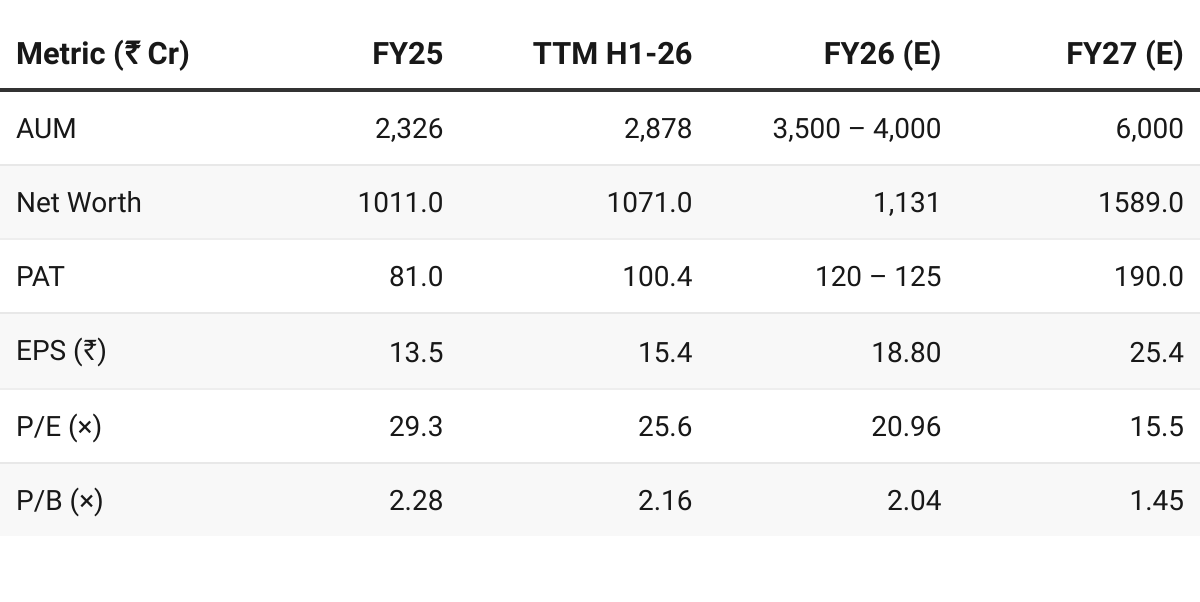

8.1 Valuation Snapshot

CMP ₹394; Mcap ₹2309.64 Cr

Earnings Dilution (FY27): 15% dilution in EPS

Base shares 5.5895 Cr + Warrants 1 Cr = Diluted shares 6.5895 Cr

On forward metrics, the stock appears reasonably valued with upside if management delivers on FY27 targets.

The valuations would start look attractive from a FY28 and beyond perspective. Hence it should be looked at from a longer term perspective.

8.2 Opportunity at Current Valuation

Undemanding Forward Valuation

P/E ~16×, P/B ~1.4× (FY27E ) are reasonable forward valuations for an NBFC which is guiding to more than 2x its PAT from ₹81 Cr to ₹190 Cr in FY27

The undemanding forward valuations have been able to sustain the downward revision in guidance

Sectoral Tailwinds

India’s formal credit shift, anchor-led distribution, and digital rails are converging to make supply-chain finance the fastest-growing NBFC sub-segment.

SG Finserve, is well positioned to benefit of these tailwinds — offering structural multi-year growth visibility with relatively low credit risk.

8.3 Risk at Current Valuation

Guidance Execution — 2nd Quarter of Lowered Expectations

SGFIN lowered PAT expectations in Q2-26 earnings call:

FY26 PAT guidance — ₹150-160Cr in Q1-26 down to ₹120-125Cr in Q2-26

SGFIN lowered profitability expectations in Q1-26 earnings call:

ROE guidance lowered —18-20% in Q4-25 to 15-18% in Q1-26 to ~15% in Q2-26 call

ROA guidance lowered — 4.5-5% in Q4-25 to 4.5% in Q1-26 call

Q4-25 earnings call: We are confident that we can take this loan book from INR2,300 crores to INR4,000 crores in 12 months and INR6,000 crores by FY27 and while growing this loan book, we are being very prudent that we continue to achieve ROE of 18% to 20% with ROA of 4.5% to 5%

Q1-25 earnings call: We should be near about INR150 crores, INR160 crores kind of PAT level

Transition in Management

This implies that Q3-26 will be a status quoist nature as current leadership will just hold fort till the new leadership takes charge. Assuming the new leadership takes time to settle in and start delivering we will see material impact in FY27.

One should be ready to see that current AUM targets and margins be change completely as the new leadership takes charge.

Previous Coverage of SGFIN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Strong analysis of SG Finserve's supply chain financing model - particularly insightful how you've highlighted the dealer financing concentration and the anchor program dynamics. The guidance execution risk amid leadership transition is a crucial watchpoint. TCLM examines similar trade credit and working capital patterns from an operational perspective, you might find it useful.

(It’s free)- https://tradecredit.substack.com/