Satin Creditcare Network: 44% revenue growth & return to profitability in FY24 at a PE of 6 and price to book of 1.2

Strong FY24 after losses in FY21-23. FY24 performance ahead of guidance. FY25 guidance carrying forward FY24 performance. At reasonable valuations with opportunities of re-rating of multiples

1. Microfinance company

satincreditcare.com | NSE: SATIN

Group Structure

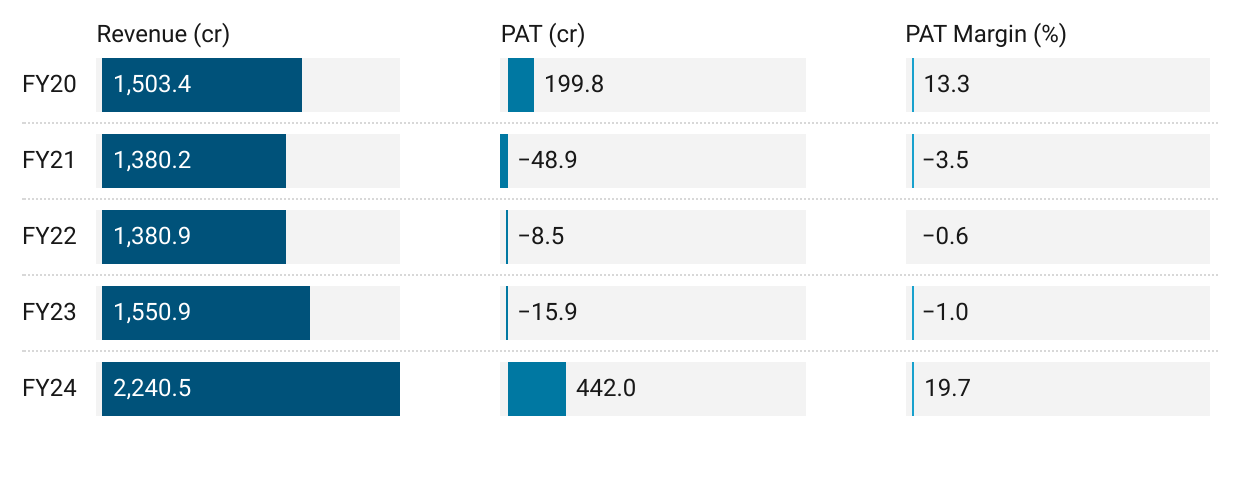

2. Weak FY20-24: Recovery in FY24 after 3 years of losses

3. Strong 9M-24: Revenue up 42% YoY and back in profit

4. Strong Q4-24: PAT up 37% and Revenue up 51% YoY

PAT up 8% Revenue up 11% QoQ

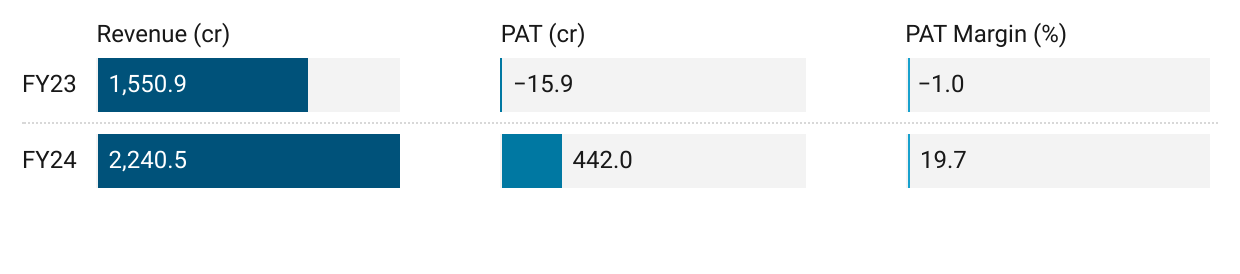

5. Strong FY-24: Revenue up 44% YoY and back in profit

6. Business Metrics: Improving return ratios

7. Outlook: Beating guidance for FY24

i. FY24 performance ahead of FY24 guidance

ii. Strong Guidance for FY25

GLP growth = 25%+

Credit cost = 1.5-1.75%

7. Return to profitability with revenue growth of 42% at a PE of 6 and price to book of 1.2

6. So Wait and Watch

If I hold the stock then one can hold on to SATIN

Coverage of SATIN was initiated after Q1-24 results. The investment thesis has not changed after a strong FY24. SATIN has delivered the highest top-line and bottom-line since FY20.

Outlook for SATIN is strong as FY25 guidance is continuation of the strong performance delivered in FY24.

SATIN has delivered QoQ growth in PAT since Q2-24. One can ride along as long as strong quarterly results are being delivered.

Outlook for Q1-25 is strong. Q1 is the slowest quarter, but Q1-25 expected to be not as slow as a typical Q1.

7. Or, join the ride

If I am looking to enter SATIN then

SATIN has delivered return to profitability & Revenue growth of 44% in FY24 at a PE of 6 which makes the valuations look attractive in the short term.

As of Q4-24 end SATIN has a net-worth of Rs 2,400.8 cr on a market cap of Rs 2,871 cr. At a price to book (P/B) of 1.2 there is headroom for re-rating of the P/B multiple

Previous coverage of SATIN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer