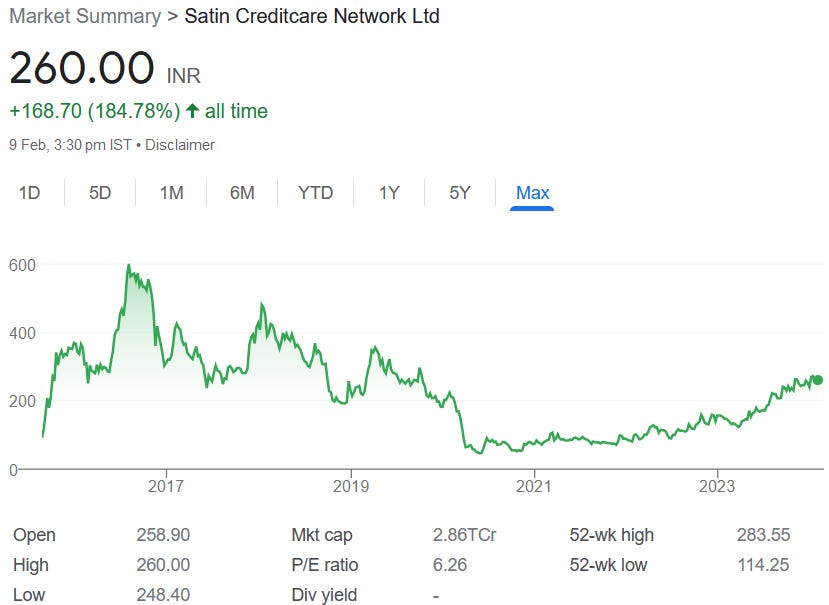

Satin Creditcare Network: 41% revenue growth & return to profitability in 9M-24 at a PE of 6 and price to book less than 1.3

After losses in the last 3 years, delivering a strong 9M-24. Performance in 9M-24 ahead of FY24 guidance. At reasonable valuations on PE and P/B with opportunities of re-rating of multiples

1. Microfinance company

satincreditcare.com | NSE: SATIN

Group Structure

2. Weak FY20-FY23: A weak track record. 3 years of losses

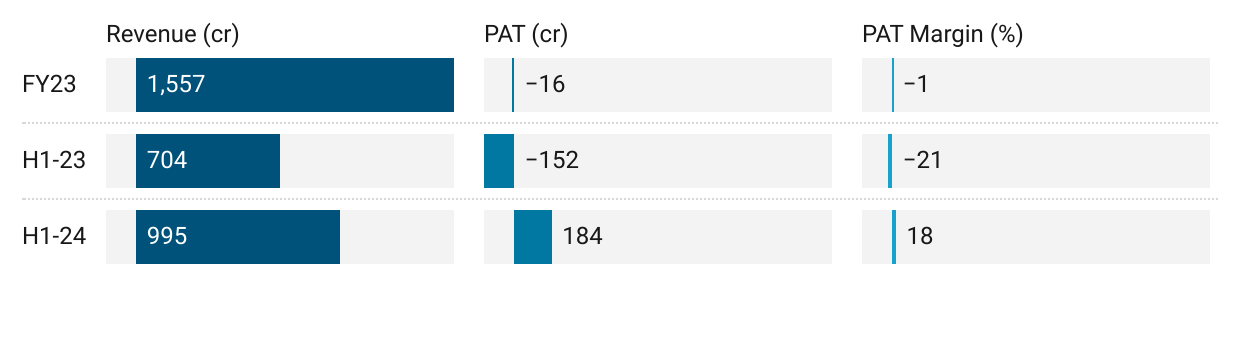

3. Strong H1-24: Revenue up 41% YoY and back to profit

Highest ever H1 profitability in last 5 years

4. Strong Q3-24: PAT up 229% and Revenue up 43% YoY

PAT up 13% Revenue up 11% with expansion in margin QoQ

5. Strong 9M-24: Revenue up 42% YoY and back in profit

6. Business Metrics: Return ratios looking positive in FY24

7. Outlook: On-track to beating guidance for FY24

i. 9M-24 performance ahead of FY24 guidance

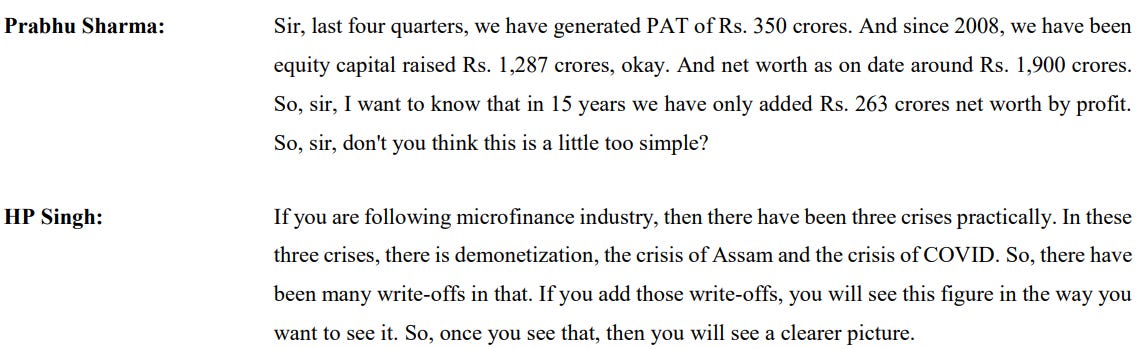

ii. Risks in business model: PAT generated has been written-off

Most of the PAT generated has been written-off on account of various crises.

7. 42% revenue growth with return to profitability at a PE of 6 and price to book less than 1.3

6. So Wait and Watch

If I hold the stock then one can hold on to SATIN

Coverage of SATIN was initiated after Q1-24 results. The investment thesis has not changed after a strong 9M-24. The only changes are the delivery of a strong H1-24 and the increased confidence in the management to deliver a stronger FY24

SATIN is looking to delivering a FY24 guidance beating performance based on 9M-24 results. One can stay in as long as top-line and bottom-line growth is being delivered.

SATIN has delivered QoQ growth in PAT in both Q2-24 and Q3-24. One can ride along as long as strong quarterly results are being delivered.

7. Or, join the ride

If I am looking to enter SATIN then

SATIN has delivered return to profitability & Revenue growth of 58% in 9M-24 at a PE of 6 which makes the valuations look reasonable.

As of Q3-24 end SATIN has a net-worth of Rs 2292 cr on a market cap of Rs 2,859.69 cr. At a price to book (P/B) of less than 1.3 there is headroom for re-rating of the P/B multiple

However, the weak track record, ability of the business to grow its net worth on account of the write-offs and the reduction in promoter holding makes it a risky stock.

On the other side, highest ever 3 quarters of profitability in last 5 years was achieved in 9M-24 and if we get more of such quarters then why cant the stock price be the best price in the last 5 years?

This quarter witnessed robust improvement in business momentum, operating efficiency and asset quality. Thus, we concluded the highest ever profitability of INR 308 crores in nine months FY'24

Previous coverage of SATIN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer