Sathlokhar Synergys H1 FY26 Results: PAT up 70%, On-track FY26 guidance

Guidance of 100%+ revenue CAGR for FY25-27 with stable margins and solid order-book. After strong H1 FY26 results Sathlokhar available at attractive valuations

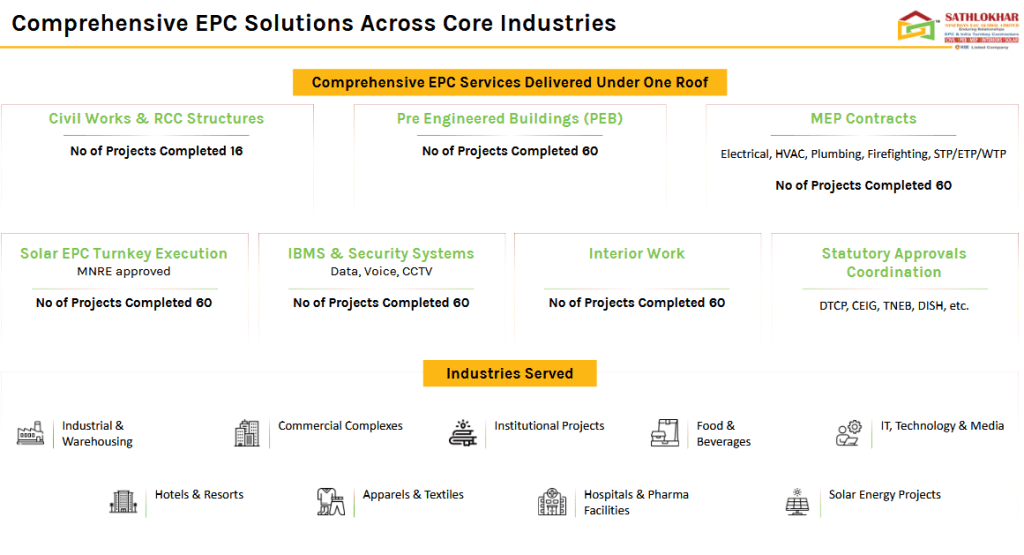

1. EPC Company

sathlokhar.com | NSE - SME: SSEGL

EPC company specializing in industrial, commercial, warehousing, institutional, healthcare, and solar projects. The company operates on a design-to-delivery model, offering turnkey solutions that span:

Civil construction & Pre-Engineered Buildings (PEB)

Mechanical, Electrical & Plumbing (MEP) installations

HVAC, firefighting, utilities, and integrated building management systems (IBMS)

Office interiors and fit-outs

Solar EPC projects (including rooftop, residential, and greenfield plants)

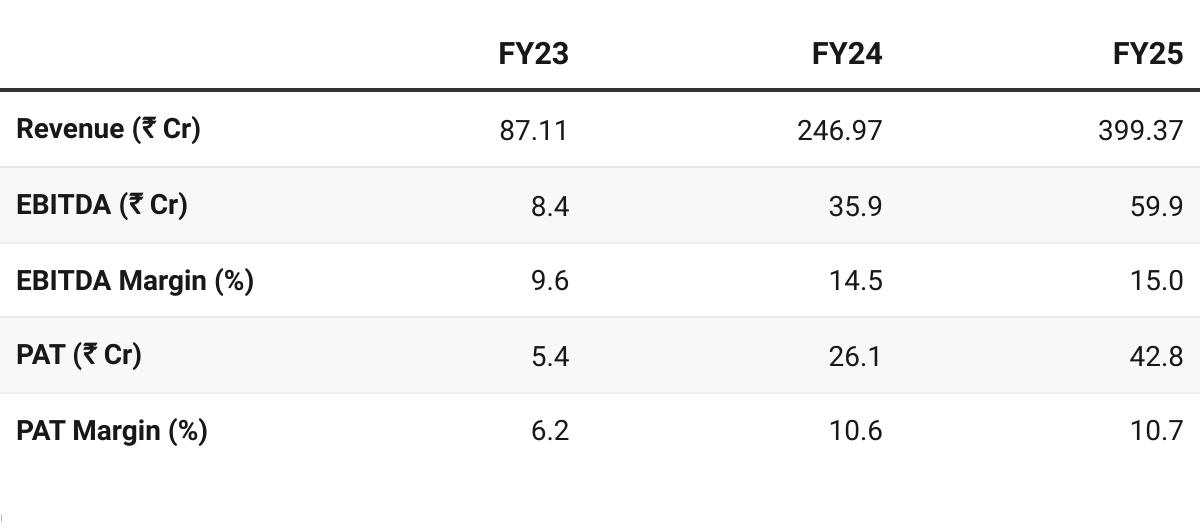

2. FY23–25: PAT CAGR of 182% & Revenue CAGR of 114%

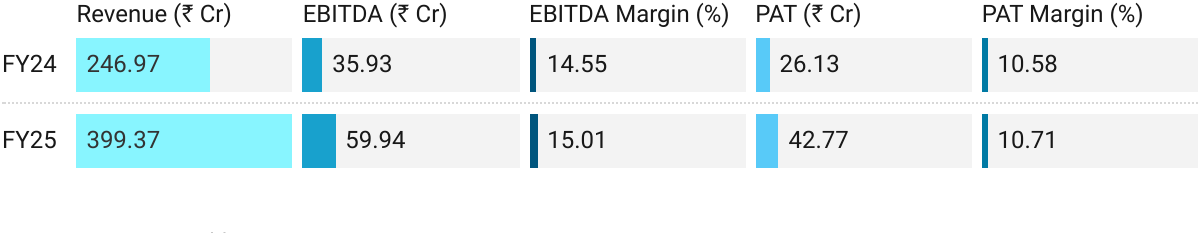

3. FY25: PAT up 64% & Revenue up 62% YoY

Topline growth driven by order execution across industrial EPC, warehousing, auto, FMCG, and solar projects.

Trade receivables ballooned from ₹1.37 Cr to ₹13.51 Cr — a working capital stretch. Operating Cash Flow turned negative (-₹908 Cr) due to receivable buildup.

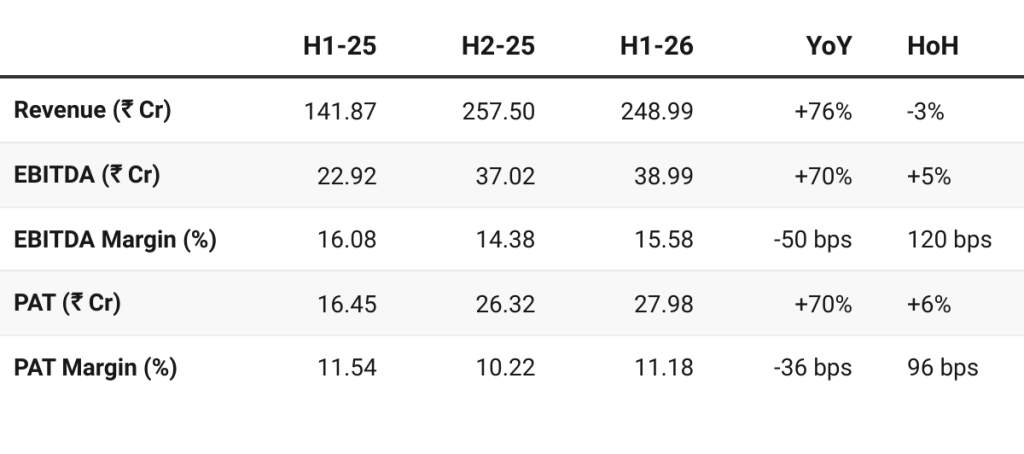

4. H1 FY26: PAT up 70% & Revenue up 76% YoY

PAT up 6% & Revenue down 3% HoH

Turnover rising by ~75% year on year, reflecting growing client trust across core EPC verticals.

Record order inflow of approximately ₹830 Cr, a milestone achievement considering our full year revenue of around ₹400 Cr in FY25.

Major orders such as ₹338.36 Cr from Reliance Consumer Products Ltd. and ₹219.22 Cr from Ceylon Beverage Can Pvt. Ltd.

Order book of ₹1367.71 Cr and a bid pipeline exceeding ₹13,637 Cr, we are positioned for a strong execution phase in H2.

On the Manufacturing side, we are planning to establish a dedicated PEB production facility aimed at significantly enhancing our monthly capability and capacity

In September 2025, the board approved the preferential issue of INR114 crores. This enhances our liquidity and supports working capital and scaling requirements.

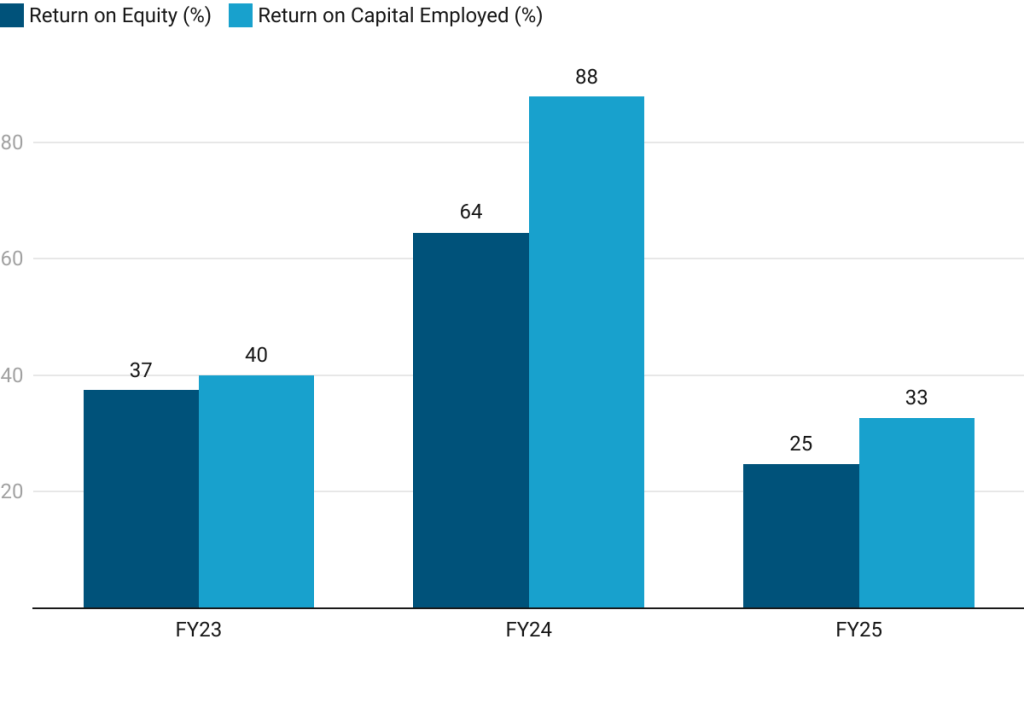

5. Business Metrics: Strong Return Ratios

FY25 — Capital base grew on account of IPO, muting returns.

6. Outlook: FY26 Revenue Growth of 100%

6.1 FY26 Guidance

Revenue

FY26: ₹1,000 Cr

Revenue guidance for FY26 has been sharply revised from ₹600 Cr during Q1 FY26 earnings call to ₹1,000 Cr during Q2 FY26 earnings call

FY27: ₹1,700 cr revenue

Margins:

EBITDA: 15%+

PAT: About 11%

Order Book: ~₹1,300 Cr+ of orders in place to support ₹750 Cr of revenue expected in H2-26

Capex:

PEB manufacturing facility by end of FY26

To improve PAT margins by 1–1.5%

6.2 H1 FY26 Performance vs FY26 Guidance

H1 FY26 Performance on-track to deliver FY26 guidance

We entered H2 with a heavier business growth than H1, offering strong revenue visibility and execution momentum.

Sathlokhar confident of delivering the balance ₹750 Cr of revenue for H2 FY25

Order-book in place to support the revenue run-rate for H2 FY26

Both EBIDTA and PAT margins in line with 15%+ and 11% targets for H1-26.

7. Valuation Analysis

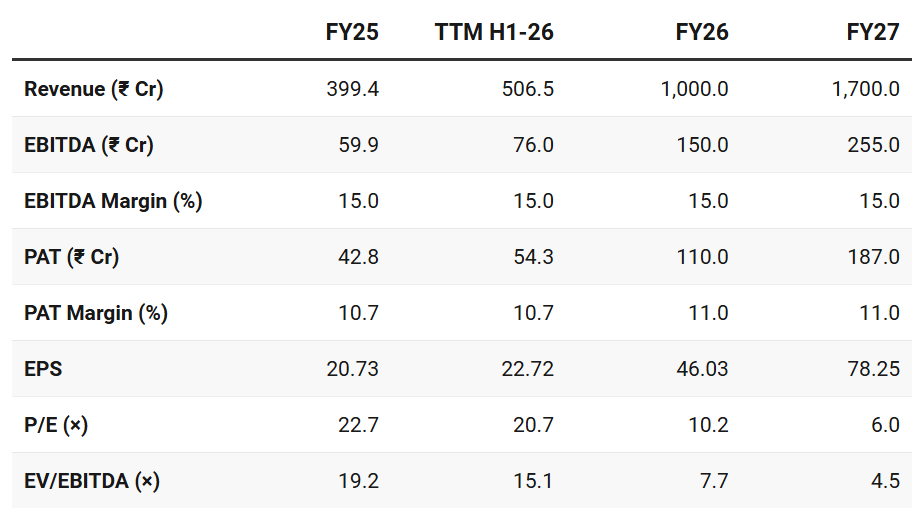

7.1 Valuation Snapshot — Sathlokhar Synergys E&C Global

CMP ₹480.00; Mcap ₹1,158.62 Cr;

Attractive Forward Valuation:

Valuations for SSEGL looking attractive both from FY26 and F27 perspective

Caution: Even though valuations are attractive the stock has not gone anywhere in the recent past

At a single digit P/E and EV/EBITDA for FY27 gives it head-room for multiple rating

7.2 Opportunity at Current Valuation

Re-rating of Multiples: Valuation at FY27E P/E ~6× provides opportunity for re-rating and also provides a margin of safety if there is a slight miss in the execution

New PEB facility: The margin expansion expected from the new PEB facility from FY28 creates a longer term opportunity beyond the FY27 guidance

Order Pipeline: Order pipeline of ₹13,000+ Cr with 12-15% conversion rate creates an opportunity for FY27

Valuation Comfort: Valuation at FY26E P/E ~10× assumes ₹1,000 Cr revenue for FY26 — provides leeway if guidance is partially met

7.3 Risk at Current Valuation

Equity Dilution: H1 FY26 EPS growth was lower than the 70% PAT growth seen in FY26 on account of dilution in equity from the preferential issue of 19.9 lakh equity shares + 3.75 lakh warrants raising up to ₹114 Cr. Future dilution could impact EPS growth and mute the opportunity in the stock

Execution Risks: Sathlokhar is targeting growth from ₹400 Cr in FY25 to ₹1,700 Cr by FY27. Scaling up with this pace could bring its own execution challenges

FY27 Revenue Visibility: An order pipeline of ₹13,000+ Cr is in-place. However, if the pipeline does not generate wins required for the ₹1,700 Cr revenue target, the impact would be seen on the stock price.

Limited Track Record of Massive Expansion: Though growth has been strong in FY24–25, Sathlokhar has a relatively short listed history. Scaling from mid-size EPC player to ₹1,000 Cr+ turnover carries uncertainty on sustaining margins, systems, and governance.

Previous Coverage of SSEGL

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer