Sathlokhar Synergys FY25 Results: PAT up 64%, Strong Growth till FY27

Revenue CAGR of 50%+ till FY27 with stable margin. Growth projections supported by an order-book. Reasonable valuation for a company with 50% growth and 11% PAT

1. EPC Company

sathlokhar.com | NSE - SME: SSEGL

EPC company specializing in industrial, commercial, warehousing, institutional, healthcare, and solar projects. The company operates on a design-to-delivery model, offering turnkey solutions that span:

Civil construction & Pre-Engineered Buildings (PEB)

Mechanical, Electrical & Plumbing (MEP) installations

HVAC, firefighting, utilities, and integrated building management systems (IBMS)

Office interiors and fit-outs

Solar EPC projects (including rooftop, residential, and greenfield plants)

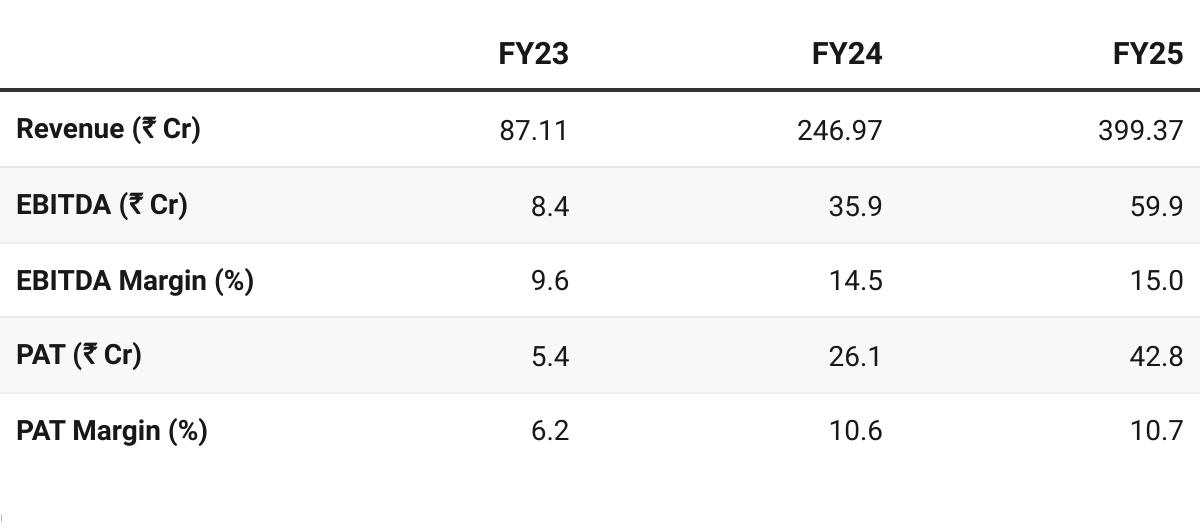

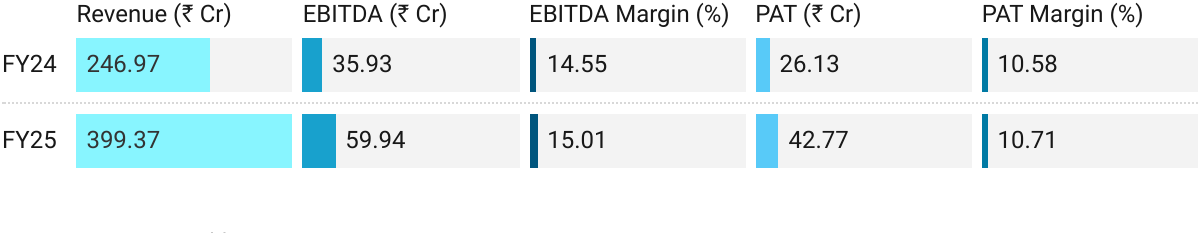

2. FY23–25: PAT CAGR of 182% & Revenue CAGR of 114%

3. FY25: PAT up 64% & Revenue up 62% YoY

Topline growth driven by order execution across industrial EPC, warehousing, auto, FMCG, and solar projects.

Trade receivables ballooned from ₹1.37 Cr to ₹13.51 Cr — a working capital stretch. Operating Cash Flow turned negative (-₹908 Cr) due to receivable buildup.

4. Business Metrics: Strong Return Ratios

FY25 — Capital base grew on account of IPO, muting returns.

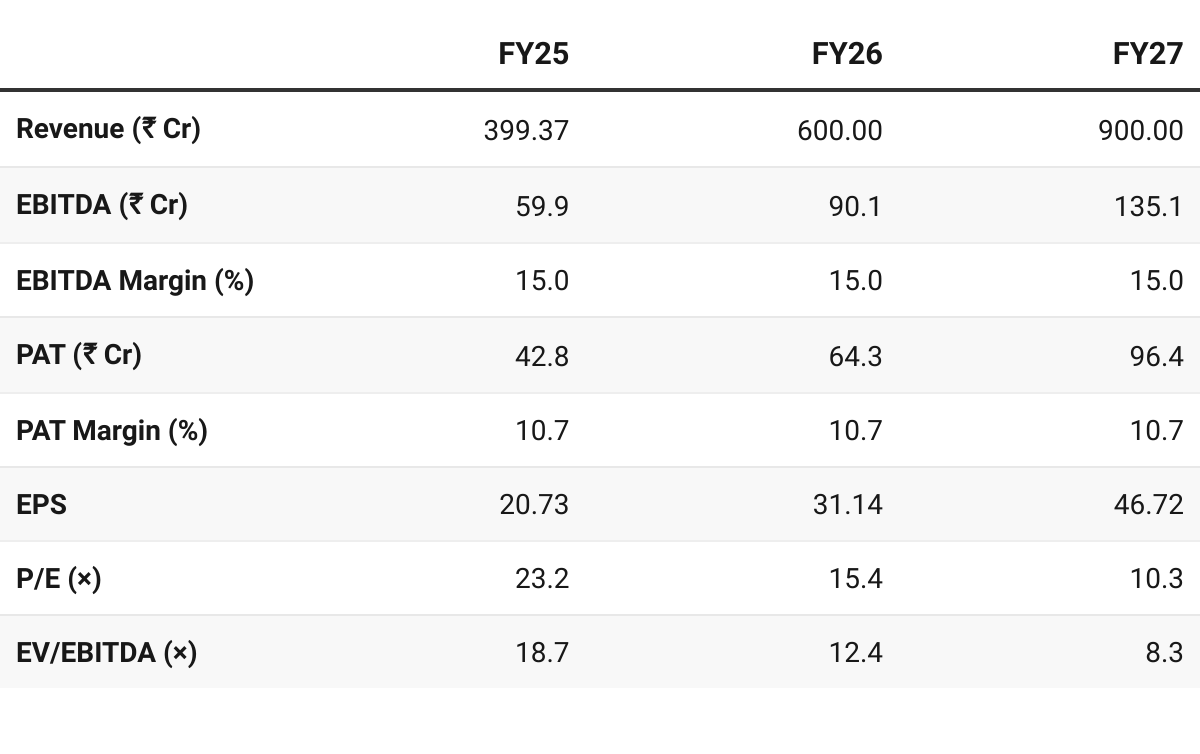

5. Outlook: Revenue CAGR of 50% FY25-27

5.1 FY26 Guidance

Revenue Growth:

50–60% YoY revenue growth in FY26. — ₹600 Cr+

Order Book Visibility:

FY26+ F627 Revenue Projection= ~₹1,600 Cr of which ₹1,200 Cr is supported by the order-book

As of 18-Aug-25: The total work order booked value as of today stands at INR 1201.59 Crores (Excluding GST) to be executed in the next 8 to 10 Months

Margins:

Aim to sustain/improve EBITDA >15% and PAT ~11%.

Management highlighted selective focus on higher-margin MEP, electrical, and firefighting packages within EPC.

Cash Flow & Working Capital:

Business requires ~30% of revenues as working capital. For ₹600 Cr revenue, ~₹150 Cr needed.

Plan to fund largely via client advances; may use limited bank lines, avoiding heavy debt.

Management confident cash flows will improve as receivable collections stabilize.

Beyond FY26 (FY27 & Long-Term Vision)

Growth Trajectory:

Targeting ₹1,000 Cr+ revenue by FY27, i.e. doubling from FY25 in two years.

Order Pipeline:

Strategy: expand repeat client base to 300+ customers, ensuring 30–40% recurring growth from existing relationships.

Geographic Expansion:

Currently 70–75% revenue from Tamil Nadu. Expanding into Uttar Pradesh, Karnataka, Odisha, Andhra Pradesh.

Sector Expansion:

EPC remains core; but solar EPC vertical being scaled up (authorized Tata Power Solar partner).

Exploring selective infra diversification (roads/bridges in future, but not immediate).

Capital Strategy:

Short-term: minimal debt, conservative funding model.

Medium-term: possibility of preferential allotment/equity raise if growth outpaces internal accruals.

Promoters committed to retaining majority stake (>50%).

6. Valuation Analysis

6.1 Valuation Snapshot — Sathlokhar Synergys E&C Global

CMP ₹480.00; Mcap ₹1,158.62 Cr;

Attractive Forward Valuation:

Management guides aims for ₹1,000 Cr by FY27, valuation analysis assumes conservative performance of ₹900 Cr by FY27

Near-term (FY25 multiples): Fully priced at 23× P/E and 19× EV/EBITDA.

Medium-term (FY26–27): Attractive, with PEG <0.5 (high growth + declining multiples).

Opportunity: If management delivers ₹900–1,000 Cr revenue with 10–11% PAT margin, stock can re-rate closer to 15× FY27E EPS

6.2 Opportunity at Current Valuation

Opportunities subject to FY26 guidance: If FY26 guidance is not met all future projections will fall like a pack of cards

Order-book to be executed faster than the guidance: ₹1,200 Cr of order book to be executed in 8-10 months implies annual revenue run-rate of ₹1,440-1,800 Cr which is significantly than the guided number of ₹600 Cr for FY26

Visibility up to FY27: With an executable ₹1,201.6 Cr order book (Aug 2025), Sathlokhar already has visibility to cover FY26 and large part of FY27

Valuation Comfort: Valuation at FY27E P/E ~10× assumes ₹600 Cr revenue for FY27 against the guidance of ₹1,000 Cr for FY27 — provides leeway if guidance is partially met

6.3 Risk at Current Valuation

Execution Risk: The company is targeting rapid scale-up (₹400 Cr → ₹1,000 Cr within 2 years). Managing multiple large EPC projects across geographies raises execution and manpower deployment risks. Any delays can impact margins and client relationships.

Limited Track Record of Massive Expansion: Though growth has been strong in FY24–25, Sathlokhar has a relatively short listed history. Scaling from mid-size EPC player to ₹1,000 Cr+ turnover carries uncertainty on sustaining margins, systems, and governance.

Margin Volatility: While FY25 margins were healthy (~15% EBITDA, ~11% PAT), competitive bidding in larger EPC projects could squeeze profitability.

Geographic Concentration: Still heavily dependent on Tamil Nadu (~70–75% of revenue); slower ramp-up in new states may limit diversification benefits.

Scalability Constraints: Rapid growth requires scaling workforce, subcontractor ecosystem, and vendor base. Any lag may cause project overruns or working capital strain.

Dilution from Preferential Issue: On 19 Sept 2025, the Board approved a preferential issue of 19.9 lakh equity shares + 3.75 lakh warrants at ₹482/share, raising up to ₹114 Cr. If fully converted, this would expand equity base by ~10%, potentially diluting existing shareholders’ stake and EPS in the near term, though proceeds will support growth and working capital.

The risks are huge if execution is not per plan. Hence entry into the stock has to be measured. Any early warning signals of guidance not being executed cannot be ignored.

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer