Sarda Energy & Minerals Q2 FY26 Results: PAT up 61%; Record Results expected in FY26

2x+ PAT in FY26. Case for re-rating as SARDAEN transitions to energy-led model with strong earnings expansion. Legal uncertainty & capex execution remain key overhangs

Looking for a stock analysis? Let us know.

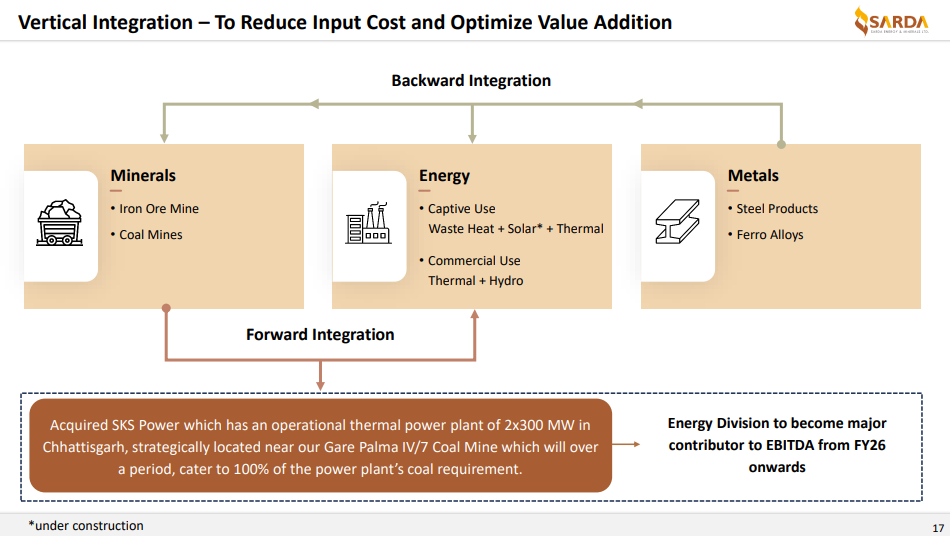

1. Metals Business Expanding into Energy & Minerals

capacite.in | NSE : SARDAEN

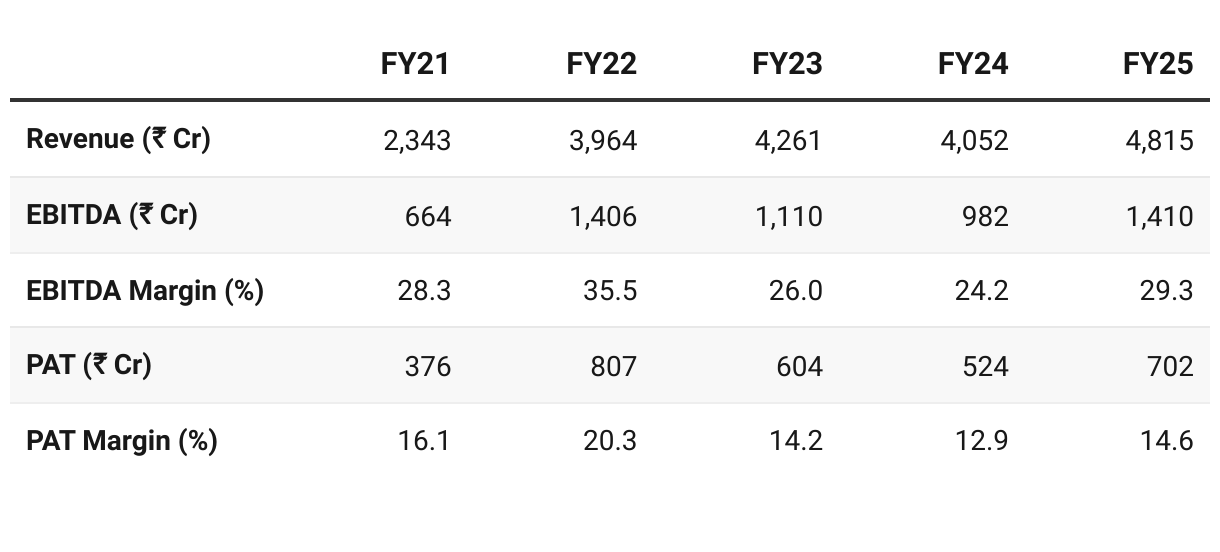

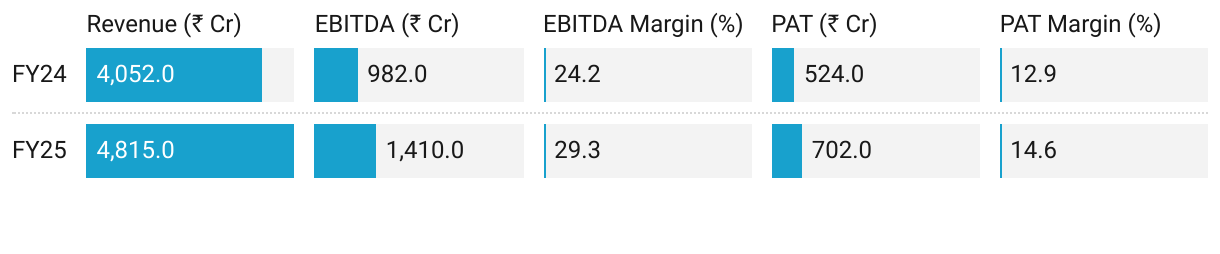

2. FY22-25: PAT CAGR of 62% & Revenue CAGR of 21%

3. FY25: PAT up 34% & Revenue up 19% YoY

Growth was largely driven by the acquisition of SKS Power (600 MW IPP) in Aug-24, which contributed ~7 months of operations in FY25.

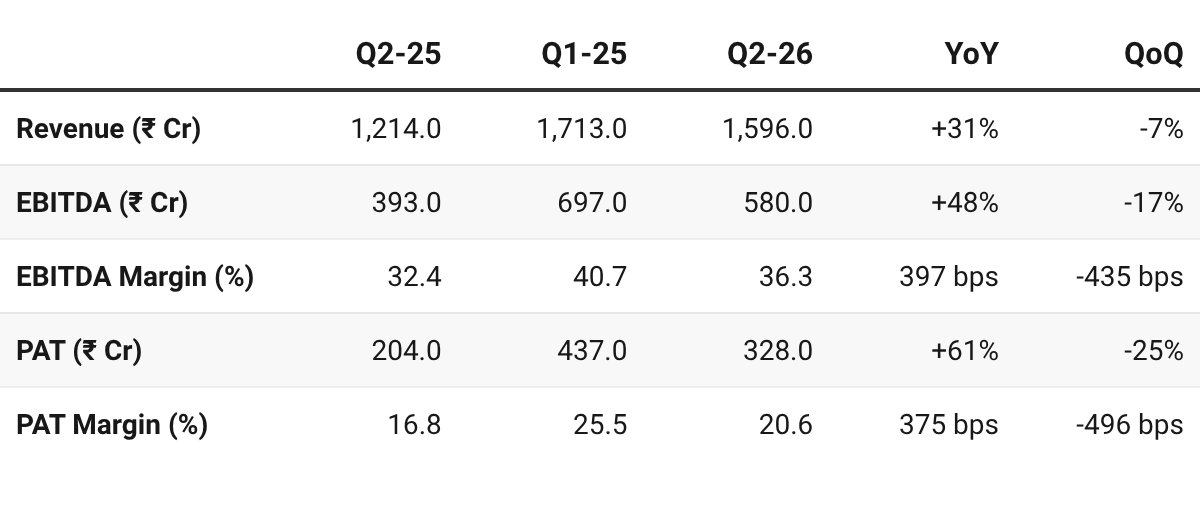

4. Q2-26: PAT up 61% & Revenue up 31% YoY

High YoY growth — sequential (QoQ) softening due to monsoon effects.

"Extraordinary" merchant power prices seen in the peak summer (Q1) moderated.

Steel & Ferro Alloys

Management cited weak global steel prices & increased imports from China

“Extended monsoon” which delayed construction activities.

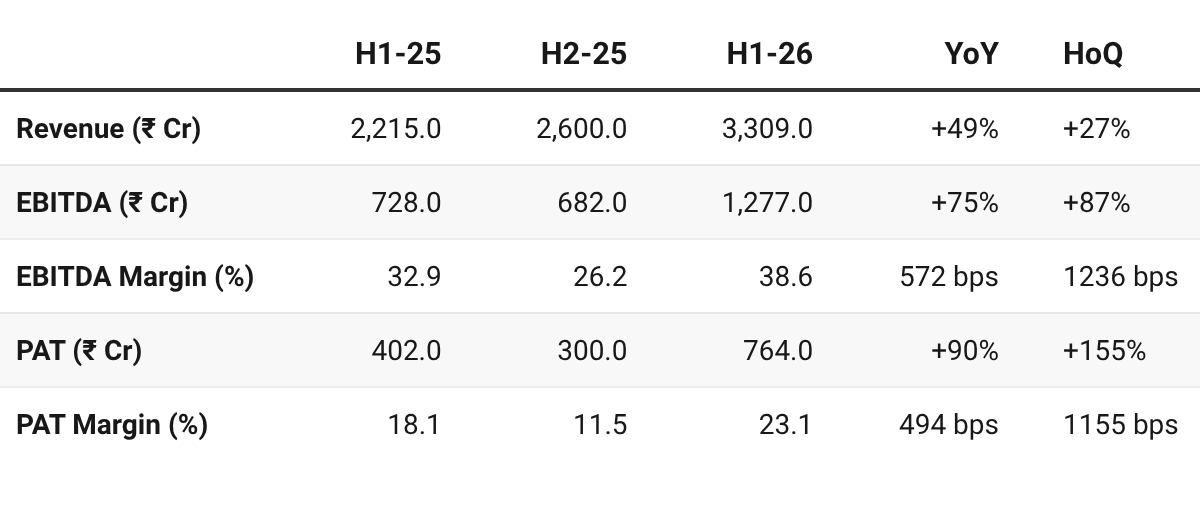

5. H1-26: PAT up 90% & Revenue up 49% YoY

PAT up 155% & Revenue up 27% HoH

The company has exceeded the last whole year's profit in the first half itself. The seasonal fall in power price realization affected the profitability of the thermal power operation, which was partly offset by higher generation of hydropower.

H1 FY26 growth is almost entirely driven by SKS Power acquisition

Decline in Core Industrial Business: While Power boomed, the legacy segments saw a year-on-year (YoY) decline in profitability for the half-year:

Steel Results: Fell from ₹261.92 crore to ₹172.38 crore (-34%).

Ferro Alloys Results: Fell from ₹148.60 crore to ₹121.42 crore (-18%).

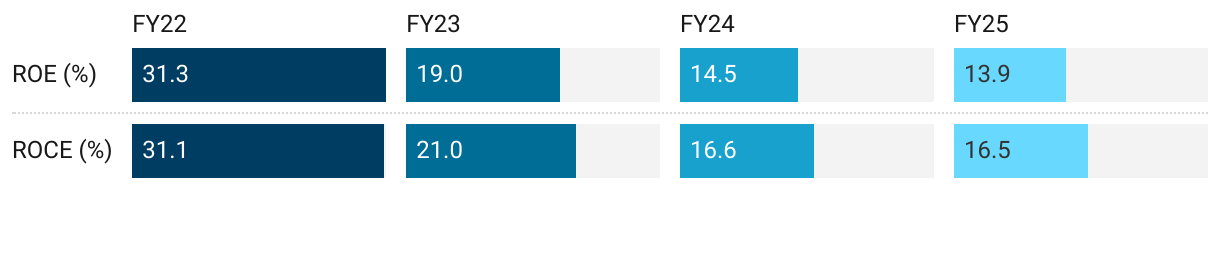

6. Business Metrics: Return Ratios are Stabilizing

ROCE compressed from >30% in FY22 to ~16% in FY25. The main driver is capital intensity of the energy business – power plants and mines require heavy upfront capital, while returns are spread over long horizons.

7. Outlook: Record Results expected in FY26

7.1 Guidance & Outlook for FY26 and Beyond

We remain confident of delivering record results for financial year '26

So, post monsoon and festive season, construction activity picks up, pushing up the steel demand. Prices of steel products are also expected to improve from current levels.

Hydropower generation is also expected to remain better year-on-year due to extended monsoon.

Executing a strategic pivot — focusing on energy and minerals verticals

Steel and ferroalloys segment treated as a legacy business — no major expansions planned.

Energy Vertical and Power Generation

Thermal Power (SKS Power):

To maintain average Plant Load Factor (PLF) of ~80% for FY’26.

Moving towards Power Purchase Agreements (PPAs) for price stability — goal of at least 50% of capacity under PPAs.

Future Thermal Expansion: To expand by an additional 600 to 800 MW.

Expects a minimum 2 years for government approvals & forest clearances before ground work can begin.

Hydropower:

25 MW Rehar project: Commissioned in July 2025 — 110% PLF during its first quarter of operation.

Three additional hydropower projects, totalling 75 MW, are currently in various stages of approval.

Solar Power: 50 MW captive solar plant to be commissioned before FY’26 end to support internal consumption.

Mining and Minerals — core growth lever for the next several years:

Coal Production (Domestic):

To increase capacity of the Gare Palma IV/7 mine from 1.68 to 1.8 million tonnes per annum in the current quarter.

Future phases aim to expand this to over 3 million tonnes.

New Mines: — Shahpur West mine

To commence production by the end of FY’27. This mine will produce high-grade coal to replace imported coal for steel and ferroalloy operations.

Additionally, the newly acquired Senduri coal block is scheduled to start production by 2033.

Indonesia: Targeting a production of 1.8 million tonnes from its Indonesian coal mine over the next 12 months, pending further land acquisition.

Steel and ferroalloys segment

New Revenue Streams: Mineral Fiber project to contribute a turnover of ₹100–₹140 crore once it reaches full-fledged production

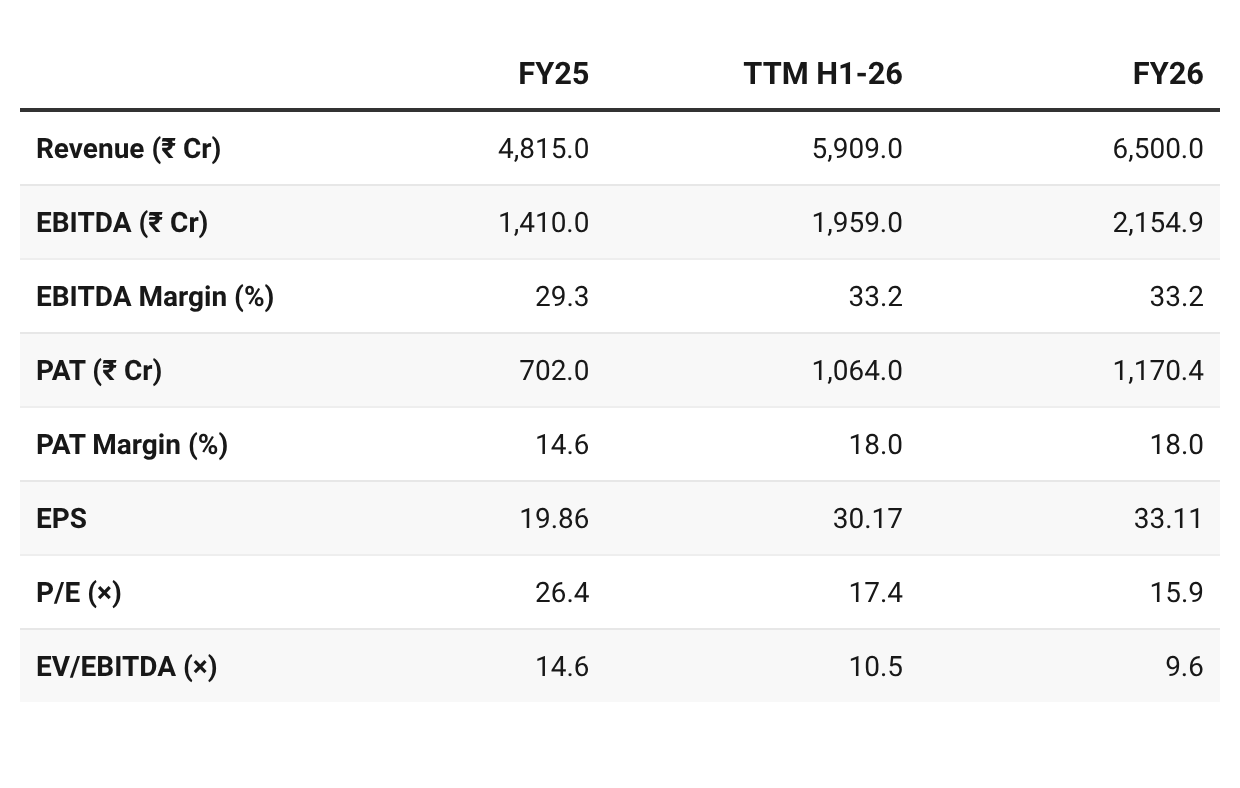

8. Valuation Analysis — Sarda Energy & Minerals

8.1 Valuation Snapshot

CMP ₹524.95; Mcap ₹18,446.5 Cr

FY26E Valuations: Reasonably valued at P/E 15×, EV/EBITDA ~10×

Longer term valuation will start looking attractive from FY27 as the capex gets monetized

SARDEN generated ₹1,032 Cr in H1 FY26. It is available at a free cash yield of 5.6% (not annualized) given the current market cap ₹18,446.5 Cr. Which makes it quite attractive from a valuation perspective.

FY '26, we have estimated capex of INR500 crores to INR600 crores.

And for next 3 years, as we stated, we already lined up capex as of INR500 crores to INR700 crores every year.

Now we will start working on the expansion of the IPP that is in addition to these things.

The capex for the next 3 years provides visibility that free cash flow generation should be strong provided operations maintain their current effieicncy.

SARDAEN is fundamentally undervalued from a cash-flow perspective, likely due to the legal uncertainty surrounding the SKS Power acquisition which prevents the market from assigning a higher multiple to these cash flows.

8.2 Opportunities at Current Valuation

Earnings-led De-rating: Valuation multiples compress sharply as earnings expand — making FY26 forward valuations more reasonable.

As businesses scale up the multiples expected to compress further in FY27 and make the valuations more attractive

Financial Strength: Strong cash flow profile to support capex without stressing balance sheet.

Margin Improvement: Sarda is aggressively moving toward 100% raw material self-sufficiency. With four new coal mines in the pipeline — SARDAEN will eventually decouple its margins from global coal price volatility.

Strategic Re-rating: Transitioning from cyclical steel/ferro alloys to a diversified Energy + Minerals business— supports a re-rating towards stable utility-like multiples with growth premium.

The Valuation Gap: Pure-play Indian power utilities often trade at P/E multiples of 20×+. Sarda, which now derives nearly 70% of its EBIT from Power, is trading at a significant discount at ~15×.

Opportunity Rating: Strong case for re-rating as SEML transitions to an energy-led model with visible earnings expansion.

8.3 Risks at Current Valuation

Legal Overhang:

SKS Power has been amalgamated with SEML

The Resolution Plan is being challenged by unsuccessful bidders in the Supreme Court.

If the Supreme Court were to set aside the NCLT approval, the entire amalgamation and the subsequent financial records would need to be reversed.

This represents a massive contingent risk to the company’s asset base and future earnings.

Steel Cyclicality: The legacy business is under margin pressure. If the post-monsoon recovery in steel prices (expected in Q3/Q4) does not materialize, the consolidated margins will be entirely dependent on the volatile merchant power marke

Capital Intensity: Large future expansions (doubling SKS capacity, new mines) require heavy capex, which could dilute return ratios (ROE/ROCE already trending lower).

Commodity & Regulatory Risks: Dependence on coal prices, power tariffs, and timely environmental/operational clearances.

Execution Risk: Timely ramp-up of expanded coal mining, new hydro/solar projects, and seamless integration of SKS operations remain critical for sustaining high growth.

Risk Rating: Legal uncertainty and high capex intensity remain key overhangs, though balance sheet strength provides cushion.

Previous Coverage of SARDAEN

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer