Sarda Energy & Minerals Q1 FY26 Results: PAT up 121%; Record Results expected in FY26

Strong case for re-rating as SARDAEN transitions to an energy-led model with visible earnings expansion. Legal uncertainty and high capex intensity remain key overhangs,

1. Metals Business Expanding into Energy & Minerals

capacite.in | NSE : SARDAEN

Here’s a clear description of Sarda Energy & Minerals Ltd (SEML)’s business and its future trajectory — tying past, present, and forward evolution together:

Business Segments — Sarda Energy & Minerals

Energy (Core Vertical – ~50% of revenue, ~70% of EBITDA in FY25):

Thermal Power:

SKS Power (600 MW IPP, acquired Aug 2024) – transformational asset, now SEML’s largest revenue/EBITDA driver.

Environmental clearance process underway to double SKS Power capacity (600 → 1,200 MW), capex ~₹8,000 Cr.

Captive thermal capacity (~160 MW) to support steel/ferro operations.

Hydro Power (~167 MW): Long-term PPAs in Chhattisgarh, Uttarakhand, Sikkim; stable annuity-like earnings with high EBITDA margins.

Hydro projects (Kotaiveera 25 MW, other small projects) in pipeline.

Renewables:

50 MW captive solar project under commissioning (FY26).

21.5 MW Waste Heat Recovery (WHR).

Revenue Model: Mix of long-term PPAs + short/medium-term merchant sales (balancing stability with upside from power prices).

Minerals (Second Growth Lever):

Coal:

Gare Palma IV/7 mine (1.68 MTPA; ramping to 1.8 MTPA FY26; plans to expand >3 MTPA).

Shahpur West & Bartunga JV mines under development.

Strategic advantage: SKS Power located near Gare Palma IV/7 → pithead model with captive coal supply.

Iron Ore:

Surjagad (Maharashtra) block licensed May 2025; other mines (Shahpur, Gare Palma IV/5) to expand supply for captive steel.

Coal mining capacity targets >3–5 MTPA to fully integrate with power requirements.

Integration Goal: Backward integration to secure cheap, reliable raw materials for both energy and metals businesses.

Metals (Legacy Business – ~30% revenue, ~20% EBITDA):

Steel Value Chain: Iron ore pellets → sponge iron → billets → wire rods → HB wire.

Ferro Alloys: Ferro manganese & silico manganese (domestic + export).

Historically core business, now repositioned as stable, integrated unit supplying downstream products.

No major expansion planned; focus on cost optimization and captive integration.

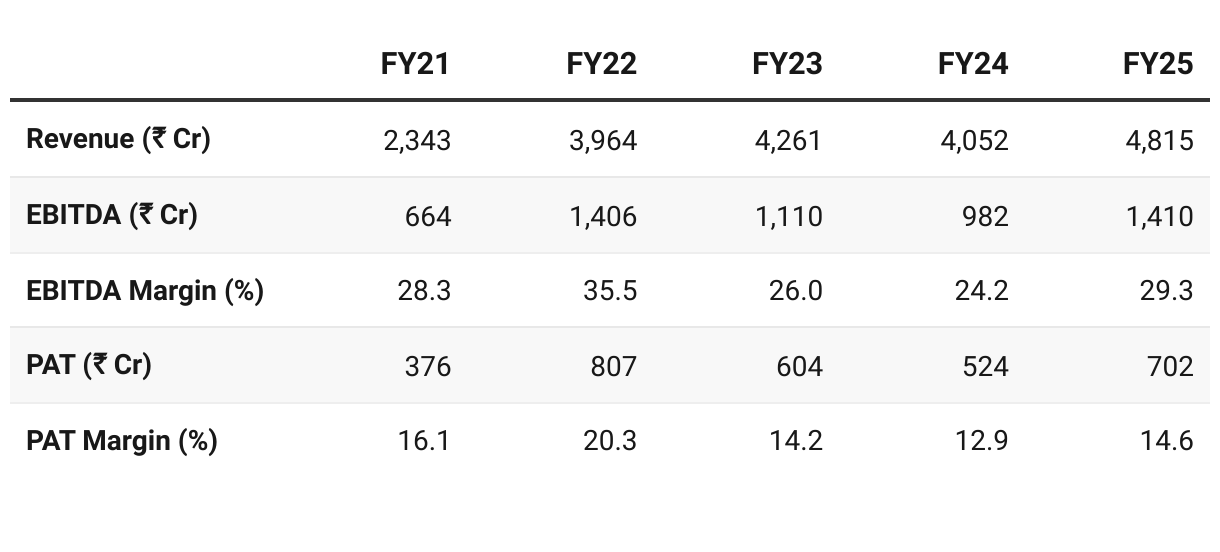

2. FY22-25: PAT CAGR of 62% & Revenue CAGR of 21%

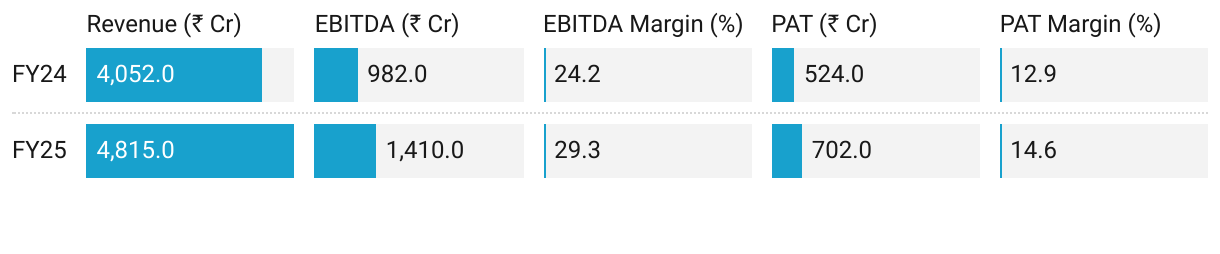

3. FY25: PAT up 34% & Revenue up 19% YoY

Growth was largely driven by the acquisition of SKS Power (600 MW IPP) in Aug-24, which contributed ~7 months of operations in FY25.

4. Q1-26: PAT up 121% & Revenue up 71% YoY

PAT up 337% & Revenue up 33% QoQ

Best-ever quarterly financials, supported by energy-led earnings and lower input costs.

Segmental Performance

Energy (49% revenue, 74% EBIT):

SKS Power (IPP, 600 MW) achieved 90% PLF vs 70% in FY25.

Realization: ₹6.16/unit (vs ₹4.9/unit in FY25).

Hydro generation +37% YoY (early monsoon), adding stability.

Energy EBIT surged to ₹428 Cr vs ₹29 Cr in Q1FY25.

Steel & Ferro Alloys:

Steel: Billets up 17% YoY, wire rods up 6% YoY; post-maintenance recovery.

Ferro Alloys: Sales +5% YoY; realizations stable at ~₹70–73k/MT.

Contribution improved, though still a smaller profit pool vs energy.

Minerals:

Iron ore pellet sales +9% YoY (140k MT).

Captive coal production lower YoY (-24%) but rebounded sharply QoQ (+117%).

Gare Palma IV/7 expansion approval to 1.8 MTPA awaited (expected FY26 Q2).

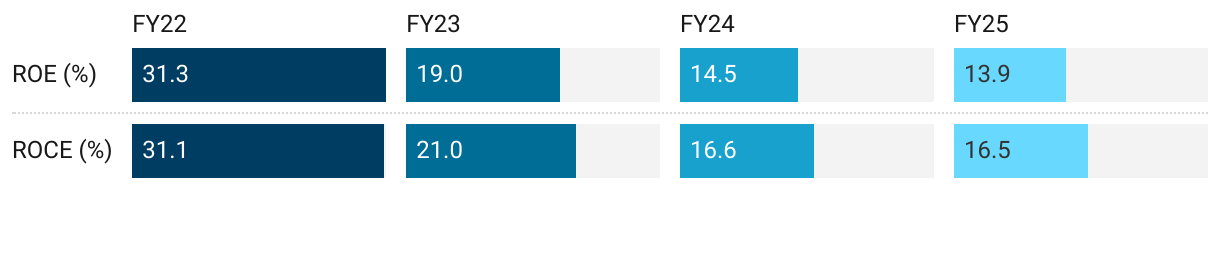

5. Business Metrics: Return Ratios are Stabilizing

ROCE compressed from >30% in FY22 to ~16% in FY25. The main driver is capital intensity of the energy business – power plants and mines require heavy upfront capital, while returns are spread over long horizons.

6. Outlook: Record Results expected in FY26

6.1 Guidance & Outlook for FY26 and Beyond

Record Results expected in FY26

We remain confident of delivering record results for the financial year '26despite sectoral challenges in steel.

FY '26 will benefit from full year operations of the IPP power plant, increased coal production and the commissioning of three new projects, which are 25-megawatt Rehar hydropower plant, which commissioned in July 2025, mineral wool plant and 50-megawatt captive solar power plant.

Incremental EBITDA from SKS Power (over FY25)= ₹397.2 cr

power generation from the thermal power project should be in the range of 400 crores plus/minus units. And EBITDA will depend upon the electricity pricing, which is varies in the range and EBITDA may range somewhere about INR2. Plus minus 50 paisa.

Units sold in FY25 were 201.4 cr units.

Hence incremental units = 400-201.4 = 199.6

Incremental EBITDA = 199.6 X 2 = ₹397.2 cr

7.2 Valuation Snapshot

CMP ₹586.15; Mcap ₹20,654 Cr

FY26E Valuations: Normalize meaningfully (P/E <19×, EV/EBITDA ~11×), supported by record earnings.

SEML is undergoing transformation into an energy-led company (70%+ EBITDA share from power)

Clear reflection of SKS Power contribution and captive coal advantage.

Stable annuity-like returns from hydro + cost-competitive thermal power underpin higher margins.

Balance sheet strength (Net debt/EBITDA <1×) provides further comfort.

Relative Comfort:

On FY26E numbers, P/E 18.7× / EV/EBITDA 11× are reasonable

However, multiples are still higher than traditional utilities due to growth optionality (doubling SKS capacity, coal expansions).

7.2 Opportunities at Current Valuation

Earnings-led De-rating: Valuation multiples compress sharply as earnings expand — making FY26 forward valuations more reasonable.

As businesses scale up the multiples expected to compress further in FY27 and make the valuations more attractive

Energy-led Transformation: Full-year SKS Power consolidation + captive coal + hydro/solar commissioning drive structural margin improvement (PAT margin rises to 17%).

Growth Visibility: Revenue poised to further scale if SKS capacity doubles (600 → 1,200 MW).

Financial Strength: Strong cash flow profile to support capex without stressing balance sheet.

Strategic Re-rating: Transitioning from cyclical steel/ferro alloys to a diversified Energy + Minerals business— supports a re-rating towards stable utility-like multiples with growth premium.

Opportunity Rating: Strong case for re-rating as SEML transitions to an energy-led model with visible earnings expansion.

7.3 Risks at Current Valuation

Legal Overhang: Supreme Court case on SKS acquisition is pending; adverse outcome could impact ownership and integration of the asset.

This needs to be watched closely as an adverse judgement could completely derail the investment thesis

Cyclical Exposure: Steel and ferro alloys (~30% revenue) remain exposed to global price cycles, which can drag consolidated performance.

Capital Intensity: Large future expansions (doubling SKS capacity, new mines) require heavy capex, which could dilute return ratios (ROE/ROCE already trending lower).

Commodity & Regulatory Risks: Dependence on coal prices, power tariffs, and timely environmental/operational clearances.

Execution Risk: Timely ramp-up of expanded coal mining, new hydro/solar projects, and seamless integration of SKS operations remain critical for sustaining high growth.

Risk Rating: Legal uncertainty and high capex intensity remain key overhangs, though balance sheet strength provides cushion.

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer