Rategain Travel Technologies: PAT up 157% & revenue up 84% in H1-24 on track to exceed FY24 guidance. Growing at a 50% CAGR FY21-23, 2X in FY24-26

Robust revenue growth and margin expansion year-over-year leading to expected beat of the FY24 growth guidance after H1-24. Focused on the new aspirational goal of doubling revenues

1. India’s Largest SaaS company in hospitality & travel

rategain.com | NSE : RATEGAIN

RateGain Travel Technologies Limited is a provider of SaaS solutions for travel and hospitality, and one of the world’s largest processors of electronic transactions, price points, and travel intent data.

Business Units

MarTech: Helping hotels drive more ROI through digital

Distribution: Reaching the Right Guest

Data-as-a-Service: Enabling hotels, car rentals, and ferries plan their demand and pricing strategy using the automated AI powered pricing recommendation platform as well as a demand forecasting solution

2. Growing at a 50% CAGR FY21-23

Strong profitability metrics supported by improved positive cash flow generated from Operating Activities

3. FY23: PAT up 8X+ on revenue growth of 54%

Revenue for FY23 stood at INR565 crores with a growth of 54%. Margin improvement has been strong as we reported a 17.6% EBITDA margin in our Q4 and 15% for the full year, well ahead of the guidance given at the time of the IPO of 200 to 300 basis points expansion from the 8.3% margin we reported last year.

PAT grew significantly last year to 68.6 crores from INR8.4 crores almost eight times

4. Q1-24: PAT up 3X on revenue growth of 80% YoY

A revenue of INR214.5 crores with a year-over year growth of 80%. We had well rounded growth from all three verticals with DaaS growing 139% distribution at 27% and MarTech at 88% for the full year.

PAT grew three times compared to last year, coming to INR24.9 crores up from INR8.4 crores. Sequentially the PAT was lower on account of one-time benefit of deferred tax asset benefit which positively impacted the PAT last quarter. Without the one-time benefit, the PAT grew sequentially by 15%.

4. Q2-24: PAT up 132% on revenue growth of 88% YoY

RateGain continues to witness robust revenue growth of 88.4% YoY to INR 2,347.2 Mn and significant improvement in operating margins to 19.8% for Q2FY24, up from 14.1% in the same period last year: on the back of operating leverage playing out as the company continues scaleup with a focus on sustainable growth across verticals.

The company’s Profit after Tax grew by 131.7% to INR 300.4 Mn in Q2FY24 as compared to INR 129.6 Mn in the same period last year.

5. H1-24: PAT up 157% on revenue growth of 84% YoY

Total Revenue at INR 4,588.4 Mn v/s INR 2,584.8 Mn (+ 77.5% YoY)

EBITDA at INR 842.1 Mn v/s INR 295.1 Mn (+ 185.3% YoY)

PAT at INR 549.5 Mn v/s PAT of INR 213.8 Mn (+ 157.0 YoY)

EBITDA margin at 18.7% v/s 12.1%

PAT margin at 12.2% v/s 8.8%

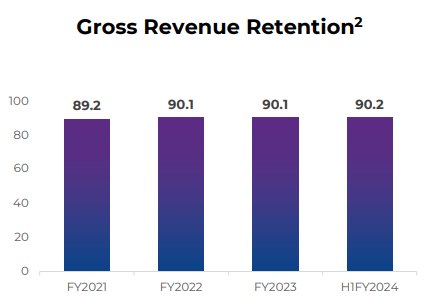

6. Revenue visibility: 90% revenue retention

Look 90% gross recurring revenue, gross retention -- gross revenue retention, which is called GRR, is a SaaS benchmark and 90% is a good metric for SaaS companies and on an NRR front, anything between 110% to 120% is a good benchmark for SaaS companies and we track them pretty seriously and this shows the mining of existing clients because our clear strategy is to land and expand. So, majority of our growth if we talk about, is coming from existing clients and that's how the net retention rates, we continue to try to thrive to increase the net revenue retention. NRR denotes the growth of our existing relationships.

6. Outlook:

i. Original guidance of 55-58% growth in FY24

Expected to be at guidance for FY24.

Guidance for FY24 vs H1-24 achievement

Revenue = Rs 875-890 cr vs Rs 458 cr achieved

EBITDA margin = 17% guidance vs 18.7% achieved

PAT margin = 12% guidance vs 12.2% achieved

EPS = Rs 10 guidance vs Rs 5.01 achieved

In terms of guidance for financial year 2024, we expect to grow around 55% to 58% and end up around INR875 crores to INR890 crores revenue in FY ‘24. On the margin front, we expect to see a 200 basis point expansion year-over-year to 17%. Our Q1 is a soft quarter, both in terms of revenue and EBITDA due to seasonality of the business and also the annual pay review impact starts kicking in in Q1. Our EBITDA margin in Q1 will be around 13.5% and gradually increase to 20% in Q4, delivering an average 17% EBITDA for the year. We expect to deliver a PAT of around 12% and EPS around INR10 per share next year.

As of Q4-23

ii. FY24 guidance on growth and margins to be beaten

In terms of guidance for FY’24 for the full year, we're confident of beating the growth guidance given last time. And similarly, we would be looking to exceed the 17% margin guidance given for the full year.

As of Q1-24

The margin expansion continues ahead of guidance and stands at a 15-quarter high.

As of Q2-24

iii. Rs 2,000 cr with 25% to 30% margin by FY26 implying 40%+ revenue CAGR.

Rs 900+ cr in FY24 (looks reasonable based on H1-24 performance) to Rs 2,000 cr. Organic growth will take it to around Rs 2,000 cr by FY27. However, RATEGAIN is talking about inorganic growth in addition to the organics growth and hence one can expect reaching Rs 2,000 cr by FY26.

Margin expansion from 17% EBITDA Rs 900+ cr in FY24 to 25-35% on Rs 2,000 cr by FY26, implies a PAT growth of 70% CAGR

So, yes, we are talking about FY '24 as the base. And let me also qualify the doubling of revenues as an aspirational goal.

But in a steady state, I see me at least let's say, at a 2,000 crores number I'm very very comfortable to say, we should be anywhere between 25% to 30% margin.

If you do a 25% growth, you can actually double the company in four years. And I do believe very, very strongly that given the tailwinds that we have the acceleration in our products and sales and marketing that we can achieve that 20%, 25% organic growth. And then in addition to that our inorganic play, which, we've demonstrated that we have a playbook that will add to the rest.

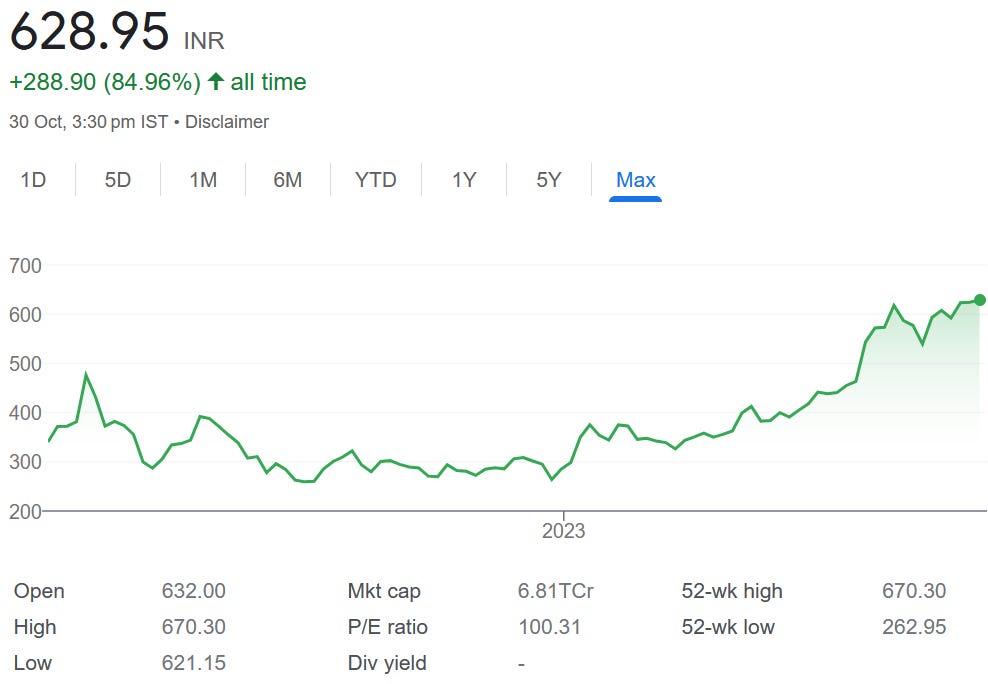

7. 60%+ EPS growth in FY24 at a PE of 67(TTM) and PE of less than 63 based on FY24 EPS

EPS expected to grow from 6.29 in FY23 to 10+ based on FY24 guidance. EPS of around 10 was the original guidance for FY24. Given that the EBIDTA guidance has been increased, one can expect a 10+ EPS for FY24. This implies that PE based on FY24 earnings will be less than 59.

This translates to an EPS growth of 60%+ in FY24

8. So Wait and Watch

If I hold the stock then one can definitely hold on to RATEGAIN

We initiated coverage of RATEGAIN after Q1-24 results. The investment thesis has not changed.

Additionally Q2-24 execution gives confidence in the ability of the management to deliver/ exceed FY24 guidance.

Outlook for EBITDA growth at 70% CAGR till FY26. This needs to be watched closely. FY26 is too far away and there can be many misses along the way.

Demand outlook is strong

With travel demand beyond 2019 levels, the industry is now investing into adopting new technologies including AI to improve customer experience, drive cost efficiencies and optimise revenue.

Management maintain a cautiously optimistic approach given the developments in Israel which could impact global travel.

Despite recent macro uncertainty, we see growth holding steady across the travel space but will maintain a cautiously optimistic approach keeping an eye on developments across key regions.

9. Or, join the ride

If I am looking to enter the stock then

RATEGAIN is guiding for a PAT CAGR of 60%+ for FY24 which makes the PE (TTM) of 67 and around 63 based on FY24 EPS look fairly valued.

Outlook for 70% EBITDA CAGR till FY26 provides an entry point in the stock. Given that FY26 is quite far away one should really believe in the story to enter RATEGAIN

Previous coverage of RATEGAIN

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades