Rashi Peripherals FY25: PAT Up 48%, FY26 Growth Outlook Remains Strong

Guides for 15–20% growth, driven by core ICT distribution & with AI and embedded bets, yet trades at 8x P/E & 6.8x EV/EBITDA for FY26 —offering re-rating potential

Check out previous Stock Ideas at moneymuscle.in

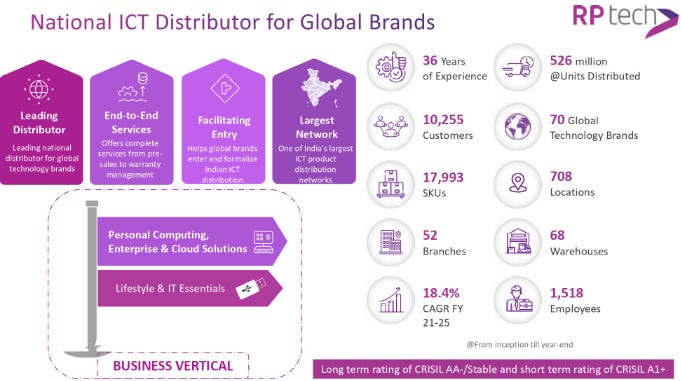

1. ICT Distributor

rptechindia.com | NSE: RPTECH

2. FY21–25: PAT CAGR of 11% & Revenue CAGR of 24%

Transitioned from volume-driven distributor to value-added tech partner

Added new verticals: AI infrastructure, embedded systems, quick commerce

Expanded from metros to 700+ locations via 52 branches

Recognized by brands like NVIDIA for execution and reach

Moved from transactional margins to solution-led growth

Strengthened balance sheet, listed entity, CRISIL AA-/Stable rating

Exploring cloud/software resale and M&A for future scalability

3. Q4-25: PAT up 12% YoY & Revenue down 1% YoY

PAT down 9% QoQ & Revenue down 1% QoQ

Revenue slightly down QoQ due to softening demand in H2 and delayed enterprise orders.

EBITDA up 44% YoY on account of improved sales mix and better cost controls.

Margins expanded: Focus on high-value verticals like embedded systems and quick commerce supported profitability.

Channel leverage and operational efficiency led to flat PAT QoQ despite topline softness.

Management expects Q1 FY26 to rebound

4. FY25: PAT up 45.8% & Revenue up 24.1% YoY

PAT surged 46% YoY driven by:

Operational efficiency

Contribution from AI infra deal & embedded vertical

EBITDA margin compressed slightly due to revenue mix (large project execution at lower margins).

Emerging verticals (embedded systems, AI, quick commerce) played a crucial role in offsetting softness in legacy business.

5. Business metrics: Return Ratios to Improve as Growth Capital gets Deployed

we have taken growth capital last year

growth capital when it comes into full cycle of the growth and revenues then the ROE will come back to the levels of the standards applicable to the industry which is 17% to 20%.

current levels of 12.6% we expect in 1-2 years to jump to 15% and beyond that when the full capital utilization happens at 12. So as

6. Outlook: 15-20% Revenue Growth in FY26

6.1 FY25 Expectations vs Performance — Rashi Peripherals

✅ Hits: What Went Right

Strong Profit Growth: PAT up 46% YoY despite margin dip.

Embedded Business: ₹100+ Cr revenue; already profitable. In-house design lab set up in Bangalore.

AI Infra Execution: ₹1,500 Cr Yotta deal completed. Now shifting to smaller AI projects.

Non-Metro Expansion: 52 branches, 700+ locations. Non-metro share up to 34% (from 30%).

Operational Efficiency: Working capital cycle steady at 54 days. Inventory days improved.

❌ Misses: What Fell Short

Margin Compression: Impacted by low-margin enterprise mix.

Soft H2 Cash Flow: Post-Diwali demand weak; collections slowed. Debtor days rose by 5; partial Yotta dues pending.

6.2: FY26 Guidance — Rashi Peripherals

Growth Target

Aiming for 15–20% revenue growth, in line with historical trend.

Confident of growth in FY26 as demand normalizes.

Strategic Focus

Partner Expansion: More locations, customers, and distribution partners.

AI Distribution: First-mover; executed ₹1,500 Cr deal; now shifting to multi-site AI rollouts.

Embedded Systems: ₹100+ Cr revenue; profitable; growth seen in auto/manufacturing.

Quick Commerce: Early-stage but promising; live with 8–9 brands.

M&A: Exploring acquisitions in software/cloud distribution despite the failed Satcom Infotech deal. Strategy is being recalibrated post learnings

Demand Tailwinds

Microsoft refresh cycle from Q3 FY26.

Higher enterprise IT spend.

AI infra demand driven by Digital India initiatives.

Margins

Targeting ~2.5% EBITDA margin for core business.

Large deals may dilute % margins but support ROE/ROCE.

Return Ratios

Target ROE: 15% in 1–2 years, long-term: 17–20%

Cash Flow & WC

FY25 saw weaker H2 collections; working capital stable at 54 days.

Focus: 50–55 day WC cycle, better collections in FY26.

Capital Allocation

Conservative debt use; dynamic working capital funding.

Ongoing investments in AI infra, embedded labs, CRM.

7. Valuation Analysis — Rashi Peripherals

7.1 Valuation Snapshot

Key Assumptions:

FY26 Revenue: +17.5% YoY (in line with midpoint of management guidance of 15-20% growth).

PAT & EBITDA Margin: Stable — same as FY25

TTM Basis: Rashi trades at a modest 9.6× P/E and 8.2× EV/EBITDA — despite strong FY25 earnings.

Forward Basis: FY26 projections imply a very modest 8× forward P/E and 6.8× EV/EBITDA, based on 17.5% top-line and bottom-line growth.

Valuation View:

Rashi appears undervalued earnings metrics. With improving ROE (~12.6%) and margin stability, the stock offers a strong case for re-rating if FY26 growth and cash flows hold up.

7.2 What’s in the Price?

The current valuation — 9.6× P/E (TTM) and 8.2× forward P/E — reflects low investor confidence in execution beyond FY25, despite strong historical delivery.

Market seems to price in:

FY26 PAT of ₹246 Cr, EPS of ₹37, and ~17.5% growth.

Flat or slightly declining margins.

Execution limited to ICT distribution and existing brands.

Implied assumptions:

AI datacenter vertical unlikely to replicate ₹1,500 Cr scale deal.

Embedded growth steady but not exponential.

No meaningful re-rating in return ratios (ROE steady at 12–13%).

At these levels, Rashi is priced like a low-margin distributor, not a tech infrastructure enabler.

7.3 What’s Not in the Price?

Several upside triggers appear underappreciated:

Embedded Systems Scale-Up: Already profitable; if scaled to ₹300–₹400 Cr+ over 2 years, margin and ROE could improve sharply.

AI/Cloud Infra Optionality: Pivot from one-time ₹1,500 Cr deal to multi-location contracts is underway. Market hasn’t priced this as recurring.

Quick Commerce: Currently small, but highly accretive channel with low channel conflict.

Software Distribution: M&A-led entry (post Satcom exit) could add high-margin annuity revenue — currently 0% in estimates.

Valuation Re-rating: If ROE improves to 15–17% and PAT CAGR sustains >20%, a move toward 13–15× P/E is realistic — not yet priced in.

7.4 Risks and What to Monitor

Execution Risks

Embedded scaling and quick commerce adoption may take longer than projected.

Receivables from large enterprise deals (e.g., Yotta) could pressure cash flow.

Demand Cyclicality

ICT hardware demand (esp. consumer PC) may soften despite commercial recovery.

Replacement cycles (e.g., Microsoft refresh) could be delayed.

Margin Headwinds

Higher low-margin orders or heavy channel discounting could compress margins.

FY26 PAT growth may trail revenue if pricing pressures rise.

Capital Absorption

ROE recovery depends on optimal deployment of IPO funds. Delays in capital productivity may keep returns muted.

What to Monitor

The stock’s valuation reflects modest expectations and low execution premium.

But if Rashi delivers even steady scaling in embedded, AI, and software, it has room to re-rate sharply — especially with improving return ratios and stable margins.

8. Implications for Investors

8.1 Bull, Base & Bear Scenarios — Rashi Peripherals

Bull Case (Probability = Moderate)

Embedded vertical scales faster with ₹300–₹400 Cr revenue by FY27

Recurring AI infra projects ramp up across 8–10 distributed sites

PAT margin expands to 2.8–3.0% with operating leverage from tech-led segments

ROE crosses 15% by FY26, enabling a re-rating to 15× P/E

FY27 revenue exceeds ₹20,000 Cr, led by software resale, embedded, and cloud partnerships

Base Case (Probability = High)

FY27 revenue reaches ₹19,000 Cr (17–18% CAGR maintained)

PAT margin stays stable at ~2.6%, supported by mix improvement

Embedded, AI, and quick commerce contribute 20–25% of incremental growth

ROE remains at 13–14%; valuation remains at 11–13× P/E range

No major shocks in working capital, collection cycles, or execution

Bear Case (Probability = Moderate)

Execution lag in AI/embedded verticals or new deals slip to FY27+

FY27 revenue caps at ₹17,000 Cr; growth slows below 15%

PAT margin contracts to 2.2–2.4% due to higher low-margin deals or channel incentives

ROE remains stuck at ~12%; valuation stuck in 8–9× P/E zone

Working capital cycle stretches; receivables pressure from older projects persists

8.2 Is There Any Margin of Safety?

Yes — Rashi offers a clear margin of safety, particularly on forward earnings and enterprise value:

Valuation Disconnect

The stock trades at just 8.2× FY26E P/E and 6.8× EV/EBITDA, despite:

Strong growth

Strong revenue visibility in emerging verticals (AI, embedded, quick commerce)

Capital Efficiency Check

ROE has stabilized at 12.6%; any improvement toward 15%+ would warrant a valuation re-rating.

Current P/B = 1.15× suggests limited downside on asset value.

Execution-Linked Optionality

The market is not pricing in:

Recurring AI infra projects

High-margin embedded solutions scaling up

A second revenue engine from software/cloud resale

This creates valuation asymmetry: downside appears contained, while upside from margin expansion or segment rerating remains underappreciated.

Previous coverage of RPTECH

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

It’s impressive to see how resilient their supply chain and distribution network remain amid ongoing global tech headwinds. The focus on expanding value-added services and enterprise solutions could be the real catalyst for sustainable margin expansion going forward. Curious to see how they navigate rising competition in the IoT and cloud infrastructure space next year—those sectors seem ripe for driving the next leg of growth. Thanks for the detailed breakdown!