Rashi Peripherals: PAT growth of 62% & revenue growth of 36% in 9M-25 at a PE of 8

Revenue CAGR of 20% delivered over long term. FY-25 to be strong based on 9M-25 performance even though stock price crashed. Available at reasonable valuation. At a P/B of 1

1. Ranks among top 5 Category-B IT hardware distributors

rptechindia.com | NSE: RPTECH

2. FY20-24: PAT CAGR of 34% & Revenue CAGR of 21%

3. FY24: PAT up 17% & Revenue up 17% YoY

4. Q3-25: PAT up 29% & Revenue up 8% YoY

5. 9M-25: PAT up 62% & Revenue up 36% YoY

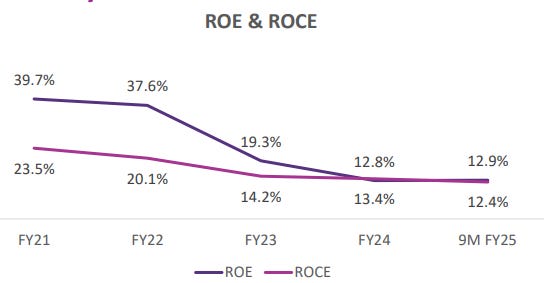

6. Business metrics: Improving return ratios to 15%+

The company aims to return to 15%+ ROE/ROCE in the medium term.

7. Outlook: 20% Revenue CAGR

1. Revenue Growth Expectations

The company remains bullish on growth, expecting to sustain its double-digit revenue CAGR.

Despite a slower Q3, the management is confident about strong growth in Q4 and FY26, driven by:

Increased penetration in tier-2 and tier-3 cities.

Expansion in enterprise solutions and AI-driven businesses.

Growth in the quick commerce segment.

PC replacement cycle revival starting in FY26.

2. Profitability & Margins

EBITDA margins are expected to stabilize around 2.5% - 2.7% in the near term.

PAT growth is expected to remain strong, supported by:

Higher-margin businesses like AI, enterprise, and embedded solutions.

Cost optimizations and efficiency improvements.

Advertising & promotions are expected to remain elevated but will be compensated through brand support over time.

3. Key Business Expansion Plans

(a) Enterprise & AI-Driven Growth

The AI & data center segment will be a major focus area, with opportunities in government AI tenders (e.g., 18,000 GPU requirements).

More phased installations are expected as AI adoption increases.

Rashi aims to be a top player in AI & data center distribution.

(b) Embedded & Semiconductor Business

The Bangalore embedded lab is gaining traction, with new design wins expected to drive growth.

The Indian embedded solutions market (~₹8,500 crore) is growing rapidly, and Rashi is positioning itself as a key player.

The company expects significant growth in the next 3-5 years, with this segment potentially contributing 5-10% of total revenue.

(c) Cybersecurity Expansion

Rashi acquired a 70% stake in a cybersecurity company to expand into this fast-growing sector.

This acquisition provides vendor alliances, technical expertise, and client access to accelerate growth.

The company plans to expand cybersecurity brand partnerships in the coming quarters.

(d) Quick Commerce & Consumer Tech

Quick commerce business has expanded with new brand additions, contributing to higher volume growth.

The company expects further growth as demand for faster product delivery rises.

(e) HP Printer Distribution

The addition of HP commercial printers completes Rashi’s ICT product basket, which is expected to boost sales.

4. Financial & Operational Efficiency

ROE/ROCE Targets:

The company aims to return to 15%+ ROE/ROCE in the medium term.

Achieving this depends on scaling high-margin segments like AI, cybersecurity, and embedded solutions.

5. Industry Tailwinds & Market Opportunities

PC Replacement Cycle to Drive Growth in FY26:

Many PCs bought during COVID (2020-21) are reaching the replacement phase, expected to boost demand.

Microsoft’s upcoming OS upgrade will further accelerate replacements.

Government’s Push for Digital & AI Adoption:

Govt. policies like Make in India, AI Mission, and semiconductor incentives will benefit Rashi.

Growth in Data Center & AI Compute Market:

AI-related spending in India is expected to grow significantly over the next 2-3 years.

8. PAT growth of 62% & Revenue growth of 36% in 9M-25 at a PE of 8

9. Hold?

If I hold the stock then one may continue holding on to RPTECH.

Based on 9M-25 performance one can look forward to a strong FY25 providing a reason to continue with RPTECH.

Current valuations remain attractive, and strong business fundamentals provide margin of safety even though price has fallen significantly.

Re-rating Potential: If Rashi sustains double-digit revenue and PAT growth, P/E can expand to ~12-15x.

RPTECH has a track record of delivering around 20% revenue growth over the long term which gives insight into the strong execution of the management.

10. Buy?

If I am looking to enter RPTECH then

RPTECH has delivered PAT growth of 62% & Revenue growth of 36% in 9M-25 at a PE of 8 which makes valuations quite attractive in the short term.

RPTECH has a long term track record of growing revenue at about 20% CAGR at a PE of 8 makes valuations look attractive from a longer term.

RPTECH had a net-worth of 1,692.2 cr as of Q3-25 end and is available at a market cap of Rs 1,673.85 cr. RPTECH is available at a price to book of less than 1 which makes valuations quite attractive

.

Previous coverage of RPTECH

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

EBIDTA MARGIN DOWN- this is not discussed.