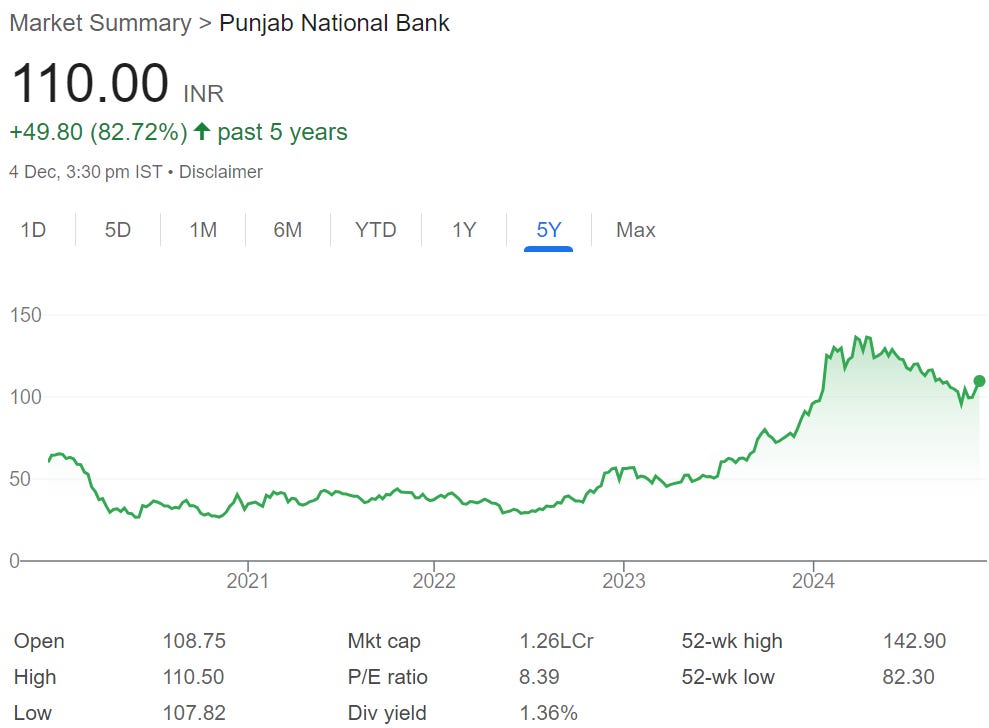

Punjab National Bank: PAT growth of 151% & Net Interest Income growth of 8% in H1-25 at a PE of 8

Outlook for 50%+ PAT growth in FY25. Upward revision in guidance. On track to deliver as per FY25 guidance. Continuing the Strong business momentum since Q1-23. Available at a reasonable P/B of 1.4

1. Why is PNB interesting

pnbindia.in | NSE : PNB

The second largest Public Sector Bank in terms of total business and deposits is available at very attractive valuations in terms of PE and P/B given the outlook for 50%+ PAT growth in FY25. The outlook is supported by a strong execution as PNB looks on track to deliver as per FY25 guidance which has been revised upwards. 2. 2nd largest Public Sector Bank

Second Largest Public Sector Bank in terms of Total Business and Deposits

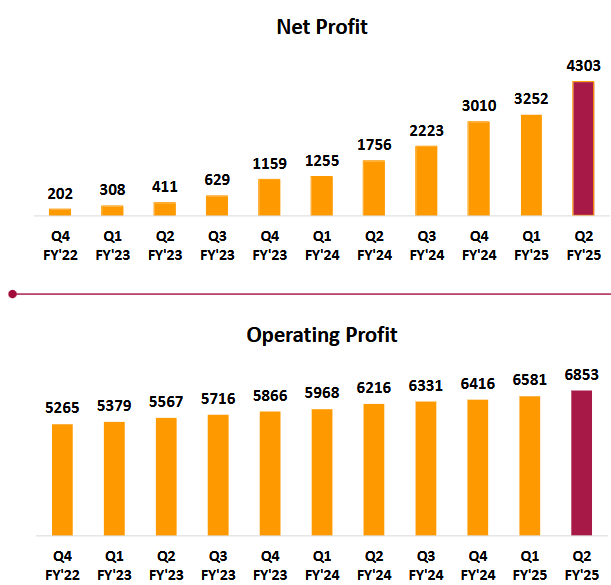

3. FY22-24: PAT CAGR of 51% & Net Interest Income CAGR of 17%

4. FY24: PAT up 229% & Net Interest Income up 16%

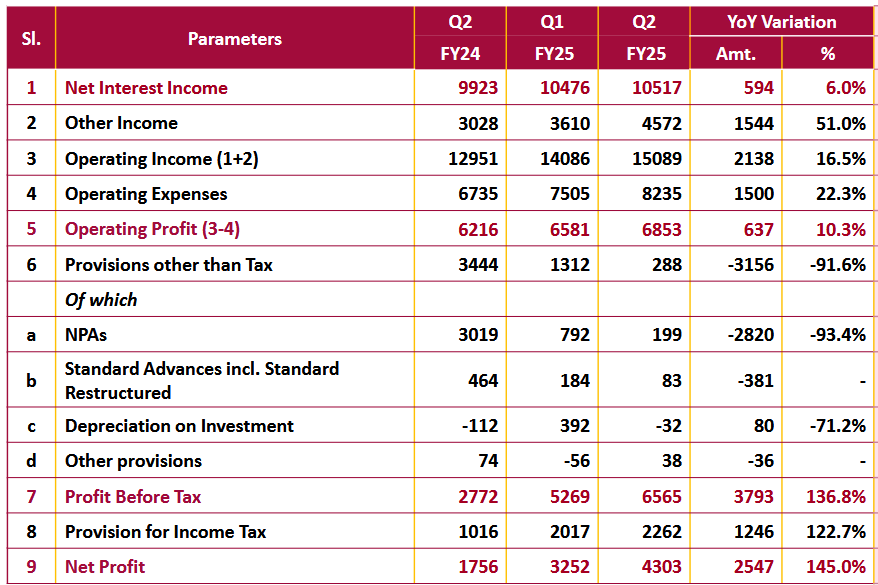

5. Q2-25: PAT up 145% & Net Interest Income up 6% YoY

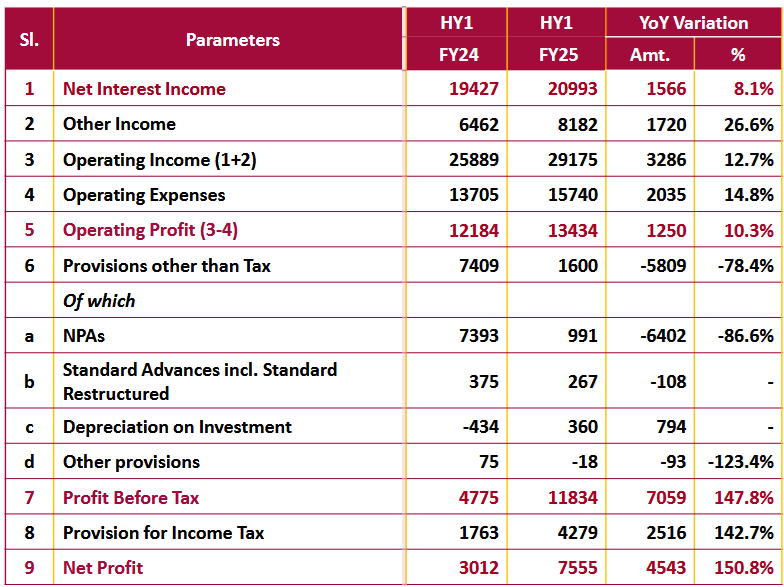

6. H1-25: PAT up 151% & Net Interest Income up 8% YoY

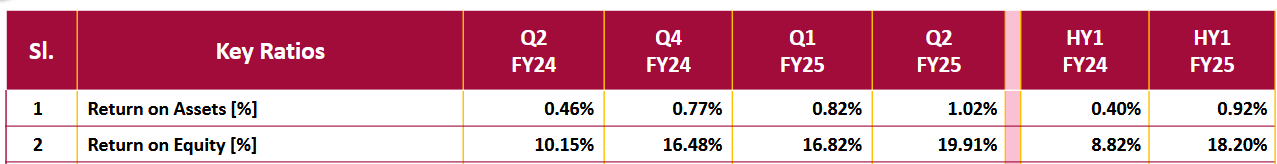

7. Business metrics: Improving return ratios

8. Outlook: 50%+ PAT growth in FY25

i. H1-25: Upward revision in FY25 guidance

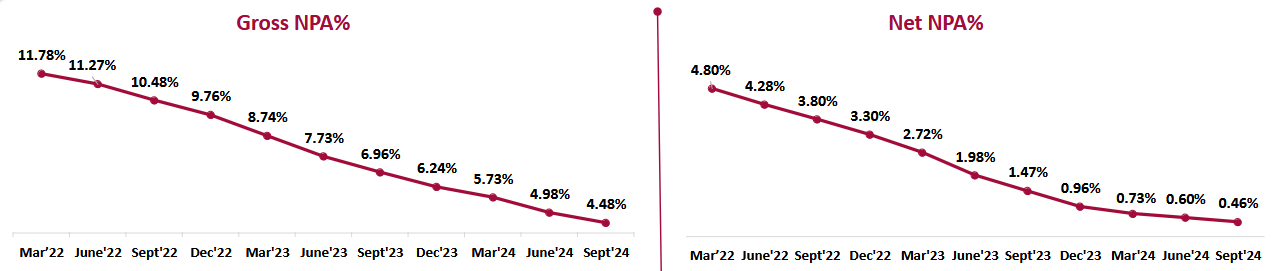

Gross NPA Guidance:

Guidance at the start of the year: around 5% by the end of March 2025.

Revision in June 2024: around 4% by the end of March 2025.

Q2-25 Revision: in the range of 3.5% to 3.75% by March 2025.

Net NPA Guidance: Maintain the net NPA around 0.5%.

Credit Cost Guidance:

Initial guidance: around 1% for the current financial year.

Revision in June 2024: 0.5%.

Q2-25 Revision: around 0.25% to 0.30% by the end of the fiscal year.

ROA Guidance:

Initial guidance: 0.8% for the whole year.

Q2-25 Revision: around 0.9% to 1% for the whole year.

NIM Guidance: Maintained the NIM guidance of 2.9% to 3%.

Credit Growth Guidance: Credit growth between 11% and 12%.

ii. FY25: 50% PAT growth

ROA increasing from 0.54% in FY24 to 0.8%+ in FY25 for the full year implies a 50%+ growth in PAT in FY25

9. PAT growth of 151% & Net Interest Income growth of 8% in H1-25 at a PE of 8

10. Hold?

If I hold the stock then one may continue holding on to PNB

Based on FY24 & H2-25 performance against the revised guidance for the year, PNB management looks on track to meet its guidance for FY25

PNB is in the middle of a very strong run. It has delivered sequential growth in PAT on QoQ in all the 4 quarters of FY23 and FY24. The trend continues in Q2-25

The outlook for PAT growth of 50%+ in FY25 provides a reason to continue with PNB

11. Buy?

If I am looking to enter PNB then

PNB has delivered PAT growth of 151% & net interest income growth of 8% in H1-25 at a PE of 8 which makes valuations quite reasonable.

PNB has delivered Operating Profit of 10% in H1-25 against a FY25 guidance of 10-12% at a PE of 8 which makes valuations quite reasonable.

Outlook for PAT growth of 50%+ for FY25 at a PE of 8 makes the valuations quite attractive.

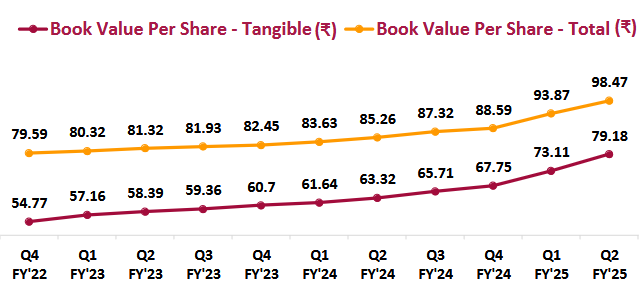

With a tangible book value of Rs 79.11 against a current price of Rs 110 as of Q2-25 end implies that PNB is available a price to book of 1.39 which makes the valuations reasonable

PNB has revised its guidance for GNPA of below 5% to 3.5-3.75% and NNPA below 0.5% in FY25. However, one needs to keep a watch on asset quality given that NPA has been a severe problem in the past

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

I like your column and impressed by your elegant data backed recommendations or appreciation. It doesn't come without hard work. Good luck & continue with giving to the world.