Power Mech Projects: PAT growth of 23% & revenue growth of 16% in Q1-25 at a PE of 40

30%+ revenue growth in FY25. Revenue CAGR of 29% for FY24-26. EBITDA margin improvement & reduction in taxes to drive PAT margins. Order book at 3.2X FY25 expected revenue

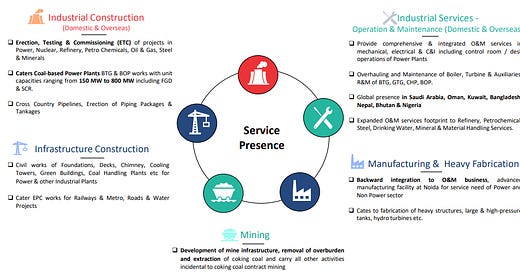

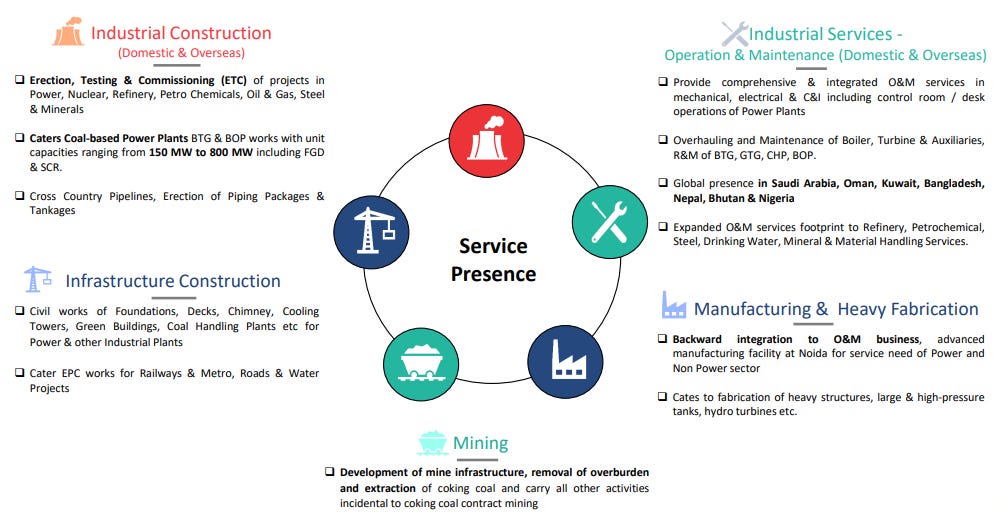

1. Industrial services & construction Company for power & infrastructure sector

powermechprojects.com | NSE: POWERMECH

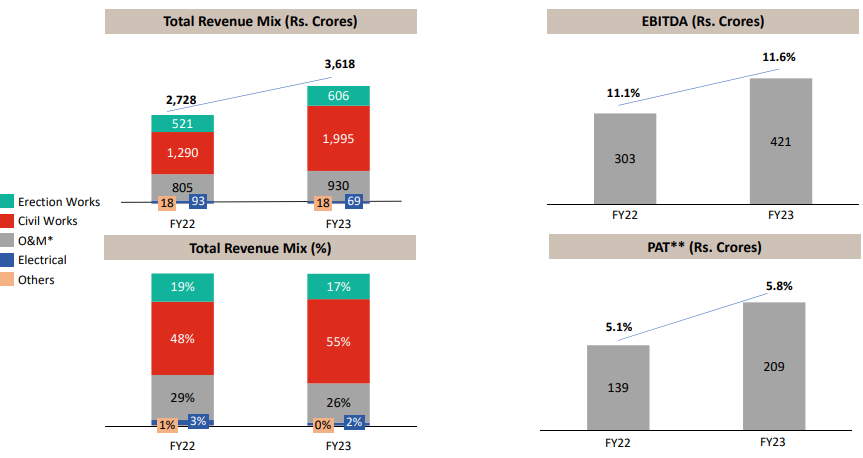

2. FY20-24: PAT CAGR of 17% & Revenue CAGR of 18%

3. FY23: PAT up 50% & Revenue up 33% YoY

4. FY24: PAT up 19% & Revenue up 17% YoY

5. Q1-25: PAT up 18% & Revenue up 16% YoY

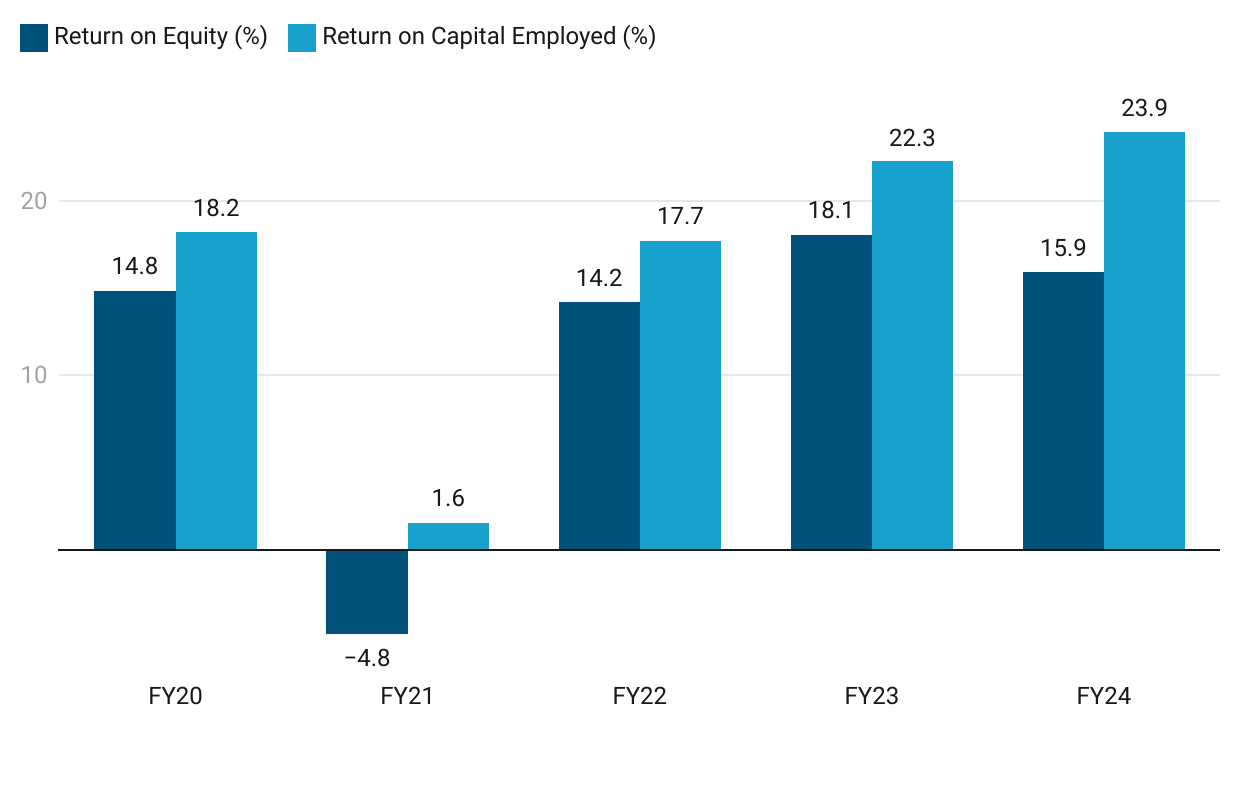

6. Business metrics: Strong & Improving return ratios

7. Outlook: 30%+ revenue growth in FY25

i. FY25: 30%+ revenue growth

So the '25, we are projecting around 30% growth in revenue, maybe around INR5,500 crores range.

ii. EBITDA margin improvement & reduction in taxes to drive overall margins

On the margins front too, the direction is on the upside. We will witness further improvement in FY '25. We will be close to achieve our peak margin levels in this year. Once the MDO revenue peak during FY '26, the margin profile will see a increase.

EBIDTA Margin: Rightly, there is a 0.3% improvement.

PAT Margin: The PAT rate will improve compared to the last year because of the tax rates. So there will be improvement in the profit margin during FY'25.

iii. FY24-26: Revenue CAGR of 29%

FY24 revenue of Rs 4206 cr growing to Rs 97,000 cr by FY26 implies a revenue CAGR of 29% for FY24-26

FY '26 after that, we're expecting order inflow of INR12,000 for the FY'26. So most likely, we may plan again 25% growth on the FY '25 numbers, maybe around INR7,000 crores, we can target revenue by FY'26.

iv. Strong order book: 3.2X FY25 expected revenue

Excluding the MDO contracts, the order backlog of Rs 17,362 cr is 3.2X FY25 expected revenue of Rs 5,500 cr

*Include 2 MDO contracts of Rs. 39,691 crores (executable over 25 years)

# exclude MDO contractMining, Development and Operations order (MDO)

8. PAT growth of 18% & Revenue growth of 16% in Q1-25 at a PE of 40

9. So Wait and Watch

If I hold the stock then one may continue holding on to POWERMECH

The past performance between FY20-24 has not been exceptional. Additionally Q1-25 was also an ordinary quarter. However, the interest in POWERMECH is on account of its large order book providing visibility in its revenue. The MDO projects will add Rs 2,000 cr of revenue from FY27.

So both MDOs put together, INR2,000 crores without price escalation as of today's price and EBITDA of 17% to 20% in the first mine and EBITDA of 27% to 30% in the second mine. This is starting FY '27 onwards.

POWERMECH will have to catch up in the remaining quarters of the year to meet its FY25 guidance 30%+ revenue growth

One can continue as long as one sees good execution and conversion of order book into revenue and PAT. From that perspective one needs to keep a watch if POWERMECH is on track to meet FY25 guidance given that Q1-25 was ordinary.

Power Mech is well set to demonstrate execution and conversion in the range of 38% to 40% of the opening order book. In addition to that, revenue from MDO business also ramping up.

10. Or, join the ride

If I am looking to enter POWERMECH then

POWERMECH has delivered PAT growth of 18% & Revenue growth of 16% in Q1-25 at a PE of 40 which makes valuations quite expensive in the short term.

POWERMECH guidance for 30%+ revenue growth in FY25 with EBITDA & PAT margin expansion at a PE of 40 makes valuations look fully priced from medium term.

POWERMECH guidance for 29% revenue CAGR for FY24-26 with EBITDA & PAT margin expansion at a PE of 40 provided opportunities in the longer term.

POWERMECH has a strong order book and contracts with life of 25 years which improves the revenue visibility and provides opportunity in the stock over the longer term.

POWERMECH generated free cash flow of Rs 114 cr in FY24 on a market cap Rs 10,364 cr, implies that its available at a free cash flow yield of 1.0% which is positive that its generating free cash flow at the time of an ongoing capex to support execution of a larger order book.

Previous coverage of POWERMECH

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer