Power Mech Projects: 39-50% FY24 revenue growth, 35% CAGR till FY26 at 25 PE

Carrying an order book of Rs 53,000+ cr on a FY23 revenue on Rs 3,600+ cr POWERMECH provides visibility for revenue and growth.

1. Industrial services & Construction company

powermechprojects.com | NSE : POWERMECH

Providing service in power and infrastructure sector

Power Mech is an integrated Infrastructure Services company providing comprehensive erection, testing and commissioning of BTG, BoP, industrial units, civil works and operation and maintenance (O&M) services. It is the largest O&M service provider to Power plants in India. In the Civil Works domain, Power Mech undertakes various Civil, Structural and Construction works. The company has diversified into other sectors like Railway works, Electrical Distribution works, Oil & Gas piping work, Mechanical works at Steel & other Non-Power sectors as well.

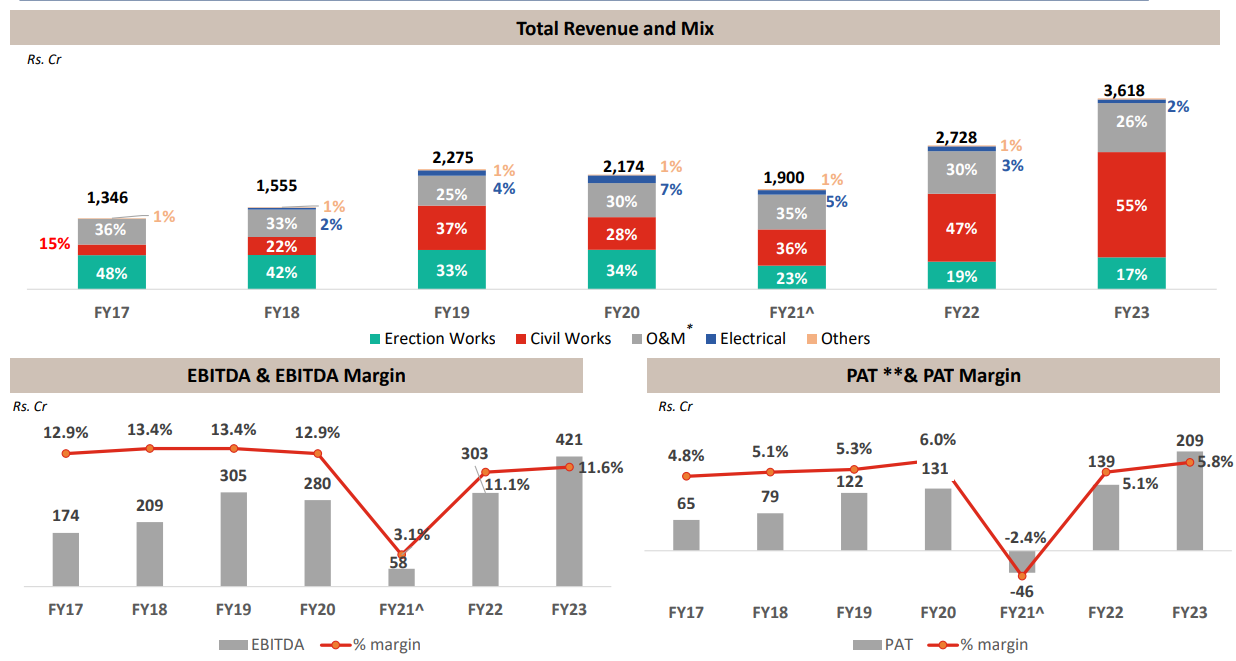

2. FY17-23: On a growth path after a bottom in FY20

PAT grown sequentially YoY since FY17, barring FY20.

3. FY23: PAT up 50% and Revenue up 33% YoY

The above growth is on account of strong order book base, increased in-house execution bandwidth. Improvement is also seen in overall margin profile and the same is further expected to improve gradually. Depreciation cost as a percentage to revenue remained lower side due to planned capex spending. And finance cost, again as a percentage to the revenue, remained lower side and continued to be controlled on account of improved working capital cycle and cash flow management.

4. Q1-24: PAT up 29% and Revenue up 16% YoY

Quarter-to-quarter there is a growth of almost 16% and with the growth of the top line the EBITDA has gone up almost 22% and whereas PAT has gone up to 29% which is significant.

5. Business metrics: A track record of growing EPS

6. Outlook: 39-50% revenue growth in FY24 followed by 35% CAGR till FY26

i. 39-50%+ top-line growth in FY24

The opening order book for FY24 was Rs 13,600 cr. 37-40% conversion of opening order book implies a revenue of Rs 5,032-5,440 cr in FY24. This translates into a top-line growth of 39-50% top-line growth in FY24

See FY '24, we have kept a target of 37% to 40% conversion to our opening order book.

See, the opening order book is almost close to INR 13,600.

ii. 35% revenue CAGR from FY24 to FY26

so probably 35% plus CAGR we are expecting next two years

iii. Strong revenue visibility for FY24: Order-book 3.5X FY23 revenue

Mining Development Operations (MDO) order book will start impacting the top-line in FY26. FY24 and FY25 revenues are dependent on Rs 13,588 cr order book (excluding MDO). Order inflow of Rs 10,000 cr (ex MDO) expected in FY24.

We have set a target of close to INR10,000 crores for this year

As of today we have got L1 status of projects around close to INR 2,000 crores and projects which we have already got INR 720 crores. So the target of INR10,000 crores is quite achievable. We have identified projects of around INR 40,000 cores plus. So INR 10,000 cores for this year's target we are quite confident, excluding the MDO part.

iv. Rs 2,500-3,000 cr revenue from Mining Development Operations & Operations & Maintenance from FY26

Yes. So put together, we are targeting close to INR 1,200 crores-plus, okay. And plus our MDO is the existing O&M, put together that O&M plus MDO 1 and MDO 2. So we are targeting that, that should cross at least INR 2,500 crores to INR 3,000 crores-plus, escalation is already in built.

7. 39-50% revenue growth in FY24 followed by 35% CAGR till FY26 at a PE of 25

8. So Wait and Watch

If I hold the stock then one may continue holding on to POWERMECH. The business is on a growth trajectory since FY20 and the management expects full growth potential to be achieved by FY26.

To achieve 35%+ revenue CAGR one needs to keep a close watch on order inflow and order execution.

One needs to keep a watching for the execution of the MDO order book into revenue by FY26. Delays in executing the MDO will impact the attractiveness of holding the POWERMECH stock

9. Or, join the ride

If I am looking to enter the stock then

POWERMECH is guiding for 35%+ revenue CAGR till FY26 at PE of 25 which makes the valuations quite attractive.

POWERMECH has a strong order book and contracts with life of 25 years which improves the revenue visibility and makes the guidance of 35%+ growth achievable.

POWERMECH has a track record of growing EPS since FY17. One can be hopeful of the trend continuing given the strong revenue visibility.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades