Piramal Finance Q2 FY26 Results: PAT up 101%, On-track FY26 Guidance

Guidance of 3X PAT in FY26. Strong profitability drivers in place till FY28. Rerating possible if execution sustains and loan book productivity continues to improve

1. Financial Services company

piramalfinance.com | NSE: PIRAMALFIN

PEL – PFL merger is now complete | seamless transition of reported consol. financials from PEL to PFL | PFL stock listed on 7th Nov 2025

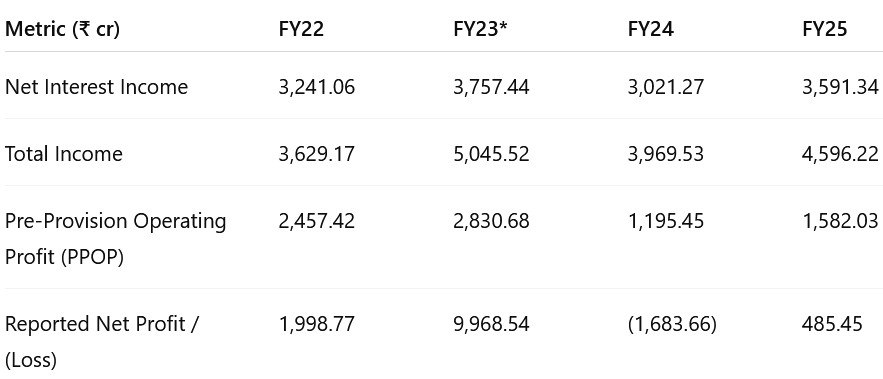

2. FY22-25: A period of transition

3. FY25: PPOP up 109% & Net Interest Income up 19% YoY

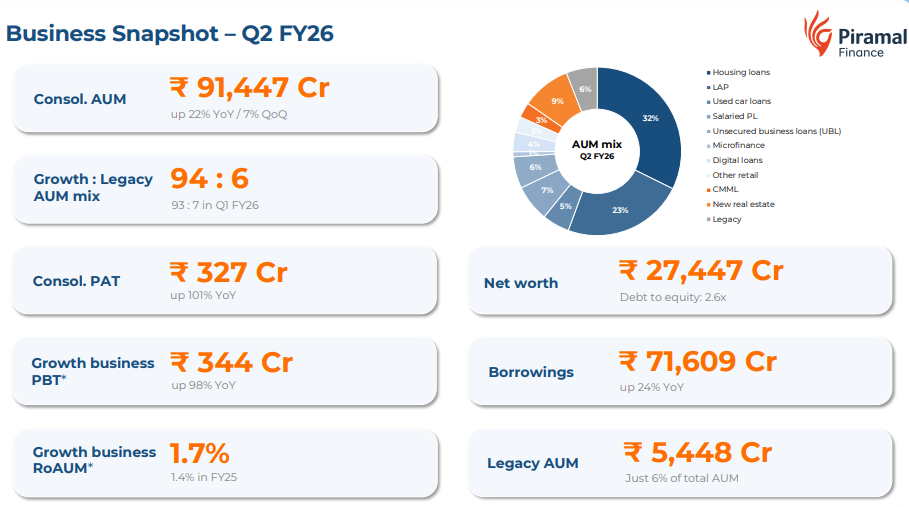

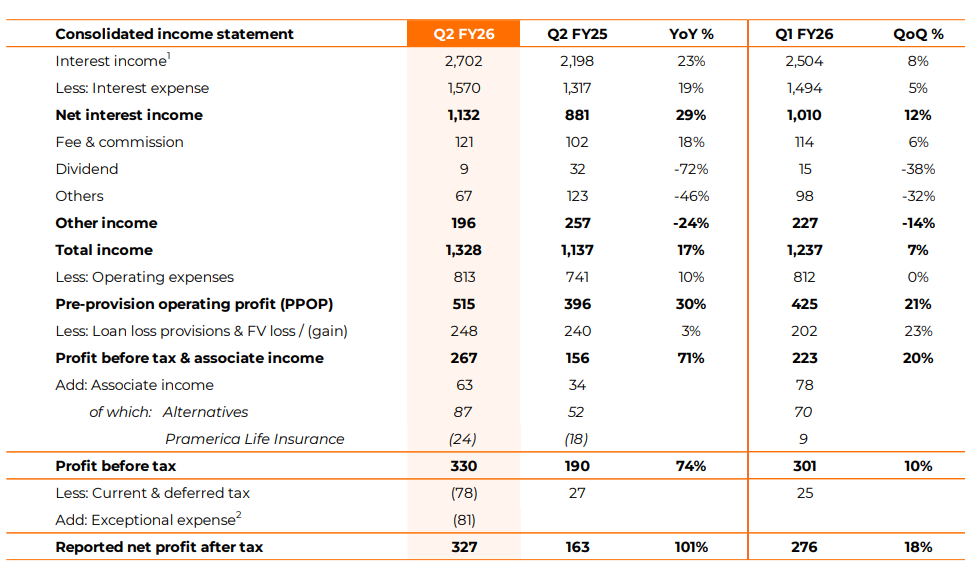

4. Q2-26: PAT up 101% & Net Interest Income up 29% YoY

PAT up 18% & Net Interest Income up 12% QoQ

Consol AUM growth of 22% YoY

Retail AUM up 36% YoY

Wholesale 2.0 AUM up 43% YoY

Legacy book at 6% of total AUM and down 55% YoY

Growth business PBT (₹ 344 Cr) drives Consol PBT (₹ 330 Cr)

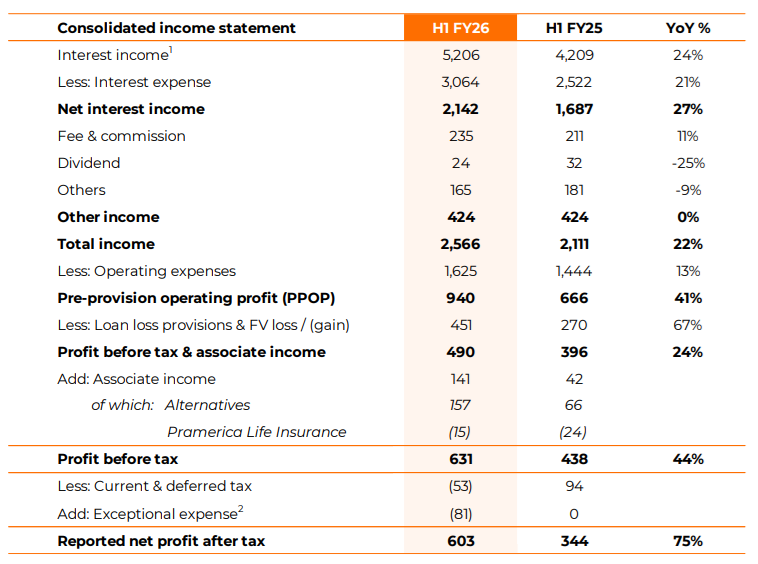

5. H1-26: PAT up 75% & Net Interest Income up 27% YoY

6. Outlook: 25% AUM Growth; 2.5-3X PAT in FY26

6.1 Management Guidance and Outlook

Bottom-line growth driven by improving profitability

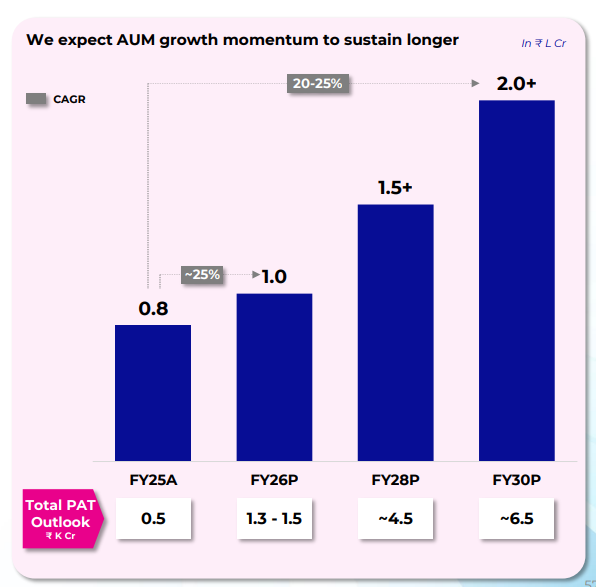

FY26 expected PAT growing from ~₹1,300-1,500 Cr to ~₹4,500 Cr in FY28 to ~₹6,500 Cr in FY30

the RoA is at 1.5 percent and it is expected to trend towards 3 percent. At this size, you don’t usually see companies talk about doubling their profitability, and that’s a very big leap for us.

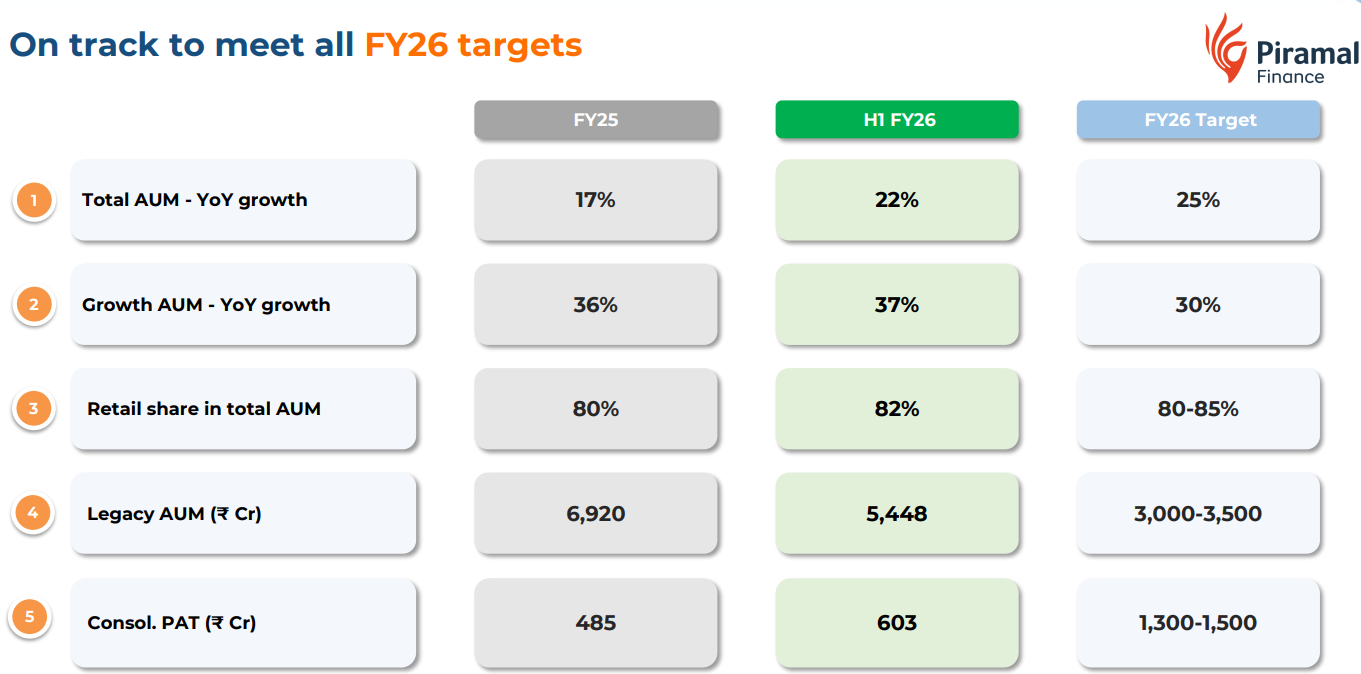

6.2 H1 FY26 Performance vs FY26 Guidance

PIRAMALFIN confirming that its on-track to meet PAT guidance of ₹1,300 Cr+

6. Valuation Analysis

6.1 Valuation Snapshot — Piramal Finance

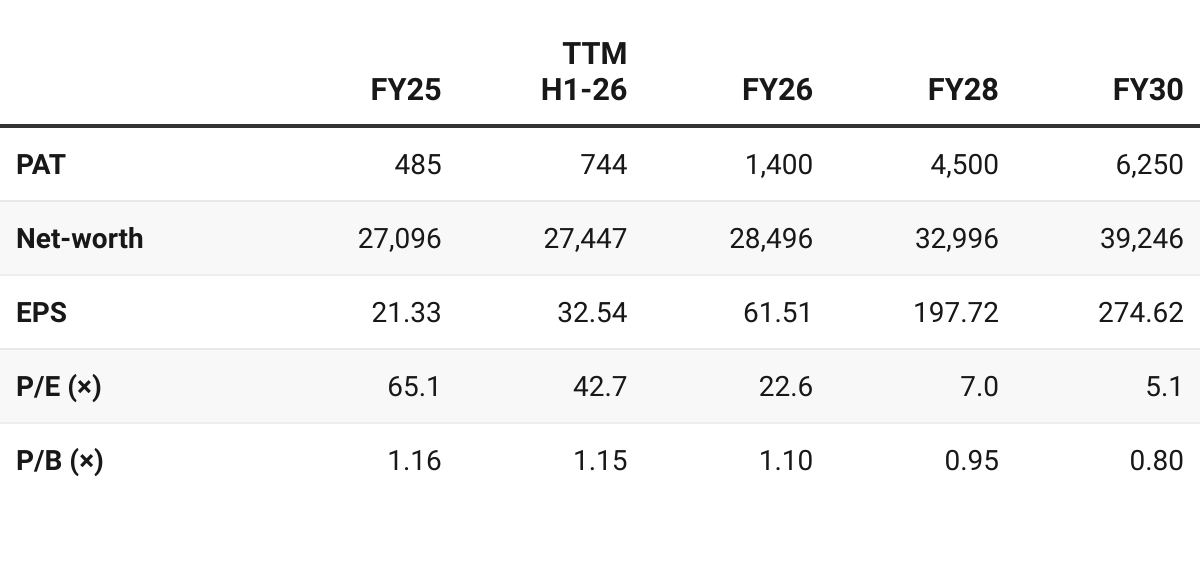

CMP ₹1,389.10; Mcap ₹31,487.80 Cr

Despite profitability improving, PIRAMALFIN still trades at about book value on FY26 estimates.

For a company guiding to deliver ~80% PAT CAGR for FY26-28 — the P/B multiple deserves a re-rating

7.2 Opportunity at Current Valuation

Increased Profitability: RoA improving from ~1.7% to 3% creates the opportunity as bottom-line grows faster than the top-line

AUM growth: 25% AUM CAGR FY26-28 to support bottom-line growth

Margin of safety: Even at a current P/B of 1.15(×) there exists a margin of safety in the perspective of the guidance for FY26 which is on-track.

Projections not discounted: Weak past record in the last 5 years — market does not fully discount the growth projection of FY28

Multiple Re-rating: Opportunity of being re-rated at around 1.5-2(×) P/B if FY26 guidance is delivered and PIRAMALFIN shows progress on executing FY28 guidance.

7.3 Risk at Current Valuation

Despite the visible turnaround, key risks remain:

Merger complexity: PEL–PFL merger could bring integration risks, restructuring charges, or operational disruptions.

Execution Risk: PIRAMALFIN is on-track to deliver FY26 guidance. The challenge is to consistently deliver on the FY28 guidance.

Residual legacy risk: ~₹5,000 Cr of legacy AUM still sits on the book; impairment or recovery delays could drag performance.

Asset quality while improving needs to be watched as it is not still the highest quality book

Previous coverage on PIRAMALFIN

Enjoyed our coverage on Piramal Enterprises? Feel free to share it.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer