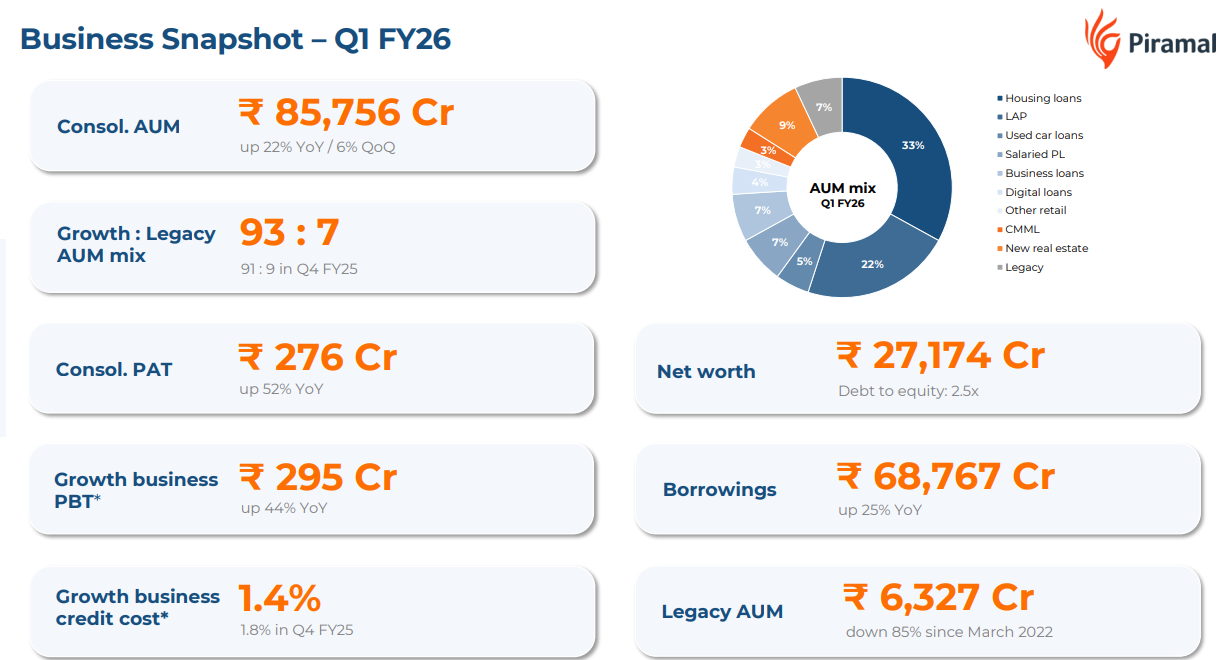

Piramal Enterprises Q1 FY26 Results: PAT up 52%, FY26 Guidance on Track

Guidance of 3X PAT in FY26. Merger on track, profitability drivers in place. Rerating possible if execution sustains and loan book productivity continues to improve

1. Financial Services company

piramal.com | NSE: PEL

PEL-PFL (Piramal Finance Ltd.) Merger: Expected completion by September 2025. Will simplify structure and unlock capital and operational synergies.

With the merger of PEL and Piramal Finance, a tax shield of Rs. 14,500 crores in assessed carry forward losses will be available. This would make our PBT equal to our PAT for several years in the future.

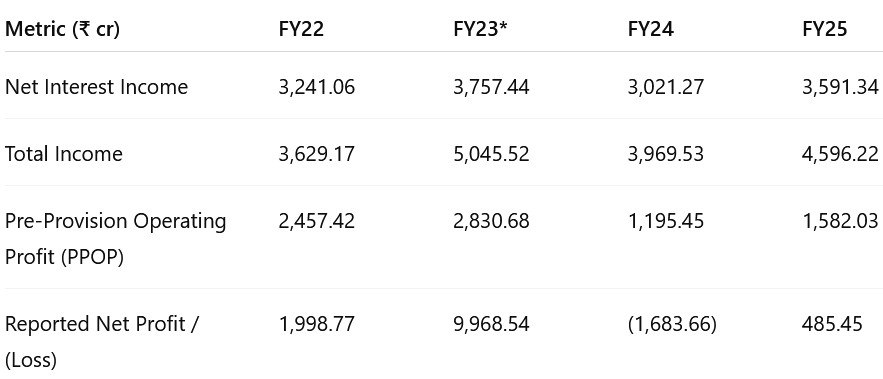

2. FY22-25: A period of transition

Moved away from “repair mode” (FY22-FY25) to “growth-and-optimise mode” for FY26.

3. FY25: PPOP up 109% & Net Interest Income up 19% YoY

Profit swing: ₹926 cr legacy/AIF recoveries turned FY25 PAT positive despite higher micro-credit costs.

ROE still low (~2 %): Elevated unsecured stress and excess capital muted return ratios.

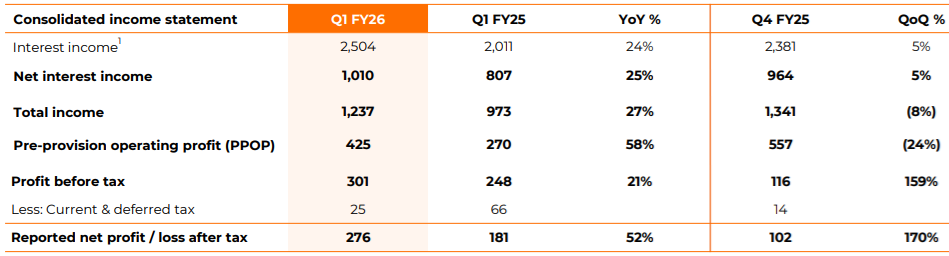

4. Q1-26: PAT up 52% & Net Interest Income up 25% YoY

Retail Lending (80% of AUM)

AUM: +37% YoY

Disbursements: +28% YoY, with mortgage disbursements up 50% YoY.

Portfolio mix:

Housing + LAP = 68% of retail AUM

Used car, salaried PL, digital loans all show double-digit YoY growth

Asset Quality: 90+ DPD steady at 0.8%

Cost efficiency: Opex-to-AUM improved to 4.2% (down 230 bps over 9 quarters)

Wholesale 2.0

AUM: +47% YoY | Disbursements: +46% YoY

Repayments: 43% of disbursements, reflecting healthy portfolio churn

Portfolio EIR: 14.5%

Granular mix: Real estate 74%, CMML 26%, diversified across geographies and sectors

High quality: No delinquencies reported

Legacy Book

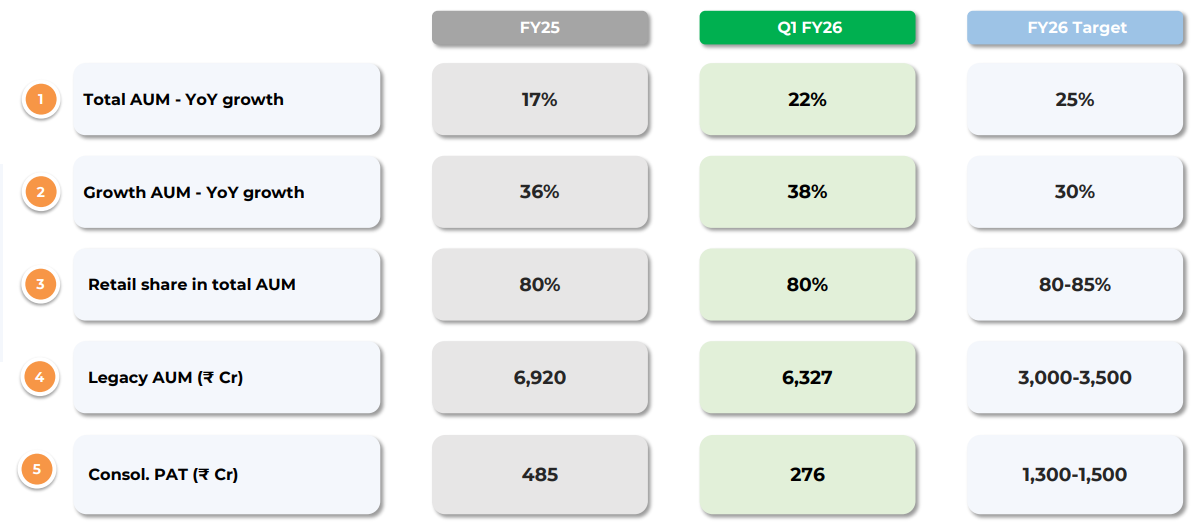

Strategy is on track to reduce legacy AUM to ₹3,000–3,500 Cr by FY26-end

Strategic Updates

Liquidity Position: Strong with ₹9,070 Cr in cash and liquid assets (9% of total assets).

Borrowing Cost: Stable at ~9.12%; fixed/floating mix is well-balanced (54:46).

ALM: Positive cumulative gaps across all maturity buckets.

AI & Tech Integration: Improving branch productivity and underwriting efficiency via AI agents for sales, collections, underwriting, and fraud detection.

What’s Working:

Retail continues to scale, led by small-ticket mortgages and cross-sell, with industry-leading asset quality.

Operating leverage is playing out — seen in falling opex/AUM and steady yields.

Wholesale 2.0 portfolio is growing with strong repayments, stable ticket size (~₹74 Cr), and sector diversification.

What to Watch:

Merger execution and integration with PFL — potential one-off costs or adjustments.

Managing asset quality in unsecured retail, especially digital PL, where DPD trends show early signs of stress.

Maintaining capital adequacy, which dipped to 19.3% (down ~245 bps QoQ).

Piramal has delivered a strong start to FY26, marked by:

Robust PAT growth

Continued derisking of legacy assets

Stable credit performance

Scalable retail franchise

With the merger on track and profitability drivers in place, valuation rerating could be possible if execution sustains and loan book productivity continues to improve.

5. Outlook: 25% AUM Growth; 2.5-3X PAT growth for FY 26

On track to meet all FY26 targets

6. Valuation Analysis

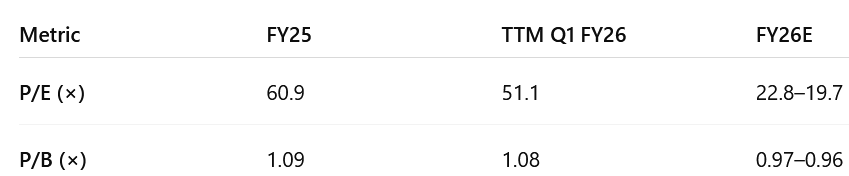

6.1 Valuation Snapshot — Piramal Enterprises ?

P/E Compression:

What it means: The stock is expected to generate significantly higher profits in FY26 — largely due to:

Retail AUM scaling efficiently,

Reduction in credit cost (1.4% vs 1.8%),

Near-zero drag from legacy book (now just 7% of AUM),

Wholesale 2.0 performing with high EIR (14.5%) and zero delinquencies.

The steep drop in P/E reflects the market anticipating a sharp jump in earnings. At ~20× forward P/E, the stock trades at fair multiples, not speculative highs.

P/B De-rating:

Despite profitability improving, Piramal still trades below book value on FY26 estimates.

Possible reasons:

Investor caution around long-term RoE (~5% expected in FY26, still sub-optimal).

Uncertainty around merger execution (PEL-PFL),

Market waiting for sustained delivery of PAT > ₹1,300 Cr and clarity on monetization of Shriram/AIF assets.

Market is not pricing in full re-rating yet. This may change if:

RoE improves to 8–10%+,

Capital is recycled into higher-yielding assets,

Operating leverage continues to kick in.

PEL is no longer expensive on earnings. But it will need to prove itself on return ratios and execution to see a valuation re-rating.

You're looking at a transitioning business trading at reasonable forward P/E and below-book P/B — a “show me” story with potential upside if FY26 delivery continues.

7.2 Opportunity at Current Valuation

Piramal Enterprises is trading at ~20–23× FY26E P/E and <1× P/B, despite a clean pivot to growth and a PAT target of ₹1,300–1,500 Cr in FY26.

Key drivers of opportunity:

Earnings lift-off: FY26 PAT is expected to rise nearly 3× YoY, driven by 38% growth in retail and wholesale books, stable asset quality (0.8% 90+ DPD), and expanding NIM (5.9%).

Improving productivity: Opex-to-AUM in the growth business is down to 3.9%; credit costs easing to 1.4%.

Legacy drag is ending: Legacy AUM has shrunk 85% since FY22 and now forms just 7% of the book.

Strong liquidity and capital: Estimated FY26-end net worth of ₹28,396–28,596 Cr supports a P/B of just 0.96–0.97×.

Optionality from monetization: Embedded value from Shriram Group, AIF recoveries, and Pramerica stake remains unpriced.

With the PEL–PFL merger completing in FY26, execution delivery could unlock re-rating closer to NBFC peers with better RoE and profitability metrics.

7.3 Risk at Current Valuation

Despite the visible turnaround, key risks remain:

Sub-par RoE: Even with ₹1,500 Cr PAT, RoE would be only ~5%, limiting P/B re-rating unless profitability scales further.

Merger complexity: PEL–PFL merger could bring integration risks, restructuring charges, or operational disruptions.

Unsecured retail exposure: Higher credit costs may emerge from the growing digital and salaried PL segments, where early-stage delinquencies are rising.

Residual legacy risk: ₹6,300 Cr of legacy AUM still sits on the book; impairment or recovery delays could drag performance.

Valuation may be fair, not cheap: At ~20–23× forward P/E, the market is already baking in earnings acceleration — re-rating beyond this would need RoE improvement and consistent execution.

Previous coverage on PEL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer