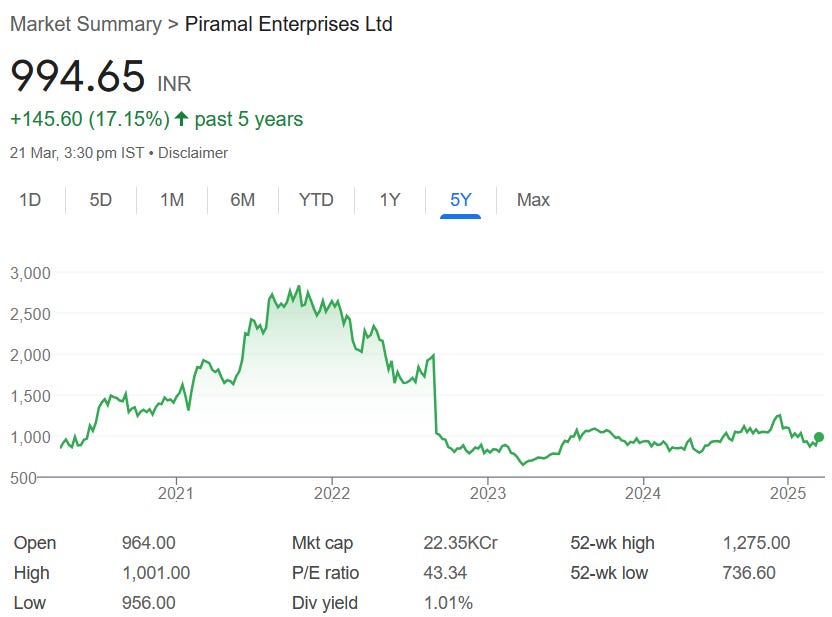

Piramal Enterprises: Pre-provision Operating Profit growth of 14% & Net Interest Income growth of 16% in 9M-25 at a P/B of 0.8

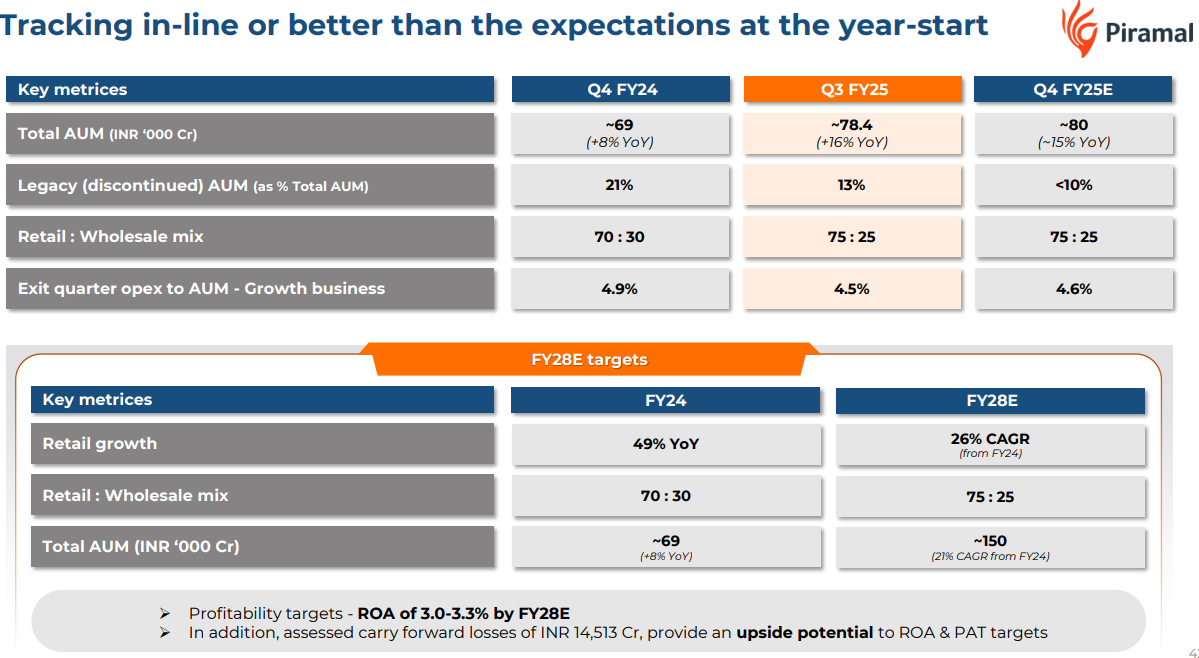

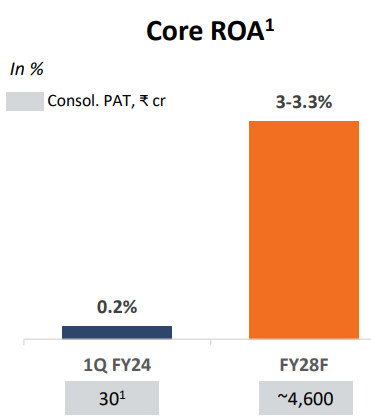

AUM CAGR of 23% for FY25-28. FY25 AUM growth guidance of 15%. Strong outlook for profitability with ROA of 3-3.3% on a AUM of Rs 1,50,000 cr by FY28

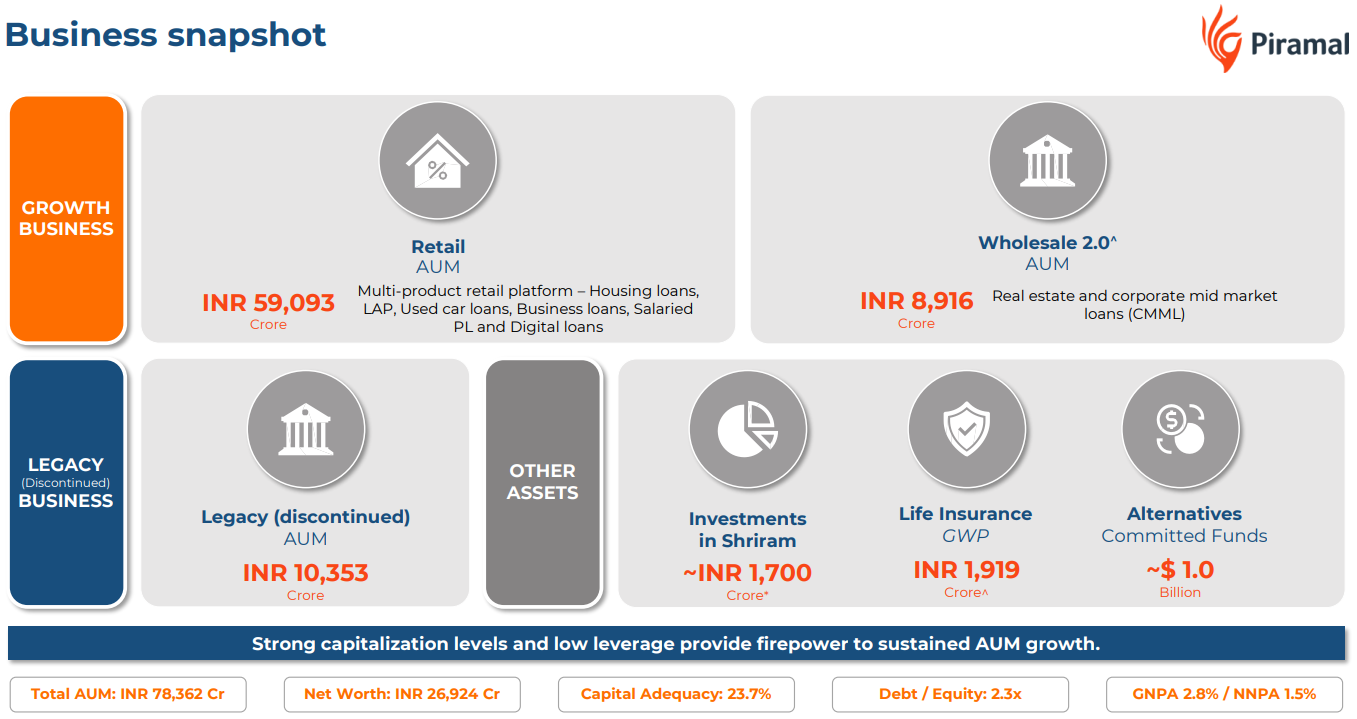

1. Financial Services company

piramal.com | NSE : PEL

2. Weak FY24: Losses with Net Interest income down 20%

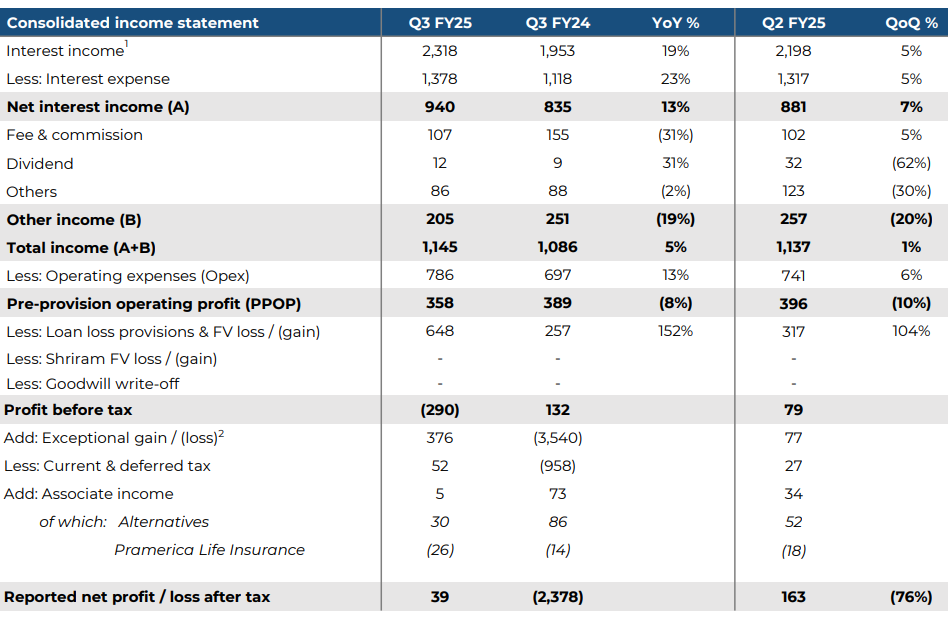

3. Q3-25: PPOP down 8% & Net Interest Income up 13% YoY

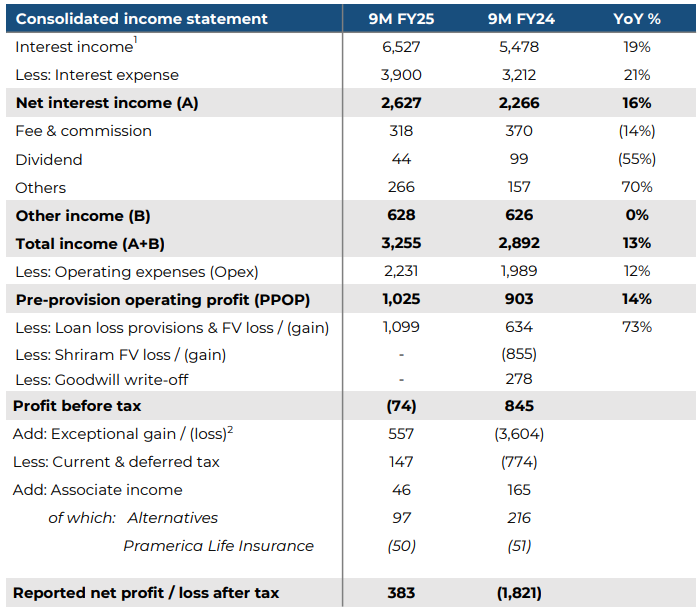

4. 9M-25: PPOP up 14% & Net Interest Income up 16% YoY

5. Outlook: 20%+ AUM Growth & 3-3.3% ROA by FY28

1. AUM Growth & Portfolio Mix

20%+ Consolidated AUM Growth

Growth in AUM, driven by strong retail lending expansion (~75% of total AUM as of Q3 FY25) & continued build-out of new (“2.0”) wholesale book

Pivot to Retail

Retail lending (home loans, LAP, used car, small business, etc.) the largest driver of growth.

Targets ~15–25% growth in retail disbursements (depending on product mix) while keeping credit quality stable.

Retail’s share of total AUM is expected to remain ~75–80% over the medium term.

Wholesale 2.0

New wholesale lending (real estate + corporate mid-market) will be granular, cash-flow-based, with smaller ticket sizes than the legacy portfolio.

Management expects healthy disbursements here while maintaining a strict underwriting approach and targeting yields of ~14–15%.

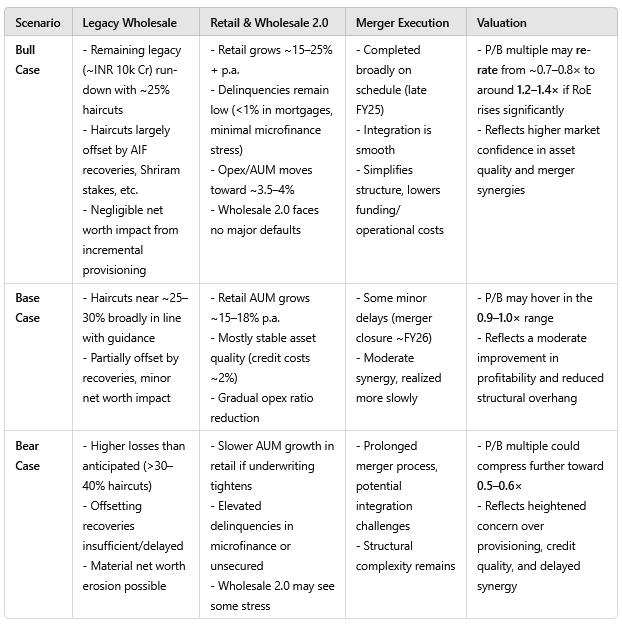

2. Legacy Book Run-Down

<10% by March 2025

Reduce the legacy (discontinued) wholesale exposures to below 10% of total AUM by end-FY25 (March 2025).

Guided for ~25% average haircuts on these assets and anticipate offsetting many of these provisioning requirements with AIF recoveries and other one-off gains.

Focus on Minimizing Earnings Drag

Incremental legacy provisions will remain largely manageable, thanks to existing buffers and future recoveries.

Once this rundown is substantially completed, Piramal’s net interest income and reported earnings should reflect primarily the “growth business” (retail + wholesale 2.0).

3. Profitability Goals

ROA of ~3% by FY28

Longer term, management aspires to 3% return on assets once the retail franchise reaches scale, opex ratios come down, and legacy risks subside.

This target implies a significant expansion from the current subdued ROA, which is suppressed by provisioning and the large equity base.

Operating Leverage & Opex Reduction

Retail’s opex-to-AUM has already improved from ~6.5% to ~4.5% in the last seven quarters.

Management sees further scope to bring it down to 3.5–4% over the next 1–2 years, resulting in higher net profitability.

Credit Costs & Asset Quality

~2% credit cost in the retail portfolio over the medium term.

Watchful of microfinance/unsecured exposures but view the overall portfolio mix (predominantly secured mortgages) as stable.

4. Merger Timeline & Structural Simplification

Piramal Enterprises + Piramal Capital & Housing Finance

Merger to form “Piramal Finance” expected to complete by Sep-25

Post-merger, the business structure should be significantly simplified, with potential synergies in funding cost, branding, and operations.

Benefits of a Single NBFC

Management expects the merged entity to unlock operational efficiencies, remove overlapping structures, and position Piramal for improved capital markets access (with a more transparent financial-services-only model).

5. Other Key Elements & Pockets of Value

AIF Recoveries & Shriram Stakes

Piramal holds stakes in Shriram Life and Shriram General Insurance, considered financial investments that can be monetized when the opportunity arises.

Additional AIF recoveries are anticipated in coming quarters, helping offset or reduce final haircuts on the legacy wholesale book.

Deferred Consideration from Pharma

Management recently disclosed that Piramal may receive ~USD 140–200 Mn as deferred consideration from the earlier sale of its pharma imaging business.

This inflow could further support capital or offset provisions if needed.

6. Overall Outlook

Confidence in Retail Franchise: Management highlights the multi-product retail model (housing, LAP, used-car, business loans) and improving branch productivity as key drivers for continued growth and margin resilience.

De-Risking Wholesale: The emphasis is on granular, lower-LTV new real estate loans and cautious corporate mid-market lending—no return to the large developer-focused style of the past.

Valuation & Rerating Potential: As legacy exposures shrink, synergy from the merger unfolds, and retail momentum fuels improved RoE, management expects the market discount (sub-1× P/B) to reduce, potentially leading to a re-rating of the stock over the medium term.

i. FY25 AUM growth of 15% & FY25-28 AUM CAGR of 23%

FY25 AUM of Rs 80,000 cr growing to Rs 150,000 cr by end of FY28 implies an AUM CAGR of 23%

ii. Outlook for strong PAT generation till FY28

PAT expected to be Rs 4,600 cr in FY28 vs Rs 383 cr of PAT in 9M-25 provides a solid outlook of PAT growth.

6. PPOP growth of 14% & Net Interest Income growth of 16% in H1-25 at a Price to book of 0.8

7. Hold?

If I hold the stock then what’s the point holding on to PEL

9M-25 performance looks weak from a P&L perspective. However the business is on track with the longer term guidance of FY28.

while the external growth environment and asset quality climate have indeed moderated in FY '25, we are encouraged that we are on track to meet or do better than the targets we set for ourselves at the start of the year on business growth, business mix and operating performance of Growth business.

PEL is actively winding down its legacy wholesale exposures, targeting <10% of total AUM by FY25.

If management’s guidance on controlled haircuts (~25%) will continue to hold—especially with AIF recoveries and potential stake monetizations to offset haircuts—then the overhang could diminish soon, potentially driving a valuation re-rating.

Retail is ~75% of AUM and growing at a healthy pace (home loans, LAP, used-car loans, etc.).

As the pivot to retail continues, net interest margins and fee income may keep rising while operating expenses (opex-to-AUM) trend down toward 3.5–4%.

If this materializes, return on assets (RoA) and overall profitability could improve significantly, supporting the share price.

One needs to be patient for the business to transform and deliver on its guidance of RoA of 3-3.3% with PAT potential of Rs 4,600 cr

8. Buy?

If I am looking to enter PEL then

Given the transition in the business one should not look at it from a PE and P&L metrics. PEL looks very expensive at PE of 43

With a market cap Rs 22,427.14 cr against a net worth of Rs 26,924 cr as of Q3-25 end implies that PEL is available a price to book of 0.8 which makes the valuations quite attractive

Our net worth stood at INR 26,924 crores with the capital adequacy at 23.7% on consolidated balance sheet basis.

AUM growth guidance of 15% in FY25 with on overall FY25-28 AUM CAGR of 23% at a P/B of 0.8 and expected ROA of 3-3.3% makes the valuations quite attractive in the short term.

PEL has a strong road-map till FY28. If PEL delivers on the roadmap to FY28, there is an opportunity for significant upside in the stock . The is a potential for consolidated PAT to to reach ~Rs 4,600 cr by FY28 could create the opportunity for the stock to multiply

This back-of-the-envelope calculation provides directional insight into how AUM expansion and a 3%+ RoA might translate into profits, but it remains subject to multiple execution and macroeconomic variables.

Previous coverage on PEL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer