Piramal Enterprises: Pre-provision Operating Profit growth of 38% & Net Interest Income growth of 18% in H1-25 at a Price to book of 1

AUM growth guidance is a CAGR of 25%-26% over a 4-5 year period. FY25 AUM growth guidance of 15%. Strong outlook for profitability with ROA of 3-3.3% on a AUM of Rs 1,50,000 cr by FY28

1. Financial Services company

piramal.com | NSE : PEL

Shifting the Business Mix from Legacy Wholesale to the "Growth Business":

Transitioning its business focus from its legacy wholesale lending operations to a new, faster-growing segment referred to as the "Growth Business".

The Growth Business, which comprises retail lending and Wholesale 2.0, now accounts for 84% of PEL's total AUM, up from just 34% in March 2022.

Transition aims to enhance PEL's profitability and reduce its reliance on the legacy wholesale book, which has faced challenges in recent years.

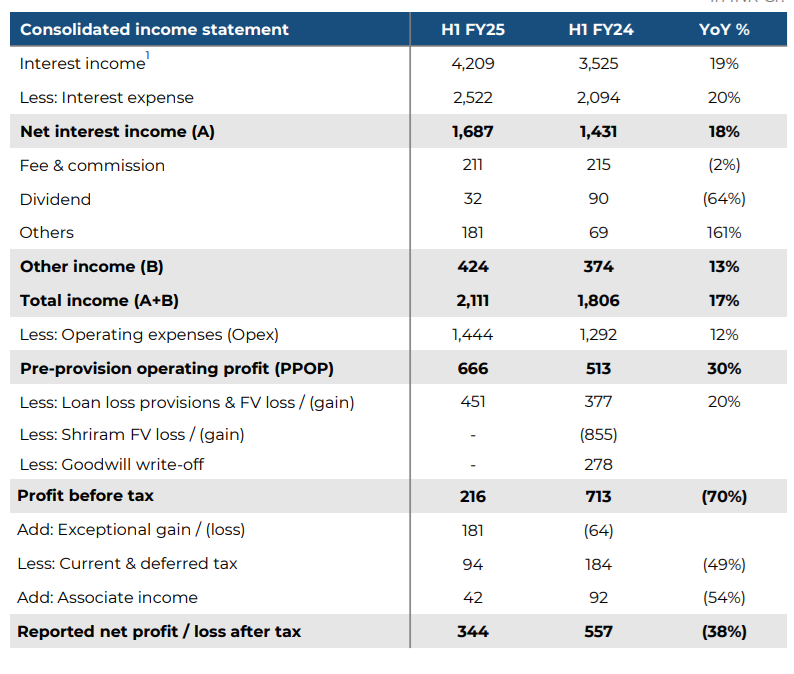

2. Weak FY24: Losses with Net Interest income down 20%

3. Q2-25: PPOP up 58% & Net Interest Income up 17% YoY

4. H1-25: PPOP up 38% & Net Interest Income up 18% YoY

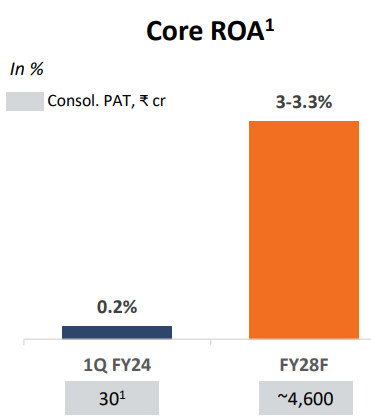

5. Outlook: Stepping back into the growth mode with aim to achieve 3-3.3% ROA by FY28

ROA Target: Return on Assets (ROA) of slightly over 3% by FY28. This target was set over a year ago, and despite potential headwinds related to credit costs, management maintains confidence in achieving it.

AUM Growth: Medium-term guidance is a CAGR of 25%-26% over a 4-5 year period. This implies a moderation in retail loan growth as the wholesale book rundown concludes.

OPEX Reduction: Targeting an OPEX to AUM ratio of 3.5% to 4% per annum for the retail business. This continued focus on operational efficiency is expected to contribute significantly to ROA expansion.

Increased Fees: Management expects to see a 60-70 basis points improvement in fees in the medium term.

Margin Expansion: Management believes that NIMs will continue to expand, driven by the shift away from the negative margin legacy wholesale business and towards the higher-margin Growth business. This trend is already evident in the Q2 FY25 results, where PEL saw NIM expansion despite broader industry trends of NIM compression.

Net Worth Neutrality on Legacy Book Rundown: Management has consistently reiterated its commitment to reducing the legacy wholesale book to less than 10% of total AUM by March 2025, and to achieving this in a net-worth neutral or better manner. This means that any losses from running down the legacy book should be offset by gains from recoveries and other strategic actions.

Credit Cost Expectations: Management expects the credit risk cycle to persist for several more quarters, and consequently, acknowledges the potential for further increases in retail credit costs.

Open to Opportunities: Management remains open to pursuing inorganic growth opportunities, particularly in segments experiencing challenging conditions and undervaluation. They view downcycles as potential opportunities to acquire businesses at attractive valuations, with a focus on long-term ownership.

Shriram Group Insurance Venture: While specific details are not yet publicly available, management has indicated progress regarding their potential investment in the Shriram Group's insurance venture. They believe the deal is more feasible now than in previous quarters but remain cautious about disclosing specific details.

i. FY25: AUM growth of 15%

ii. Outlook for strong PAT generation till FY28

PAT expected to be Rs 4,600 cr in FY28 i.e. ~Rs 1150 cr of PAT per quarter compared to Rs 30 cr of PAT in Q1-24 or the Rs 113 cr of PAT before exceptional gain / (loss) in Q2-24

6. PPOP growth of 38% & Net Interest Income growth of 18% in H1-25 at a Price to book of 1

7. Hold?

If I hold the stock then what’s the point holding on to PEL

H1-25 performance looks weak from a P&L perspective. However the business is on track with the longer term guidance of FY28.

Our financial performance in the 2nd Quarter of FY25 tracked the objectives we have been speaking about as part of our transformation in the last few years. In the 2nd Quarter, our Growth business continued to scale up steadily. Risk was well-controlled and operating leverage further improved. At the same time, we continue with the focused rundown of our discontinued legacy business

The business is undergoing a transformation into a housing focused diversified retail business from a wholesale business.

The clean up in the business is getting over

Completed stressed asset recognition cycle and made sufficient provisions

As you can see, the size of some of these clean-up is getting smaller and smaller every quarter. So we don't think there's anything kind of major that's out there. Minor things might come up every now and then like in all spring cleaning, which is like you might realize some other things in some corners, but nothing material.

One needs to be patient for the business to transform and deliver on its guidance of RoA of 3-3.3% with PAT potential of Rs 4,600 cr

8. Buy?

If I am looking to enter PEL then

Given the transition in the business one should not look at it from a PE and P&L metrics.

With a market cap Rs 27,865 cr against a net worth of Rs 26,930 cr as of Q2-25 end implies that PEL is available a price to book of 1 which makes the valuations quite attractive

Our net worth stood at Rs. 26,930 crores, with the capital adequacy at 23.3% on consolidated balance sheet basis.

AUM growth guidance of 15% in FY25 at a P/B of 1 makes the valuations quite attractive in the short term.

AUM growth guidance is a CAGR of 25%-26% over a 4-5 year period at a P/B of 1 makes the valuations quite attractive over the longer term.

PEL has a strong road-map till FY28. If PEL delivers on the roadmap to FY28, there is an opportunity for significant upside in the stock . The is a potential for consolidated PAT to to reach ~Rs 4,600 cr by FY28 could create the opportunity for the stock to multiply

One needs to keep in mind the risk associated with the transition not getting executed as per plan. However, at a P/B of 1 there is a margin of safety in the valuations.

Previous coverage on PEL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Please advise latest qtr result review