Piramal Enterprises FY25 Results: Return to Profits, Targeting 3X PAT in FY26

With 25% AUM growth, re-rating from 0.9× P/B hinges on PAT delivery, retail traction & merger gains—while embedded assets limit downside risk at current valuations

1. Financial Services company

piramal.com | NSE: PEL

Proposed merger of PEL with PFL (Piramal Finance Ltd.) to complete by Q2FY26

MERGING PEL and PFL will simplify the group structure and provide shareholders with direct access to the entire lending business

With the merger of PEL and Piramal Finance, a tax shield of Rs. 14,500 crores in assessed carry forward losses will be available. This would make our PBT equal to our PAT for several years in the future.

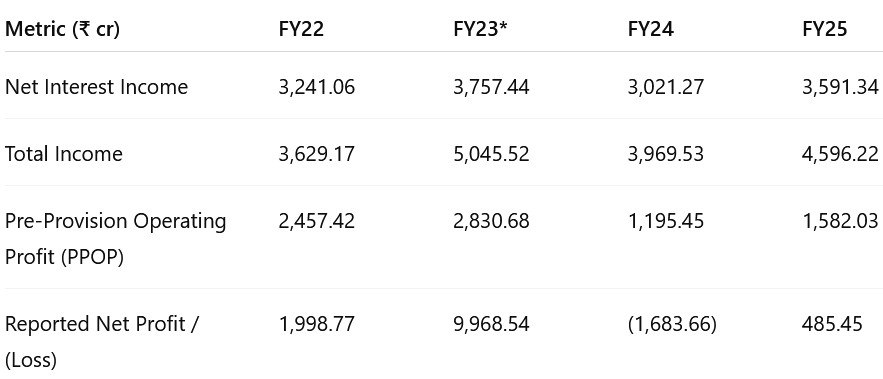

2. FY22-25: A period of transition

Piramal has moved away from “repair mode” (FY22-FY25) to “growth-and-optimise mode” for FY26.

Core spreads are recovering, the cost platform is lighter, and legacy drag is <10 % of assets.

Sustainable shareholder returns now hinge on converting the cleaned-up balance-sheet into stable, double-digit ROE, something the FY26 performance must finally demonstrate.

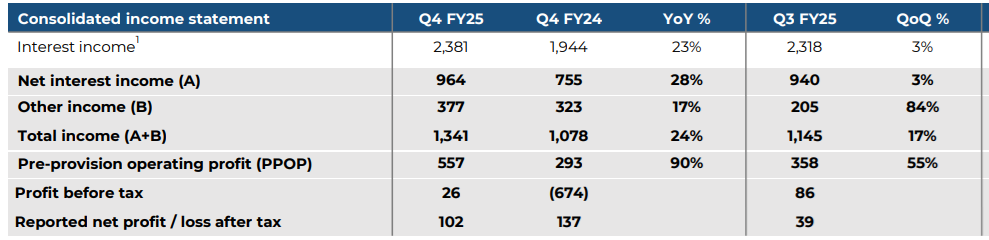

3. Q4-25: PPOP up 90% & Total Income up 24% YoY

Q4-25: PPOP up 55% & Total Income up 17% YoY

Core profit up; Growth-book PBT-RoAUM rose to 1.8 %.

Cost tailwind: borrowing cost –10 bp QoQ; opex/AUM trimmed to 4 %.

Retail push: disbursements +17 % QoQ, mortgages & used-cars led.

Wholesale-2.0: AUM edged higher, zero delinquencies despite 45 % pre-payments.

Legacy recoveries: ₹802 cr AIF cash-back lifted Q4 earnings.

Credit stable: GNPA 2.8 %, retail 90 + DPD steady at 0.8 %.

4. FY25: PPOP up 109% & Net Interest Income up 19% YoY

Cost efficiency: Opex-to-AUM compressed 190 bp over the year, underpinned by AI-driven scale.

Profit swing: ₹926 cr legacy/AIF recoveries turned FY25 PAT positive despite higher micro-credit costs.

ROE still low (~2 %): Elevated unsecured stress and excess capital muted return ratios.

FY26 challenge: keep credit discipline and convert the cleaner, larger balance-sheet into double-digit ROE.

5. Outlook: 25% AUM Growth; 2.5-3X PAT growth for FY 26

5.1 FY-25 Expectations vs Performance — Piramal Enterprises

✅ HITS (Met / Beat Guidance)

Legacy Run-down Delivered. Legacy AUM cut from ₹14,572 cr to ₹6,920 cr, dipping below the “<₹7,000 cr” target and now just ≈9 % of the book.

Mix Shift Out-performed. Retail share jumped to 80 % vs guidance of 75 %, accelerating the pivot to a granular, secured portfolio.

Growth Beats Plan. Total AUM reached ₹80,689 cr (+17 % YoY) versus the ~₹80,000 cr goal (+15 %), proving branch-product engine scalability.

Efficiency Surprise. Exit-quarter Opex / AUM fell to 4.0 % (target 4.6 %), thanks to AI-driven underwriting, collections, and branch productivity gains.

AIF Recovery Cushion. Realised ₹926 cr gains (vs planned ~₹850–900 cr for the year), offsetting haircut costs in the legacy book.

Swing Back to Profit. Consolidated PAT turned positive at ₹485 cr (from –₹1,684 cr in FY24); 50 % dividend payout reinstated shareholder returns.

✖️ MISSES (Below / Deferred vs Guidance)

Credit-Cost Creep. Growth-book credit cost rose to 1.6 % (1.9 % ex-POCI) against a “stable” narrative, led by micro-finance (90 + DPD 6.9 %).

Asset-Quality Slippage. GNPA / NNPA climbed to 2.8 % / 1.9 % (vs 2.4 % / 0.8 % in FY24) as residual stress surfaced in run-off pools.

Unsecured Growth on Hold. Digital & business-loan AUM contracted (-24 % YoY) as the firm throttled riskier originations, delaying mix diversification.

ROE Still Sub-Par. Despite profit swing, FY25 ROE stayed around 2 %, well below mid-teens ambition; stronger leverage & margin lift are still pending.

Wholesale Net-Adds Tempered. Wholesale 2.0 faced 45 % pre-payments, muting net AUM build and highlighting dependence on buoyant property cash-flows.

Bottom-line: Piramal beat on every headline guidance metric—AUM, mix, cost and profit—but still has work to do on unsecured revival, asset-quality normalization and ROE lift as it heads into FY26.

5.2 FY26 Guidance — Piramal

Operating efficiency (Growth book) Opex / AUM trajectory to edge lower toward 3.5 – 4 % (medium-term band)

Capital structure Debt-to-equity to stay comfortably < 4× while funding growth

Merger milestone Complete PEL ↔ Piramal Finance merger by Q2 FY26; unlock ₹14,500 cr tax shield

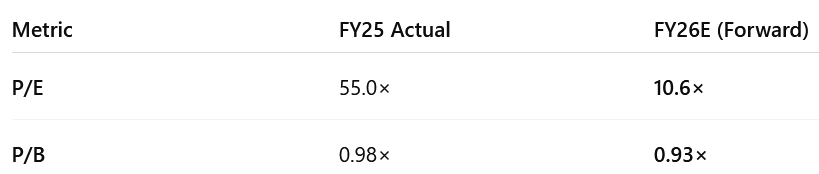

6. Valuation Analysis

6.1 Valuation Snapshot — Piramal Enterprises ?

P/E drops sharply to ~10.6× assuming guidance is met, driven by a 3× jump in PAT.

P/B moderates slightly as book value grows with retained earnings and possible fair-value adjustments post-merger.

This implies re-rating potential if guidance is credible and FY26 execution is on track—especially as ROE rises toward 5–6 %.

6.2 What’s in the Price? — Piramal Enterprises

Execution Fully Baked In: Street is assuming Piramal will meet FY26 PAT guidance of ₹1,300–1,500 Cr, achieve 25% AUM growth, and cut legacy AUM to below ₹3,500 Cr without major provisioning surprises.

Tax Shield Realization Assumed: The ₹14,500 Cr carry-forward loss benefit from the PEL–Piramal Finance merger is priced in, supporting zero-tax PAT delivery.

Retail Dominance Expected: 80–85% retail AUM mix is the assumed steady state; mortgage disbursement run-rate and used-car scale-up are reflected in expectations.

Opex Gains Locked In: Exit opex/AUM at 4.0% is treated as the new base; street assumes further leverage will flow through FY26.

Book-Value Support: At 0.93× P/B, stock trades near book — downside protection is priced in via balance-sheet strength, not earnings momentum.

Credit Cost Normalization Implied: FY26 plan assumes stable/declining credit costs (1.5–1.6%) with no new stress from unsecured or microfinance portfolios.

6.3 What’s Not in the Price?

ROE Re-Rating: Street isn’t yet pricing in ROE moving to 10–12% levels; rerating to 1.5× P/B would require PAT compounding beyond FY26.

Optional Upside from Monetization: Shriram Group stakes, Piramal Imaging (USD 140 Mn), and alternatives book are not reflected in valuation — monetization could trigger upgrades.

Export-Linked Tailwinds: Loan export from IT services or OEM ecosystems (used-car dealers, healthcare aggregators) is not factored into cross-sell uplift.

AUM Upside Optionality: If FY26 AUM grows >₹1.05 lakh Cr (vs. guided ₹1 lakh Cr), spread income and operating leverage could surprise positively.

Co-lending & DA Income Scale-up: Fee-based revenue from direct assignment or co-lending partnerships with banks is still in early innings — not in base case.

New Segments & Product Wins: Micro-LAP, business loans, and small-ticket secured products scaling faster than expected could lift disbursements and margins.

6.4 Risks and What to Monitor — Piramal Enterprises

🔺 Key Risks

Execution Risk: Merger timeline, legacy asset recovery, and PAT delivery are tightly linked — delays in either could defer guidance achievement.

Credit Risk (Micro / Digital): Unsecured portfolio still volatile — microfinance 90+ DPD at 6.9%, any resurgence could spike credit cost.

Provisioning Surprises: Legacy run-down to ₹3,000 Cr assumes no material slippage or incremental haircuts beyond historical 25–30%.

ROA Fragility: With ROA ~0.17% in FY25, any rise in opex or credit cost erodes bottom-line sharply — margin of error is thin.

Loan Pricing Pressure: Competition in housing finance and LAP may pressure NIMs; lower disbursement yields may offset scale.

📌 What to Monitor

Retail Disbursement Run-rate: Watch Q1/Q2 traction in used-cars, mortgages, and personal loans — ≥₹9,000 Cr/quarter needed to sustain AUM growth.

Merger Closure: Regulatory approvals and tax-shield unlock — monitor if merger closes by H1 FY26 as guided.

Legacy Recovery Realizations: Track AIF and land asset exits; shortfall vs. ₹926 Cr in FY25 could pressure PAT.

Operating Efficiency: Opex/AUM must stay in 3.5–4% band to absorb margin volatility and build ROE.

Wholesale Granularity & Prepayments: Monitor originations and prepay trends in Wholesale 2.0; 45% prepay in FY25 diluted net growth.

Co-lending / DA Fee Uptick: Early signs of scale in off-balance sheet income streams can support NIM and diversify risk.

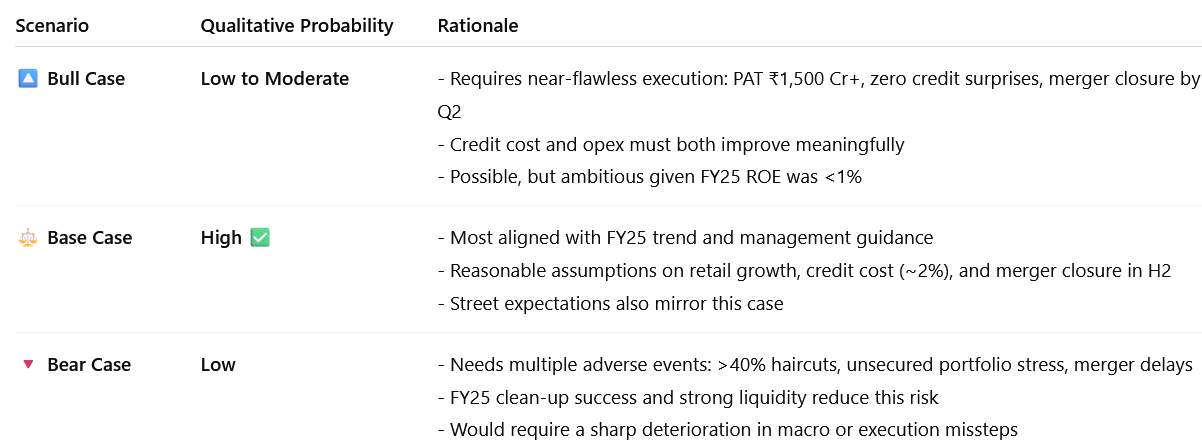

7. Implications for Investors

7.1 Bull, Base & Bear-Case Scenarios — Piramal

7.2 Margin of Safety – Piramal Enterprises

⚙️ Execution Embedded in Price

PAT Guidance Fully Priced: Market already assumes ₹1,300–1,500 Cr PAT for FY26 — leaving no cushion for delays in merger closure, legacy resolution, or credit normalisation.

Opex & Credit Cost Must Hold: Opex/AUM at 4.0% and credit cost at 1.6–1.9% are already near the lower bound — any uptick can derail ROE expansion.

💼 Legacy Buffers Strengthen the Floor

Provision buffer of ₹728 Cr already absorbed in past P&Ls.

₹2,900 Cr of monetizable assets (AIF recoveries, Piramal Imaging, Shriram stake) offer P&L upside not priced into base-case FY26 PAT.

₹14,500 Cr of carry-forward losses ensure near-zero tax for years — net PAT = PBT, giving Piramal a compounding advantage.

These buffers reduce downside risk, even if execution falters.

📊 Valuation Leaves Modest Cushion

P/B ~0.93×: Close to book; not expensive, but no real undervaluation unless ROE lifts to double digits.

Forward P/E ~10.6× (FY26E): Appears low, but assumes full delivery of PAT guidance — repeatability is key.

🔍 Re-rating Needs More Than One Good Year

FY25 ROE was ~0.5%; even if FY26 hits 5–6%, it’s still below peer averages.

Valuation expansion to 1.2–1.5× P/B needs clear visibility into sustained earnings and long-term compounding.

💸 Balance Sheet = Safety Net, Not a Catalyst

Net worth of ₹27,096 Cr and 2.4× leverage provide downside protection.

But capital strength must now translate into consistent returns — without that, the valuation stays capped.

📉 Peer Valuation Gap Justified — For Now

Compared to NBFC leaders like Bajaj and Chola (ROE 14–18%, P/B >3×), Piramal’s discount is fair until it proves durability of profits.

As earnings scale and normalize, this gap can close — but it’s not automatic.

🟡 Bottom Line

Piramal’s valuation isn't stretched, and the legacy buffers meaningfully reduce downside risk — especially vs. earlier phases.

However, the stock still requires flawless execution in FY26 to justify current pricing.

Margin of safety: Moderate.

The balance sheet, provisions, and hidden value create a firmer floor — but upside will only unlock if FY26 guidance is met and sustained.

Comfort comes only after delivery.

Previous coverage on PEL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer