PG Electroplast Q4 FY25 Results: PAT Doubles, Revenue Jumps 77%, FY26 Growth Guidance Strong

Robust earnings growth, expanding ODM partnerships, margin gains, and a net cash balance sheet position PGEL as a high-quality EMS compounder for FY26 and beyond.

1. Electronic Manufacturing Services provider

pgel.in | NSE: PGEL

2. FY21-25: Revenue Grows 7x, Profits 24x

Product-led growth: Consumer durables (ACs, WMs, Coolers) now make up 72%+ of revenues.

Operating leverage in action: Scale has driven costs lower and lifted margins.

Backward integration + client stickiness: Served 60+ brands across verticals, reducing cyclicality.

Tight cost controls: Employee and admin costs stayed lean even as topline scaled aggressively.

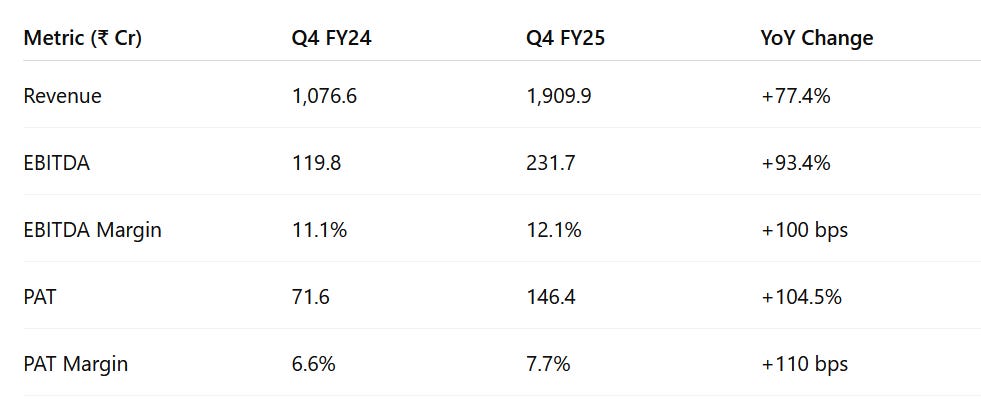

3. Q4-25: PAT up 105% & Revenue up 78%

Air Conditioners Peak Season: Room AC segment, now PGEL’s largest vertical, saw heightened OEM/ODM demand ahead of summer, driving topline and utilization.

New Plant Efficiency: The newly operational Bhiwadi AC facility contributed to faster throughput and higher asset turnover.

Gross Margin Stability: Despite higher volumes, raw material costs held steady, keeping gross contribution margin at 20%.

Operating Leverage Payoff: SG&A as % of sales remained flattish, driving EBITDA expansion.

4. FY25: PAT up 112% & Revenue up 77% YoY

New Capacity Online: Bhiwadi Phase 2 plant for ACs became operational, boosting throughput and quality.

Operating Leverage Kicks In: Fixed asset turnover rose to 5.08x, RoCE improved to 26.9% — margin uplift came without bloating the cost base.

Efficient Working Capital: Cash Conversion Cycle dropped to 49.9 days, with better inventory and receivables management.

5. Business metrics: Returns Up, Efficiency Scales With Growth

Even with QIP-led equity dilution in FY25, RoE remains robust, while RoCE has hit all-time highs.

RoCE rising faster than RoE ➝ Indicates strong internal accruals and low dependence on leverage for growth.

RoE dipped in FY25 ➝ Due to QIP-led equity infusion, but PAT more than doubled. Earnings will catch up.

27% RoCE in FY25 ➝ Despite ₹488 Cr capex and expanded fixed asset base, returns improved — a rarity in EMS businesses.

6. Outlook: Growth momentum to continue

6.1 Strategic Priorities for FY26:

Capex-Backed Expansion: Four new facilities planned — for plastic components, coolers (Rajasthan), WMs (Greater Noida), refrigerators (South India), and additional RAC capacity in Supa.

Product Depth & Backward Integration: Continued investments in tooling, moulding, PCB assembly to strengthen control and reduce input volatility.

Client Consolidation: Expanding wallet share with existing partners in RAC and WM; onboarding new OEM relationships in refrigerators.

Working Capital Efficiency: Sustained focus on reducing receivable days, improving cash conversion cycle further from 49.9 days.

6.2 Longer-Term Vision (FY26–FY30):

Aim to retain leadership in RAC/WM ODM in India

Drive margins upward with scale + premiumisation

Explore exports or higher-value verticals over time

Maintain RoCE above 25% through asset-light execution

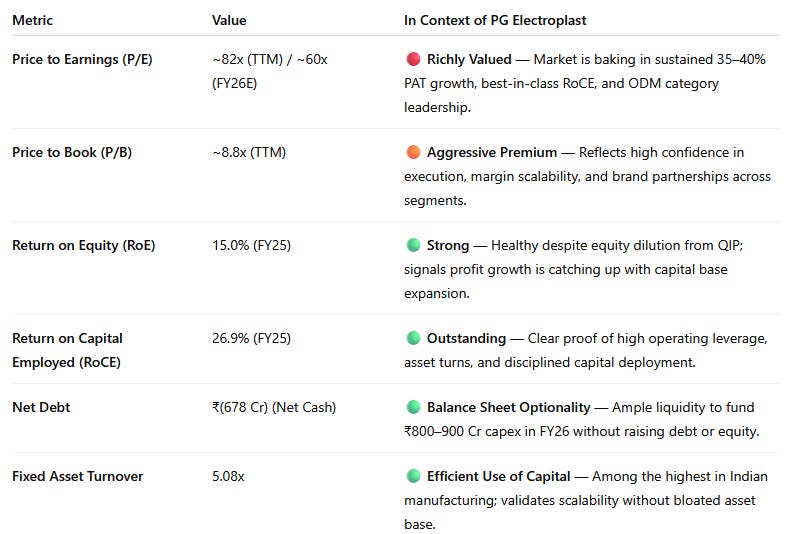

7. Valuation: Premium Multiples — Expensive but Earned?

The market is assigning it a valuation comparable to structural compounders — betting that PGEL can consistently deliver high growth, superior capital efficiency, and dominant category positioning.

7.1 Valuation Snapshot

PGEL trades at premium valuations relative to peers in EMS/consumer durable manufacturing, but in line with high-ROCE compounders.

7.2 What’s Priced In Today?

At ~60x forward earnings, the market has high expectations baked into PGEL’s stock. The current valuation assumes not just continuity, but consistency and precision in execution.

PGEL is priced as a proven compounder. The valuation implies no room for missteps — execution risk is the biggest multiple threat.

7.3 Risks to the Multiple

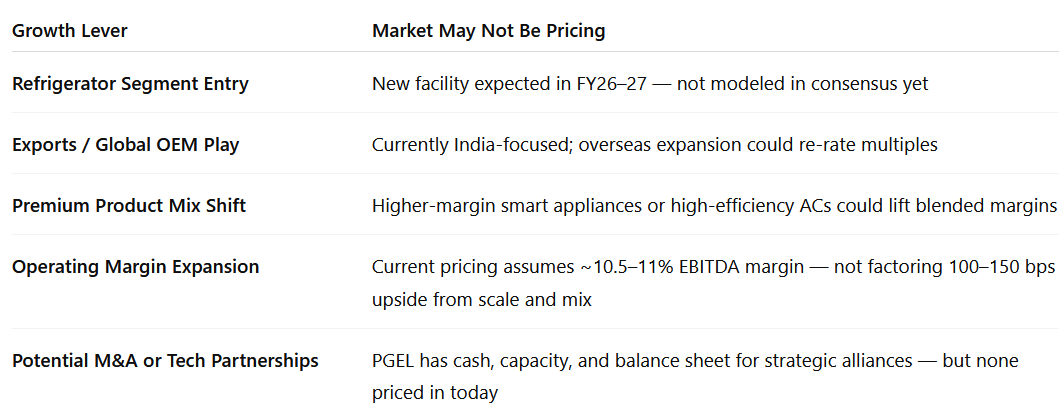

Despite the rich multiples, several optionalities remain — offering potential upside if executed well:

8. Implications for Investors: What to Watch

PGEL has already delivered a multi-year rerating. The stock is no longer a secret — it's a consensus bet in the high-growth manufacturing space. What matters now is how well it sustains momentum and whether it can convert execution into durable cash flows and returns over FY26–FY30.

8.1 Bull, Base & Bear Case Scenarios

Even in the base case, PGEL offers meaningful compounding. But at current multiples, future price appreciation depends on sustained delivery — not re-rating.

8.2 Why Investors May Want to Stay Invested or Add

Execution Track Record: PGEL has delivered on every metric — growth, margins, RoCE, balance sheet strength.

ODM Model with Brand Stickiness: Strong customer retention across RACs and WMs, with growing SKUs and partnerships.

Net Cash Balance Sheet: With ₹678 Cr+ liquidity and high asset turns, capex is self-funded.

Optional Upside Triggers: Refrigerator entry, exports, and new design-led products can unlock additional growth.

Valuation Supported by Quality: Premium multiple is backed by fundamentals — not just hype.

8.3 Risks to Monitor

Execution Missteps: Delay or cost overruns in new plants may hit margins and timelines.

Customer Concentration: ODM exposure to a few large brands may limit pricing power.

Margin Compression: Input cost volatility or price wars in RAC/WM segments could erode profitability.

Re-rating Risk: At ~60x P/E, even small misses can lead to steep corrections.

Slowdown in Consumer Durables: Macroeconomic headwinds may affect demand for white goods.

8.4 Investor Suitability

Previous Coverage of PGEL

Got Feedback on This Analysis? Let Us Know at hi@moneymuscle.in

Read the Full Disclaimer (Important)

Please provide us the valuation strategy or source that we can do our own valuation