PG Electroplast: PAT growth of 121% & revenue growth of 77% in 9M-25 at a PE of 108

Guidance for 105% PAT growth & Revenue growth of 66% with improvement in margin in FY25. Orders in place to support the growth for FY25. On track to accelerate product business growth significantly.

1. Electronic Manufacturing Services provider

pgel.in | NSE: PGEL

2. FY20-24: PAT CAGR of 169% & Revenue CAGR of 44%

3. Average FY24: PAT up 77% & Revenue up 27% YoY

4. Strong Q3-25: PAT up 109% & Revenue up 82% YoY

5. Strong 9M-25: PAT up 121% & Revenue up 77% YoY

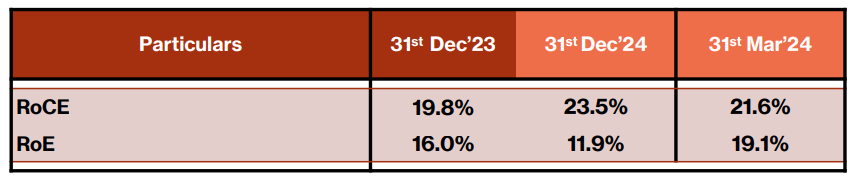

6. Business metrics: Strong return ratios

7. Outlook: PAT growth of 105% & Revenue growth of 66%

PGEL has been maintaining a 30-35% CAGR for the last 8-9 years

PGEL thinks they have enough opportunities to maintain historic growth

Operational margin to be in the similar range as Q3-25

Additional bump up coming into the margin in the Q4-25

PGEL will be recognizing PLI & will receive the money from the government

Expecting about Rs 30 cr from PLI for FY24

PGEL aims for a 5% PAT margin

8. PAT growth of 121% & revenue growth of 77% in 9M-25 at a PE of 108

9. Hold?

If I hold the stock then one may continue holding on to PGEL

PGEL is bullish about its prospects in FY25 as it has revised its guidance upwards after a strong 9M-25.

One needs to see the guidance for FY26 by PGEL before forming a longer view on it. Till then on could hold on to PGEL as the business momentum is in place.

we will be finalizing our business plan in the coming months and then we will disclose at the those numbers in the fourth quarter results.

PGEL has a track record of growth, with a revenue CAGR of 30%+ for FY16-24, followed by an extremely strong quarter in 9M-25.

Order book is in place to support the growth guidance for FY25

As compared to last year, the order book and overall visibility for the product division remains very strong, positioning this company to significantly enhancing its growth trajectory in the product business throughout this financial year.

The underlying business momentum for PGEL is strong and will sustain future growth

Whatever is the industry growing, we'll be try to grow much better than that than that. That is what we have been doing for last 9 years.

While PAT has grown by 121% in 9M-25, EPS has grown by 5.5% on account of QIP in Dec-24. If the trend of equity dilutive growth continues in the future then holding on to PGEL should be reviewed.

10. Buy?

If I am looking to enter PGEL then

PGEL has delivered PAT growth of 121% & Revenue growth of 77% in 9M-25 at a PE of 108 which makes valuations fully priced in the short term.

FY25 outlook of PAT growth of 105% & Revenue growth of 66% with the support of strong order book at a PE of 108 makes the valuation fully priced from FY25 perspective

While no quantitative numbers are given by PGEL, it is pointing towards a story which would continue beyond FY25. At a future CAGR of 30-35% the PE of 108 looks very expensive. However, one could look at the FY26 guidance expected in Q4-25 to take a longer term view.

The Management is enthused about the overall opportunity size and anticipates high growth rates in the industry segments where, company has presence.

Company is uniquely positioned in the consumer durable & plastics space in India and would derive higher revenue growth by growing its market share in the customer outsourcing wallet.

Company’s management see exciting times ahead for all its business segments.

At a PE of 108 the margin of safety is limited in PGEL.

Previous Coverage of PGEL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer