Northern ARC Capital: 35% PAT growth & 40% Net Interest Income growth in Q1-25 at a PE of 14

Growth of 30%+ for the last 3 years to continue in FY25. Balance sheet will grow faster than the industry growth. Demand of credit in H2 will pick up with the advent of festival seasons

1. Why is NORTHARC interesting?

northernarc.com | NSE: NORTHARC

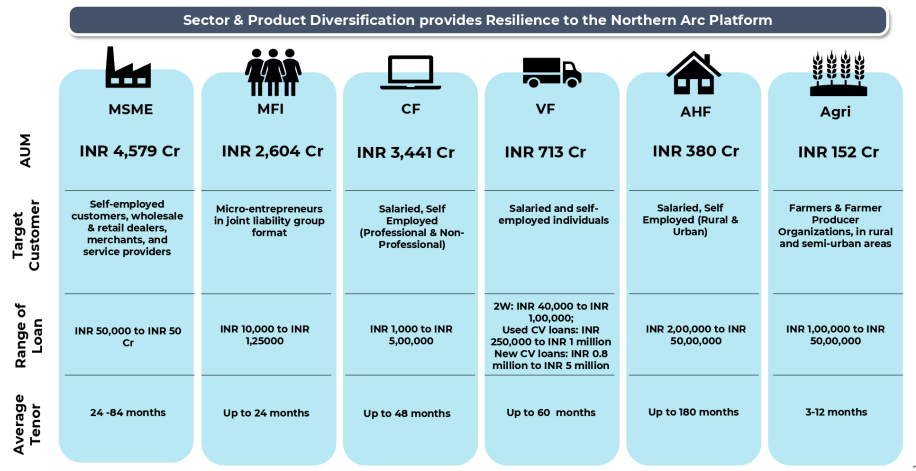

NORTHARC is promising to sustain the momentum of 30%+ growth in business achieved over the past 3 years. While remaining cautious about borrower repayment issues in FY25, the company aims to grow its balance sheet faster than the industry average. NORTHARC is also optimistic about a strong second half of the year, anticipating increased credit demand during the festival season. Given its promise of 30%+ growth, NORTHARC is available at reasonable valuations, with a price-to-book ratio of 1.65 and a price-to-earnings ratio of 15.2. NBFC: Retail credit provider

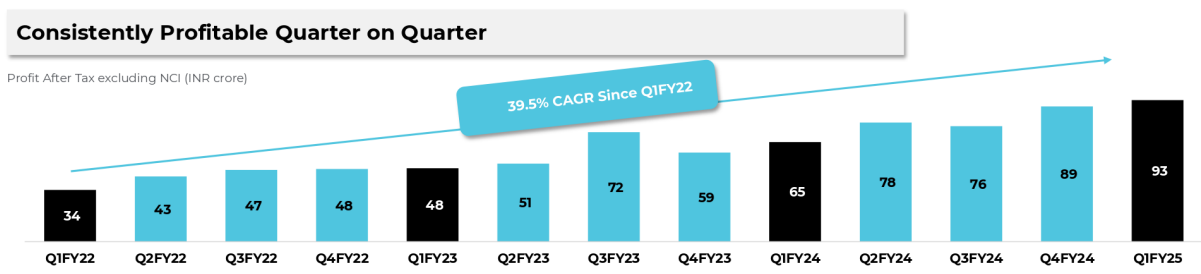

3. FY21-24: PAT CAGR of 49% & Net Interest Income CAGR of 61%

Net worth CAGR of 14% for FY21-24

4. FY-24: PAT up 45% & Net Interest Income up 31%

Net worth growth of 18%

5. Q1-25: PAT up 35% & Net Interest Income up 40%

6. Improving return ratios

7. Outlook: 30% growth in business

if you look at the past 3 years, we have been growing at about 30%+ CAGR

I think we are pretty confident of where we stand today and as we look forward, we should be able to deliver in line with our performance, what we have demonstrated over the last 3 years

8. PAT growth of 35% & Net Interest Income growth of 40% in Q1-25 at a PE of 14

9. Hold?

If I hold the stock then one may continue holding on to NORTHARC

Q1-25 was the first result as a public company. Q1-25 was a a strong quarter and one can carry on with a quarter to quarter view till NORTHARC develops a track record as a listed company.

The underlying business momentum and execution in NORTHARC is strong

NORTHARC is indicating for a strong Q2-25 while remaining cautious about borrower repayment

I'm confident our balance sheet will align and will grow faster than the industry growth

Credit cost should remain consistent in line with our proactive approach in managing risk, and we remain cautious about potential impact of macroeconomic factors among the borrower repayment.

NORTHARC is indicating for a strong H2

I also believe the further expansion will also witness given that the seasonality of the business, the demand of credit in H2 will pick up with the advent of festival seasons .

NORTHARC is the middle of a strong run in the business where PAT growth has been not only strong but consistent

10. Do I enter?

If I am looking to enter NORTHARC then

NORTHARC has delivered a strong Q1-25 with PAT growth of 35% & Net Interest Income growth of 40% at a PE of 14 which makes the valuations quite reasonable in the short term.

NORTHARC has track record of growing its net worth by 14% CAGR and is available at a PE of 14 which makes the valuations quite reasonable

NORTHARC with a net worth of Rs 2,777 crore as of Q1-25 end, with a current market cap of Rs 4,296 crore results in a price-to-book ratio of 1.55. This indicates reasonable valuations, especially considering that management has projected a 30% growth in the book, in line with historical growth rates.

One needs to be cautious about borrower repayment issues and keep a watch on asset quality of NORTHARC

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer