NCC FY25 Results: PAT up 15%, Order to Drive Future Growth

Guides 10% revenue growth in FY26 with margin expansion. ₹71,500 Cr order book ensures visibility. Valuations fair with upside opportunity as execution scales.

1. Construction Company

ncclimited.com | NSE : NCC

2. FY21-25: PAT CAGR of 32% & Revenue CAGR of 30%

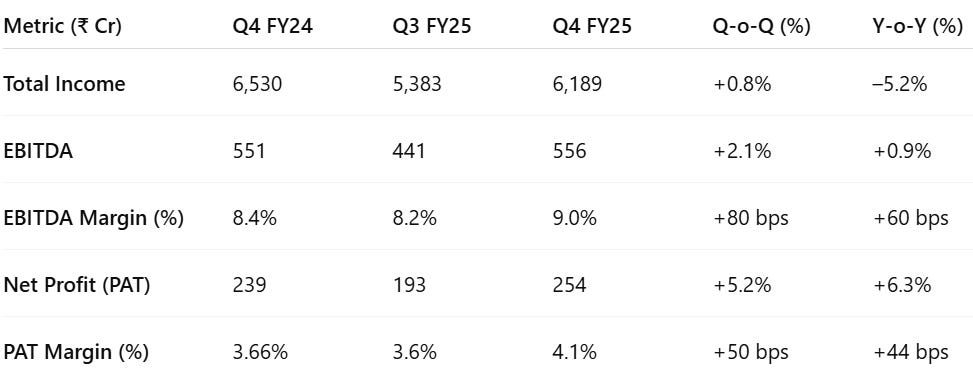

3. Q4–25: PAT up 6% & Revenue down 5% YoY

PAT up 5% & Revenue up 0.8% QoQ

Execution Recovery in Q4:

Momentum picked up post-election, reversing H1 delays

Strong performance in buildings, water, and mining segments

EBITDA Margin Improved in Q4 FY25

Better project mix: Higher execution in buildings, T&D, and mining

Lower JJM impact: Reduced share of delayed, low-margin water projects

Smart meter execution began: Early margin contribution started

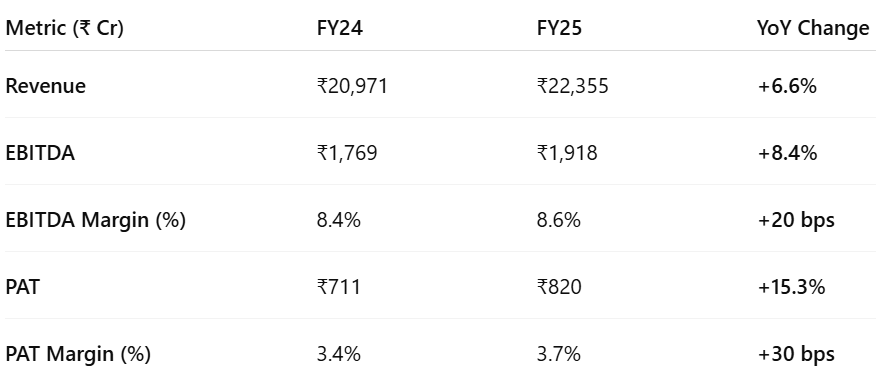

4. FY-25: PAT up 15% & Revenue up 7%

Improved margins: Margins expanded modestly despite input cost pressures, thanks to disciplined project-level execution.

Profitability at multi-year high: aided by better working capital management and lower interest cost.

Strong balance sheet: Net debt fell, keeping leverage low.

Execution poised to accelerate: FY25 closed with record order inflow of ₹32,888 Cr, setting the stage for stronger ramp-up in FY26.

5. Business Metrics: Strengthening Return Profile

Steady return improvement driven by margin expansion, order inflow discipline, and working capital optimization

Sustained margin gains: ROCE improved consistently over five years — driven by better project execution, stable EBITDA margins, and cost control.

Improving return on equity: Reflecting rising profitability and capital efficiency on a stronger equity base.

Disciplined capital allocation: Despite record order inflow and ₹750 Cr planned FY26 capex, NCC maintained a debt/equity ratio of ~0.20x and reduced net debt to ₹710 Cr.

Outlook: ROCE is expected to remain resilient in FY26 as execution picks up on recently bagged projects like BSNL Phase 2 and AP Capital City infra, with improved working capital discipline continuing to support return ratios.

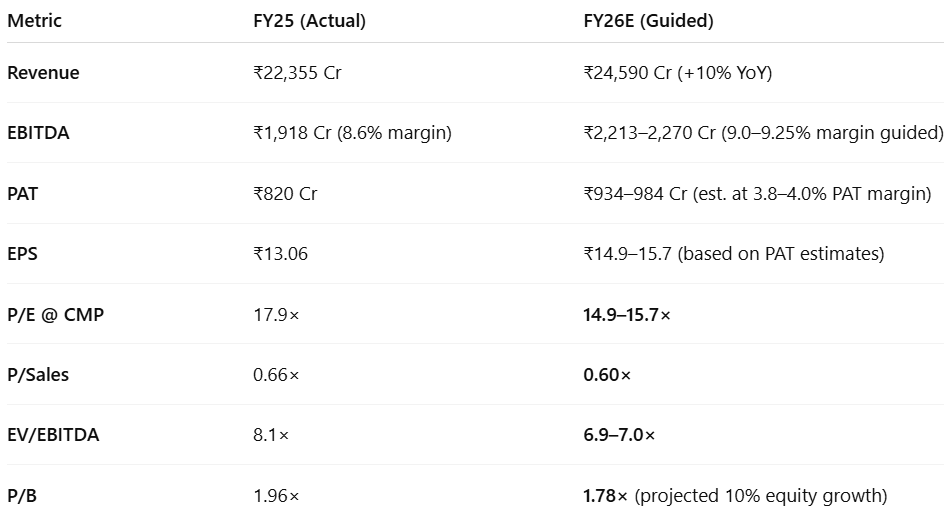

6. Outlook: 10% Revenue Growth with margin expansion

Growth supported by order book execution

6.1 FY25 Expectations vs Performance — NCC Ltd

✅ Hits: What Went Right

Order Inflow Significantly Beat Guidance

– ₹32,888 Cr booked vs ₹20,000–22,000 Cr guided through FY25

– Led by BSNL BharatNet, Andhra infra projects, and strong wins in T&D, irrigationRevenue Growth Aligned with Revised Guidance

– Though original guidance was 15%+, it was revised to 5% due to elections and delayed clearances

– Actual 6.6% YoY growth delivered on the reset targetWorking Capital & Debt Control

– Net debt fell to ₹710 Cr by Q4 FY25 (from ₹2,344 Cr in Q3)

– Debtor days reduced to 65; WC cycle remained stable at 77 days

❌ Misses: Where the Company Fell Short

EBITDA Margin Below Even Revised Guidance

– Guided range: 9.5–10% → Revised to 9.25%

– Actual margin was 8.6% due to slower execution in high-margin segments (roads, smart meters), and delayed billingSmart Meter Project Execution Delay

– Ray project under rollout, but Marathwada financial closure delayed

– FY25 contribution negligible; impact shifted to FY26–27Election & Payment Cycle Headwinds

– Projects delayed due to state and general elections (esp. Q1/Q2 FY25)

– Jal Jeevan Mission collections still pending (~₹1,500 Cr)

FY25 was a reset year. After ambitious initial guidance, NCC prudently revised expectations mid-year to reflect macro realities. Despite this, the company:

Outperformed on order inflow

Delivered solid revenue and PAT growth

Sharply reduced debt

Even with margin pressure, it exits FY25 well-positioned for scale-up in FY26

6.2 Outlook for FY26 and Beyond

Disciplined growth backed by record order book and execution visibility

FY26: Measured Growth with Execution Discipline

Revenue Guidance: NCC is targeting ~10% revenue growth in FY26, led by robust project execution across buildings, electrical, and transport verticals.

Key Drivers:

Ramp-up in large new orders won in Q4 FY25 (e.g., BSNL BharatNet Phase 2)

On-ground execution acceleration in Andhra Pradesh capital city infra projects (~₹9,000 Cr order book)

Uptick in smart meter deployment and tunneling activity (GMLR project, Mumbai)

Improved payment flows in delayed segments (e.g., Jal Jeevan Mission)

Profitability Levers Intact

EBITDA Margin: Expected to stay in the 9.0–9.25% range, reflecting cost optimization, stable input environment, and mix management

PAT Margin: Expected to remain around 3.8–4.0%, in line with FY25, despite a high base and upfront investments (capex, smart meter SPVs)

Net Debt Control: With net debt down to ₹710 Cr in Q4FY25 and tight working capital cycles, finance cost containment remains a tailwind.

FY27 Outlook (Limited Visibility)

Management has not yet guided FY27 revenue, but commentary indicates execution of large Q4FY25 orders will peak mid-FY27.

Smart meter execution and Ken-Betwa irrigation project may meaningfully contribute from FY27 onward.

7. Valuation Analysis — NCC Ltd

7.1 Valuation Snapshot (FY26E)

Assumptions

EBITDA Margin: Guided at 9.0–9.25% for FY26

PAT Margin: Estimated at 3.8–4.0%, in line with FY25

Net debt expected to remain stable around ₹879 Cr

Book value growth assumed at ~10% based on internal accruals

Takeaways

Valuation reset: Multiples are compressing as earnings rise, even without price re-rating

EV/EBITDA of ~7× for a debt-light EPC firm with ₹70,000 Cr+ order book offers upside

P/E < 16× on FY26E earnings makes valuation reasonable vs historical and peers

FCF yield >3%, with dividend payout retained at ₹2.20/share

NCC transitions from fairly valued (FY25) to moderately undervalued (FY26E) — earnings growth, not re-rating, is expected to drive stock performance.

7.2 What’s in the Price?

At CMP the market is pricing in:

FY26 Guidance Delivery: Revenue growth of +10% &

EBITDA margin stabilizing at 9.0–9.25%

Execution Recovery Already Priced In

Q4FY25 momentum assumed to continue into FY26

Smart meter rollout (Ray) priced in, despite Marathwada delay

Andhra infra execution seen as normalizing, not incremental

No Major Surprises in Capex, Debt, or Working Capital

Capex of ₹750 Cr (including ₹300 Cr for TBM) assumed absorbed without strain

Net debt expected to remain below ₹1,000 Cr

Implied Valuation Assumes:

Timely execution across infra + electrical T&D + smart meters

No further delays in Jal Jeevan or smart meter financial closures

Stable margins in water, buildings, and EPC contracts

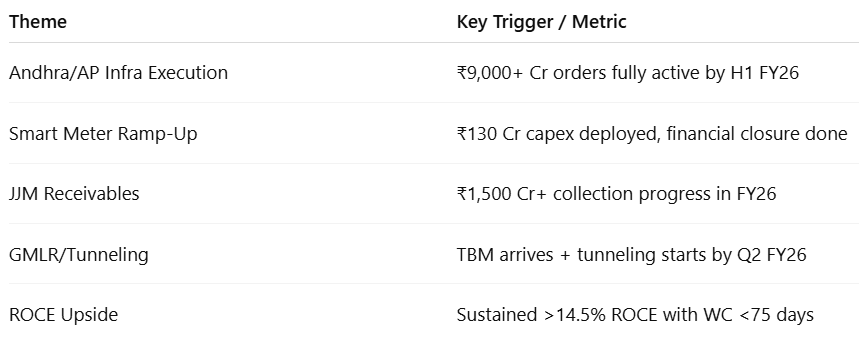

7.3 What’s Not in the Price?

The stock does not yet price in the upside from:

Order Book Conversion Surprises

₹9,000+ Cr of Andhra capital region orders began mobilizing only in Q4FY25

Execution pick-up could surprise on revenue & margin in H2FY26

Smart Meter Margin Boost

Smart meter rollout could yield superior margins (asset-light + annuity)

Contribution expected in FY27–28 but not reflected in current valuation

Working Capital Release Upside

₹1,500 Cr stuck in JJM receivables: resolution could free up capital

Reinvestment into high-margin verticals could elevate ROCE >15%

Valuation Re-rating

From 15× P/E → 17–18× possible if ROCE climbs past 14.5–15%

Current valuation is earnings-driven, not multiple-driven

7.4 Risks and What to Monitor

Despite steady execution in Q4FY25, risks remain that could cap upside or disrupt valuation:

Execution Risk

Election-year disbursement delays (e.g., JJM receivables still pending)

Smart meter (Marathwada) still pending financial closure

TBM tunneling (GMLR) yet to begin; slippage could defer revenue

Working Capital Drag

WC days at 77: if collections slow, ROCE could fall below 13–14%

Delayed conversion of mobilization advances to billables remains a risk

Sector/Policy Volatility

Infra margin profiles sensitive to:

Commodity prices

Regulatory pushback

Project-specific payment cycles

✅ What to Monitor

8. Implications for Investors

8.1 Bull, Base & Bear Scenarios — NCC Ltd

Base Case assumes clean execution and is already priced in, supported by stable margin, strong order book, and working capital control.

Bull Case unlocks upside via smart meter monetization, AP infra acceleration, and JJM recovery.

Bear Case reflects external delays — not structural weakness, but execution or funding disruptions that defer value realization.

8.2 Is There Any Margin of Safety?

✅ Where There Is Margin of Safety

Business Model Strength

Diversified EPC verticals across buildings, T&D, water, mining, irrigation — reduces revenue concentration risk.

High-quality order book of ₹71,568 Cr (3.2× FY25 revenue) offers multi-year visibility with good project spread.

Asset-light model in smart meters and buildings improves capital efficiency over time.

Low dependence on private sector or overseas bids — protects against FX or geopolitical volatility.

Capital Structure

Net debt of ₹710 Cr vs equity of ₹7,500 Cr → Net D/E = 0.09× (FY25)

Strong cash conversion from operations, even with ₹483 Cr FCF after dividend and capex.

FY26 capex of ₹750 Cr (mostly one-time for TBM + smart meters) is fully fundable without equity dilution.

Execution Levers Not Yet Priced In

AP Infra projects (~₹9,000 Cr) just began execution in Q4FY25 — peak billing to occur in FY26–27.

Smart meter monetization (Marathwada) pending — not factored into FY26 estimates yet.

Jal Jeevan Mission recovery (₹1,500 Cr receivables) could unlock WC and improve ROCE.

Working capital tailwinds likely if debtor days sustain below 65.

Room for re-rating if ROCE improves past 15% or EBITDA margin exceeds 9.25%.

Valuation to Forward Earnings

These are not demanding, especially if FY26 guidance is met.

❌ Where There Isn’t Much Margin of Safety

Valuation Is Fair, Not Cheap

Current multiples assume full execution: no room for FY26 slippage.

Margins are highly sensitive to smart meter delays and JJM recovery timing.

Market expects working capital stability — any reversal could compress ROCE and FCF yield.

Execution & Receivable Risks

Marathwada smart meter financial closure still pending — execution skewed to FY27.

₹1,500 Cr JJM receivables remain unresolved — collections may be slow in H1 FY26.

TBM tunneling (GMLR project) still in mobilization — delays could impact margin mix.

Failure to scale newer verticals (smart meters, tunneling) may cap margin expansion.

FY26 valuation leaves limited room for error — but significant upside if AP infra, smart meters, and receivables execute smoothly.

Previous coverage on NCC

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer