NCC: PAT growth of 47% & Revenue growth of 18% in H1-25 at a PE of 23

30%+ EBITDA growth with 15% revenue growth in FY25. NCC management reiterates guidance for FY25. Order book 2.2X revenue expected in FY25.

1. Why is NCC interesting?

ncclimited.com | NSE : NCC

NCC's order book exceeding Rs 52,000 cr, more than double the expected revenue for FY25, combined with an expected FY25 order inflow of Rs 20,000-22,000 cr, lays a strong foundation for growth through to FY27. Additionally, the potential for an upward revision in FY25 revenue guidance alongside an EBITDA growth exceeding 30% presents a compelling short-term opportunity for FY25.2. Second largest listed construction company by revenue

EPC company with in-house design and engineering capabilities

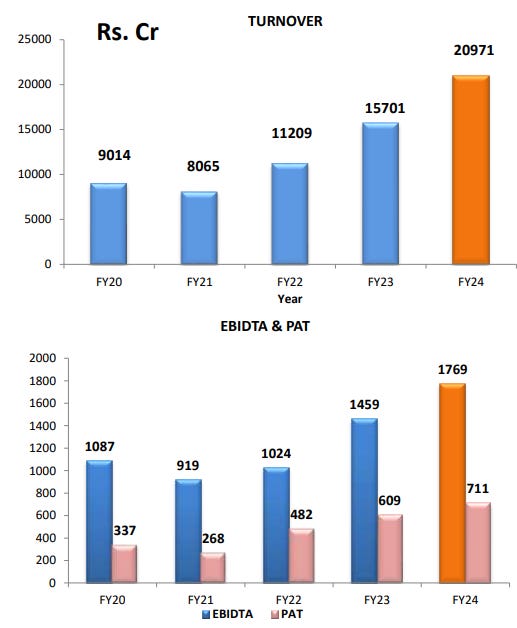

2. FY20-24: PAT CAGR of 21% & Revenue CAGR of 24%

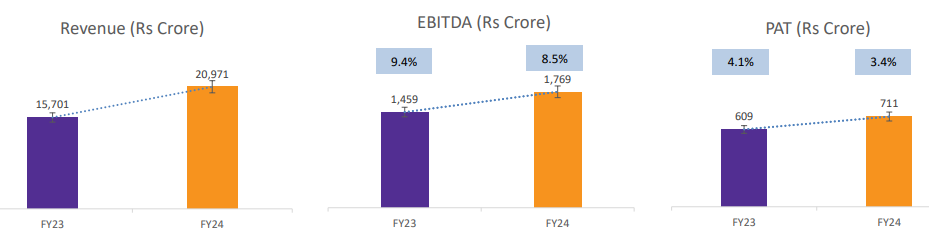

3. FY24: PAT up 17% & Revenue up 34%

4. Q2-25: PAT up 95% & Revenue up 10% YoY

5. H1-25: PAT up 47% & Revenue up 18% YoY

6. Business metrics: Improving return ratios

The ROE stands at 13.61 as against 14.04 at FY24 end

Return on net worth against PBT is 14.02 as against 13.88

Return on net worth against PAT is 10.44 as against 9.62

Book value per share is at Rs. 112, as against Rs. 108.50 paisa at the Financial Year ‘24 end

7. FY25 Outlook: 15%+ revenue growth & 30%+ EBITDA growth

i. Guidance for FY25

I also take this opportunity to reiterate the guidance that we have shared with the market participants.

order inflow of Rs. 20,000 to Rs. 22,000 crore,

revenue growth of 15% upwards and

EBITDA margin of 9.5% to 10% in the FY25.

ii. Strong order book: Order book 2.2X expected revenue of FY25

We are seeing a very healthy pipeline of future prospects. As we speak, we have a prospective project pipeline of more than Rs 2,10,000 crore. We are currently sitting on an order book of Rs. 52,370 crore.

iii. FY25: 30-36% surge in EBITDA as margin expands to 9.5-10%

In FY25, EBITDA is projected to surge by 30-36%, reaching Rs 2291-2411 cr, up from Rs 1769 cr in FY24, driven by a revenue growth of 15% and an EBITDA margin expansion from 8.5% to 9.5-10%.

We expect the EBITDA margin 9.5% to 10%. Going forward, next couple of years, our intention is always to keep the needle moving.

8. PAT growth of 47% & Revenue growth of 18% in H1-25 at a PE of 24

9. Hold?

If I hold the stock then one may continue holding on to NCC

NCC has outperformed its FY24 guidance and is on track with its H1-25 performance to meet the FY25 guidance.

Order book in the first half year is lower than what we supposed to do, but the kind of the pipeline of the orders giving a good confidence to us to achieve easily the 20 to 22,000 crores. Even there is a good visibility to surpass the limit what we given for the order booking

As far as invoice booking is concerned, as in the first half year we achieved 13% that you know already we explained. Particularly in the 2nd Quarter because of the rains and floods, we couldn't achieve because of the difficulties happened because of the heavy rains in the season. So, in the second half, so whatever 15% is there, we easily achieve, but the 2% whatever is there, now the backlog, that also we are confident we achieve that one. And ultimately at this moment, we are confident we achieve 15% guidance whatever is given for the invoice booking.

As far as EBITDA margins are concerned, as we've given 9.5% bottom lower band. And in the first half year, we achieved about 9.2% in EBITDA. So, in the second half, we are sure to achieve 9.5% lower band. But what our backlog is there for the first half year, the 0.3, is to be seen that how far we able to achieve 9.8 or 9.9 to make it as 9.5. But at this moment, we are able to achieve 9.5% in the second half year.

NCC's order book exceeding Rs 52,000 cr and an anticipated order inflow of Rs 20,000-22,000 cr in FY25 ensure strong revenue visibility through at least FY27, presenting a case for long-term investment in the company.

10. Buy?

If I am looking to enter NCC then

NCC delivered PAT growth of 47% & revenue growth of 18% in H1-25 at a PE of 24 which makes the valuations fairly valued in the short term

Top-line growth of 15%+ in FY25 with EBITDA growth of 30%+ at a PE of 24 which makes the valuations attractive from a FY25 perspective.

The longer term opportunity will emerge as the Rs 52,000 order book gets executed in FY26 and FY27.

Previous coverage on NCC

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer