NCC: PAT growth of 17% & Revenue growth of 34% in FY24 at a PE of 29

15% revenue growth & 30%+ EBITDA growth in FY25. Order book 2.4X+ revenue expected in FY25. At a free cash flow yield of 5.4%

1. Second largest listed construction company by revenue

ncclimited.com | NSE : NCC

EPC company with in-house design and engineering capabilities

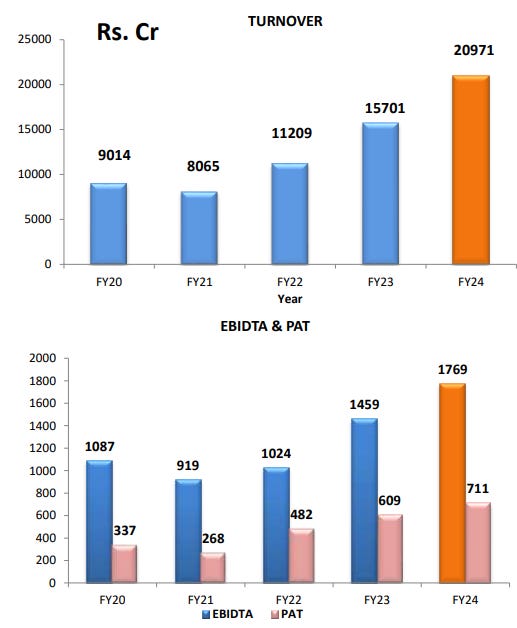

2. FY20-24: PAT CAGR of 21% & Revenue CAGR of 24%

3. Strong FY23: PAT up 26% & Revenue up 40%

4. 9M-24: PAT up 13% & Revenue up 35%

5. Q4-24: PAT up 25% & Revenue up 31%

6. FY24: PAT up 17% & Revenue up 34%

7. Business metrics: Improving return ratios

On a consolidated basis, the RoCE reported is 15.77% as against 14.41%.

8. FY25 Outlook: 15%+ revenue growth & 30%+ EBITDA growth

i. Strong order book: Order book 2.4X+ expected revenue of FY25

So, for the year 24-25 we give a guidance on order booking about 20,000 to 22,000 considering the present market environment particularly the general elections, followed by some state assembly elections.

ii. FY25: Conservative guidance for 15% revenue growth

Top line growth guidance about 15% plus as against 20% guidance given in the last year.

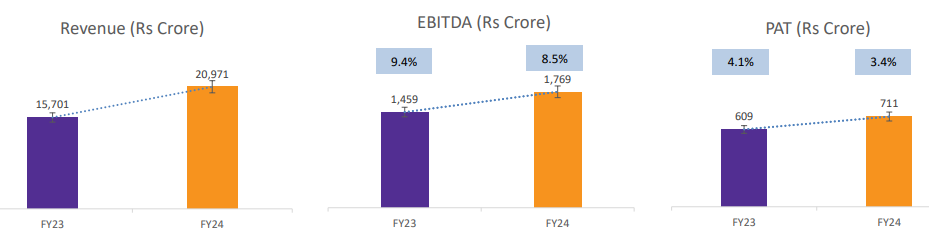

iii. FY25: EBITDA margin expansion to 9.5-10%

EBITDA margin expansion to 9.5-10% in FY25 from the 8.5% in FY-25 on revenue growth of 15% implies that EBIDTA is expected to grow from Rs 1769 cr in FY24 Rs 2291-2411 cr which would be a 30-36% EBITDA growth in FY25.

We expect the EBITDA margin 9.5% to 10%. Going forward, next couple of years, our intention is always to keep the needle moving.

9. PAT growth of 17% & Revenue growth of 34% in FY24 at a PE of 29

10. So Wait and Watch

If I hold the stock then one may continue holding on to NCC

Coverage of NCC was initiated after Q1-24 results. The investment thesis has not changed after a strong FY24. NCC has delivered a strong FY24 ahead of guidance.

We have given guidance for order booking for FY23-24 as INR26,000 crores whereas we have achieved INR27,283 crores and top line we have given a growth of 20%, but we achieved 37%.

With a FY24 closing order book Rs 57,000 cr and order inflow of Rs 20,000-22,000 cr in FY25 provides strong revenue visibility till at least FY27 which provides an a reason to stay in NCC over the long term.

FY25 guidance is conservative on account of the general elections. Possibility for change in guidance exists.

So if there is no impact -- good impact on the front of the elections, so we may get more orders. But a minimum of 20,000 to 22,000 is the benchmark the company has kept.

One needs to keep a watch on the 9.5-10% EBITDA margin guided by NCC management. Without the margin expansion, bottom-line growth would be lower than the 15% revenue growth guidance. It would not be interesting to be in NCC when earnings growth is not higher than 15% revenue growth.

11. Or else join the ride

If I am looking to enter NCC then

NCC has delivered PAT growth of 17% & Revenue growth of 34% in FY24 at a PE of 29 which makes the valuations richly valued in the short term

NCC on a market cap of Rs 20656 cr generated free cash flow of Rs 1,108 cr which implies that its available at a free cash flow yield of 5.4% which makes the valuations reasonable.

NCC has grown its free cash flow from Rs 877 cr in FY23 to Rs 1,108 cr in FY24 a growth of 26% (vs PAT growth of 17%) at PE of 29 which makes the valuations reasonable. One can expect strong fee cash flow generation in FY25 to continue as capex in FY25 is expected to be lower.

Capex Spend: In FY '24, we spent about INR285 crores. And for FY '25, we are targeting to spend about INR250 crores

Top-line growth of 15% in FY25 with EBITDA growth of 30%+ at a PE of 29 which makes the valuations fairly valued in the medium term

While it does not impact valuations, NCC market cap of Rs 20,656 cr is lower than the expected revenue for FY25. NCC order book is 2.8X of its market cap

A PE of 29 vs a median PE of 14 in the last 3 years for an EPC company is quite rich. There is no margin of a safety to accommodate a slow quarter. Reaction in stock price will be seen if execution for even one quarter is not in line with the guidance given.

Previous coverage on NCC

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer