NCC: PAT growth of 13% & Revenue growth of 35% in 9M-24 at a PE of 21 & P/B of 2.1

20% growth in FY24 & 15% revenue growth in FY25 looks conservative given the visibility on the back of an order book 3X+ revenue expected in FY24. Valuations look reasonable with NCC at 2.1 P/B

1. NCC Ltd, a leading construction company

ncclimited.com | NSE : NCC

Second largest listed construction company by revenue

EPC company with in-house design and engineering capabilities

2. FY20-23: PAT CAGR = 22% & Revenue CAGR = 20%

3. Strong FY23: PAT up 26% & Revenue up 40%

4. Weak H1-24: PAT down 2% & Revenue up 36%

5. Strong Q3-24: PAT up 40% & Revenue up 33%

6. 9M-24: PAT up 13% & Revenue up 35%

7. Business metrics: Improving return ratios

8. Outlook for 20%+ revenue growth in FY24

i. FY24: Will exceed 20% revenue growth guidance

NCC based on 9M-24 performance looks on track to beat FY24 guidance

As far as guidance is concerned we have given 20% growth guidance for topline for the year 2023 and 2024. In the first half year we have exceeded the guidance to what the target basing on the guidance of 20% be internally stipulated for six months exceeded this by 5% and the management is confident to achieve the guidance given for FY2023-FY2024

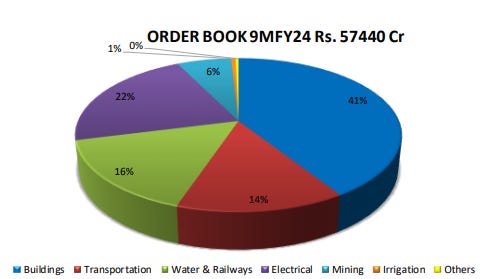

ii. Strong order book: Order book 3X+ expected revenue of FY24

80-85% of Rs 57,400 cr orders to be executed in 3 years implies an revenue visibility of Rs 15000-16000 cr per year

80% to 85% is executable in the next 2 to 3 years - - in 3 years

iii. FY25: Conservative guidance for 15% revenue growth

15% revenue growth looks very conservative when revenue visibility of Rs 15000-16000 cr is in place

Yes, the company plans to maintain that 15% plus the growth in the turnover, and since we have the strong order book at this moment, it is possible to achieve that kind of growth.

iii. FY25: EBITDA margin expansion to 10%

EBITDA margin expansion to 10% in FY25 from the 8.5% in 9M-24 which will grow the bottom line faster than the 15% guided for the revenue

9. PAT growth of 13% & Revenue growth of 35% in 9M-24 at a PE of 21

10. So Wait and Watch

If I hold the stock then one may continue holding on to NCC

Coverage of NCC was initiated after Q1-24 results. The investment thesis has not changed after a strong 9M-24. The only changes are the delivery of a strong Q3-24 and the increased confidence in the management to deliver a higher top-line and bottom-line in FY24

No slowdown in FY25 on account of upcoming general elections

But as far as NCC is concerned, already, we built a good amount of orders in our order book. As such, we are not foreseeing any impact in terms of revenue booking in the coming '24-'25.

FY24 guidance on order intake will be met, providing strong revenue visibility

The target orders for the current year is INR26,000 crores, against which the company secured in 9-month period about INR21,238 crores.

The management is confident now to achieve the INR26,000 crores order book

One needs to keep a watch on the 10% EBITDA margin guided by NCC management. Without the margin expansion, bottom-line growth would be lower than the 15% revenue growth guidance. It would not be interesting to be in NCC when earnings growth is less than 15%.

11. Or else join the ride

If I am looking to enter NCC then

NCC has delivered PAT growth of 13% & Revenue growth of 35% in 9M-24 at a PE of 21 which makes the valuations acceptable from a longer term .

The market cap of Rs 14,023 cr for NCC against its net-worth of Rs 6608 cr as of Q2-24 end implies that its trading at price to book of 2.12 which makes the valuations reasonable.

Top-line growth of 15% in FY25 looks conservative but the real opportunity is that the earnings growth is expected to be higher given the guidance for 10% EBITDA margin

While it does not impact valuations, NCC market cap is lower than the expected revenue for FY24. NCC order book is 4X of its market cap

Execution against the FY25 guidance would drive NCC in the medium term. Over the long term order intake and execution of the order book would create opportunity in NCC. With an all time-high order book in place, can the stock create an all time high?

Previous coverage on NCC

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer