Manappuram Finance: PAT growth of 44% & Net Interest Income growth of 33% in FY24 at a PE of 7

Guiding for AUM growth of 20% with ROE of 20% for FY25. At a price to book of 1.3, potential for re-rating of P/B & PE multiples given the growth guidance for FY25

1. NBFC offering gold loans, home loans, vehicle finance, microfinance, SME loans and insurance brokerage business

manappuram.com | NSE : MANAPPURAM

#2 lender in gold loans in India (core product),

Products

Group Structure

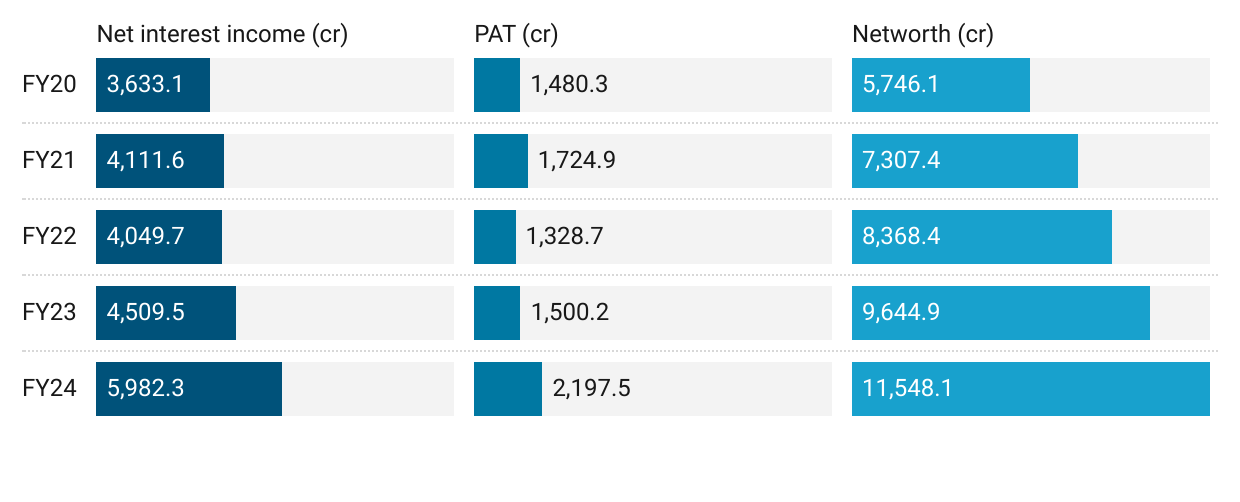

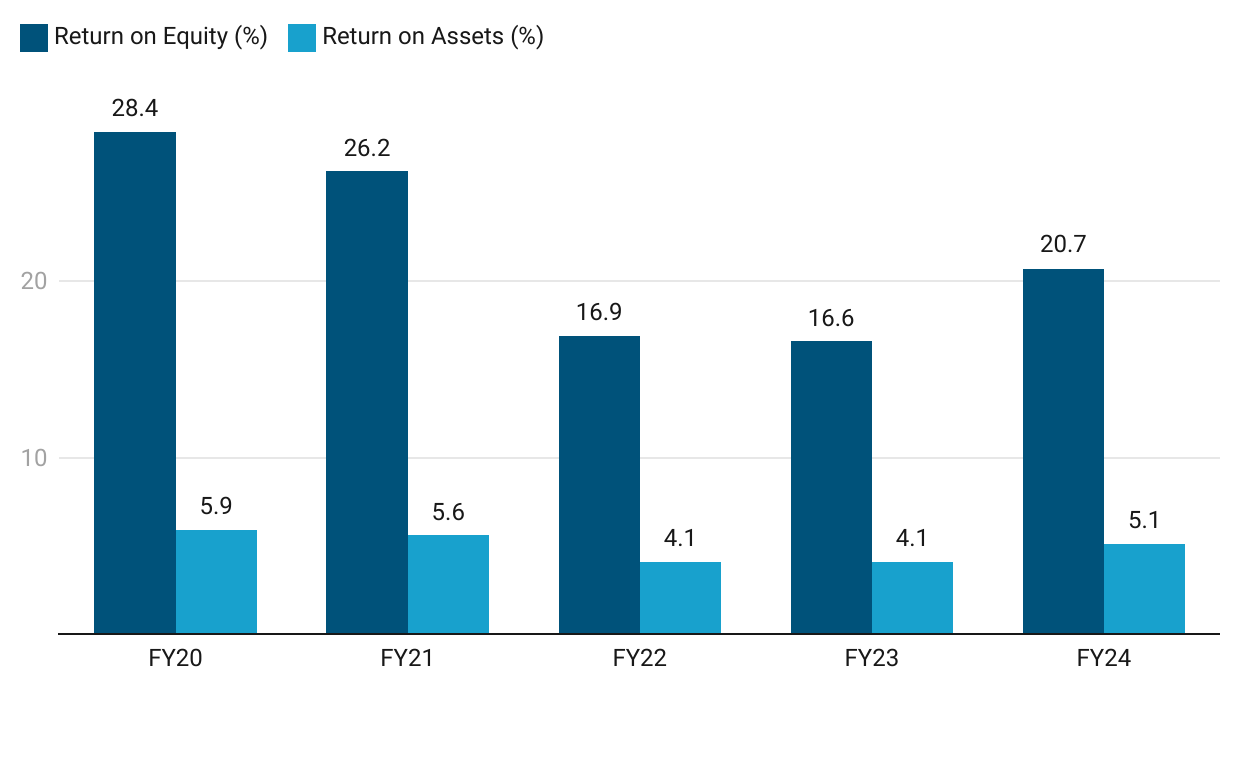

2. FY20-24: PAT CAGR of 13% & Income CAGR of 10%

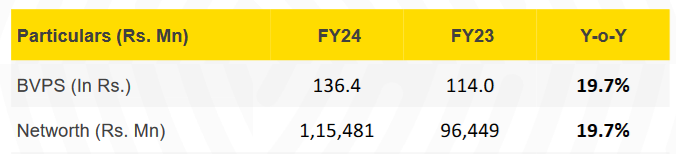

FY20-24: Networth CAGR of 19%

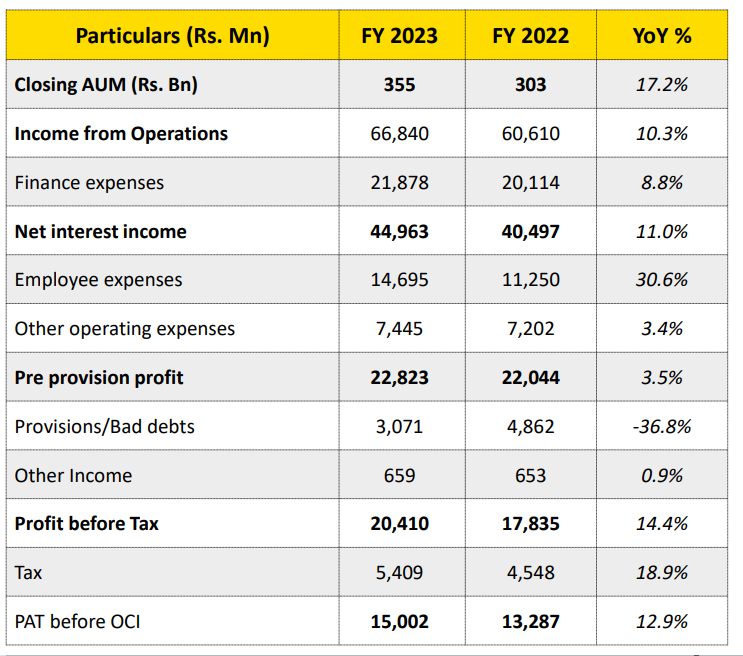

3. FY23: PAT up 13% & Net Interest Income up 10% YoY

4. 9M-24: PAT 51% & Net Interest Income up 33% YoY

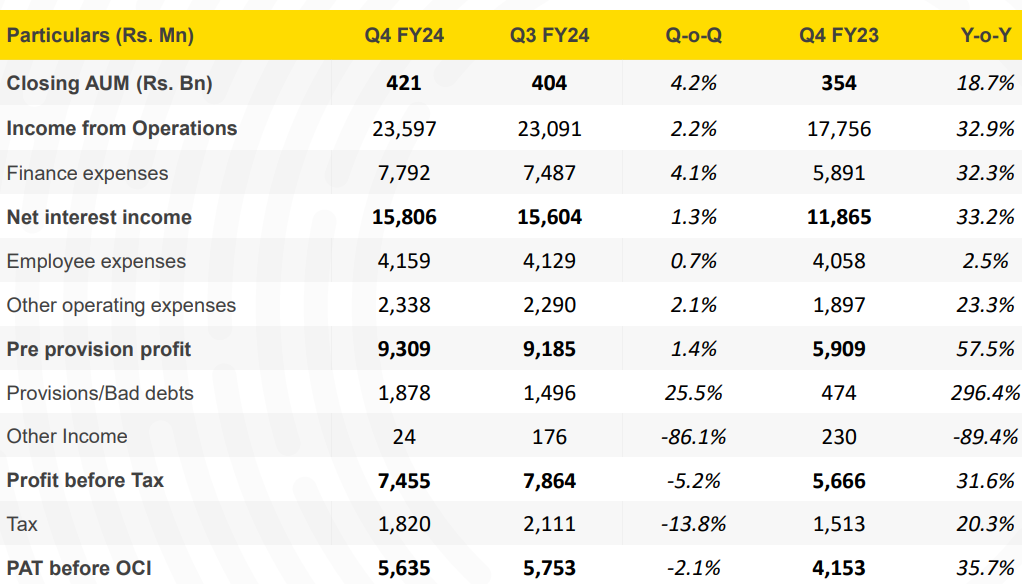

5. Q4-24: PAT 36% & Net Interest Income up 33% YoY

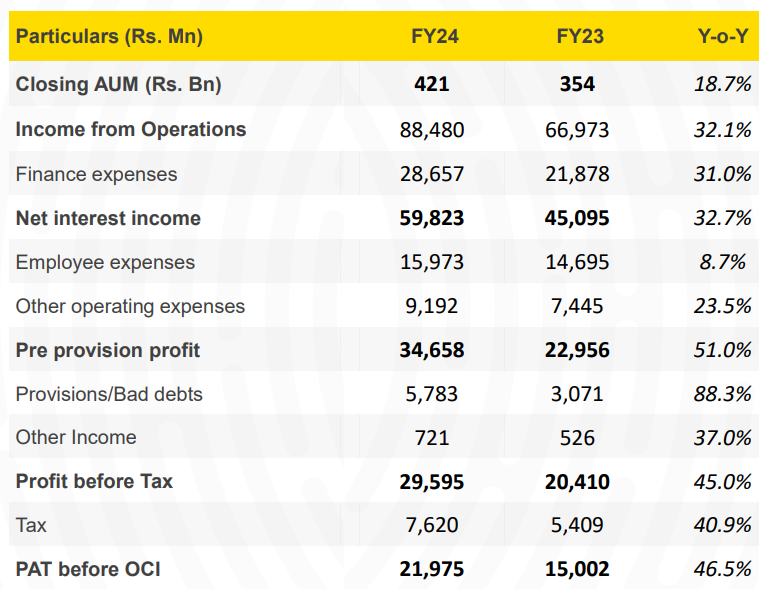

6. FY24: PAT 47% & Net Interest Income up 33% YoY

7. Business metrics: Improvement in return ratios

8. Outlook: 20% AUM growth in FY25

i. 20% growth in AUM

Well, what we have been talking about is a CAGR of 20% and ROE of 20%.

9. PAT growth of 47% & Income growth of 33% in H1-24 at a PE of 7

10. So Wait and Watch

If I hold the stock then one may continue holding on to MANAPPURAM .

Coverage of MANAPPURAM was initiated after Q2-24 results. The investment thesis has not changed after a strong FY24 even though the management has delivered 19% AUM growth and missed on its FY24 guidance of 20% AUM growth.

The FY25 guidance of delivering of 20% AUM growth and 20% ROE is a reason enough to continue in the stock given.

One needs to keep a watch on guidance for FY25. AUM growth was slightly below the FY24 guidance so can be ignored. However, one would not like to see the trend of guidance being missed to continue.

11. Or, join the ride

If I am looking to enter MANAPPURAM

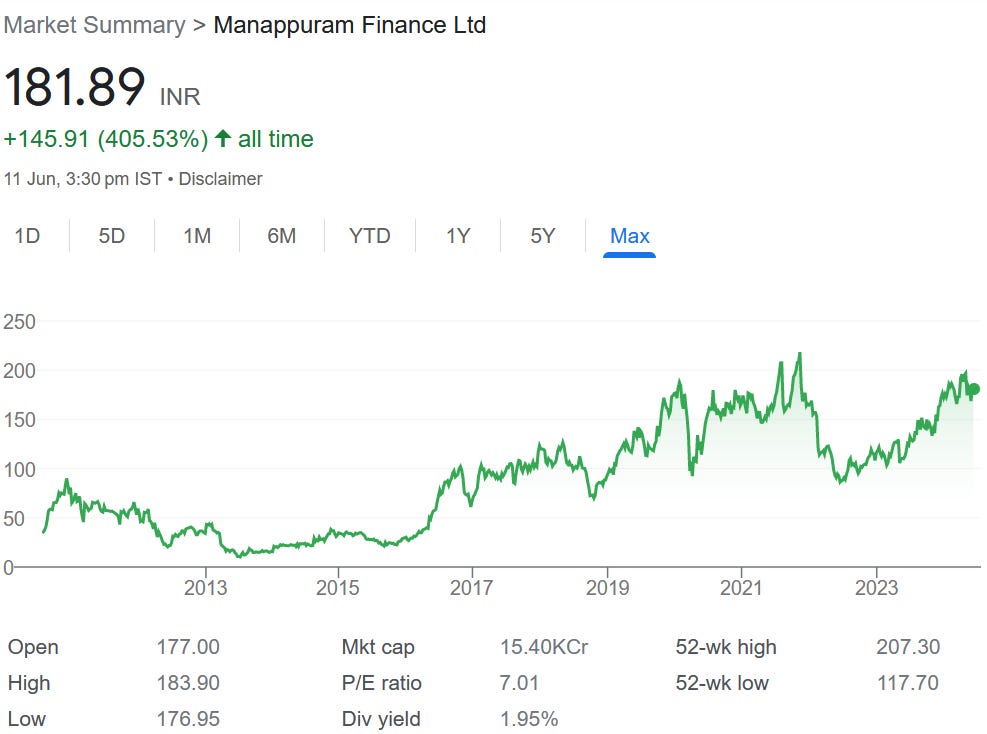

MANAPPURAM has delivered PAT growth of 47% & Income growth of 33% in FY24 at a PE of 7 which makes valuations quite attractive.

MANAPPURAM is quoting at a price of Rs 181.89 on a book value of Rs 136.4. It is available a price to book of 1.3 which is quite attractive for the FY24 performance delivered.

MANAPPURAM has delivered 20% YoY growth in net worth in FY24 which also makes valuations of PE 7 quite attractive.

The guidance for 20% AUM growth and ROE of 20% in FY25 makes the current valuations quite attractive.

The potential for a 7 PE moving to a a mid teen PE or the price to book moving closer to 2 is easily possible if MANAPPURAM is able to deliver a strong FY25. The potential of a PE rand price to book re-rating could provide multi-bagger upside in the stock over the medium term.

Previous coverage on MANAPPURAM

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer