Manappuram Finance: PAT growth of 51% & Income growth of 33% in 9M-24 at a PE less than 8 & P/B of 1.4

MANAPPURAM valuations are attractive. Potential for re-rating of P/B & PE multiples given the top-line and bottom growth seen in 9M-24. Value unlocking from IPO of its subsidiary Asirvad Microfinance

1. #2 in gold loans (core product) in India

manappuram.com | NSE : MANAPPURAM

Products

Group Structure

Micro Finance Segment: IPO on the way

Asirvad Microfinance IPO by mid March or early April.

Business Segment FY23

H1-24: Strategy of diversifying into other sectors is gaining pace. The share of non-gold verticals in our total asset-under-management now stands at 47% and is in line with the objective of achieving a 50-50 portfolio mix between gold and non-gold segments

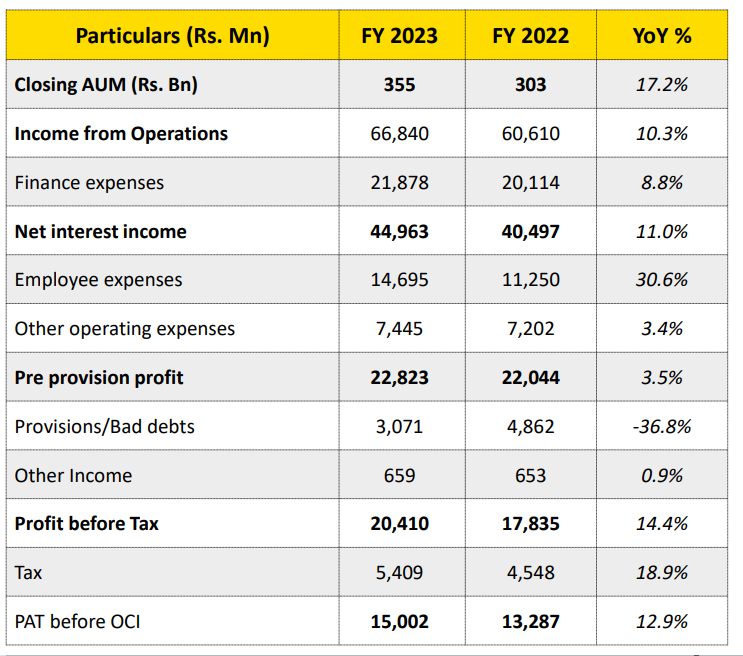

2. FY20-23: PAT CAGR of 13% and Income CAGR of 10%

FY19-23: Net Worth growing at a solid CAGR of 15%

3. Ordinary FY23: PAT up 13% and Income up 10% YoY

4. Strong H1-24: PAT up 53% & Income up 31% YoY

5. Strong Q3-24: PAT 46% & Income up 35% YoY

PAT 3% & Income up 6% QoQ

6. Strong 9M-24: PAT 51% & Income up 33% YoY

7. Business metrics: Strong return ratios

8. Outlook: 20% AUM growth in FY24

i. 20% growth in AUM

9. PAT growth of 51% & Income growth of 33% in H1-24 at a PE of less than 8

10. So Wait and Watch

If I hold the stock then one may continue holding on to MANAPPURAM .

Coverage of MANAPPURAM was initiated after Q2-24 results. The investment thesis has not changed after a strong 9M-24. The only changes are the delivery of a strong Q3-24 and the increased confidence in the management to deliver a stronger FY24

9M-24 AUM growth for MANAPPURAM is in line with the guidance for FY24

MANAPPURAM has delivered 4 quarters of sequential PAT growth QoQ

Net Interest Margin, NIM highest in the last 10 quarters

hope to maintain NIM at this level

Expecting reasonable gold growth in Q4-24

Yes, there is a season. During that season, we used to get growth. With that growth, we may be able to maintain the rate generally

11. Or, join the ride

If I am looking to enter MANAPPURAM

MANAPPURAM has delivered PAT growth of 51% & Income growth of 33% in 9M-24 at a PE of less than 8 which makes valuations quite attractive.

MANAPPURAM is quoting at a price of Rs 186.05 on a book value of Rs 130.7. It is available a price to book of 1.4X which is quite attractive for the 9M-24 performance delivered.

The consolidated net worth was at INR 11,063 crores and the book value was INR130.70

MANAPPURAM has delivered 19% YoY growth in net worth in 9M-24 which also makes valuations of PE less than 8 quite attractive.

For its microfinance business, Asirvad Microfinance, the IPO is expected in mid march or early April for the purpose to augment the capital base of the firm to meet future business requirements. The IPO could also unlock value for MANAPPURAM

The potential for a 8 PE moving to a a mid teen PE or the price to book moving closer to 2 is easily possible if MANAPPURAM is able to deliver a strong FY24. The potential of a PE rand price to book re-rating could provide multi-bagger upside in the stock over the medium term.

Previous coverage on MANAPPURAM

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer