Manappuram Finance: PAT growth of 53% & Income growth of 31% in H1-24 at a PE of 7 & P/B of 1.24

Potential for re-rating of price to book and PE multiples given the top-line and bottom growth seen in H1-24.

1. #2 in gold loans (core product) in India

manappuram.com | NSE : MANAPPURAM

Products

Group Structure

Micro Finance Segment: IPO on the way

Asirvad Microfinance filed DRHP on October 5, 2023.

Business Segment FY23

H1-24: Strategy of diversifying into other sectors is gaining pace. The share of non-gold verticals in our total asset-under-management now stands at 47% and is in line with the objective of achieving a 50-50 portfolio mix between gold and non-gold segments

2. FY20-23: PAT CAGR of 13% and Income CAGR of 10%

FY19-23: Net Worth growing at a solid CAGR of 15%

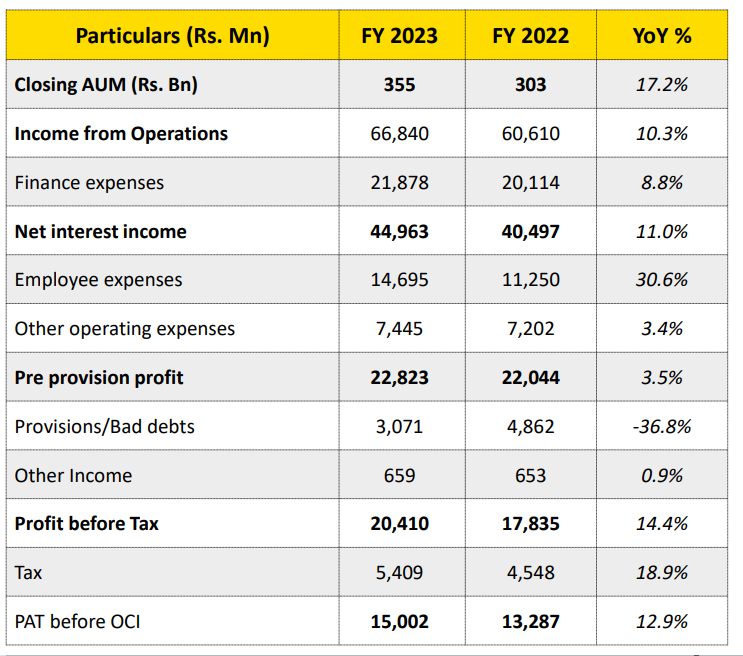

3. Ordinary FY23: PAT up 13% and Income up 10% YoY

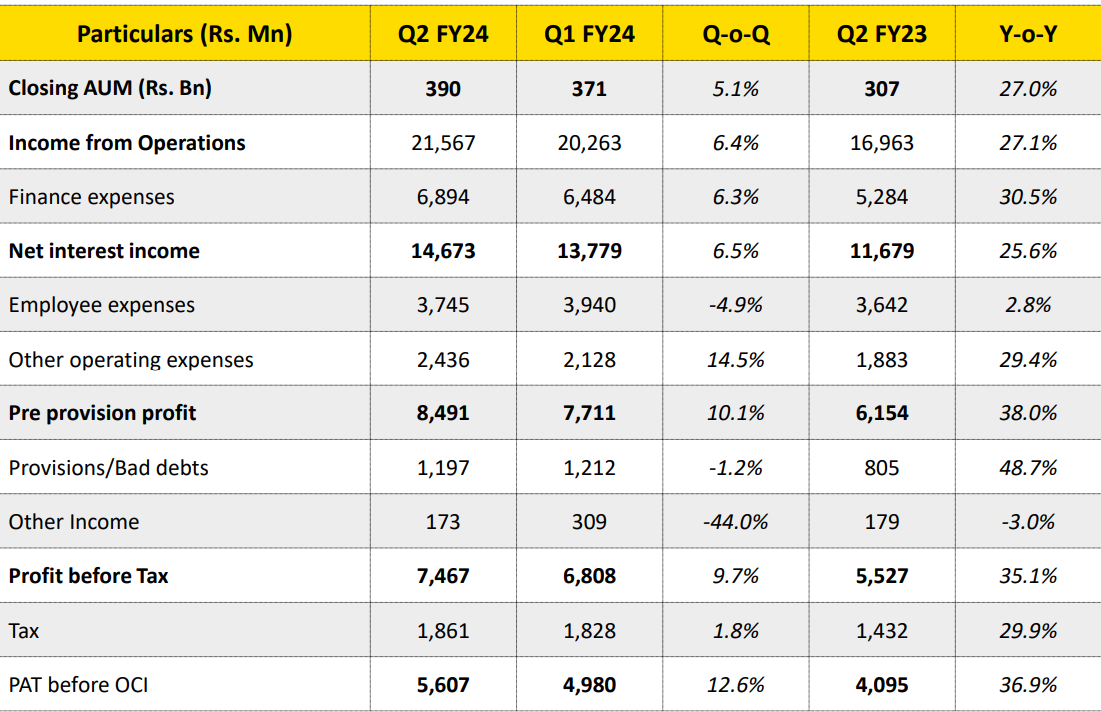

4. Strong Q1-24: PAT up 77% and Income up 35% YoY

PAT 21% & Income up 14% QoQ

5. Strong Q2-24: PAT 37% & Income up 27% YoY

PAT 13% & Income up 6% QoQ

6. Strong H1-24: PAT up 53% & Income up 31% YoY

7. Business metrics: Strong return ratios

8. Outlook: 20% AUM growth in FY24

i. 20% growth in AUM

9. PAT growth of 53% & Income growth of 31% in H1-24 at a PE of 7

10. So Wait and Watch

If I hold the stock then one may continue holding on to MANAPPURAM .

Based on H1-24 performance, MANAPPURAM looks on track to deliver a strong FY24

H1-24 AUM growth is in line with the guidance for FY24

The past record during FY20-23 has seen bottom line going up & down, with no clear growth trajectory. Hence one needs to watch and decide on MANAPPURAM at a quarter to quarter level. One doesn’t want to get stuck with a stock where the business is not showing a clear growth trajectory.

11. Or, join the ride

If I am looking to enter the stock then

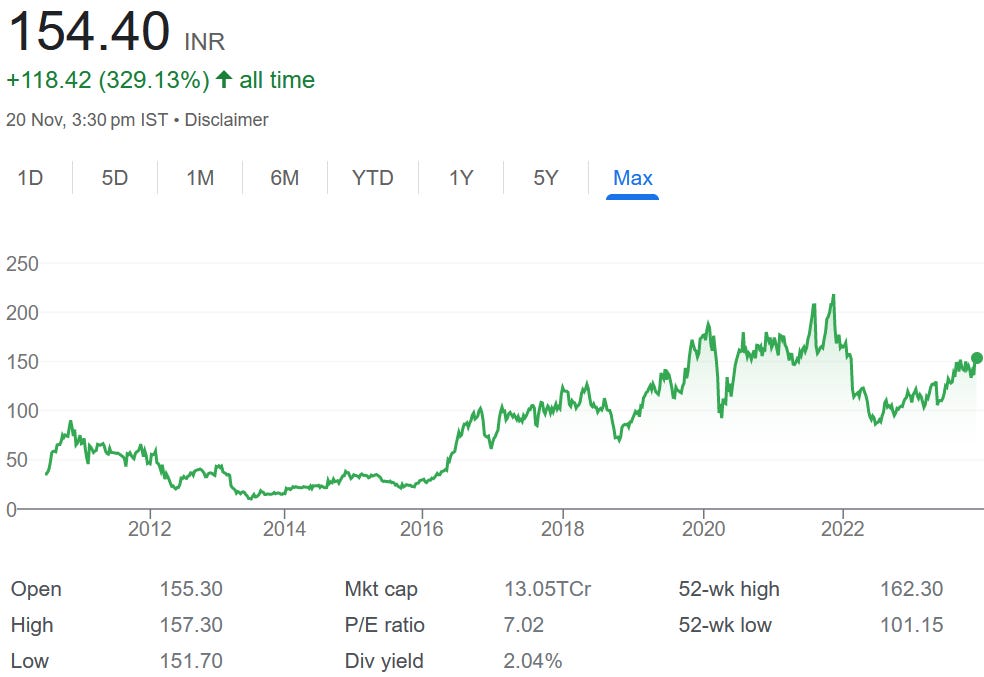

MANAPPURAM has delivered PAT growth of 53% & Income growth of 51% in H1-24 at a PE of 7 which makes valuations quite attractive.

MANAPPURAM quoting at a price of Rs 154.4 on a book value of Rs 124.9. It is available a price to book of 1.24X which is quite attractive for the H1-24 performance delivered.

MANAPPURAM has delivered 18% YoY growth in net worth in H1-24 which also makes valuations quite attractive.

For its microfinance business, Asirvad Microfinance filed DRHP on October 5, 2023 for the purpose to augment the capital base of the firm to meet future business requirements but the IPO could also unlock value for MANAPPURAM

The potential for a 7 PE moving to a a mid teen PE or the price to book moving closer to 1.5 is easily possible if MANAPPURAM is able to deliver a strong FY24. The potential of a PE rand price to book re-rating could provide multi-bagger upside in the stock over the medium term.

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades