Man Industries: PAT growth of 93% & Revenue growth of 43% in 9M-24 at a PE of 22

MANINDS is on track to deliver on its FY24 revenue growth guidance of 40-50%. For FY23-26 MANINDS is guiding for 31% revenue CAGR and 59% EBITDA CAGR for FY23-26

1. Manufacturer of large diameter carbon steel line pipes (LSAW, HSAW & ERW)

mangroup.com | NSE : MANINDS

Product Segments

Longitudinal Submerged Arc Welded (LSAW) Pipe

Helically Submerged Arc Welded (HSAW) Pipe

Electric Resistance Welded (ERW) Pipe

MANINDS is undertaking capex to to enter Stainless Steel pipes.

MANINDS has two state-of-the-art manufacturing facilities with 1 facility located in Anjar, Gujarat having 2 LSAW line Pipe units & 2 HSAW Line Pipe units, 1 ERW unit and also for various types of Anti-Corrosion Coating Systems and 1 facility in Pithampur, Madhya Pradesh, having a total installed capacity of over 1.15 Mn+ MTPA.

2. Weak FY21-23: PAT de-growth & flat top-line

3. Weak FY23: PAT down 33% and Revenue up 4% YoY

4. Strong H1-24: PAT up 950% & Revenue up 54% YoY

5. Weak Q3-24: PAT down 18% & Revenue up 27% YoY

6. Strong 9M-24: PAT up 93% & Revenue up 43%

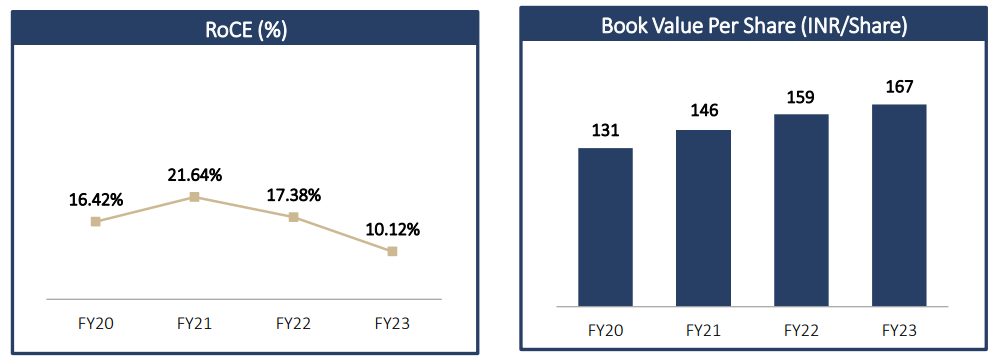

7. Business metrics: Strong return ratios

6. Outlook: Strong PAT growth in FY24

i. Top-line growth of 40-50% in FY24

Top-line growth of 40-50% in FY24 looks conservative or indicating a slowing down of momentum given that H1-24 delivered 54% growth YoY

There will be the growth 40% to 50% in closing 2024.

ii. EBITDA expansion in FY24

EBITDA guidance is 10% for FY24. EBITDA for 9M-24 was around 9.5%.

overall average will be approximately 10% in coming quarter

iii. FY24: Revenue growth of 20-25% & PAT growth of 30-35%

Coming at the outlook of '24-25, our top line will grow at approximately 20%, 25%, which would be approximately around INR3,600 crores and the similar growth of 30%, 35% on the bottom line. EBITDA will stand at approximately 9% to 11% and -- which would contribute to around INR350 crores to INR360 crores.

iv. FY25: Revenue growth of 60-70%

For '25-'26, our top line will grow around 60% to 70% from year on, which will be approximately INR5,000 crores. And the EBITDA would stand at approximately 10% to 11% to around INR500 crores.

v. Strong revenue visibility for FY25

Unexecuted order book as on date stands at around INR1,300 crores to be executed in the next 6 months. We continue to have outstanding bids for more than INR11,000 crores at various stages of evaluation for several oil, gas, water projects in India and abroad, which sets our expectancy for good order inflows in the next few months. Currently, some of the orders are also we are at a good strong L1 position.

7. PAT growth of 93% & Revenue growth of 43% in 9M-24 at a PE of 22

8. So Wait and Watch

If I hold the stock then one may continue holding on to MANINDS.

FY24 is expected to be a strong year after a weak FY23. The guidance of 40-50% growth looks realistic given that MANINDS has delivered a PAT growth of 93% and Revenue growth of 43% in 9M-24

Revenue visibility for MANINDS is strong given the order book.

MANINDS is guiding for a revenue growth from Rs 2,231.3 cr in FY23 to Rs 5,000 cr in FY26 implies a FY23-26 revenue CAGR of 31%

MANINDS is guiding for a EBITDA growth from Rs 124.9 cr in FY23 to about Rs 500 cr in FY26 implies a FY23-26 EBITDA CAGR of 59%

9. Or, join the ride

If I am looking to enter MANINDS then

MANINDS has delivered a PAT growth of 93% and Revenue growth of 43% in 9M-24 and guided for 40-50% growth in FY24. MANINDS at a PE of 22 makes valuations quite attractive.

MANINDS is guiding for a FY23-26 revenue CAGR of 31% and EBITDA CAGR of 59% at a PE of 22 makes the valuations quite attractive from a long term perspective.

MANINDS at a market cap of about Rs 2,538 cr against an expected revenue of Rs 3,000+ cr in FY24 means that it is available at a market cap to sales of less than 1

A H1-24 net-worth of Rs 1,172 cr on a market cap of about Rs 2,538 cr, implies that MANINDS is available at a price to book of less than 2.2 which makes the valuations quite reasonable.

Previous coverage of MANINDS

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer