Man Industries: PAT growth of 950% & Revenue growth of 54% in H1-24 & FY24 revenue growth guidance of 40-50% at a PE of 13 & P/B of 1.3

Q2-24 performance along with management guidance for FY24 has created opportunity in the stock. Introduction of new products, ERW and stainless steel to drive growth from FY25

1. Manufacturer of large diameter carbon steel line pipes (LSAW, HSAW & ERW)

mangroup.com | NSE : MANINDS

Product Segments

Longitudinal Submerged Arc Welded (LSAW) Pipe

Helically Submerged Arc Welded (HSAW) Pipe

Electric Resistance Welded (ERW) Pipe

MANINDS is undertaking capex to to enter Stainless Steel pipes.

MANINDS has two state-of-the-art manufacturing facilities with 1 facility located in Anjar, Gujarat having 2 LSAW line Pipe units & 2 HSAW Line Pipe units, 1 ERW unit and also for various types of Anti-Corrosion Coating Systems and 1 facility in Pithampur, Madhya Pradesh, having a total installed capacity of over 1.15 Mn+ MTPA.

2. Weak FY21-23: PAT de-growth & flat top-line

3. Weak FY23: PAT down 33% and Revenue up 4% YoY

4. Mixed Q1-24: PAT up 14% and Revenue down 4% YoY

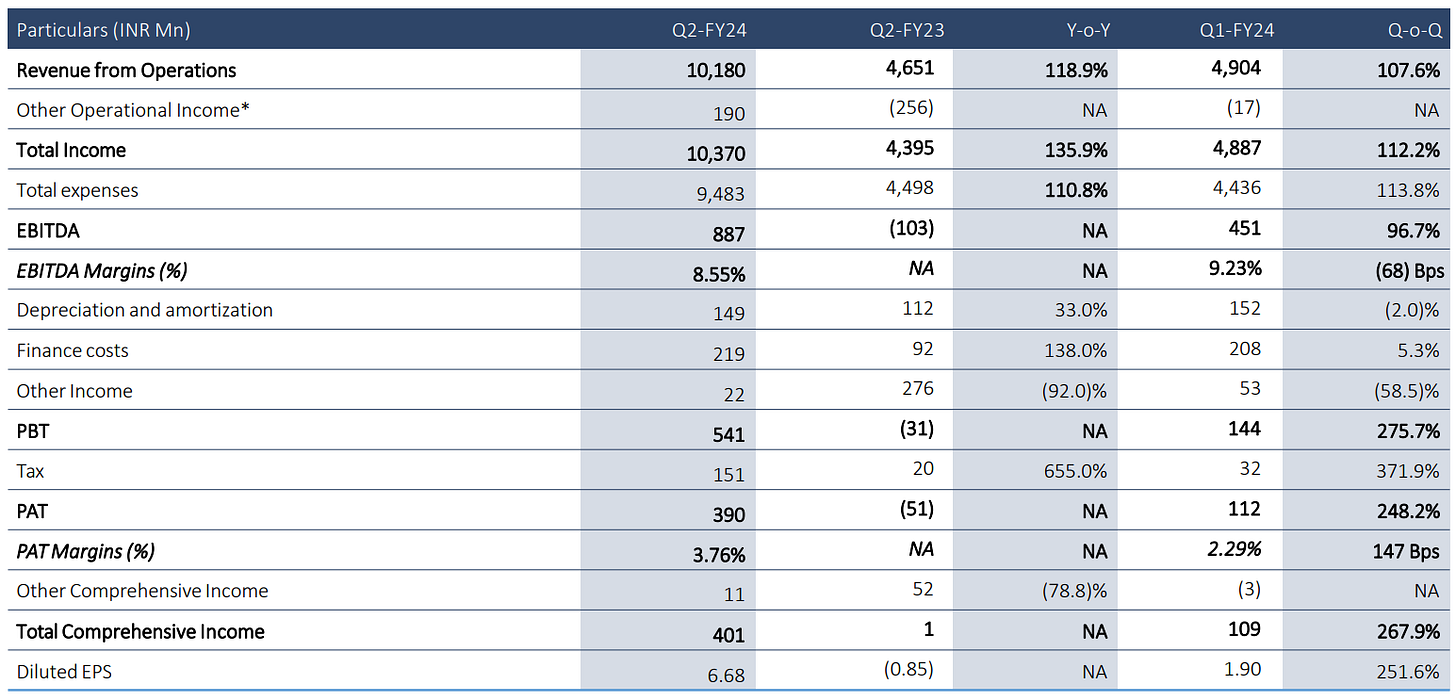

5. Strong Q2-24: Revenue up 119% and back to profit YoY

PAT up 248% & Revenue up 108% QoQ

6. Strong H1-24: PAT up 950% & Revenue up 54% YoY

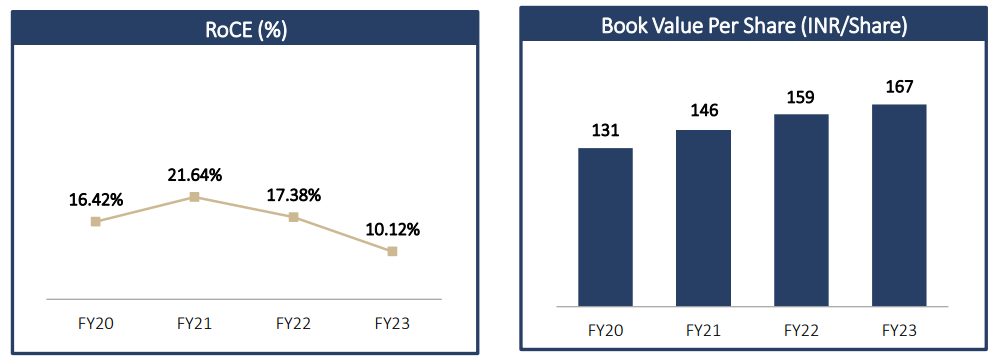

7. Business metrics: Strong return ratios

MANINDS had a net worth of Rs 1,172 cr as of Q2-24 end. At a market cap of Rs 1,485 cr, MANINDS is quoting at price to book ratio of less than 1.3

6. Outlook: Strong PAT growth in FY24

i. Top-line growth of 40-50% in FY24

Top-line growth of 40-50% in FY24 looks conservative or indicating a slowing down of momentum given that H1-24 delivered 54% growth YoY

There will be the growth 40% to 50% in closing 2024.

ii. Strong revenue visibility for FY24

The current unexecuted order book as on date (9-Nov-23) stands at Rs. 1400 Crores, to be executed within the next 6 months.

iii. EBITDA expansion in FY24

EBITDA guidance is 10% for FY24. EBITDA for H1-24 was around 9%. To deliver 10% for the whole year, MANINDS would deliver EBITDA of around 11% in H2-24.

overall average will be approximately 10% in coming quarter

7. PAT growth of 950% & Revenue growth of 54% in H1-24 & FY24 revenue growth guidance of 40-50% at a PE of 13

8. So Wait and Watch

If I hold the stock then one may continue holding on to MANINDS.

FY24 is expected to be a strong year after a weak FY23. The guidance of 40-50% growth looks conservative given that MANINDS has delivered a PAT growth of 950% and Revenue growth of 54% in H1-24

Revenue visibility is strong given the order book.

Expanded capacities getting operationalized providing a roadmap for growth in FY25. Additional Rs 1600-2000 cr of max revenue expected from ERW and SS

ERW, we can do between INR 800 crores to INR 1,000 crores, and SS is also between INR 800 crores to INR 1,000 crores.

9. Or, join the ride

If I am looking to enter MANINDS then

MANINDS has delivered a PAT growth of 950% and Revenue growth of 54% in H1-24 and guided for 40-50% growth in FY24. MANINDS at a PE of 13 makes valuations quite attractive.

MANINDS at a market cap of about Rs 1,485 cr against an expected revenue of Rs 3,000+ cr in FY24 means that it is available at a market cap to sales of less than 0.5

A net-worth of Rs 1,172 cr on a market cap of about Rs 1,485 cr, implies that MANINDS is available at a price to book of less than 1.3 which makes the valuations quite attractive.

The potential for rerating on a price to book and market cap to sales ratio could provide multi-bagger upside in the stock over the long term provided the performance delivered in H1-24 is sustained.

The quality of corporate governance in MANINDS needs to be kept in mind while entering the stock

MAN Industries case: NFRA imposes 5-year ban on auditor for lapses

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades