Lloyds Metals & Energy: 88% EBITDA growth & 95% revenue growth in 9M-24 at a PE of 24

Solid growth expected in FY24 with another year of solid growth in FY25 on account of iron ore capacity expansion by 40%. Steelmaking is the future and expected to give returns over the long term

1. Metals & mining company

lloyds.in | NSE: LLOYDSME

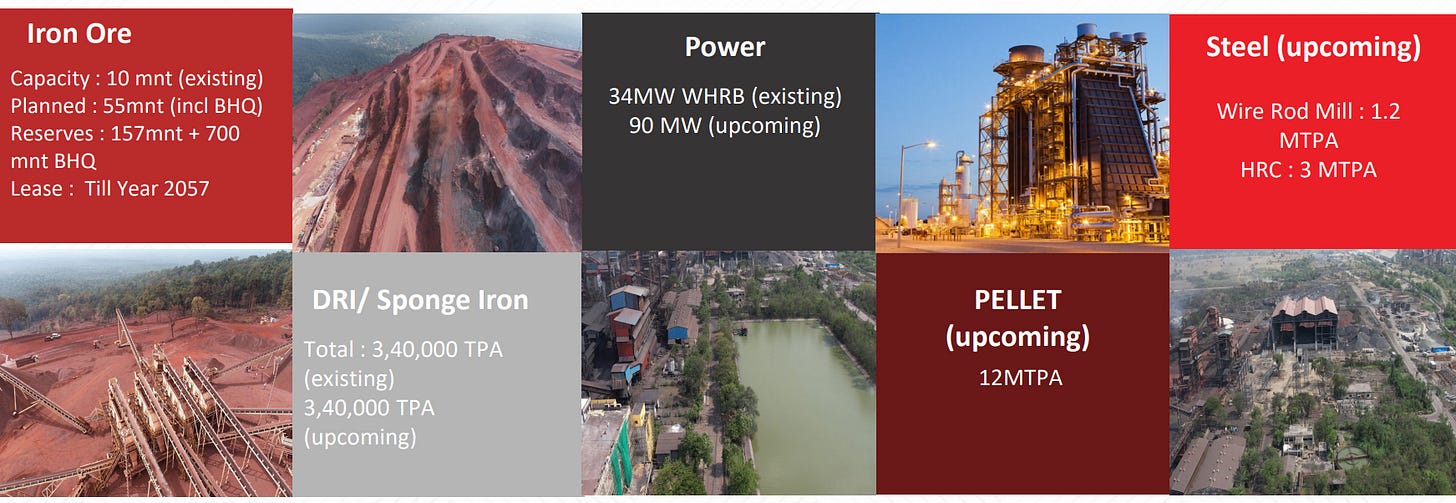

Current Business: Mining iron ore, manufacturing sponge iron and generating power

Transforming to a fully integrated steel manufacturer

LMEL is setting up a fully integrated Steel Manufacturing facility expected to commence in FY26/FY27. On completion, LMEL will have 12 mt of Iron ore mining capacity, 672k MTPA DRI capacity, 100MW of CPP, 4MPTA of Pellet capacity, 1.2MTPA of Steel capacity and 1.2 MTPA of wire rods capacity.

2. 100% capacity utilization of iron ore mines drove growth in FY23

Strong growth in FY23: First full year of iron ore mining operations

The company extracted 3 mn tonnes in FY23, which was the rated capacity for FY23.

3. Strong H1-24: 92% EBITDA growth & Revenue up 100% YoY

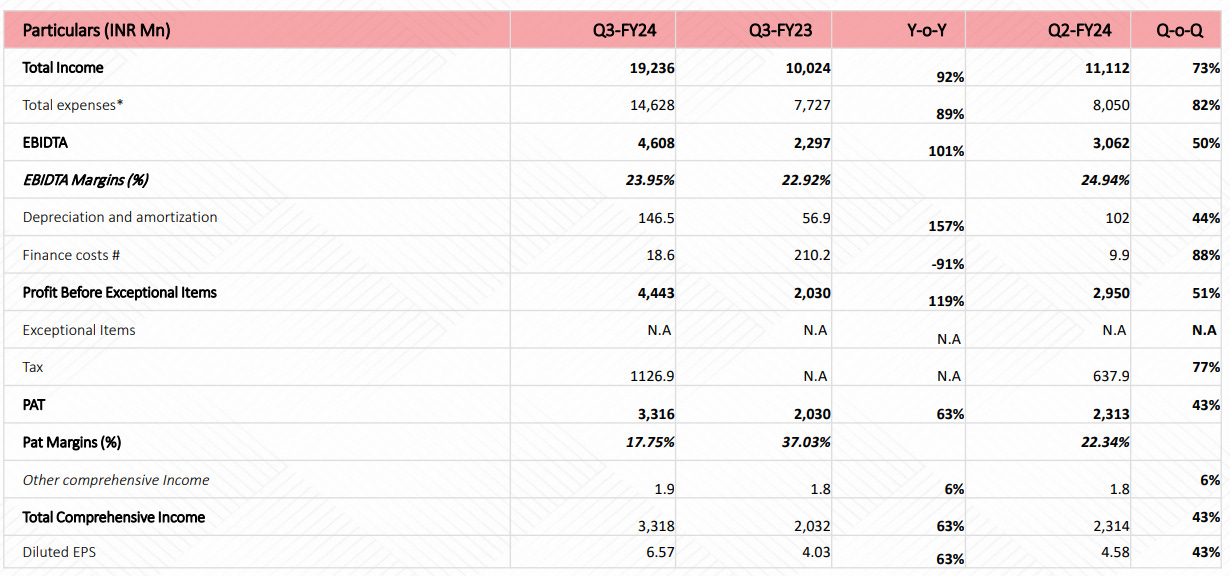

4. Strong Q3-24: PAT up 63% & Revenue up 92% YoY

PAT up 43% & Revenue up 73% QoQ

5. Strong 9M-24: EBITDA up 88% & Revenue up 95% YoY

6. Business Metrics: Improving Margins & Return ratios

7. Outlook: Capacity expansion & transformation a miner into an integrated steel manufacturer by FY26

i. FY25: Volume growth of 40%

Iron ore which drives 80% revenue expected to deliver volumes growth of 40% in FY25 over the 10 million ton expected in FY24

FY'23-'24 will be 10 million and FY'24-'25 should be close to 14 million tons

iii. FY26 & beyond: Capex & moving up the value chain will improve margins

Our proposed capacities include

pellet plants of 12 million tons

DRI of further 0.36 million tons

wire rod of 1.2 million tons

blast furnace and HR coil for 3 million tons

two slurry pipelines of 85 kilometres and 190 kilometres respectively

a beneficiation plant and a coke oven of 1.8 million tons.

These projects are expected to roll out in phases over the next 6-7 years.

All our capital expenditure will be financed through internal accruals adhering

8. 88% EBITDA growth & 95% revenue growth YoY in 9M-24 at a PE of 24

9. So Wait and Watch

If I hold the stock then one may continue holding on to LLOYDSME

Coverage of LLOYDSME was initiated after Q1-24 results. The investment thesis has not changed after a strong 9M-24. After a solid Q3-24 confidence in the management is in place to deliver a strong FY24

The growth driver for FY25 is in place with the iron ore capacity expected to grow by 40% to 14 million tons.

There is a road of transformation from FY26 and beyond, which is good to know but one should hold on keeping FY25 in mind and taking it one year at a time.

10. Join the ride

If I am looking to enter LLOYDSME then

LLOYDSME has delivered 88% EBITDA growth & 95% revenue growth in 9M-24 at a PE of 24 which makes valuations fair in the short term.

In the medium term, the outlook for 40% volume growth of iron ore in FY25 will provide upside potential in LLOYDSME. At a PE of 24, 40% growth in FY25 makes for reasonable valuations in the medium term.

Over the long term, the full impact of the transformation to an integrated steel manufacturer will be seen by FY26/FY27 onwards.

Execution of the transformation from a miner to an integrated steel manufacturer is a big challenge for LLOYDSME. Delays in execution of transformation to an integrated steel manufacturer will reduce the upside potential in the stock.

Previous coverage of LLOYDSME

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer