Lloyds Metals & Energy: 92% EBITDA growth & 100% revenue growth YoY in H1-24 at a PE of 22

Solid growth in FY23 and H1-24. Integration into steelmaking is the future. Value added steel to give better returns than iron ore mining

1. Metals & mining company

lloyds.in | NSE: LLOYDSME

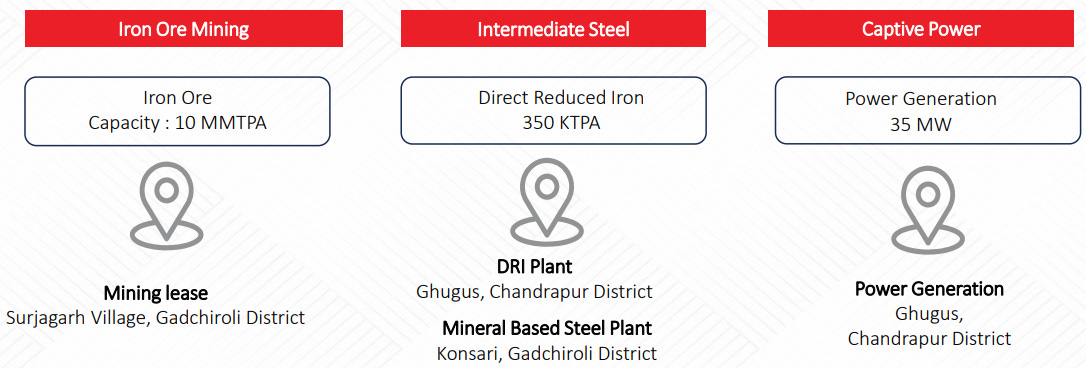

Current Business: Mining iron ore, manufacturing sponge iron and generating power

Transforming to a fully integrated steel manufacturer

LMEL is setting up a fully integrated Steel Manufacturing facility expected to commence in FY26/FY27. On completion, LMEL will have 12 mt of Iron ore mining capacity, 672k MTPA DRI capacity, 100MW of CPP, 4MPTA of Pellet capacity, 1.2MTPA of Steel capacity and 1.2 MTPA of wire rods capacity.

2. 100% capacity utilization of iron ore mines drove growth in FY23

Strong growth in FY23: First full year of iron ore mining operations

The company extracted 3 mn tonnes in FY23, which was the rated capacity for FY23.

3. Q1-24: Growth driven by capacity expansion

100%+ YoY and QoQ revenue, EBITDA growth

Revenue up 131% YoY and 121% QoQ.

EBITDA up 100% YoY and 198% QoQ

4. Strong Q2-24: PAT up 62% & Revenue up 62% YoY

5. Strong H1-24: 92% EBITDA growth & Revenue up 100% YoY

6. Return ratios: Improving with capacity expansion since FY23

CAPEX to be funded predominantly via Internal accruals

Under the state government's policy of ‘IPS refund, LMEL is entitled to receive 110% of the Chandrapur project cost and 150% of the Gadhchiroli project cost as a subsidy from the state government (in the form of SGST refunds)

7. Outlook: Capacity expansion & transformation a miner into an integrated steel manufacturer by FY26

Potential for revenue to grow 3.3X as mining increases from 3 to 10MTPA

Company received EC for 10mn tonnes on March-23, and with infrastructure in place, the company began mining for expanded capacities.

Possibility of increasing mining capacity from 10 to 12 MTPA

We also seek to apply for EC to enhance the Mining Capacity of the Surjagarh Iron Ore Mines of the Company from 10MTPA to 12 MTPA. This increase of 20% is within EC norms, whereby no public hearing is required.

DRI capacity 1.3x in H1-24, increasing to 350K MTPA

Construction work is in full swing, with Civil work being done. Expected commissioning – H1FY24

Moving up the value chain will improve margins

Captive iron ore reserves to give consistency in profits

Value added Steel to give better Returns

Complete funding through Internal Accruals

8. 92% EBITDA growth & 100% revenue growth YoY in H1-24 at a PE of 22

9. So Wait and Watch

If I hold the stock then one must wait and watch for quarterly results to see if the company is continuing with the momentum from FY23. H1-24 has been very strong (Q2 is traditionally a weak quarter) and a strong momentum is expected to continue in H2-24

Despite Q2FY24 being a traditionally softer quarter for mining due to the monsoon season, Lloyds Metals has defied expectations.

Our sponge production for H1FY24 was strong, and although a routine shutdown in Q2FY24 impacted QoQ production, our sponge margins remained consistent.

One needs to keep a watch on the planned capacities coming online as per schedule given by management. The schedule shown in Q1-24 earnings presentation was for FY26 and is now being changed to FY26/27 in the Q2-24 earnings presentation.

10. Join the ride

If I am looking to enter the stock then

Valuations are priced reasonably in the short term. PE of 22 for a 92% EBITDA growth & 100% revenue growth YoY in H1-24.

Opportunities to make money in the stock exist in the mid to long term given the full impact of the transformation to an integrated steel manufacturer will be seen by FY26/FY27.

Execution of the transformation from a miner to an integrated steel manufacturer is a big challenge for LMEL. Delays in execution of transformation to an integrated steel manufacturer will reduce the upside potential in the stock.

Positions need to be built over time over bad days when the stock is not doing well.

Previous coverage of LLOYDSME

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will send you better stuff.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades