Lloyds Metals & Energy: PAT up 29% & Revenue up 29% in Q1-25 at a PE of 29

Outlook for 30% volume growth in FY25. Ambitious capex program and forward integration to grow top-line to 6X. Strong growth expected in the coming years

1. Why is LLOYDSME interesting

lloyds.in | NSE: LLOYDSME

LLOYDSME is embarking on a transformative journey to become an integrated value-added steel producer, planning a significant capital expenditure (capex) that will 6X its size upon completion. LLOYDSME aims to execute this ambitious expansion without incurring debt, ensuring a robust balance sheet. The projected investments boast an impressive payback period of under 3.5 years and a return on equity (ROE) exceeding 35%, positioning LLOYDSME for substantial growth opportunities.2. Iron ore miner transforming into an integrated value added steel producer

3. FY20-24: PAT CAGR of 64% & Revenue CAGR of 24%

4. Strong FY24: EBITDA up 101% & Revenue up 90%

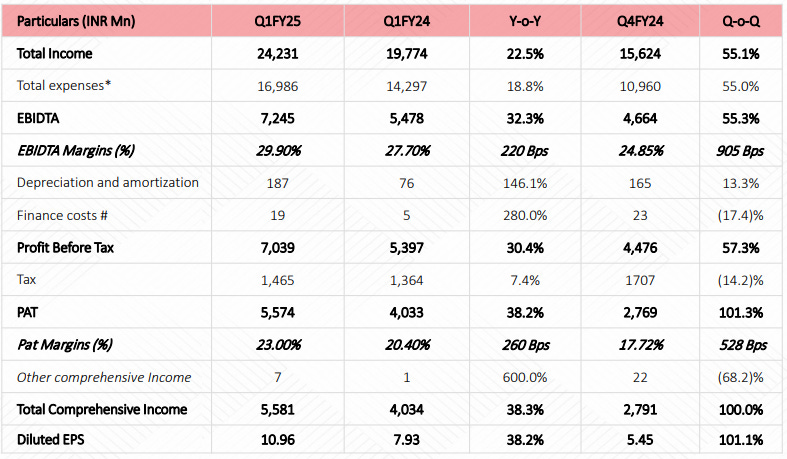

5. Q1-25: PAT up 38% & Revenue up 23% YoY

6. Business metrics: Strong return ratios

The company intends to remain debt-free for all the projects.

7. Strong outlook: 30% PAT CAGR for FY24-28

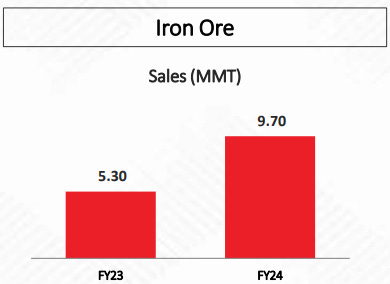

i. FY25: 30% growth in iron ore volume

Iron Ore sales for FY25 expected to be 13 MMT up from 9.7 MMT in FY24

So, around 13 million is what we are expecting to be doing in this financial year.

ii. FY25-27: New revenue streams coming online with margin expansion

The DRI, pellet, and steel plant will drive top-line growth. However, value addition in the steel plant, the backward integration with iron ore and the reduction of freight through the slurry pipeline will drive bottom-line growth faster that the top-line

FY25: we should be up and running with the first pellet plant and the slurry pipeline to go with it, as well as to double our DRI capacity to 700,000 tons and the pellet plant would be 4 million tons. That should be up and running by the end of this financial year.

FY26: we hope to start the second pellet plant of another 4 million tons

FY27: the 1.2 million steel plant would be June to September of 2026

iii. Targeting Rs 40,000 cr+ revenue after completion of capex

Approximately, our iron ore sales at that point of time will be around 6 million tons, sorry, 9 million tons, after our whole CAPEX plan is over. And steel pellet will be around 6 million tons, and other semis will be around half a million tons, and steel will be around 4.2 million tons. So, if you total all of that would come to 40,000 crores or probably a little more than that.

iv. Demand outlook is strong

the iron ore market demand in India remains buoyant, pricing being volatile seasonally. The structural demand of steel, therefore iron ore and therefore the metal space is very strong and we remain in a firm position as we speak.

8. PAT growth of 38% & Revenue growth of 23% in Q1-25 at a PE of 29

9. Do I stay?

If I hold the stock then one may continue holding on to LLOYDSME

Carrying forward after a strong FY24, Q1-25 performance has been strong. Overall FY25 is expected to be strong given the expected 30% growth in iron volume

highest-ever quarterly performance both in terms of operation and financial

LLOYDSME capex projects are progressing as per plan one can hold on as long as the company is on track to transforming into an integrated value added steel producer

On the capex front, the projects are well executed and progressing as expected or maybe even better.

10. Do I enter?

If I am looking to enter LLOYDSME then

LLOYDSME has delivered PAT growth of 38% and revenue growth of 23% in Q1-25 at a PE of 29 which makes the valuations fully valued in the short term.

With an outlook of iron ore volume growing by 30% in FY25 a PE of 29 can be sustained in LLOYDSME from a FY25 perspective

The outlook of revenue growing 6X from around Rs 6,500 cr to Rs 40,000 by FY30 with margin expansion would create opportunity in LLOYDSME over the longer term. The timely execution of the capex projects is key for the thesis to play out

Previous coverage of LLOYDSME

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer